Abstract

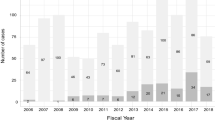

The Anti-Monopoly Law in China took effect in 2008, and it is unquestionable that it has led to a meaningful transformation of economic policy. Chinese competition law has been understood as a constitution for free and fair competition and also an important means of creating a price-driven market economy. In particular, since China is one of the world’s largest economies, its adoption of a competition law has drawn the attention of trading partners and large multinational enterprises. When examining the current enforcement of competition law in China, it is noteworthy that most cases involve the enforcement of merger control rather than cartels or abuse of market dominance, and the number of merger cases continues to increase significantly. Therefore, understanding merger control is important for an overall understanding of competition policy in China. The Chinese competition regime has improved the techniques for merger assessment, but it also appears to have some problems due to a lack of experience. This article aims to introduce and analyse the recent enforcement and development of Chinese merger control. It also acknowledges fundamental differences between the objectives of Chinese competition law and the objectives of competition law in Western countries, and explains how this eventually results in dissimilar outcomes. Lastly, this article provides proposals for establishing a better merger policy based on the competition-priority principle rather than socio-political values.

Similar content being viewed by others

Notes

The Order of the President of the People’s Republic of China, No. 68, 2007. A translation in English is available at: http://www.china.org.cn/government/laws/2009-02/10/content_17254169.htm. Accessed 9 March 2013.

Gaens (2009), p. 57.

Bernitz and An (2010).

Mitnick et al. (2009). In fact, this outcome is inevitable since, given mandatory notification measures in the AML, Chinese merger control jurisdiction cannot be avoidable for foreign enterprises.

See e.g. http://fldj.mofcom.gov.cn/article/zcfb/201211/20121108437868.shtml. Accessed 9 March 2013.

Wei (2011).

The Chinese economy is somehow different from other transitional economies since geographic concentration is evenly distributed and also relatively low. See Student (2008).

See Zheng (2010).

The Constitution of China declares that the state implements a system of “socialist market economy”. Socialist market economy refers to an economic system where the state owns major industrial sectors, although market competition by private enterprises can be allowed based on their product prices and qualities with some governmental control. There are various opinions about its meaning, e.g. a Chinese version of market economy or a similar concept of the EU’s social market economy, which provides its support for societal needs. For further discussions, see Blodgett et al. (2009); Gerber (2004); Harris (2006); Shan et al. (2012); Wang (2002). The importance of socialist market economy has been emphasised as prescribed in competition-related legal provisions, e.g. Art. 1 of the Act Against Unfair Competition in 1993 and Art. 1 of the AML in 2008. See also Yu (1994).

See Berry (2005).

See generally Snell (1996).

The Order of the President of the People’s Republic of China, No. 14, 1993.

The Order of Ministry of Foreign Trade and Economic Cooperation, State Administration of Taxation of The People's Republic of China, State Administration for Industry and Commerce of the People’s Republic of China, & State Administration of Foreign Exchange, No. 3, 2003 (amended in 2006 and 2009); now The Order of MOFCOM, No. 6, 2009. See also Berry (2005), at 136–139.

The Order of the State Development and Reform Commission of the People’s Republic of China, No. 3 (now withdrawn and replaced by the Provisions against Price Fixing, promulgated by the Order of National Development and Reform Commission, No. 7, 2010). For further detail, see Berry (2005), at 136–139.

Ryberg (2010), at 533–534.

It includes general provisions, monopoly agreement, abuse of market dominance, concentration of business operators, abuse of administrative power to eliminate or restrict competition, investigation into the suspicious monopolistic conducts, legal liability, and supplementary provisions.

E.g. the competition acts in Korea and Japan clearly stipulate their objectives for ensuring effective enforcement and legal certainty, which may come from the civil law tradition.

Some commentators criticise that the objectives of the AML may bring a conflict, as economic efficiency and socialist market economy may collide. Moreover, the term, “public interest”, is not defined well and seems unclear in the context of the AML at this moment. See Furse (2009); Wang (2008), at 142–144.

The AML uses the term, “business operator (jingyingzhe)”, as referring to a natural person, legal person, or any other organisation that is in the engagement of commodities production or operation or service provision under Art. 12. This article uses enterprise or undertaking as indicating business operator in the AML.

It is unclear whether the AML adopted the US type effects doctrine or EU’s implementation doctrine, but Chinese competition lawmakers seem to adopt an extraterritorial application provision to avoid any unfamiliar case-law development regarding extraterritoriality.

