Abstract

Using longitudinal data from Health and Retirement Surveys over 1992–2010, this paper analyzes decisions by older American to continue smoking and the number of cigarettes to consume using two-part hurdle models with correlated effects. We build on the existing literature by incorporating a myriad of factors including cigarette prices, health shocks and smoke-free laws in one econometric framework. Our estimates indicate that higher cigarette prices play an important role in both reducing participation and the intensity of consumption even for this adult population. In addition, health shocks, as measured by newly diagnosed diseases, raise the probability of quitting, highlighting the ‘curative’ aspects of cessation. However, we find very little effect of health on smoking intensity if an older adult does not quit after a health shock. Per capita cigarette consumption in the US declined by over 64% during the period. We show that increased cigarette prices and health shocks together contribute almost equally to explain nearly 86% of the decline, with little that can be attributed to smoking bans and anti-smoking sentiment.

Source: The Tax Burden on Tobacco (2012), 2012

Source: The Tax Burden on Tobacco (2012) and authors’ calculation using HRS

Source: Authors’ calculation using HRS survey in 1994

Source: The Tax Burden on Tobacco (2012) and authors’ calculation

Similar content being viewed by others

Notes

Centers for Disease Control and Prevention. Smoking and tobacco use. http://www.cdc.gov/tobacco/data_statistics/fact_sheets/fast_facts. Accessed August 18, 2016.

Centers for Disease Control and Prevention. Economic facts about US tobacco production and use. http://www.cdc.gov/tobacco/data_statistics/fact_sheets/economics/econ_facts. Accessed August 18, 2016.

The biennial Indian HRS known as LASI (Longitudinal Ageing Study in India) is currently in its 4th round, which started in 2010. In China, HRS sister survey CHARLS was implemented for a national representative sample of persons 45 years of age or older since 2011. These surveys are harmonized with HRS in the U.S. Thus, the methodology adopted in this paper can be implemented in India and China using LASI and CHARLS, respectively.

The Tobacco Use Supplement to the Current Population Survey (TUS-CPS) is a national survey of tobacco use as part of the US Census Bureau’s Current Population Survey in 1992–1993, 1995–1996, 1998–1999, 2000, 2001–2002, 2003, 2006–2007, and 2010–2011.

Pesko et al. (2016) use intra-state variations in cigarette prices due to local taxes to show, though for a much younger sample, that the resultant price elasticity is almost tripled compared to state-level prices. Since most of these local taxes are overwhelmingly concentrated in Alabama, Missouri and Virginia, we included a dummy variable representing these three states and its interaction with the state price variable in our cessation and conditional consumption equations. These additional controls were statistically insignificant in out estimations.

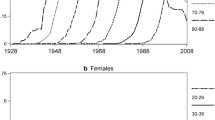

We should point out that since HRS does include few individuals in their 1930s and 1940s (except due to the inclusion of younger spouses), the peaks of age profiles at 36 or 50 should be taken with due caution.

References

Adda J. and Cornaglia F., (2013). “Taxes, Cigarette Consumption, and Smoking Intensity: Reply,” American Economic Review, American Economic Association, vol. 103(7), pages 3102–14, December.

Arcidiacono, P., H. Sieg, and F. Sloan. 2007. Living rationally under the volcano? An empirical analysis of heavy drinking and smoking. International Economic Review 48: 37–65.

Becker, G.S., and K.M. Murphy. 1988. A Theory of Rational Addiction. Journal of Political Economy 96 (4): 674–700.

Bitler, M.P., C.S. Carpenter, and M. Zavodny. 2010. Effects of venue-specific state clean indoor air laws on smoking-related outcomes. Health Economics 19: 1425–1440.

Carton, T.W., M. Darden, J. Levendis, S.H. Lee, and I. Ricket. 2016. Comprehensive Indoor Smoking Bans and Smoking Prevalence. American Journal of Health Economics 2 (4): 535–556.

