Abstract

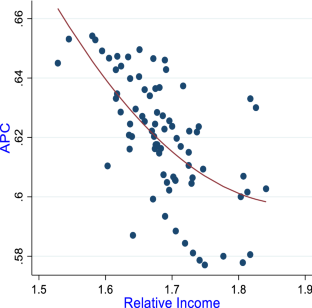

Despite being mysteriously ignored and displaced by mainstream consumption theories, Duesenberry’s relative income hypothesis appears to be highly relevant to modern societies where individuals are becoming increasingly obsessed with their social status. Accordingly, this study aims to provide some evidence on relative income hypothesis by investigating the relevance of Duesenberry’s demonstration and ratchet effects in Ethiopia using quarterly data from 1999/2000Q1 to 2018/19Q4. We estimate two specifications of the relative income hypothesis using the traditional Autoregressive Distributed Lag (ARDL) model and the dynamic ARDL simulations approach. The findings confirm a Backward-J-shaped demonstration effect, implying that an increase in relative income induces a steeper reduction in Average Propensity to Consume (APC) at lower-income groups (the demonstration effect is stronger for lower-income groups). The results also support the ratchet effect, indicating the importance of past consumption habits for current consumption decisions. In resolving the consumption puzzle, the presence of demonstration and ratchet effects reflects a stable APC in the long run. Therefore, consumption-related policies should be carefully designed, as policies aimed at boosting aggregate demand can motivate low-income households to gallop into a wasteful competition to ‘keep up with the Joneses’—the relative riches.

Similar content being viewed by others

Notes

It is relative income, not absolute one, which matters more for consumption decisions of an individual.

Past consumption patterns (habit formation) significantly determines an individual’s current consumption.

References

Abebe S (2006) Essay on poverty, risk and consumption dynamics in Ethiopia. Doctoral thesis, Goteborg University, School of Business, Economics and Law. http://hdl.handle.net/2077/2908

Alimi RS (2013) Keynes' Absolute Income Hypothesis and Kuznets Paradox

Alimi RS (2015) Estimating consumption function under permanent income hypothesis: a comparison between Nigeria and South Africa. Int J Acad Res Bus Soc Sci. https://doi.org/10.6007/IJARBSS/v5-i11/1917

Altunc OF, Aydin C (2014) An estimation of the consumption function under the permanent income hypothesis: the case of D-8 countries. J Econ Cooper Dev 35(3):29–42

Bisset T, Tenaw D (2020) Keeping up with the joneses: the relevance of duesenberry’s relative income hypothesis in ethiopia. Research Square. https://doi.org/10.21203/rs.3.rs-83692/v1

Brown TM (1952) Habit persistence and lags in consumer behavior. Econometrica 20(3):355–371. https://doi.org/10.2307/1907409

Davis TE (1952) The consumption function as a tool for prediction. Rev Econ Stat 34(3):270–277. https://doi.org/10.2307/1925635

DeJuan J, SeaterJ WirjantoT (2006) Testing the permanent-income hypothesis new evidence from West-German States. Empir Econ 31:613–629

Douglas M, Isherwood B (1978) The World of Goods: Towards an Archaeology of Consumption

Duesenberry JS (1949) Income, saving and the theory of consumption behavior. Harvard University Press, Cambridge

Duesenberry JS, Eckstein O, Fromm G (1960) A simulation of the United States economy in recession. Econometrica 28(4):749–809. https://doi.org/10.2307/1907563

Easterlin RA (1974) Does economic growth improve the human lot? Some empirical evidence. Nations and Households in Economic Growth: Essays in Honor of Moses Abramovitz. https://doi.org/10.1016/B978-0-12-205050-3.50008-7

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813−836

Frank RH (1985) The demand for unobservable and other nonpositional goods. The American Economic Review 75(1):101–116

Frank RH (2005) The mysterious disappearance of James Duesenberry. The New York Times

Friedman M (1957) A theory of the consumption function. Princeton University Press, Princeton

Gaertner W (1974) A dynamic model of interdependent consumer behavior. Zeitschrift Für Nationalökonomie/journal of Economics 34:327–344

Gomes FAR (2012) A direct test of the permanent income hypothesis: the brazilian case. Brazilian Business Review 9(4):87−102

Gupta R, Ziramba E (2011) Is the permanent income hypothesis really well-suited for forecasting? East Econ J 37:165–177. https://doi.org/10.1057/eej.2010.14

