Abstract

This paper studies the association of remittances inflow and economic growth in eleven African emerging economies from 1990 to 2022. Autoregressive distributed lag and cointegration techniques are applied to panel data from eleven countries. The study uses the mean group, pooled mean group, and dynamic fixed effects for robustness tests. The findings show that remittances significantly affect the gross domestic product growth rate negatively. Credit to the private sector negatively influences economic growth. Policymakers should prioritize a targeted response to the COVID-19 crisis by reducing the costs of access to vaccines and healthcare for the populace so that the received remittances will significantly impact the population’s welfare. African governments should recognize the importance of remittance inflows and reduce remittance costs by reducing taxes on remittances so that more remittances are sent home to boost economic growth. Governments should increase the formalization of remittance inbound transfers to improve the conditions of accessibility to financial services in emerging economies, which reduces the unbanked population. The monetary authorities should establish remittance-based policies that promote the use of formal channels, ease the pressure on emerging countries’ credit services, and improve foreign exchange rates, which would increase the amount of remittances received. Banks should create financial products and services that attract investments and growth for diaspora remittances in developing economies. This would promote financial inclusion and the effective use of credit by the private sector to boost economic growth.

Source World Bank-Global Knowledge Partnership on Migration and Development estimates

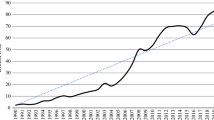

Source World Bank Prices of Remittances

Source Author’s Conception

Similar content being viewed by others

Availability of data and materials

The datasets generated and analyzed in the current study are available in the World Bank development indicators database.

References

Abeka MJ, Andoh E, Gatsi JG, Kawor S (2021) Financial development and economic growth nexus in SSA economies: the moderating role of telecommunication development. Cogent Econ Finance 9(2):1862395

Adams S, Klobodu EKM (2016) Remittances, regime durability, and economic growth in Sub-Saharan Africa. Econ Anal Policy 50(1):1–8

Adekunle IA, Tella SA, Subair K, Adegboyega SB (2022) Remittances and financial development in Africa. J Public Affairs 22(3):e2545

Aggarwal R, Demirguc-Kunt A, Peria MSM (2011) Do remittances promote financial development? J Dev Econ 96(4):255–264

Ajide FM (2016) Financial innovation and sustainable development in selected countries in West Africa. J Entrep Manag Innov 12(3):85–111

Ajilore T, Ikhide S (2012) A bounds-testing analysis of migrants’ remittances and financial development in selected sub-Saharan African countries. Rev Finance Bank 4(2):79–96

Akanle O, Kayode D, Abolade I (2022) Sustainable development goals (SDGs) and remittances in Africa. Cogent Soc Sci 8(5):2037811

Amuedo-Dorantes C, Pozo S (2014) Remittance income uncertainty and asset accumulation. IZA J Labor Dev 3(3):1–24

Aneja R, Ahuja V (2020) An assessment of the socioeconomic impact of the COVID-19 pandemic in India. J Public Aff 21(2):1–6

Aneja R, Praveen A (2022) International migration remittances and economic growth in Kerala: an econometric analysis. J Public Aff 22(1):16–29

Asongu SA, Odhiambo NM (2022) Remittances and value-added across economic sub-sectors in Sub-Saharan Africa. Q Quant 56(3):23–41

Azizi SS (2020) Impacts of remittances on financial development. J Econ Stud 47(3):467–477

Basnet HC, Koirala B, Upadhyaya KP, Donou-Adonsou F (2020) Workers’ remittances and financial development: the case of South Asia. Int Rev Econ 68(2):185–207

Bettin G, Zazzaro A (2012) Remittances and financial development: Substitutes or complements in economic growth? Bull Econ Res 64(4):509–536

Bhattacharya M, Inekwe J, Paramati SR (2018) Remittances and financial development: empirical evidence from a heterogeneous panel of countries. Appl Econ 50(38):4099–4112

Cao S, Kang SJ (2020) Personal remittances and financial development are important for economic growth in transition countries. Int Econ J 34(3):1–21

Cirolia LR, Hall S, Nyamnjoh H (2021) Remittance micro-worlds and migrant infrastructure: circulations, disruptions, and the movement of money. Trans Inst Br Geogr 00(1):1–14

Coulibaly D (2015) Remittances and financial development in Sub-Saharan African countries: a system approach. Econ Model 45(2):249–258

Donou-Adonsou F, Pradhan G, Basnet HC (2020) Remittance inflows and financial development: evidence from the top recipient countries in Sub-Saharan Africa. Appl Econ 52(53):1–14

Easterly W (1999) The ghost of the financing gap: testing the growth model used in international financial institutions. J Dev Econ 60(2):423–438

