Abstract

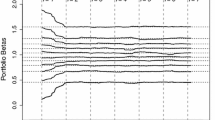

The holy grail for scholars and practitioners of finance is to comprehend the behavior of equity returns. This research extends that comprehension by integrating methods from the field of bioinformatics into the capital asset pricing model. We examine 198,499 firm-year observations for stocks traded on the NYSE, the NASDAQ, and the AMEX from July 1963 to June 2014. Whereas the conventional models invoke beta as the measure of variability in equity returns, our model adopts the dynamic programming algorithm of (Needleman and Wunsch in J Mol Biol 48(3):443–53, 1970). It allows the incorporation of sporadic gaps in the daily returns to obtain the best fit between the returns of individual stocks and a broader equity index. In doing so, it demonstrates the importance of timing in estimating beta.

Similar content being viewed by others

References

Amihud, Y. (2002). Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets, 5(1), 31–56.

Ang, A., Chen, J., & Xing, Y. (2006). Downside risk. The Review of Financial Studies, 19(4), 1191–1239.

Black, F. (1972). Capital market equilibrium with restricted borrowing. The Journal of Business, 45(3), 444–455.

Breen, W., Glosten, L. R., & Jagannathan, R. (1989). Economic significance of predictable variations in stock index returns. The Journal of Finance, 44(5), 1177–1189.

Er, H., & Hushmat, A. (2017). The application of technical trading rules developed from spot market prices on futures market prices using CAPM. Eurasian Business Review, 7(3), 313–353.

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. The Journal of Finance, 47(2), 427–465.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Fama, E. F., & French, K. R. (2016). Dissecting anomalies with a five-factor model. The Review of Financial Studies, 29(1), 69–103.

Fama, E. F., & MacBeth, J. D. (1973). Risk, return, and equilibrium: Empirical tests. The Journal of Political Economy, 607–636.

Günay, S. (2017). Value at risk (VaR) analysis for fat tails and long memory in returns. Eurasian Economic Review, 7(2), 215–230.

Keim, D. B., & Stambaugh, R. F. (1986). Predicting returns in the stock and bond markets. Journal of Financial Economics, 17(2), 357–390.

Lintner, J. (1965). Security prices, risk, and maximal gains from diversification. The Journal of Finance, 20(4), 587–615.

Needleman, S. B., & Wunsch, C. D. (1970). A general method applicable to the search for similarities in the amino acid sequence of two proteins. Journal of Molecular Biology, 48(3), 443–453. https://doi.org/10.1016/0022-2836(70)90057-4.

Scholes, M., & Williams, J. (1977). Estimating betas from nonsynchronous data. Journal of Financial Economics, 5(3), 309–327.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442.

Tobi, D. (2012). Dynamics alignment: Comparison of protein dynamics in the SCOP database. Proteins, 80(4), 1167–1176. https://doi.org/10.1002/prot.24017.

Tobi, D. (2013). Large-scale analysis of the dynamics of enzymes. Proteins, 81, 1910–1918. https://doi.org/10.1002/prot.24335.

Zaremba, A. (2016). Is there a low-risk anomaly across countries? Eurasian Economic Review, 6(1), 45–65.

Acknowledgements

We thank Sagi Akron for his fruitful discussions and suggestions. The Ariel University Research Authority funded this study through an internal interdisciplinary grant between the Computer Science Department and the Economics and Business Administration Department.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Taussig, R.D., Tobi, D. & Zwilling, M. The importance of timing in estimating beta. Eurasian Econ Rev 9, 61–70 (2019). https://doi.org/10.1007/s40822-018-0103-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-018-0103-7