Abstract

Italian governments have frequently chosen tax amnesties or concessions, with the twofold purpose of creating new budget resources and cancelling irredeemable debts. Such course of action constitutes a “shortcut” policy in terms of fighting tax evasion, which is a matter less popular among voters and more demanding in terms of efficiency and political continuity. This paper investigates the effects of the 2016–2019 tax concession, bringing empirical evidence based on the car tax paid to the Tuscany Region. The car tax is the main source of regional fiscal autonomy in Italy. In terms of revenue recovery, we found a net amount of only 1.6% of the unpaid taxes accrued. A difference-in-difference (DiD) analysis of the effects on compliance showed that those who took advantage of the tax amnesty in the past, when cheating again, were more likely to default on their tax debts, as compared to those who did not join the amnesty program. Therefore, our analysis provides original evidence of a very low budget recovery and confirms the results of literature according to which tax amnesties impact negatively on taxpayers’ behaviour.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Tax amnesty can be defined as a limited-time offer addressed to specified groups of taxpayers by public authorities, who ask for a reduced payment in exchange for the remission of previous tax obligations (including interests and penalties), at the same time granting immunity from legal action (Baer & La Borgne, 2008). Franzoni (1996) identifies three types of tax amnesty:

–Return amnesty: it allows taxpayers to adjust their tax returns and pay a reduced penalty on the due amount, without preventing subsequent audit and control activities from tax authorities;

–Investigation amnesty: it offers immunity from administrative actions in exchange for the payment of a determined amount (amnesty fee);

–Prosecution amnesty: it grants a total or partial reduction of penalties to already-identified tax evaders in the aim of simplifying procedures and putting an end to judicial proceedings before tax authorities.

Among the main purposes for enforcing tax amnesty (Baer & Le Borgne, 2008) are certainly those related to the immediate revenue needs, the offshore capital repatriation, but also the encouragement of tax compliance, so to raise tax revenues in the medium-long term. Moreover, tax amnesty may help to ‘reset’ the system (i.e. reorganise the piling up of tax liability) before a tax reform. Recent national measures have repeatedly called attention to the clearance of debt collectors’ stock – for example, with the ‘full and final settlement agreement’ (saldo e stralcio) of tax bills – since the current legal framework requires twenty years to pass before debts are written off as irrecoverable.Footnote 1

Notwithstanding their frequent use and supposed advantages, amnesty programmes still constitute a controversial issue: in fact, despite the immediate revenue increase and the return of part of tax evaders back into the system, their medium and long-term effects are debateable.

Scholars generally agree that tax amnesty alone negatively impacts on individual compliance, and that without the concurrent implementation of more stringent enforcement actions aimed at modifying the cost of evasion, it is very plausible that tax amnesty participants will still avoid taxes, and taxpayers will interpret the mitigating measure as a sign of weakness on the authorities’ part (Alm & Beck, 1990; Baer & Le Borgne, 2008). In addition, it is of paramount importance to prevent the taxpayer expectations of future interventions from reducing tax compliance in the long run (Luitel & Sobel, 2007); indeed, repeated tax amnesties weaken the psychological costs of evasion – increasing a perceived sense of inequity among honest taxpayers, with the risk of ‘legitimising’ evasion (Nar, 2015).

As to tax revenue, economic models confirm how, in the lack of subsequent enforcement actions, the possible positive impact of tax amnesty may be offset by more avoidance and less compliance in the long run (Andreoni, 1991; Fiorentini & Martina, 1997; Stella, 1989). Empirical research has sought to confirm the expected effects for different national and socio-economic contexts. By and large, these surveys highlight how tax amnesties, without additional reforms or legislative-administrative measures aimed at strengthening the tax system, will probably have a negative impact in the long run (Alm & Beck, 1993; Alm & Malézieux, 2021; Alm et al., 1990; Bernasconi & Lapecorella, 2006; López-Laborda & Rodrigo, 2003).

This paper analyses a database built on car tax billsFootnote 2 issued in Tuscany, and investigates how the introduction of a prosecution amnesty (definizione agevolata) can impact on tax revenues, as well as on the compliance of defaulting taxpayers, i.e. those who had already received the payment notice and had been enrolled in the tax register. The revenue increase has been estimated in 11 million euros, a non-negligible sum if referred to the ordinary annual revenue, but of very limited extent if compared to the 817 million euros of accrued tax bills (only 1.6% of the total unpaid amount). Regarding compliance, by using a difference-in-difference analysis, we estimate that those who participated in the amnesty reduce by 5.3% the payment of the post-amnesty tax bills. This is probably due to the fact that at least a part of these individuals chooses not to pay directly but wait in the expectation of future tax concessions. These estimates of the effects on revenue and compliance constitute an important empirical work because it analyses, on real micro data, the effects of the prosecution tax amnesty for the first time for Italy. Obviously, the results can be extended with caution due to the tax specificity, and the database built only for a single region and on those who received at least one tax notice in the observation period.

The paper is organised as follows: after this introduction, Sect. 2 describes the framework of car taxation, the related executive action rules set by the Revenue Agency, and the specific policy of prosecution amnesty under analysis. Section 3 illustrates the dataset, whereas Sect. 4 analyses the revenue effect and Sect. 5 provides an estimation of the compliance effect, i.e. the likelihood that tax cheaters will settle their bills in the future. Section 6 draws some conclusions.