Fayissa B, Nsiah C (2010) The impact of remittances on economic growth and development in Africa. Am Econ 55(2):92–103

Fromentin V (2017) The long-run and short-run impacts of remittances on financial development in developing countries. Q Rev Econ Finance 66:192–201

Gninigue M, Ali E (2021) Migrant remittances and economic growth in ECOWAS countries: Does digitalization matter? Eur J Dev Res 7(3):123–142

Islam MdS (2021a) Is the trade-led growth hypothesis valid for the Kingdom of Saudi Arabia? Evidence from an ARDL approach. Fudan J Human Soc Sci 14(3):445–463

Islam MdS (2021b) Do personal remittances influence economic growth in South Asia? A panel analysis. Rev Dev Econ 26(1):242–258

Islam MS (2022c) Does the trade-led growth hypothesis exist for South Asia? A pooled mean group estimation. Region Sci Policy Pract 14(2):244–257

Islam MS, Alhamad IA (2022) Impact of financial development and institutional quality on the remittance-growth nexus: evidence from the top most remittance-earning economies. Heliyon. https://doi.org/10.1016/j.heliyon.2022.e11860

Islam MS, Alsaif SS, Alsaif T (2022) Trade openness, government consumption, and economic growth Nexus in Saudi Arabia: ARDL cointegration approach. SAGE Open 12(2):21582440221096660

Islam MS, Rahaman SH, Akhtar T (2023) Impact of remittance on economic growth and environmental quality in the purview of energy use, regulatory quality, and financial development. Natural resources forum. Blackwell Publishing Ltd, Oxford

Kakhkharov J, Rohde N (2019) Remittances and financial development in transition economies. Emp Econ 59(2):731–763

Karikari NS, Mensah S, Harvey SK (2016) Do remittances promote financial development in Africa? Springerplus 5(1101):3–21

Kindleberger CP (1959) United States economic foreign policy: research requirements for 1965. World Polit 11(4):588–613

Lartey EKK (2013) Remittances, investment, and growth in sub-Saharan Africa. J Int Trade Econ Dev 22(7):1038–1058

Offor KO, Ngong CA, Onyejiaku CC, Enemuo J, Ugbam CO, Ibe GI, Onwumere JU (2024) Remittances and emerging African economies’ growth nexus in a post COVID-19 era. Natural resources forum. Blackwell Publishing Ltd, Oxford, pp 171–183

Olayungbo DO, Quadri A (2019) Remittances, financial development, and economic growth in sub-Saharan African countries: evidence from a PMG-ARDL approach. Financ Innov 5(9):1–25

Opperman P, Adjasi CKD (2018) Remittance volatility and financial sector development in sub-Saharan Africa. J Policy Model 41(2):336–351

Pesaran MH, Shin Y, Smith RJ (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(4):621–634

Rocher E, Pelletier A (2008) Migrant workers’ remittances: What is the impact on the economic and financial development of Sub-Saharan African countries? Banque De France Bull Digest 173:27–38

Tarus DK (2015) Do diaspora remittances affect banking sector development in Sub-Saharan Africa? Int J Commer Manag 25(3):356–368

Todaro MP (1969) A model of labor migration and urban employment in less developed countries. Am Econ Rev 59(1):138–148

Williams K (2016) Remittances and financial development: evidence from Sub-Saharan Africa. Afr Dev Rev 28(3):357–367

World Bank (2020) The World Bank predicts the sharpest decline of remittances in recent history [Press Release No. 2020/175/SPJ]. https://www.worldbank.org

World Bank (2021a) Defying predictions, remittance flows remain strong during the COVID-19 crisis [Press release no. 2021/147/SPJ]. https://www.worldbank.org

World Bank (2021b) Remittance flows register robust 7.3 percent growth in 2021 [Press Release No. 2022/027/SPJ]. https://www.worldbank.org

World Bank (2021c) Recovery: the COVID-19 crisis through a migration lens [Migration and Development Brief 35]. https://www.worldbank.org

Acknowledgements

We acknowledge the effort of all the reviewers and editors of the journal to improve the quality of this paper. We specially acknowledge Prof. Shu Elvis for mentorship.

Funding

No Funding for this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All financial and non-financial competing interest have been declared.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ngong, C.A., Onyejiaku, C.C., Kum, F.V. et al. Remittances inflow and economic growth nexus: evidence from emerging African economies in a post-COVID-19 Era. J. Soc. Econ. Dev. (2024). https://doi.org/10.1007/s40847-024-00323-x

Accepted:

Published:

DOI: https://doi.org/10.1007/s40847-024-00323-x