Abstract

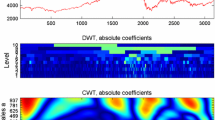

This paper seeks to understand the long memory behaviour of global equity returns using novel methods from wavelet analysis. We implement the wavelet based multivariate long memory approach, which possibly is the first application of wavelet based multivariate long memory technique in finance and economics. In doing so, long-run correlation structures among global equity returns are captured within the framework of wavelet-multivariate long memory methods, enabling one to analyze the long-run correlation among several markets exhibiting both similar and dissimilar fractal structures.

Similar content being viewed by others

Notes

This is not to be confused with the regular wavelet correlation where correlations tend to be strong in the long-run. Correlations based on fractal connectivity are used to determine the similarity in mechanisms that generate the underlying long memory behaviour among markets.

Wavelet correlation and cross-correlations are like the usual cross-spectral meaures from spectral analysis. However, cross-spectral methods cannot capture the time component as it relies on Fourier decomposition of time signal wherein time information is completely lost, which is not the case with wavelet based decompositions where information from both time and frequencies are captured or localized simultaneously.

References

Abry et al. 1995. Wavelets, spectrum analysis and 1/f processes. In Lecture notes in statistics: Wavelets and statistics, eds. Antoniadis, A., and Oppenheim, G, vol. 103, pp. 15–29.

Abry, et al. 1998. Wavelet analysis of long range dependent traffic. IEEE Trans Inf Theory 44 (1): 2–15.

Abry, P., and D. Veitch. 1998. Wavelet analysis of long range dependent traffic. IEEE Transactions on Information Theory 44 (1): 2–15.

Abry, P., P. Flandrin, M. Taqqu, and D. Veitch. 2003. Self-similarity and long-range dependence through the wavelet lens. In Theory and Applications of Long Range Dependence, ed. P. Doukhan, G. Oppenheim, and M.S. Taqqu. Basel: Birkhauser.

Achard, S., and I. Gannaz. 2016. Multivariate wavelet Whittle estimation in long-range dependence. Journal of Time Series Analysis 37 (4): 476–512.

Achard, S., D.S. Bassett, A. Meyer-Lindenberg, and E.T. Bullmore. 2008. Fractal connectivity of long-memory networks. Physical Review E. https://doi.org/10.1103/PhysRevE.77.036104.

Andersen, T.G., and T. Bollerslev. 1997. Heterogeneous information arrivals and return volatility dynamics: uncovering the long run in high frequency returns. Journal of Finance 52 (3): 975–1005.

Assaf, A., and J. Cavalcante 2002. Long-range dependence in the returns and volatility of the brazilian stock market. [Internet]. http://www.long-memory.com/volatility/CavalcanteAssaf2002.pdf. Accessed 15 Oct 2018.

Barkoulas, T.J., C.F. Baum, and N. Travlos. 2000. Long memory in the Greek stock market. Applied Financial Economics 10 (2): 177–184.

Bilal, T.M., and S. Nadhem. 2009. Long memory in stock returns: evidence of G7 stocks markets. Research Journal of International Studies 9: 36–46.

DiSario, R., H. Saraoglu, J. McCarthy, and H.C. Li. 2008. An investigation of long memory in various measures of stock market volatility, using wavelets and aggregate series. J Econ Finance 32: 136–147.

Davidson, J., and P. Silberstein. 2005. Generating schemes for long memory processes: regimes, aggregation, and linearity. Journal of Econometrics 128: 253–282.

Ding, Z., C.W.J. Granger, and R.F. Engle. 1993. A long memory property of stock returns and a new model. Journal of Empirical Finance 1 (1): 83–106.

Elser, J., and A. Serletis. 2007. On fractional integration dynamics in the US stock market. Chaos, Solitons and Fractals 34: 777–781.

Gencay, R., F. Selcuk, and B. Whitcher. 2001. An Introduction to Wavelets and Other Filtering Methods in Finance and Economics. San Diego: Academic Press.

Gencay, R., F. Selcuk, and B. Whitcher. 2005. Multiscale systematic risk. Journal of International Money and Finance 24: 55–70.

Geweke, J., and S. Porter-Hudak. 1983. The estimation and application of long memory time series models. Journal of Time Series Analysis 4 (4): 221–238.

Granger, C.W.J. 1980. Long memory relationships and the aggregation of dynamic models. Journal of Econometrics 14: 227–238.

Granger, C.W.J., and Z. Ding. 1995. Some properties of absolute value return an alternative measure of risk. Annales d’Economie et de Statistique 40: 67–91.

Granger, C.W.J., and Z. Ding. 1996. Varieties of long memory models. Journal of Econometrics 73: 61–77.

Granger, C.W.J., and R. Joyeux. 1980. An introduction to long-memory time series models and fractional differencing. Journal of Time Series Analysis 1 (1): 15–29.

Han, Y.W. 2005. Long memory volatility dependency, temporal aggregation and the Korean currency crisis: the role of a high frequency Korean won (KRW)-US dollar ($) exchange rate. Japan and the World Economy 17: 97–109.

Henry, O.T. 2002. Long memory in stock returns: some international evidence. Applied Financial Economics 12: 725–729.

Hosking, J.R.M. 1981. Fractional differencing. Biometrika 68 (1): 165–176.

Hurst, H. 1951. Long term storage capacity of reservoirs. Transaction of the American Society of Civil Engineer 116: 770–799.