2 Vehicle duty compliance in Italy

The vehicle duty (or car tax) in Italy is a compulsory annual tax due by all vehicle owners (households, firms, and public entities). During the fiscal decentralisation process, started in the 1990s, the revenue from the vehicle duty was attributed to the regions and, with Law no. 449 of 1997, the assessment, collection, refunds, as well as the application of sanctions and administrative litigation were also delegated to them. The tax base depends on the engine power, the pollution class and the owner’s region of residence with some tax exemption valid in the whole country.Footnote 3 The tax rates are set by regional authorities in a limited range of variation (between 90 and 110% of the base tax rate),Footnote 4 so that for the less polluting class tax rates range between 2.32 and 4.26 euro per kW in different regions.Footnote 5 Although the design of the tax is shared by State and regional bodies, it is nevertheless one of the most significant tools of fiscal autonomy – accounting for an average of 14% of total regional taxes.

Unfortunately, this levy presents substantial levels of tax evasion in all regions, notwithstanding the relatively small average amounts due (on average less than 400 euro) and the rather immediate identification of taxpayers.Footnote 6 As far as Tuscany is concerned, the burden of late taxpayers and tax dodgers can be appreciated by looking at official regional budget data on vehicle tax duty that show, during the second part of the last decade, an average difference of 10% (around 40 million euro) between tax due and tax actually paid within the same year.Footnote 7 Moreover, a study for 2014 conducted in Tuscany and concerning only private cars estimated that unpaid taxes accounted for 18% of the total due amount.Footnote 8

In case taxpayers fail to pay within the prescribed deadline, they incur in a 30% penalty on the due amount, which can be reduced if they pay before the authority starts the tax audit. If this is not the case, the executive procedure begins with the Region sending the notification of the tax bill to the taxpayerFootnote 9 and the transmission of the same bill to the Revenue Agency tax roll (or register, iscrizione a ruolo).Footnote 10 However, this complex procedure – shared by regional tax authority and the national collecting body – is far from being satisfying.

One of the measures aimed at stopping the accumulation of tax debt is contained in article 6 of Decree-Law no. 193 of 22 October 2016, introducing a tax concession for the bills entrusted to debt collectors up to 2016.Footnote 11 The new policy, allowing taxpayers to pay off the debt accrued without penalty or default interest, was extended by Decree-Law no. 148 of 16 October 2017 and later by Decree-Law no. 119 of 23 October 2018, the latter to cover all fiscal charges entrusted to the collecting agent until 31 December 2017.Footnote 12

In short, the tax concession introduced with the three measures mentioned above applies to the tax bills issued between 2000 and 2017, and it provides a tax rebate to eligible applicants.Footnote 13 It thus falls under the typology of ‘prosecution amnesty’, since it is intended to rapidly increase revenues from the discounted repayments while reducing the costs of executive actions.

3 The dataset

The dataset for the empirical analysis was built on the car tax notices issued in Tuscany in the 2000–2017 period, and on related payments in the 2004–2019 period.Footnote 14 Figure 1 illustrates the payment phases for car tax and notices, and the information recorded in the dataset.

To have an idea of the amount of money at stake, the tax bills issued between 2004 and 2019 add up to more than 1175 million euros, 358 of which (namely 30.5%) were collected while the remaining 817 million euros (equalling 69.5% of the total) are still uncashed.Footnote 15 Table 1 shows the new tax notices issued each year, the collected amount (the yearly cashed amount, irrespective of the year of issue) and the residual amount due (the total sum to be raised considering the newly issued bills and the collected sums).

The amounts being collected seem to have grown fairly steadily over the observed period and have reached a stable level around 38 million euros in recent years. On the contrary, tax notices show considerable instability as result of an inconstant administrative action over the years, with peculiar bottlenecks—including staff availabilityFootnote 16—for some specific years (such as 2017).Footnote 17

4 The revenue effect

In order to determine the benefits of the tax concession measure, we need to compare the revenue collected from tax amnesty applicants – an amount obviously affected by the tax rebate – and the revenue that would have been recovered in the event of a successful executive action. To this end, it is useful to refer to Fig. 2, which shows the ratio between the recovered revenue and the volume of tax notices issued, depending on the time lag from issue date.Footnote 18 If t represents the year of registration of the new tax notice, it is easy to verify that the collecting agent (AdER) can recover 11.5% of this amount in year t, and 10.3% in the following year (t + 1); the percentage falls to 4.3% two years later (t + 2), and reduces to almost zero after ten years.

What clearly emerges is that the share of recovered tax is higher in the first two years from issue, presents a sharp drop in the third year, and a progressive, constant decrease in the following years. Probably, part of the individuals who receive a tax notice are late payers, others feel intimidated by AdER’s collection procedure and tend to settle their debt immediately: however, this effect weakens over the following years and payments gradually reduce. As a matter of fact, in ten years the regional Tax Office only cashes an average 36.7% of the total fiscal notices, so that almost 70% of the amount due for the tax bills issued in the period 2004–2019 remains unpaid.

Our dataset provides information on what happens after the introduction of the measure by making available, from 2017 (when it came into effect) to 2019, the money collected thanks to the tax concession from the eligible tax bills, namely those issued in the period 2004–2017.Footnote 19 However, in order to acknowledge the counterfactual effect of the measure, it is necessary to estimate for those same years (2017–2019) the amount that would have been collected if the measure had not been put in place, then calculate the difference between this value and the actual sum. In other words, while it is known how much was cashed from amnesty participants and non-participants, the hypothetical amount that would have been collected in case of no remission of interests and penalties remains to be estimated.

