Abstract

We examine the Pasinettian multi-sectoral two-class model with a microfoundation of a capitalist and a worker. The microfoundation assumed in this study is an infinitely lived agent and an agent whose behaviour follows the overlapping generations model. We consider two combinations of the microfoundation of capitalists and workers: one is that both capitalists and workers act as infinitely lived agents and the other is that capitalists act as infinitely lived agents and workers act as in the overlapping generations model. We exclusively analyse the steady states and focus on the switches of equilibria from the Pasinetti equilibrium to the dual equilibrium and vice versa, together with the paradoxes in capital theory. The relationship between the rates of economic growth and profit obtained in Pasinetti equilibrium is independent of technology and the combination of the microfoundation. The relationship obtained in dual equilibrium is dependent on technology and differs, depending on the combination of microfoundation. A numerical example shows the simultaneous analysis of the switch of equilibria, income distribution, and capital theory paradoxes. The result indicates that it is necessary to reconsider the importance of capital as a bundle of reproducible and heterogeneous commodities to construct an alternative model analysing the distribution of income and capital (wealth), which is unaccountable by the standard neo-classical models with capital as the primary factor of production.

Similar content being viewed by others

Notes

See also Pasinetti (1964, 1966a, 1966b, 1974). Baranzini and Mirante (2018: Chaps. 6, 7) provide an excellent survey of the extensions of the Pasinettian two-class model. Baranzini and Mirante (2018: pp. 86–89, pp. 212–214) show us the correspondence among Hahn, Kaldor, and Pasinetti with respect to Pasinetti (1962).

Baranzini (1991) is an early example of the models introducing the OLG into the Pasinettian two-class model.

Mattauch et al. (2016) investigate the distribution of wealth in relation to public investment in a model with high-income households that are ILA and middle-income households that follow the OLG model. Their analysis focuses on the equilibrium at which both types of households survive in the steady state (i.e. PE).

In contrast to Kaldor’s (1961) old stylised facts, the new ones proposed by Stiglitz (2016) are:

-

There is growing inequality in both wages and capital income (wealth), and growing inequality overall;

-

Wealth is more unequally distributed than wages;

-

Average wages have stagnated, even as productivity has increased, so the share of capital has increased;

-

The wealth ratio has increased significantly;

-

The return on capital has not declined, even as the wealth–income ratio has increased.

-

Stiglitz (2016: pp. 15–16) mentions the possibility of such phenomena arising, yet assumes a perfectly neo-classical technology in his model.

Here, we do not consider technical progress in that the row or the column of \({\varvec{A}}\) and \({\varvec{L}}\) changes as time goes by. In other words, m and n are fixed over time.

Although it is assumed that both the capitalist and worker control \({\varvec{q}}_{t+1}\), we do not need to apply the differential game to our problem. This is because the non-substitution theorem holds in the economies assumed in this study. According to the theorem, any \({\varvec{q}}_{t+1}\ge {\varvec{0}}\) is efficient and, as we show in Subsect. 3.1.4, the solution of the capitalist’s problem is consistent with that of the worker’s problem in an economic system. Regarding the application of the differential game to the Pasinettian two-class model, see Chappell and Latham (1983).

The numerical example is from Vienneau (2005).

Given that the profit share is obtained by the rate of profit multiplied by the capital coefficient, the extent of the decline in the capital coefficient is great enough to offset the rise in the rate of profit around the switch point. Therefore, the profit share also declines.

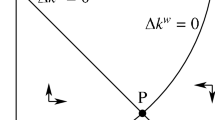

According to Burmeister (1980: p131), this peculiar assumption is that the so-called real Wicksell effect is negative for all feasible \(r>0\):

$$\begin{aligned} {\displaystyle \sum \limits _{i=1}^{n}} p_{i}\left( r\right) \frac{\text {d}k_{i}\left( r\right) }{\text {d}r}<0, \end{aligned}$$where \(p_{i}\left( r\right)\) and \(k_{i}\left( r\right)\) denote the relative price of commodity i and the per capita amount of the commodity necessary as the capital input, respectively. As our analysis shows, it is not necessary to assume that the inequality is likely to be satisfied.

References

Baranzini M (1991) A theory of wealth distribution and accumulation. Clarendon Press, Oxford

Baranzini M, Mirante A (2018) Luigi L. Pasinetti: an intellectual biography: leading scholar and system builder of the Cambridge school of economics. Palgrave Macmillan, Cham

Burmeister E (1980) Capital theory and dynamics. Cambridge University Press, Cambridge

Caggetti M, De Nardi M (2008) Wealth inequality: data and models. Macroecon Dyn 12:285–313

Chappell D, Latham RW (1983) The Pasinetti-Samuelson-Modigliani model as a two-person nonzero-sum differential Game. Keio Econ Stud 20:67–85

Darity WA (1981) The simple analytics of neo-Ricardian growth and distribution. Am Econ Rev 71:978–993

Harcourt G (1972) Some Cambridge controversies in the theory of capital. Cambridge University Press, Cambridge

Hosoda E (1989) Competitive equilibrium and the wage-profit Frontier. Manch Sch Econ Soc Stud 57:262–279

Kaldor N (1956) Alternative theories of distribution. Rev Econ Stud 23:83–100

Kaldor N (1961) Capital accumulation and economic growth. In: Lutz FA, Hague DC (eds) The theory of capital. Macmillan, London, pp 177–222