In, F., S. Kim, and R. Gencay. 2011. Investment horizon effect on asset allocation between value and growth strategies. Economic Modelling 28: 1489–1497.

Jagric, T., B. Podobnik, and M. Kolanovic. 2005. Does the efficient market hypothesis hold? Evidence from six transition economies. Eastern European Economics 43 (4): 79–103.

Jensen, M. 1999. Using wavelets to obtain a consistent ordinary least Squares estimator of the fractional differencing parameter. Journal of Forecasting 18: 17–32.

Jensen, M. J., and B. Whitcher 2000. Time-varying long-memory in volatility: detection and estimation with wavelets. Working paper, Department of Economics, University of Missour.

Kang, S.H., C. Cheong, and S.M. Yoon. 2010. Contemporaneous aggregation and long-memory property of returns and volatility in the Korean stock market. Physica A 389: 4844–4854.

Lo, A.W. 1991. Long-term memory in stock market prices. Econometrica 59 (5): 1279–1313.

Lo, A.W. 2004. The adaptive markets hypothesis: market efficiency from an evolutionary perspective. Journal of Portfolio Management 30 (5): 15–29.

Lobato, I.N., and N.E. Savin. 1998. Real and spurious long-memory properties of stock-market data. Journal of Business Economic Statistics 16: 261–268.

Lobato, I.N., and C. Velasco. 2000. Long memory in stock market trading volume. The Journal of Business and Economic Statistics 18: 410–426.

Mandelbrot, B. 1965. Self-similar error clusters in communication systems and the concept of conditional stationarity. IEEE Trans Commun Technol 13 (1): 71–90.

Mandelbrot, B., and J.W. Van Ness. 1968. Fractional Brownian motions, fractional noises and applications. SIAM Review 10: 422–437.

Mariani, M.C., I. Florescub, M. Beccar Varelaa, and E. Ncheuguim. 2010. Study of memory effects in international market indices. Physica A 389 (8): 1653–1664.

Nekhili, R., A. Altay-Salih, and R. Genncay. 2002. Exploring exchange rate returns at different time horizons. Physica A 313: 671–682.

Ozdemir, Z.A. 2007. Linkages between international stock markets: a multivariate long memory approach. Physica A 388 (12): 2461–2468.

Ozun, A., and Cifter, A. 2007. Modeling long-term memory effect in stock prices: A comparative analysis with GPH test and daubechies wavelets. MPRA Paper 2481, University Library of Munich, Germany.

Panas, E. 2001. Estimating fractal dimension using stable distributions and exploring long memory through ARFIMA models in Athens Stock Exchange. Applied Financial Economics 11: 395–402.

Pascoal, R., and A.M. Monteiro. 2014. Market efficiency, roughness and long memory in PSI20 index returns: wavelet and entropy analysis. Entropy 16: 2768–2788.

Power, G.J., and C.G. Turvey. 2010. Long-range dependence in the volatility of commodity futures prices: wavelet-based evidence. Physica A 389: 79–90.

Ranta, M. 2013. Contagion among major world markets: A wavelet approach. Int J Manag Finance 9: 133–150.

Ray, B., and R. Tsay. 2000. Long-range dependence in daily stock volatilities. Journal of Business and Economic Statistics 18: 254–262.

Souza, L.R. 2007. Temporal aggregation and bandwidth selection in estimating long memory. Journal of Time Series Analysis 28 (2007): 701–722.

Tan, P.P., D.U.A. Galagedera, and E.A. Maharaj. 2012. A wavelet based investigation of long memory in stock returns. Physica A 391: 2330–2341.

Tan, P.P., C.W. Chin, and D.U.A. Galagedera. 2014. A wavelet-based evaluation of time-varying long memory of equity markets: a paradigm in crisis. Physica A 410: 345–358.

Tolvi, J. 2003. Long memory and outliers in stock market returns. Applied Financial Economics 13 (7): 495–502.

Vuorenmaa, T. 2005. A wavelet analysis of scaling laws and long-memory in stock market volatility, Bank of Finland Research Discussion Paper.

Wendt, H., A. Scherrer, P. Abry, and S. Achard. 2009. Testing fractal connectivity in multivariate long memory processes. 34th Proceedings of IEEE ICASSP, Taipei, Taiwan, pp. 2913–2916.

Xu, Z., and R. Gencay. 2003. Scaling, self-similarity and multifractality in FX markets. Physica A 323: 578–590.

Xue, Y., R. Gençay, and S. Fagan. 2014. Jump detection with wavelets for high frequency financial time series. Quantitative Finance 14 (8): 1427–1444.

Acknowledgement

Computations are done in both MATLAB and R Programming language. The authors would like to thank Prof. Darryl Veitch for providing the MATLAB program which can be accessed from https://crin.eng.uts.edu.au/~darryl/secondorder_code.html. The R codes written by the authors are based on multiwave and fArma packages in R. The dataset used along with the codes, which can replicate results of this paper, shall be provided by the corresponding author on request.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations

Rights and permissions

About this article

Cite this article

Bhandari, A., Kamaiah, B. Long Memory and Fractality Among Global Equity Markets: a Multivariate Wavelet Approach. J. Quant. Econ. 19, 23–37 (2021). https://doi.org/10.1007/s40953-020-00220-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-020-00220-0