This information can be obtained using a regression modelFootnote 20 that predicts the average sum recovered starting with year t + 1 from the issue date (t). As it can be drawn from Fig. 3, the model’s estimates seem to provide an accurate representation of actual data – the dots in the graph – for both the “non-amnesty” revenue, i.e. cashed before the tax concession was introduced (2004–2016), and the “amnesty” revenue, i.e. collected after (2017–2019).

For each lag from the issue of tax notices, if we compare the average values of tax recovery with no measure (dotted line) and tax recovery in the tax amnesty period (solid line), a positive effect stands out. In particular, the tax concession had a positive impact on the recovery rate of older bills, issued at least three years before it came into effect (from t + 3 onwards); for more recent tax notices (at times t + 1 and t + 2) it had a weaker effect, in line with (if not lower than) tax recoveries of previous years. Therefore, those having a recent tax notice to pay took advantage of the remission of interests and penalties, but on a debt they would have paid anyway. In this case the revenue differential is zero, or even negative. In short, the tax concession seems to have a null effect on more recent tax notices, and a positive effect on older ones, for which it has increased taxpayers’ compliance and, accordingly, tax revenue.

Using the above-mentioned model, it is possible to estimate the expected revenue effect of the tax concession and compare it to the amount recoverable without its introduction. Figure 4 represents, for each period starting from the tax notice issuing year, the profile of the difference in tax collection between the incentivised and non-incentivised periods, which is negative in terms of recovery rate at time t + 1, grows and reaches a peak at t + 6, and then gradually gets thinner.Footnote 21

Table 2 shows the estimates of the procedure amnesty’s effect for the tax collection years 2017–2019. They are calculated, for each payment year (2017–2019) and tax notice issuing year (2004–2017), as the difference between the expected revenues in a non-incentive situationFootnote 22 and the amounts actually collected in those same years. In the period 2017–2019, the tax concession policy led to a revenue increase of approximately 13.4 million euros as compared to what the Region would have collected so far without any tax concession.

In addition to the revenue loss of previous years as calculated above, it is interesting to determine how much could have been collected in the following years had there not been the fiscal measure (Andreoni et al., 1998). In fact, as already mentioned above, a share of tax amnesty participants who took advantage of the tax rebate to clear their debts would have still paid the amount owed in later years. Consequently, due to such ‘discount’ effect on the late but diligent taxpayers, the implementation of the measure is likely to result in a fall of revenues. On the one hand, the payment data actually show that, during the prosecution tax amnesty period (2017–2019), there has been a revenue increase from tax amnesty applicants, but on the other hand, a 30% decrease compared to normal revenues deriving from taxpayers who did not apply is evident. Using this information for the estimation of the three-year period 2020–2022, what emerges is that around 1.5 million euros out of the 13.4 million euros collected thanks to this measure would have been paid just the same and were only given ‘in advance’ through tax amnesty participation.

The net overall effect of the tax concession is therefore a revenue gain of about 11.9 million eurosFootnote 23 over a three-year period. At first glance it seems an appreciable outcome, except that the unpaid car tax bills, representing the overall amount of missed payments the amnesty was intended to recoup, totals to more than 817 million euros (column ‘Residual amount due’ in Table 1). Since the Region has only collected 1.6% of what was due, the tax amnesty policy has been seemingly ineffective in encouraging car tax defaulters to settle their arrears.

However, to have a full assessment we should have also considered the cost savings due to the simplification of executive actions introduced by the policy.Footnote 24 Unfortunately, it is not possible for us to estimate this saving, which, in any case, is not very high in this kind of amnesty discounting interests and fines. In contrast, the savings in administrative costs would have been much higher in the case of the ex-officio cancellation (also known as tax notice ‘scrapping’ measure), which are frequently promoted precisely on the basis of saving such costs, but whose consequences in terms of revenue and taxpayer loyalty are much more problematic.

5 The compliance effect. A difference-in-difference analysis of recurrent tax dodgers

The second part of our analysis aims at validating the widespread assumption according to which the introduction of some form of tax amnesty leads to decreased tax compliance in the medium-long term (Alm et al., 1990; Baer & Le Borgne, 2008). To this end, we compared the extent to which taxpayers meet their obligations after the enforcement of the prosecution tax amnesty (for the tax notices issued until 2017) against the pre-amnesty period. All other things being equal, the comparison of payment behaviour between the two periods – before and after the tax amnesty – allows us to estimate its impact on the propensity to pay new tax obligations, and consequently its expected future compliance effect. We took into account the payments of all tax notices issued in 2014, as the pre-amnesty year, and in 2018, as the post-amnesty year, when it was no more possible to avoid the payment of interest and penalties on the new tax notices.Footnote 25 In this matching, we have kept the observation group unvaried and monitored the behaviour of the individuals who had received a tax notice in the two years (the ‘inveterate tax dodgers’) for the pre- and the post-period. The aim of our analysis is to find possible differences in the propensity to pay between individuals who did participate (treated group) and those who did not participate (control group) to the tax amnesty; we then estimate the difference-in-difference (DiD) effect over time for the treated observations.

For each taxpayer with tax notices issued in 2014 and in 2018, we calculate the fraction of actual tax payment, as follows:

where, for each taxpayer i, \({paid amount}_{year,i}\) represents the sum of the payments made in 2018–2019Footnote 26 for bills issued in 2018 and in 2014–2015 for bills issued in 2014; and \({due amount}_{year,i}\) represents the total sum of the tax notices issued in 2014 and 2018, respectively. The frequency distribution of the variable thus obtained is presented in Fig. 5.

