Abstract

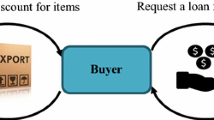

In this paper, an EOQ model for breakable items to a retailer has been studied. Here, demand of the business is stock dependent. The breakability of the items is dependent on stock and holding cost. Here, a credit period has been offered to the retailer, which depends on lead time. Stock dependent demand and breakability are balanced by the lead time dependent credit period. The main intention of the present model is to detect the optimal order quantity, optimal lead time and to maximize the total profit of the whole business. To test our proposed model, two numerical examples are also illustrated.

Similar content being viewed by others

References

Banu, A., Mondal, S.K.: Analysis of credit linked demand in an inventory model with varying ordering cost. Springerplus 5(1), 926–939 (2016)

Chopra, S., Reinhardt, G., Dada, M.: The effect of lead time uncertainty on safety stocks. Decision Sci. 35(1), 1–24 (2004)

Das, B.C., Das, B., Mondal, S.K.: Integrated supply chain model for a deteriorating item with procurement cost dependent credit period. Comput. Ind. Eng. 64(3), 788–796 (2013)

Das, B.C., Das, B., Mondal, S.K.: An integrated inventory model with delay in payment for deteriorating item under Weibull distribution and advertisement cum price-dependent demand. Int. J. Oper. Res. 20(3), 341–368 (2014)

Das, B.C., Das, B., Mondal, S.K.: Optimal transportation and business cycles in an integrated production-inventory model with a discrete credit period. Transp. Res. Part E 68, 1–13 (2014)

Das, B.C., Das, B., Mondal, S.K.: An integrated production inventory model under interactive fuzzy credit period for deteriorating item with several markets. Appl. Soft Comput. 28, 453–465 (2015)

Glock, C.H.: Lead time reduction strategies in a single-vendor-single-buyer integrated inventory model with lot size-dependent lead times and stochastic demand. Int. J. Prod. Econ. 136(1), 37–44 (2012)

Goh, M.: EOQ models with general demand and holding cost functions. Eur. J. Oper. Res. 73, 50–54 (1994)

Goyal, S.K.: Economic order quantity under conditions of permissible delay in payments. J. Oper. Res. 36(4), 335–338 (1985)

Guria, A., Mondal, S.K., Maiti, M.: A two-ware house EOQ model with two-level delay in payment. Int. J. Oper. Res. 15(2), 170–194 (2012)

Guria, A., Das, B., Mondal, S.K., Maiti, M.: Inventory policy for an item with inflation induced purchasing price, selling price and demand with immediate part payment. Appl. Math. Modell. 37(1–2), 240–257 (2013)

Harris, F.: Operations and Cost. Factory Management Service, Chicago, A.W. Shaw Co. (1915)

Hayya, J.C., Harrison, T.P., He, X.J.: The impact of stochastic lead time reduction on inventory cost under order crossover. Eur. J. Oper. Res. 211, 274–281 (2011)

Hoque, M.A.: A vendor-buyer integrated production-inventory model with normal distribution of lead time. Int. J. Prod. Econ. 144, 409–417 (2013)

Jha, J.K., Shanker, K.: Single-vendor multi-buyer integrated production-inventory model with controllable lead time and service level constraints. Appl. Math. Model. 37, 1753–1767 (2013)

Liberatore, M.J.: Planning Horizons for a stochastic lead-time inventory model. Oper. Res. 25(6), 977–988 (1977)

Mallick, R.K., Patra, K., Mondal, S.K.: Mixture inventory model of lost sale and back-order with stochastic lead time demand on permissible delay in payments. Ann. Oper. Res. 292, 341369 (2020)

Mallick, R.K., Manna, A.K., Mondal, S.K.: A supply chain model for imperfect production system with stochastic lead time demand. J. Manag. Anal. 5(4), 309–333 (2018)

Mallick, R.K., Mondal, S.K., Dey, J.K.: Analysis of lead time on permissible delay in payments in an inventory model including the lead time crashing cost. Adv. Math. Models Appl. 3(2), 142–163 (2018)

Mandal, M., Maiti, M.: Inventory model for damageable items with stock dependents demand and shortages. Opsearch 34(3), 155–166 (1997)

Manna, A.K., Das, B., Dey, J.K., Mondal, S.K.: Two layers green supply chain imperfect production inventory model under bi-level credit period T\(\acute{E}\)KHNE. Rev. Appl. Manag. Stud. 73, 1–19 (2017)

Manna, A.K., Dey, J.K., Mondal, S.K.: Imperfect production inventory model with production rate dependent defective rate and advertisement dependent demand. Comput. Ind. Eng. 104, 9–22 (2017)

Maragatham, M., Gnanvel, G.: A purchasing inventory model for breakable items with permissible delay in payments and price discount. Ann. Pure Appl. Math. 15(2), 305–314 (2017)

McAfee, R.P., Velde, V.: Dynamic pricing with constant demand elasticity. Prod. Oper. Manag. 17(4), 432–438 (2008)

Raa, B., Aghezzaf, E.H.: Designing distribution patterns for long-term inventory routing with constant demand rates. Int. J. Prod. Econ. 112, 255–263 (2008)

Shah, N.H., Cardenas-Barron, L.E.: Retailer’s decision for ordering and credit policies for deteriorating items when a supplier offers order-linked credit period or cash discount. Appl. Math. Comput. 259, 569–578 (2015)

Taleizadeh, A.A., Nematollahi, M.: An inventory control problem for deteriorating items with back-ordering and financial considerations. Appl. Math. Model. 38, 93–109 (2014)

Teng, J.T., Ouyang, L.Y., Cheng, M.C.: An EOQ model for deteriorating items with power-form stock-dependent demand. Inf. Manag. Sci. 16(1), 1–16 (2005)

Teng, J.T., Min, J., Pan, Q.: Economic order quantity model with trade credit financing for non-decreasing demand. Omega 40, 328–335 (2012)

Van Eijs, M.J.G.: A note on the joint replenishment problem under constant demand. J. Opl Res. Soc. 44(2), 185–191 (1993)

Acknowledgements

The authors express their heartfelt gratitude and boundless regards to Vidyasagar University to giving opportunity of research.

Author information

Authors and Affiliations

Contributions

The model has been developed and analyzed by all the authors together. All authors read and approved the final manuscript.

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Mallick, R.K., Patra, K. & Mondal, S.K. An EOQ Model with Breakable Items Considering Stock Dependent Demand and Lead Time Dependent Credit Period. Int. J. Appl. Comput. Math 7, 231 (2021). https://doi.org/10.1007/s40819-021-01165-5

Accepted:

Published:

DOI: https://doi.org/10.1007/s40819-021-01165-5