See Farmer (2010); Zheng (2010), at 647–648; Wei (2011), at 812–814. According to Wei, there are several reasons for this resemblance that comes from the intrinsic common features between the EU and China, such as: (i) the diverse objectives of the law; (ii) the experience of state-run monopolies; (iii) the civil law tradition; and (iv) the reliance on administrative authority in application of the law. Furthermore, it is possible that fair trade including competition was one of the substantive issues between China and the EU at the time of drafting the Act, and this might have formed a strong cooperation in establishing a competition law framework. See e.g. Mattlin (2009), p. 101.

Its similar structure was established through the Chinese frequent and effective cooperation with other regimes. See Zhan (2009).

Some explain that the AML addresses three pillars of anti-competitive conducts, which can be categorised as practices by “economic monopoly”, but others also introduce the AML framework as four pillars. Addition to the three types above, the AML also prohibits abuse of administrative power that is also known as “administrative monopoly”. This provision is established to prevent local protectionism in China. See Mitnick et al. (2009), at 53; Ryberg (2010), at 530; Wang (2008), at 135; Wei (2011), at 809.

Furse (2009), at 70.

Furse (2009), at 70–71.

For further information, see Bernitz and An (2010), at 249.

One of the hotly debated issues regarding unfair provisions against foreign investor is the interpretation of “national security” in Art. 31, as it states that, where national security is concerned, an extra review on it should be conducted according to the relevant regulations of the state. This statement is vague and can be discriminatory since it applies only to foreign enterprises. See Blodgett et al. (2009), at 223; Wu (2010); Furse (2010). For further information on historical background of Chinese competition law legislation, see also Mehra and Meng (2009); Williams (2009); Zhan (2009), at 246–247.

Furse (2009), at 97–98. Prior to the current merger control framework, there was an enforcement system of the Ministry of Foreign Trade and Economic Cooperation (MOFTEC) and the SAIC.

Mitnick et al. (2009), at 53.

Article 20 of the AML stipulates that “a concentration refers to (i) the merger of business operators; (ii) acquiring control over other business operators by virtue of acquiring their equities or assets; or (iii) acquiring control over other business operators or possibility of exercising decisive influence on other business operators by virtue of contract or any other means.” For further detail about the effect of control in the Chinese Company Law, see Wei (2011), at 815.

Council Regulation (EC) No 139/2004 on the Control of Concentrations between Undertakings, OJ L24.

Under Art. 25 of the Act, MOFCOM shall conduct a preliminary review of the notified concentration within 30 days. According to Art. 26, where it decides to conduct further review, it should, within 90 days from the decision, complete the concentration review, make a decision on whether to prohibit the concentration, and notify its conclusion to the merging parties. For further detail, see also Fosh et al. (2009), at 117.

Decree No. 529 of the State Council of China, promulgating the Provision on Application Criteria for the Concentration of Enterprises. A translation in English of the Decree is available at: http://fldj.mofcom.gov.cn/article/c/200903/20090306071501.shtml. Accessed 29 January 2013.

The old merger regulation prior to the AML also provided thresholds based on both annual turnover and market share. See also Ross (2008), at 66–67. When there is a concentration between enterprises in the financial industry, the turnover is calculated under the Decree of Calculation Method of Declaration Turnover on Concentration of Financial Industry (The Order of MOFCOM, the People’s Bank of China, China Securities Regulatory Commission, China Banking Regulatory Commission & China Insurance Regulatory Commission, No. 10, 2009).

Furse (2009), at 101.

Articles 3 through 6 of the Interim Provisions on Assessment of Competitive Effects of Concentration, No. 55, 2011, promulgated by MOFCOM (hereinafter, the 2011 Merger Assessment Provisions).

Since the AML legislation, Chinese competition authorities have provided secondary laws and rules for improving merger control. See also Wei (2011), at 818–819.

Wei (2011), at 828.

The six factors are also provided in Art. 3 of the 2011 Merger Assessment Provisions, and they are important criteria for merger assessments in China.

Some critics argue that, regarding the ultimate objective of merger control in China, Art. 1 of the AML indicates that the statement of consumer welfare and the public interest implies its aim of total welfare improvement. See Shan et al. (2012), at 34.

Some assert that the statement of “national economic development” in merger assessments may appear to be inconsistent with the substantive competitive test, and this statement may thus bring confusion as to what extent the MOFCOM’s approach towards industrial policy would be in each case with regards to exemption. See Wu (2010), at 490.

There is an argument whether Art. 27 of the AML can be a catchall provision. See Bu (2010).

For the discussion about the EU’s approach, see Kokkoris (2011), p. 24.

Wei (2011), at 839.

Furse (2009), at 108.