As it can be seen, we are dealing with a fractional response variable ranging between 0 and 1, with many 0-valued observations (zero-inflated), i.e. unpaid tax bills, and a lower, but still present, excess of 1-valued observations, i.e. totally paid tax bills.Footnote 27

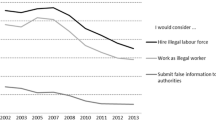

Choosing the same reference group of individuals for both the pre- and the post-amnesty periods for the sake of simplification seems an acceptable method, given that the share of recurrent tax dodgers is particularly large (Table 3). In fact, 86% of the taxpayers with an outstanding tax debt for 2018 had already received a tax notice in previous years (see Fig. 6), especially in 2014 and in 2015 (65%), and with tax notices issued in 2014 as well as in 2018 (60%). The high degree of overlap in the observations used to build the panel seems to imply a low level of bias in using records present in both years, as they constitute a broad subsample of the whole population.

As already mentioned, the impact of the prosecution tax amnesty policy on taxpayers with outstanding tax debt was estimated using a difference-in-difference (DID) approach with the aim of accurately capturing the behavioural changes induced by the tax amnesty, with a limited loss in terms of external validity, given that the reiteration of non-compliance represents a high percentage of the overall population under analysis.

As a robustness check, we reiterated the analysis for the couples of years 2013–2018 and 2015–2018, obtaining very similar results, and thus confirming the robustness of the estimates. In what follows, we focus on the comparison between 2014 and 2018, while the results for the other years are shown in Appendix 2.

5.1 The compliance effect: methodology and results

5.1.1 The matching procedure

The matching approach adopted here estimates the propensity score, P(W = 1), using a logistic model for the binary variable tax amnesty, the treatment variable W, which takes value 1 for participation and 0 otherwise. Each treated observation (participation in tax amnesty) is iteratively associated with a control observation (non-participation in tax amnesty) on the nearest propensity score (nearest neighbour propensity score matching) (Ho et al., 2007, 2011; Rosenbaum et al., 1985).

The linear predictor of the propensity score used in the logistic model is:

where male is a gender dummy; foreign is a dummy for the Italian/foreign nationality, age is a discrete variable representing age of the taxpayer; household_income represents the taxpayer’s household earnings, kilowatt represents the power of the car engine (in Kw); number of cars is the variable representing the number of vehicles belonging to the taxpayer; age car is a variable representing the age of the vehicle since the year of registration, family_status is a binary variable (family/single); work_status is a categorical variable that can be either ‘employee’, ‘self-employed’, ‘retired’ or ‘other’; unemployment – a proxy for the local economic situation – is the unemployment rate in the province of residence; capital is a binary variable taking value 1 if the home residence is in one of the ten provincial capitals of Tuscany, and 0 otherwise; province embraces the pure localization effect of the taxpayer’s residence considering the 10 provinces, while fraction2014 is the (lagged) response variable for the pre-amnesty period. The matching procedure generated a database of more than 61 thousand rows (N = 30,562 observations by T = 2 time periods). The variables used for the matching procedure can be classified in three groups: the first variable tries to classify taxpayers by considering gender, age, nationality, family status, income level, and job-related characteristics. The following three variables describe the situation with respect to the vehicle being taxed (age and engine power, which influence the tax due) and the number of vehicles owned. The other three variables, on the other hand, refer to the characteristics of the area of residence (unemployment, capital, province), also recalling the theory of 'power distance' discussed in footnote 16. Finally, the variable fraction2014 represents the behaviour of the agent before the implementation of the prosecution amnesty. In order to compare the two populations for two different periods (the pre- and the post-tax amnesty), we computed some descriptive statistics of the DiD model’s variables. Table 4 illustrates some significant differences emerging from the comparison between the two populations of individuals, namely those who participated in the tax amnesty programme (the “treated” group) and those who did not. The initial group of subjects not involved in the tax amnesty is much larger and includes a larger share of foreigners and singles, while the group of tax amnesty participants presents somewhat higher average incomes and tax liabilities, and an ampler share of self-employed workers. The last two columns report the data for the post-matching sample, which obviously has the same number of observations (30,562).

Table 5 compares the two populations with a tax notice issued in 2014 and in 2018, respectively, using the same variables calculated for the individuals in the DiD analysis. Being the same individuals observed at two different times, their characteristics are identical in 2014 and in 2018.Footnote 28 What emerges from these comparisons is that the populations and the taxpayers with tax debt both in 2014 and 2018 present very similar characteristics among them and with the post-matching sample.

The results indicate that the matching brought about an improved balance of variables, among both the time intervals, and the observations of amnesty and non-amnesty individuals.

5.1.2 Models, probability, and payment effects

In this section, we compare the compliance of individuals who did versus did not participate in the tax amnesty before and after the prosecution amnesty (Imbens et al., 2015). As we have a zero-inflated fractional response variable, we adopted a two-part fractional model (Ramalho, 2019; Ramalho et al, 2011): one for P(fraction > 0) – probability of the fraction being greater than zero (following the binary model ‘I pay at least one instalment’ vs ‘I pay nothing’) – and one for E(fraction|(fraction > 0)) – expected value of the fractions greater than zero, that is the payment rate for the observations with at least one instalment paid.Footnote 29 The two models are combined using the following formula:

where xib and xif are the explanatory variables used in the binary and fractional parts of the model, θb and θf the corresponding vectors of the parameter coefficients, and Gb(.) and Gf(.) two link functions: (0,1) → R, both with a logistic link in this case. The two components are assumed to be independent, and therefore separately estimated: while the binary component is estimated by Maximum Likelihood (ML) using the whole sample, the fractional component is estimated by Quasi Maximum Likelihood (QML), using only the values of the non-zero observation subsample and robust standard errors.Footnote 30

The linear predictors used in the two models, ηm, can be expressed as:

where the index m designates the (binary or fractional) model and the corresponding dataFootnote 31. Time is a dummy that takes value 0 in 2014 and 1 in 2018. In this case, the parameters of interest are β4,m, the treatment effect, β5,m, the year variable 2014 or 2018 (pre- and post-amnesty) and – particularly meaningful – β15,m, the interaction between the variables time and tax amnesty, which indicates the post-tax amnesty effect on the treated observations (Average Treatment Effect on the Treated – ATET).