Chamberlain, G. (1984). Panel data, chapter 22 in Z. Griliches and M. Intrilligator, eds., Handbook of Econometrics, (North Holland, Amsterdam), 1247–1318.

Chatterji, P., D. Kim, and K. Lahiri. 2014. Birth weight and academic achievement in childhood. Health Economics 23: 1013–1035.

DeCicca, Philip, Don Kenkel, and Alan Mathios. 2008. Cigarette taxes and the transition from youth to adult smoking: Smoking initiation, cessation, and participation. Journal of Health Economics 27 (2008): 904–917.

DeCicca, Philip, and Logan McLeod. 2008. Cigarette taxes and older adult smoking: Evidence from recent large tax increases. Journal of Health Economics 27 (2008): 918–929.

DeCicca, Philip, and Don Kenkel. 2015. Synthesizing Econometric Evidence: The Case of Demand Elasticity Estimates. Risk Analysis 35 (6): 1073–1085.

Evans, N.William, and C.Matthew Farrelly. 1998. The compensating behavior of smokers: taxes, tar and nicotine. RAND Journal of Economics 29 (3): 578–595.

Farrelly, C.M., W.J. Bray, T. Pechacek, and T. Woollery. 2001. Responses by adults to increases in cigarette prices by sociodemographic characteristics. Southern Economic Journal 68 (1): 156–165.

Fernandez-Val, I. 2009. Fixed effects estimation of structural parameters and marginal effects in panel probit models. Journal of Econometrics 150: 71–85.

Smoking: Duration Analysis of British Data. Journal of the Royal Statistical Society. Series A (Statistics in Society), Vol. 164, No. 3(2001), pp. 517–547.

Grossman, Michael. 1972. On the concept of health capital and the demand for health. Journal of Political Economics 80: 223–255.

Hahn, J., and G. Kuersteiner. 2011. Bias reduction for dynamic nonlinear panel models with fixed effects. Econometric Theory 27: 1152–1191.

Heckman, James J. (1979): Sample Selection Bias as a Specification Error. Econometrica, Vol. 47, No. 1 (Jan., 1979), pp. 153–161.

ImpacTeen.org. (2009). Tobacco Control Policy and Prevalence Data: 1991–2008. In: ImpacTeen.org.

Jha, P., and R. Peto. 2014. Global Effects of Smoking, of Quitting, and of Taxing Tobacco. New England of Medicine 370: 60–68. https://doi.org/10.1056/nejmra1308383.

Jha, P. 2019. Smoking cessation and e-cigarettes in China and India. BMJ 367: l6016. https://doi.org/10.1136/bmj.l6016.

Jones, Andrew M. 1994. Health, addiction, social interaction and the decision to quit smoking. Journal of Health Economics 13: 93–110.

Jones, A.M., A. Laporte, N. Rice, and E. Zucchelli. 2015. Do public smoking bans have an impact on active smoking? Evidence from the UK. Health Economics 24: 175–192.

Khwaja, A., F. Sloan, and S. Chung. 2006. Learning about individual risk and the decision to smoke. International Journal of Industrial Organization 24 (2006): 683–699.

Labeaga, J.M. 1999. A double-hurdle rational addiction model with heterogeneity: Estimating demand for Tobacco. Journal of Econometrics 93: 49–72.

Lahiri, Kajal, and Song, G.J: Song. 2000. The effect of smoking on Health using a sequential self-selection model. Health Economics 9: 491–511.

Lewit, M.Eugene, and Douglas Coate. 1982. The potential for using excise taxes to reduce smoking. Journal of Health Economics 1: 121–145.

Liu, Feng. 2010. Cutting through the smoke: separating the effect of price on smoking initiation, relapse and cessation. Applied Economics 42: 2921–2939.

Maclean, C.Johanna, S.Asia Kessler, and S.Donald Kenkel. 2016. Cigarette Taxes and Older Adult Smoking: Evidence from the Health and Retirement Study. Health Econ. 25: 424–438.