Kurose K (2020) A two-class economy from the multi-sectoral perspective: the controversy between Pasinetti and Meade–Samuelson–Modigliani revisited. Tohoku Economics Research Group Discussion Paper, No. 416. http://www.econ.tohoku.ac.jp/econ/dp/terg/terg416v3.pdf. Accessed 24 Dec 2020

Kurz H, Salvadori N (1995) Theory of production: a long-period analysis. Cambridge University Press, Cambridge

Mattauch L, Edenhofer O, Klenert D, Bénard S (2016) Distributional effects of public investment when wealth and class are back. Metroeconomica 67:603–627

Mattauch L, Klenert D, Stiglitz J, Edenhofer O (2017) Piketty meets Pasinetti: on public investment and intelligent machinery. Conference paper at Beiträge zur Jahrestagung des Vereins für Socialpolitik 2017: Alternative Geld- und Finanzarchitekturen - Session: Taxation II, No. B19-V2, ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften, Leibniz-Informationszentrum Wirtschaft, Kiel, Hamburg

Meade JE (1963) The rate of profit in a growing economy. Econ J 73:665–674

Meade JE (1966) The outcome of Pasinetti-process: a note. Econ J 76:161–165

Meade JE, Hahn F (1965) The rate of profit in a growing economy. Econ J 75:445–448

Michl T (2007) Capitalists, workers and social security. Metroeconomica 58:244–268

Michl T (2009) Capitalists, workers, and fiscal policy: a classical model of growth and distribution. Harvard University Press, Cambridge

Michl T, Foley D (2004) Social security in a classical growth model. Camb J Econ 28:1–20

Morishima M (1969) Theory of economic growth. Clarendon Press, Oxford

Pasinetti L (1962) Rate of profit and income distribution in relation to the rate of economic growth. Rev Econ Stud 29:267–279 (reprinted in Pasinetti (1974))

Pasinetti L (1964) A comment on professor Meade’s Rate of profit in a growing economy. Econ J 74:488–489

Pasinetti L (1966a) New results in an old framework: comment on Samuelson and Modigliani. Rev Econ Stud 33:303–306

Pasinetti L (1966b) The rate of profit in a growing economy: a reply. Econ J 76:158–160

Pasinetti L (1974) Growth and income distribution: essays in economic theory. Cambridge University Press, Cambridge

Pasinetti L (1977) Lectures on the theory of production. Columbia University Press, New York

Pasinetti L (1983) Conditions of existence of a two-class economy in the Kaldor and more general models of growth and income distribution. Kyklos 36:91–102y

Pasinetti L (2007) Keynes and the Cambridge Keynesians: a ‘revolution in economics’ to be accomplished. Cambridge University Press, Cambridge

Pasinetti L (2012) A few counter-factual hypotheses on the current economic crisis. Camb J Econ 36:1433–1453

Piketty T (2014) Capital in the twenty-first century. The Belknap Press of Harvard University Press, Cambridge

Piketty T (2015) About capital in the twenty-first century. Am Econ Rev 105:48–53

Samuelson P, Modigliani F (1966a) The Pasinetti paradox in neoclassical and more general models. Rev Econ Stud 33:269–301

Samuelson P, Modigliani F (1966b) Marginal productivity and the macro-economic theories of distribution: reply to Pasinetti and Robinson. Rev Econ Stud 33:321–330

Sasaki H (2018) Capital accumulation and the rate of profit in a two-class economy with optimization behavior. MPRA Paper, No, p 88362

Sraffa P (1960) Production of commodities by means of commodities: prelude to a critique of economic theory. Cambridge University Press, Cambridge

Stiglitz J (2016) New theoretical perspectives on the distribution of income and wealth among individuals. In: Basu K, Stiglitz J (eds) Inequality and growth: patterns and policy, vol I. Concepts and analysis. Palgrave Macmillan, Basingstoke, pp 1–71

Taylor L (2014) The triumph of the rentier? Thomas Piketty vs Luigi Pasinetti and John Maynard Keynes. Int J Polit Econ 43:4–17

Taylor L, Foley D, Rezai A (2019) Demand drives growth all the way: Goodwin, Kaldor, Pasinetti and the steady state. Camb J Econ 43:1332–1352

Vienneau RL (2005) Creating two-good reswitching examples. https://ssrn.com/abstract=687492. Accessed 19 Oct 2020

Zamparelli L (2016) Wealth distribution, elasticity of substitution and Piketty: an ‘anti-dual’ Pasinetti economy. Metroeconomica 68:927–946

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The corresponding author declares that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

An earlier version of this paper was presented at the International Conference on Economic Theory and Policy, held on 16–18 September 2018 at Meiji University in Japan; the 9th Summer School on Analytical Political Economy, held on 26–28 August 2019 at Doshisya University in Japan; and the 10th Annual Conference of the Keynes Society Japan, held on 5–6 December 2020, by using Zoom. The author is grateful for helpful comments and suggestions from the participants, especially Toichiro Asada, Hiroyuki Ozaki, Neri Salvadori, Hiroaki Sasaki, and Naoki Yoshihara. In addition, the author gives special thanks to the two anonymous referees for their helpful comments and suggestions, which substantially improved this paper. He is solely responsible for all remaining errors. Finally, financial support from the Japan Society for the Promotion of Science KAKENHI (Grant Number JP17K03615) is gratefully acknowledged.

About this article

Cite this article

Kurose, K. A two-class economy from the multi-sectoral perspective: the controversy between Pasinetti and Meade–Hahn–Samuelson–Modigliani revisited. Evolut Inst Econ Rev 19, 239–270 (2022). https://doi.org/10.1007/s40844-021-00202-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40844-021-00202-8