Abstract

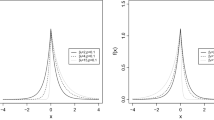

We propose a new distribution, called two-sided Lindley distribution. Some of its statistical properties are derived including the probability and cumulative density functions, moments and quantile function. The proposed distribution is applied to GARCH volatility model. An application on Nikke-225 index is given to demonstrate the performance of GARCH model specified under two-sided Lindley innovation distribution against to normal, Student’s-t, skew-normal and skew-T models based on the forecasting accuracy of value-at-risk. It is concluded that GARCH model with two-sided Lindley innovation distribution provides better fits than other competitive models and produce the most accurate value-at-risk forecasts among others.

Similar content being viewed by others

References

Altun E (2018) A new approach to value-at-risk: GARCH-TSLx model with inference. Commun Stat Simul Comput. https://doi.org/10.1080/03610918.2018.1535069

Altun E (2019a) Two-sided exponential-geometric distribution: inference and volatility modeling. Comput Stat 25:1–31

Altun E (2019b) The generalized Gudermannian distribution: inference and volatility modelling. Statistics 53(2):364–386

Altun E, Tatlidil H, Ozel G, Nadarajah S (2018) A new generalization of skew-T distribution with volatility models. J Stat Comput Simul 88(7):1252–1272

Altun E, Tatlidil H, Ozel G (2019) Conditional ASGT-GARCH approach to value-at-risk. Iran J Sci Technol Trans A Sci 43(1):239–247

Angelidis T, Benos A, Degiannakis S (2004) The use of GARCH models in VaR estimation. Stat Methodol 1(1–2):105–128

Azzalini A (1985) A class of distributions which includes the normal ones. Scand J Stat 12:171–178

Azzalini A, Capitanio A (2003) Distributions generated by perturbation of symmetry with emphasis on a multivariate skew t distribution. J R Stat Soc Ser B (Stat Methodol) 65(2):367–389

Bakouch HS, Al-Zahrani BM, Al-Shomrani AA, Marchi VA, Louzada F (2012) An extended Lindley distribution. J Korean Stat Soc 41(1):75–85

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31(3):307–327

Bollerslev T (1987) A conditionally heteroskedastic time series model for speculative prices and rates of return. Rev Econ Stat 69:542–547

Braione M, Scholtes NK (2016) Forecasting value-at-risk under different distributional assumptions. Econometrics 4(1):3

Brooks C, Persand G (2003) The effect of asymmetries on stock index return value-at-risk estimates. J Risk Finance 4(2):29–42

Christoffersen PF (1998) Evaluating interval forecasts. Int Econ Rev 39:841–862

Cont R (2001) Empirical properties of asset returns: stylized facts and statistical issues. Quant Finance 1:223–236

Dendramis Y, Spungin GE, Tzavalis E (2014) Forecasting VaR models under different volatility processes and distributions of return innovations. J Forecast 33(7):515–531

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econom J Econom Soc 50:987–1007

Ghitany ME, Atieh B, Nadarajah S (2008) Lindley distribution and its application. Math Comput Simul 78(4):493–506

Ghitany ME, Al-Mutairi DK, Balakrishnan N, Al-Enezi LJ (2013) Power Lindley distribution and associated inference. Comput Stat Data Anal 64:20–33

Giot P, Laurent S (2003) Market risk in commodity markets: a VaR approach. Energy Econ 25(5):435–457

Hung JC, Lee MC, Liu HC (2008) Estimation of value-at-risk for energy commodities via fat-tailed GARCH models. Energy Econ 30(3):1173–1191

Kupiec PH (1995) Techniques for verifying the accuracy of risk measurement models. J Deriv 3(2):73–84

Lyu Y, Wang P, Wei Y, Ke R (2017) Forecasting the VaR of crude oil market: Do alternative distributions help? Energy Econ 66:523–534

MirMostafaee SMTK, Alizadeh M, Altun E, Nadarajah S (2019) The exponentiated generalized power Lindley distribution: properties and applications. Appl Math A J Chin Univ 34(2):127–148

Nadarajah S, Bakouch HS, Tahmasbi R (2011) A generalized Lindley distribution. Sankhya B 73(2):331–359

Politis DN (2004) A heavy-tailed distribution for ARCH residuals with application to volatility prediction. Ann Econ Finance 5:283–298

Sarma M, Thomas S, Shah A (2003) Selection of value-at-risk models. J Forecast 22(4):337–358

Venkataraman S (1997) Value at risk for a mixture of normal distributions: the use of quasi-Bayesian estimation techniques. Econ Perspect Fed Reserve Bank Chic 21:2–13

Zangari P (1996) An improved methodology for measuring VaR. RiskMetrics Monit 2(1):7–25

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Altun, E. Two-Sided Lindley Distribution with Inference and Applications . J Indian Soc Probab Stat 20, 255–279 (2019). https://doi.org/10.1007/s41096-019-00065-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41096-019-00065-8