The results of the binary model presented in Table 6 describe the effect of tax amnesty on the probability to pay (at least, in part) or to not pay at all one’s tax debt. What emerges is that applying or not for the tax concession (variable ‘Amnesty participation’) positively impacts on the probability to pay at least one part of the debt, P(fraction > 0), arising from the bills issued both before (2014) and after (2018) tax amnesty participation. In other words, the taxpayers participating in the programme would have most likely paid their debt even without the prosecution amnesty and, conversely, the individuals who never pay their bills did not adhere to the tax amnesty regime.

Another significant result concerns the negative effects of both variables ‘Time’, considering the overall decrease of payments made in 2018 as compared to 2014, and ‘Time-amnesty interaction’. The latter is particularly interesting for our analysis: in fact, although we have already seen that individuals applying for tax amnesty have a higher probability of paying their bills, the opposite comes true in the interaction between time and amnesty, since taxpayers who have taken advantage of the reduced interest and penalties option are unlikely to pay the new 2018 tax notice within the deadline (the interaction effect on odds is exp(-0.607821) = 0.5445361). Therefore, as claimed in literature, tax amnesty participation negatively affects the probability to pay future tax notices in the lack of additional facilitating measures, presumably because who takes advantage of tax amnesties waits for new concessions before paying off other debts.

Table 7 presents the results for the fractional model, in which the dependent variable is not binary (I pay/I do not to pay), but continuous within the values of the share of payment. This analysis shows a negative effect of amnesty participation on the debt repayment share E(fraction|fraction > 0), and a positive effect of the time dummy and of the time-amnesty interaction. This means that, when making at least one payment, tax amnesty participants are generally inclined to disburse smaller fractions of their debt compared to other individuals (i.e. they do not pay all the instalments, or choose instalment plans spread out over a longer time span), whereas after adhering to tax amnesty they pay a higher share of the amounts due; in other words, tax amnesty participation leads the individuals who usually pay to become more faithful payers for future tax bill instalments or to choose an instalment plan with closer deadlines. The estimate of the interaction effect on E(fraction|fraction > 0) is thus exp(0.197654) = 1.218541, i.e. 21% higher amounts from individuals making at least one payment. This shows that the expected higher compliance effect once the previous debts are closed (often recalled as a motivation for amnesties in the political debate), seems very limited as far as observable in this study.

5.1.3 The average effect

Previous estimation results have shown that the coefficients of the relevant variables have opposite signs in the two models (binary 0/1 and payment share), so that it is not possible to directly infer an ‘overall’ effect of the policy. However, it is possible to calculate the partial effectFootnote 32 of the j-th variable as follows (Ramalho, 2019):

where yi is the response variable, i.e.the payment fraction for the i-th observation, xi f the corresponding set of covariates, and xij the j-th variable. Since the partial effects depend on the value of the other response variables, the average partial effect could be calculated using all the observations and averaging the estimate effects. Hence, the partial effect allows us to estimate the policy’s impact on the outcome variable while taking full account of the other response variables. Given the covariates, E (y/x) is the conditional estimate of the payment fraction obtained by combining the estimates of the two partial models described above, thus using the same set of covariates already introduced.

Table 8 presents the results for the average partial effects. The ‘overall’ effect of participation in the tax amnesty on the expected value of the payment fraction, E(fraction), is therefore positive, thus confirming that those who adhere to this policy are the same individuals who would have paid their own debt anyway.

Instead, the effect of time is not significant, while the time-amnesty interaction appears to negatively impact on the probability to pay. Specifically, the ATET is -0.0533, which indicates that those benefiting from the tax incentive will reduce by 5.3% the payment fraction of post-amnesty bills. This confirms that the ‘overall’ effect of amnesty on payments (considering both the payment of tax notice and the fraction of payment) is negative, which means that tax amnesties encourage behaviours leading to pay smaller amounts than due in the expected time span.

6 Conclusions

The vehicle tax, a property tax on the ownership of vehicles levied by regional governments, has surprisingly low levels of compliance (about 13% of owners don’t pay, accounting for 18% of the total tax amountFootnote 33), also considering that compulsory motor vehicle registration makes it utterly straightforward to identify who should be subject to the tax, and that the car tax corresponds, on average, to a rather small amount. As it happens in many other contexts, however, the propensity to pay late or to not pay at all produced a stockpile of tax arrears that national policy makers have traditionally dealt with through tax amnesties or concessions, rather than by measures against tax evasion or policies aimed at encouraging, or even nudging, voluntary payment.Footnote 34 The manifold typologies of tax amnesty or rebate put in place did not seem to produce any remarkable effect, either on revenue or on payment, in the following years (Luitel & Sobel, 2007).