Min, Y., and A. Agresti. 2005. Random effect models for repeated measures of zero-inflated count data. Statistical Modelling 5: 119.

Mishra, G.A., S.A. Pimple, and S.S. Shastri. 2012. An overview of the tobacco problem in India. Indian Journal of Medical and Paediatric and Oncology 33 (3): 139–145.

Mundlak, Y. 1978. On the pooling of time series and cross section data. Econometrica 46 (1): 69–85.

Erik, Nesson. 2017. Heterogeneity in Smokers’ Responses to Tobacco Control Policies. Health Economics 26 (Dec): 206–225.

Ophem, V.Hans. 2000. Modeling Selectivity in Count-Data Models. Journal of Business & Economic Statistics 18 (4): 503–511.

Orzechowski, W., and R.C. Walker. 2012. The Tax Burden on Tobacco, Historical Compliance. Arlington: Orzechowski and Walker.

Ostbye, T., and D.H. Taylor. 2004. The effect of smoking on ‘Years of Healthy Life’ lost among middle-aged and older Americans. Health Services Research 39 (3): 531–551.

Pesko, F. Michael, Tauras, A. John, Huang, Jidong, Chaloupka, J. Frank (2016): The Influence of Geography and Measurement in Estimating Cigarette Price Responsiveness. NBER Working Paper 22296.

Smith, V.Kerry, Donald H. Taylor Jr., Frank A. Sloan, F.Reed Johnson, and William H. Desvousges. 2001. Do smokers respond to health shocks? Review of Economics and Statistics 83 (4): 675–687.

Sundmacher, L. 2012. The effect of health shocks on smoking and obesity. Europe. J. Health Econ. 12: 451–460.

Tauras, J.A. 2006. Smoke-free Air Laws, Cigarette Prices, and Adult Cigarette Demand. Economic Inquiry 44: 333–342.

Taylor, D.H., V. Hasselblad, J. Henley, M.J. Thurn, and F.A. Sloan. 2002. Benefits of smoking cessation for longevity. American Journal of Public Health 92: 990–996.

US Department of Health, Education, and Welfare. Smoking and Health: Report of the Advisory Committee to the Surgeon General of the Public Health Service. Washington, DC: US Department of Health, Education, and Welfare, Public Health Service; 1964. (Public Health Service Publication No. 1103).

Wang, H., and D. Heitjan. 2008. Modeling heaping in self-reported cigarette counts. Statistics in Medicine 27: 3789–3804.

Wooldridge, J.M. 1995. Selection corrections for panel data models under conditional mean independence assumptions. Journal of Econometrics 68 (1): 115–132.

Yang, J.J., D. Yu, W. Wen, et al. 2019. Tobacco Smoking and Mortality in Asia. JAMA Network Open 2 (3): e191474.

Acknowledgements

This research was supported by the National Institute on Minority Health and Health Disparities, National Institutes of Health (Grant number 1 P20 MD003373). The content is solely the responsibility of the authors and does not represent the official views of the National Institute on Minority Health and Health Disparities or the National Institutes of Health. We thank an anonymous referee for making a number of useful comments that has helped to revise our paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Both authors Kajal Lahiri and Xian Li declare that they have no conflict of interest with the results of this study.

Ethical standards

This article does not contain any studies with human participations or animals performed by any of the authors (University at Albany Institutional Review Board Protocol number 13269-01).

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Lahiri, K., Li, X. Smoking Behavior of Older Adults: A Panel Data Analysis Using HRS. J. Quant. Econ. 18, 495–523 (2020). https://doi.org/10.1007/s40953-020-00196-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-020-00196-x

Keywords

- Smoking cessation

- Price elasticity

- Health shocks

- Hurdle model

- Correlated random effects

- Self-selection

- Anti-smoking laws