Hamilton D (2001) Comment provoked by Mason´s “Duesenberry´s contribution to consumer theory.” J Econ Issues. https://doi.org/10.1080/00213624.2001.11506400

Jordan S, Philips AQ (2018) Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J Promot Commun Stat Stata 18(4):902–923. https://doi.org/10.1177/1536867X1801800409

Kelikume I, Alabi F, Anetor F (2017) Nigeria consumption function—an empirical test of the permanent income hypothesis. J Glob Econ Manag Bus Res 9(1):17–24

Keynes JM (1936) The general theory of employment, interest, and money. Macmillan, London

Khalid K, Mohammed N (2011) Permanent income hypothesis, myopia and liquidity constraints: a case study of Pakistan. Pak J Soc Sci 31(2):299–307

Khan H (2014) An empirical investigation of consumption function under relative income hypothesis: evidence from farm households in Northern Pakistan. Int J Econ Sci 3(2):43–52

Kuznets S (1942) Uses of national income in peace and war. National Bureau of Economic Research, New York

Leibenstein H (1950) Bandwagon, snob and veblen effects in the theory of consumers’ demand. Q J Econ 64(2):183–207. https://doi.org/10.2307/1882692

Mason R (2000) The social significance of consumption: james Duesenberry’s contribution to consumer theory. J Econ Issues 34(3):553–572

McCormick K (1983) Duesenberry and veblen: the demonstration effect revisited. J Econ Issues 17(4):1125–1129

McCormick K (2018) James Duesenberry as a practitioner of behavioral economics. J Behav Econ Policy 2(1):13–18

Modigliani F, Brumberg R (1954) Utility analysis and the consumption function: an interpretation of cross-section data. In: Kurihara KK (ed) Post-Keynesian economics. Rutgers University Press, New Brunswick, pp 388–436

Nkoro E, Uko AK (2016) Autoregressive Distributed Lag (ARDL) cointegration technique: application and interpretation. J Stat Econ Methods 5(4):63–91

Osei-Fosu AK, Butu MM, Osei-Fosu AK (2014) Does Ghanaian’s consumption function follow the permanent income hypothesis? The Cagan’s adaptive expectation approach. Afr Dev Resour Res Inst (Adrri) J133–148

Palley T (2008) The relative income theory of consumption: a synthetic Keynes-Duesenberry-Friedman model. Working paper 170, Political Economy Research Institute

Parada JC, Mejia WB (2009) The relevance of Duesenberry consumption theory: an applied case to Latin America. Revista De Economía Del Caribe 4:19–36

Paz LS (2006) Consumption in Brazil: myopia or liquidity constraints? A simple test using quarterly data. Appl Econ Lett 13(15):961–964. https://doi.org/10.1080/13504850500425931

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Pollak, R. A. (1976). Interdependent Preferences. The American Economic Review, 66(3): 309–320. https://www.jstor.org/stable/1828165

Reid M (1952) Effect of income concept upon expenditure curves of farm families. In: conference on research in income and wealth, studies in income and wealth, NBER, New York, p 15

Sanders S (2010) A model of the relative income hypothesis. J Econ Educ 41(3):292–305. https://doi.org/10.1080/00220485.2010.486733

Shrestha MB, Bhatta GR (2018) Selecting appropriate methodological framework for time series data analysis. J Finance Data Sci 4:71–89. https://doi.org/10.1016/j.jfds.2017.11.001

Singh B, Kumar RC (1971) The relative income hypothesis-a cross-country analysis. Rev Income Wealth. https://doi.org/10.1111/j.1475-4991.1971.tb00787.x

Singh B, Drost H, Kumar RC (1978) An empirical evaluation of the relative, permanent income and the life-cycle hypothesis. Econ Dev Cultural Change 26(2):281–305

Veblen T (1899) The theory of the leisure class. Macmillan, New York

Acknowledgements

The authors would like to thank the reviewers for their helpful comments.

Funding

No funding was received.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The first (preprint) version of this paper is available at Research Square (and can be accessible at www.researchsquare.com/article/rs-83692/v1).

Rights and permissions

About this article

Cite this article

Bisset, T., Tenaw, D. Keeping up with the Joneses: macro-evidence on the relevance of Duesenberry’s relative income hypothesis in Ethiopia*. J. Soc. Econ. Dev. 24, 549–564 (2022). https://doi.org/10.1007/s40847-022-00182-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40847-022-00182-4