This work analyses the effects of the tax concession policy adopted for the tax notices issued from 2000 to 2017. This measure was applicable for local taxes as well, and among them the car taxes levied by regional authorities. We referred to a database containing the tax roll recording and payment of the car tax due in the years from 2004 to 2019 and provided an estimation of the post-intervention effects on revenue and payment behaviours. The tax concession measure has produced in a three-year period a revenue increase of 13.4 million euros, corresponding to 21% of ordinary tax collection; this sum must be reduced by the estimated revenue from taxpayers who would have paid even without the tax reduction, which amounts to about 1.5 million euros. There has been a revenue increase, then, but of very limited extent: compared to the 817 million euros of accrued tax bills, it only represents 1.6% of the total unpaid amount.

Regarding compliance, instead, the theoretical models underline how turning to forms of tax amnesty or concession produces negative effects in the medium-long term. In this work, a difference-in-difference analysis was carried out on a panel of individuals with tax notices issued both before (2014) and after (2018) the introduction of the measure. The analysis reveals that those who participated in the amnesty reduce the payment of the post-amnesty tax bills by 5.3%. This is probably because at least a part of these individuals chooses not to pay directly in the expectation of future tax concessions. Besides, it is estimated that a part of amnesty participants would have paid their debts in any case, even without the cancellation of penalties and interests. These results have been estimated just for one region and we need to be cautious in extending these conclusions to other Italian regions or other countries. However, almost all other Italian regions complain about high evasion rates of the vehicle tax, so the topic certainly deserves further investigation and we hope that our analysis can be replicated on new data.

Therefore, even in the field of local taxation, tax amnesties and concessions seem to represent more of a method to lighten the bureaucratic burden of administration – the piling up of tax bills – than a successful way of increasing revenue as well as the compliance of taxpayers. Basically, this analysis confirms the existing literature on the revenue effect of tax amnesty, according to which immediate positive effects are counterbalanced by subsequent negative effects deriving from the behaviours of defaulting taxpayers, who wait for further concessions to be granted. When considering vehicle taxation in Italy, a tax aversion component seems to prevail: the amount of tax is limited, the probability of being discovered is almost one, and yet the level of evasion remains high. The results show that the greater the distance—kilometric or perceived—from the decision-making centre, the higher the level of evasion. The policies that need to be put in place to encourage spontaneous compliance are diverse: from those that can reduce compliance costs to information campaigns that foster awareness of the destination of revenue, to those that stimulate the idea of influencing the allocation of resources. Laboratory experiments (see Casal et al., 2016) highlight that reducing the social distance between taxpayers and tax authorities boosts taxpayers’ acceptance of tax load and tax compliance. All in all, the strengthening of anti-avoidance and nudging policies – aimed at voluntary tax paymentFootnote 35 – should then be considered the most promising strategy to gain greater loyalty from taxpayers and mark a turning point in the accumulation of tax debts.

Data availability

The data that support the findings of this study are available from Regione Toscana but restrictions apply to the availability of these data, which were used under special permission for the current study, and so are not publicly available.

Notes

The debt collector must take different formal steps for each tax liability to recover the due amount, even if small. The volume of tax bills, especially from long past due years, makes the collection task more difficult and inefficient because the older the debt, the harder it is to get it back. The Corte dei Conti (2021) shows that as for 2019 the value of total tax notice load, entrusted for all taxes by the various creditor entities to the Collection Agency-AdER since 1 January 2000, amounted to approximately one thousand billion euros.

The tax bill is a notice delivered to taxpayers by the Revenue Agency, ordering payment to creditors (the Agency itself, the Social Security Institute, municipalities, etc.).

The main general tax exemptions are: for historical vehicles over 30 years, for electric vehicles in the first 5 years (from the first registration) and for vehicles used by disabled persons.

Palumbo (2010).

Decree-Law of 6 July 2011 introduced a surcharge, known as ‘superbollo’, if the vehicle engine power exceeds 185 kW. For an analysis of the effect of the superbollo, see Bergantino et al. (2021).

According to the Ministry of Finance Report on underground economy (MEF 2021), in 2019 almost 45% of regional revenue recovery came from unpaid vehicle duties.

See Regione Toscana, Rendiconto generale, several years. Indeed, the budget residuals from previous budgets accrued in only 5 years – from 2015 to 2019—sum to more than 400 million euros in 2020, highlighting a phenomenon which is far from being negligible.

See Diddi et al. (2018).

It is worth noting that the regional tax authority must send the notification within three years, otherwise the whole procedure is null. For a detailed description of the car tax enforcement process and of the amnesty programme see Angeli et al. (2021).

The tax roll (or register) is a list compiled by the tax authority [Agenzia delle entrate riscossione (AdER)] acting as Revenue and Collection Agency for the specific purpose of collecting. Each record contains for every debtor the amounts due to the collection agent, including levies, penalties, default interests, incidental charges, and any further fees arising from failed (or delayed) payment. The enrolment on the register takes place when a debtor’s name and amount are included in the record.

The adhesion of local authorities to the government’s amnesty plan is mandatory when the collection agent is AdER.

Article 4 of Decree-Law no. 119 of 23 October 2018 also introduces the ‘balance and excerpt’ of tax bills, which writes off ‘older’ uncollectible tax receivables up to 1000 euros, i.e. not yet paid and unlikely to be paid in the future. Next to mere political consensus, the aim of the legislator is to alleviate the burdens of AdER by cutting several low-value tax bills, and correspondingly their operating costs. The end result is a revenue loss for the Region against an efficiency gain for the collection agency.

For empirical reasons, the tax concession measures will be treated here like a single unit covering the three-year period.

The dataset is restricted to car tax bills issued to households (non-firm and non-public entity) taxpayers and specifically to those households for which is possible to find a valid tax code. The dataset includes many variables for each bill; the most relevant for our analysis are the date of issue, the amount due (i.e. the tax charge), the chosen number of instalments, the paid amount and the possible application for amnesty.

Interestingly, the share of tax dodgers or late payers is highly differentiated by geographical location and nationality. In line with the concept of 'power distance' (Pukeliene and Kazemekaityte, 2016), i.e. the degree to which individuals perceive themselves as possessing or not possessing power in a society, tax evasion has a higher incidence in provinces further away from the regional capital and in those where there is a higher concentration of foreign residents.

Indeed, it should be recalled that there have been frequent periods of turnover freezes for civil service staff since the financial crisis.

The irregular data trend is therefore neither due to a strategy of the regional authority nor is it possible to speculate on taxpayers' waiting behaviour for the next tax amnesty, as these have always been continuous over time, as pointed out by Bordignon and Zanardi (1997).

The graph presents the data referring only to the period 2006–2019 because the information on previous payments is incomplete.

For each record, the dataset provides information on the recovered sum with reference to the corresponding amnesty plan.

Specifically, we relied on a fractional response model estimated through a beta regression with logit link (Cribari-Neto & Zeileis, 2010). For a description of the model, see Appendix 1.

The estimate of the revenue that would have been received in the absence of tax concession was subtracted from the estimate of the revenue actually raised thanks to the amnesty. The confidence intervals represent the 0.05 and 0.95 quantile predictions.

The estimates of the expected revenue were obtained multiplying, for each payment year and tax bill year, the percentage of collected taxes without amnesty – as predicted using the above-mentioned model – by the total number of tax bills issued each year (the annual charge of Table 1).

The revenue lost due to the ex-officio cancellation procedure could also have been included in the calculation of the revenue effect. However, we decided to disregard this element both because the estimate would have been inconsistent with what was done for the prosecution's tax amnesty procedure outlined above and because we do not consider this very policy intervention in the regression analysis of the following paragraphs.

See Langenmayr (2017) for an analysis of the change in administrative costs in the case of a policy of voluntary disclosure. Langenmayr carried out a specific survey among regional tax offices in Germany, finding a remarkable decrease in administrative costs. However, in the case of voluntary disclosure the tax inspection activity is quite complex, very different from the case under study here, were the identity of taxpayers and the amount due is known with certainty.

It should be recalled that the bills issued in 2018 relate to missing payments from previous years.

Payment in 2019 can be linked to the tax notice issued in 2018. Therefore, there is no interaction with the ex-officio cancellation measure.

The intermediate fractions between 0 and 1 are due to the possible payment/missed payment of single instalments in the years under survey, or to the preferred instalment plan.

All the information on which the variables were calculated is referred to the year 2014, so that an individual who, for example, had a specific income in 2014 presents the same level in 2018. The unchangeability of the dataset is not a problem for our analysis, because it concerns both groups.

In other words, we estimate the percentage of taxes paid for the observations with at least one instalment paid.

We have used the Generalized Variance Inflation Factor (GVIF) for detecting multicollinearity and we did not detect the high values of the inflation factor, suggesting low level of multicollinearity for the variables used in the model. See Fox (1997).

As mentioned above, although the binary logistic model is estimated from all the data, whereas the fractional logistic model is estimated only from data of fractions greater than zero, they can be expressed with a single formula having the same covariates.

It is important to note that the interpretation of the partial effect coefficients is additive, + (βx) rather than exponential/multiplicative, *exp(βx). Consequently, the binary treatment for partial effects represents the variation of the expected fraction of payment for the treated observations.

Diddi et al. (2018).

For an analysis of political cycle and tax amnesties see Raitano and Fantozzi (2015).

In this regard, we can recall initiatives such as the direct debit payment of car tax activated by Regione Lombardia – which allows for a 15% reduction on the amount due – or the courtesy text messages sent by Regione Toscana to remind the payment deadlines.

References

Alm, J., & Beck, W. (1990). Tax amnesties and tax revenue. Public Finance Quarterly, 18(4), 433–453.

Alm, J., & Beck, W. (1993). Tax amnesties and compliance in the long run: A time series analysis. National Tax Journal, 46(1), 53–60.

Alm, J., & Malézieux, A. (2021). 40 years of tax evasion games: A meta-analysis. Experimental Economics, 24(3), 699–750.

Alm, J., McKee, M., & Beck, W. (1990). Amazing grace: Tax amnesties and compliance. National Tax. Journal, 43(1), 23–37.

Andreoni, J. (1991). The desirability of a permanent tax amnesty. Journal of Public Economics, 45, 143–159.

Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818–860.

Angeli, A., Lattarulo, P., & Palmieri, E. (2021). Condono, fiscalità generale ed effetti sulla compliance, Irpet Report, http://www.irpet.it/archives/64428

Baer, K., & Le Borgne, E. (2008). Tax amnesties. Theory, trends, and some alternatives. Washington, DC: International Monetary Fund.

Bergantino, A. S., Intini, M., & Percoco, M. (2021). New car taxation and its unintended environmental consequences. Transportation Research Part A: Policy and Practice, 148, 36–48.

Bernasconi, M., & Lapecorella, F. (2006). I condoni nel sistema tributario italiano. In M.C. Guerra, & A. Zanardi (Eds.), La finanza pubblica italiana. Rapporto 2006 (pp. 377–405). Bologna: il Mulino.

Bordignon, M., & Zanardi, A. (1997). Tax evasion in Italy. Giornale degli economisti e annali di economia, 169–210.

Casal, S., Kogler, C., Mittone, L., & Kirchler, E. (2016). Tax compliance depends on voice of taxpayers. Journal of Economic Psychology, 56, 141–150.

Corte dei Conti (2021). La gestione dei residui di riscossione nel bilancio dello Stato, Corte dei Conti, Roma

Cribari-Neto, F., & Zeileis, A. (2010). Beta regression. R. Journal of Statistical Software, 34, 1–24.

Diddi, F., Grossi, G., & Lattarulo, P. (2018). Civismo, qualità istituzionale e politiche di contrasto all’evasione. Evidenze dalla tassazione regionale sugli autoveicoli, Irpet Report, http://www.irpet.it/archives/52292

Fiorentini, G., & Martina, R. (1997). L’efficacia dei provvedimenti di condono fiscale: analisi teorica e risultati empirici. In G. Fiorentini, & C. Marchese (Eds.), Il fisco indulgente: amnistie e concordati nei moderni sistemi fiscali. Torino: Giampichelli.

Fox, J. (1997). Applied regression, linear models, and related methods. Sage.

Franzoni, L. A. (1996). Punishment and grace: On the economics of permanent amnesties. Quaderni – Working Paper DSE, No. 252.

Ho, D. E., Imai, K., King, G., & Stuart, E. (2007). Matching as nonparametric preprocessing for reducing model dependence in parametric causal inference. Political Analysis, 15, 199–236.

Ho, D. E., Imai, K., King, G., & Stuart, E. (2011). MatchIt: Nonparametric preprocessing for parametric causal inference. Journal of Statistical Software, 42(8), 1–28.

Imbens, G. W., & Rubin, D. B. (2015). Causal inference for statistics, social and biomedical sciences: An introduction. Cambridge University Press.

Langenmayr, D. (2017). Voluntary disclosure of evaded taxes - increasing revenue, or increasing incentives to evade? Journal of Public Economics, 151, 110–125.

López-Laborda, J., & Rodrigo, F. (2003). Tax amnesties and income tax compliance: The case of Spain. Fiscal Studies, 24(1), 73–96.

Luitel, H. S., & Sobel, R. S. (2007). The revenue impact of repeated tax amnesties. Public Budgeting & Finance, 27, 19–38.

Nar, M. (2015). The effects of behavioral economics on tax amnesty. International Journal of Economics and Financial Issues, 5(2), 580–589.

Palumbo, A. (2010). Bollo auto e federalismo fiscale, Rivista giuridica della circolazione e dei Traporti, Aci

Pukeliene, V., & Kažemekaityte, A. (2016). Tax behaviour: Assessment of tax compliance in European Union countries. Ekonomika, 95(2), 30–56.

Raitano, M., & Fantozzi, R. (2015). Political cycle and reported labour incomes in Italy: Quasi-experimental evidence on tax evasion. European Journal of Political Economy, 39, 269–280.

Ramalho, J. (2019). Modeling fractional responses using R. In H. D. Vinod & C. R. Rao (Eds.), Conceptual econometrics using R. Handbook of statistics 41 (pp. 245–279). Elsevier.

Ramalho, E. A., Ramalho, J. J. S., & Murteira, J. M. R. (2011). Alternative estimating and testing empirical strategies for fractional regression models. Journal of Economic Surveys, 25(1), 19–68.

Rosenbaum, P. R., & Rubin, D. B. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41–55.

Stella, P. (1989). An economic analysis of tax amnesties. IMF Working Paper, No. 42, Fiscal Affairs Department, IMF.

Acknowledgements

We wish to thank A. Ferracani, J. Geroni and S. Graziani for their suggestions.

Funding

Open access funding provided by Università degli Studi di Firenze within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Appendix 1: fractional beta model for payment fractions – referred to paragraph 4

We have chosen a specific model for the estimation of average recovery rate over time (that is a variable ranging between zero and 1), considering two periods, with and without amnesty.

This model is useful for a fractional response variable and can be estimated using beta regression with a link logit, through the formula:

where time indicates how many years have passed since the tax notice was issued, amnesty specifies whether the tax was or was not paid when the amnesty was in force, first is a dummy that takes value 1 at the first year of payment, thus taking into account the consistently greater fraction of payment in the year following debt creation discussed in paragraph 3, and finally time*amnesty is an interaction term.

As expected, time has a negative and significant coefficient, and first a positive one. The interaction term has a positive significant sign, which suggests an increase of recovery rate for older debts during the amnesty period compared to the no-amnesty period.

Appendix 2: a robustness check. DiD analysis for the periods 2013-2018 and 2015-2018

In order to evaluate the robustness of the conclusions outlined by the analysis, the estimates of average partial effects were repeated by comparing different models for the pre-amnesty years 2013, 2014 and 2015 matched against the only post-amnesty year with available data, 2018.

As it can be seen from Table A2, the estimates of the time-amnesty interaction – the main parameter of interest – are consistent. The same holds true for the estimates of the other parameters in the model, which on the whole present very similar results. The stability of the coefficients show that our results are not sensitive to the pre-amnesty year of reference.

See Table

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Angeli, A., Lattarulo, P., Palmieri, E. et al. Tax evasion and tax amnesties in regional taxation. Econ Polit 40, 343–369 (2023). https://doi.org/10.1007/s40888-023-00297-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-023-00297-9