The Chinese competition authority provides market definition guidance for merger assessments, such as the Guidelines of the Anti-Monopoly Committee of the State Council for the Definition of the Relevant Market, 24 May 2009. The Guidelines include substitutability in both supply and demand sides like those of other competition regimes.

See Bernitz and An (2010), at 250.

E.g. Arts. 3 through 6 of the 2011 Merger Assessment Provisions. The Provisions explain that the agency can use both Herfindahl–Hirschman Index (HHI) and CR tests. Before this guidance, there was no comprehensible principle for examining concentration. Although the AML provides the presumption of market dominance through a CR test, it was not very clear whether this measure was relevant for the merger assessment.

Bernitz and An (2010), at 251–252. The authors argue that the MOFCOM’s decisions in Coca-Cola/Huiyuan, Mitsubish Rayon/Lucite, and Panasonic/Sanyo demonstrate its close scrutiny on the market concentration level although the decisions were very brief and simple.

See the MOFCOM Anti-Monopoly Bureau website, available at http://fldj.mofcom.gov.cn/article/zcfb/201211/20121108437868.shtml. Accessed 9 March 2013.

Wei (2011), at 816.

See the MOFCOM News Release available at http://english.mofcom.gov.cn/article/newsrelease/counselorsoffice/westernasiaandafricareport/200905/20090506238421.shtml. Accessed 30 January 2013.

Wei (2011), 817. In particular, just after the proposed acquisition was announced, the public showed concerns about foreign brand’s dominance in the market. See Davis (2010); Huang (2008); Lin and Zhao (2012). The issue of national champion in merger control is not new in some countries. See e.g. Kokkoris (2011), at 9.

Williams (2009), at 150.

Most MOFCOM merger decisions are very short and simple, which does not seem to follow the criteria in Art. 27 of the AML, and the contents of decisions explain brief market share and market power analysis while other competition authorities provide explanations of apparent assessment in detail. See e.g. Williams (2009), at 151; Bernitz and An (2010), at 256; Su and Wang (2013), at 224–225.

It seems that MOFCOM adopted the rationale of leverage effect from the Australian competition authority’s decision on the Berri Ltd.’s merger. However, in the Australian case, the merging party held almost 50% of market share, which was bigger than that of Huiyuan. See Sang Youn Youn, “Joong-kuk Ban-dok-jeom-beob-sang Ki-up-kyol-hap Kyu-jae-e Kwan-han Ko-chal [A Study on the Merger Control in China]” (in Korean), Symposium Paper presented at the Korea Legislation Research Institute in April 2012 (on file with the authors).

Bernitz and An (2010), at 255.

There was no legally binding provision regarding hearing procedure at that time, but MOFCOM seemed to consider this in Coca-Cola/Huiyuan. See Davis (2010), at 312.

Wei (2011), at 816.

Some argue that MOFCOM has explains its intention of consumer protection through its stated rationale and remedies; however, this argument is not very clear because of MOFCOM’s insufficient data in analysis. See Shan et al. (2012), at 34.

Mitnick et al. (2009), at 57.

Wei (2011), 829; Williams (2009), at 139. Williams criticises that the statement “other factors” is one of the vaguest terms in Chinese merger scrutiny. Some also argue that industrial policy is an important element as shown in Coca-Cola/Huiyuan. Industrial policy as one of the competition law objectives is hardly observed in the Western competition jurisdictions. See Howell et al. (2009); Lin and Zhao (2012), at 118; Su and Wang (2013), at 213. There are some discussions of whether this decision was made to protect agricultural sector, thereby supporting local fruit producers who supply the juice materials. The concentration would make Coca-Cola have a bargaining power, thereby harming small producers of fruit or juice concentration from fruit. See Ying (2011).

Dabbah (2010). Dabbah argues that this phenomenon is common in the developing world.

Bu (2010), at 207. The nationalism and protectionism in China can often be observed in merger decisions, such as in the InBev/Anheuser-Busch beer merger. See also Chin (2010); Sun et al. (2009). Sun et al. argue that there is a special protection provision for the industry of the national economy and security in the AML, but in the Coca-Cola/Huiyuan case, the relevant market was not related to the national economy and security. Therefore, it did not fall within the scope of the special protection under the AML, and there was no legal basis for national economy in this case, although some insist that MOFCOM should have reviewed this issue in the case.

Google entered into an agreement to acquire Motorola on 25 August 2011. See the US DOJ Press Release of 13 February 2012, available at http://www.justice.gov/atr/public/press_releases/2012/280190.htm. Accessed 9 March 2013. Google made pre-merger notifications in several jurisdictions including the EU and Korea on 25 November 2011 and 6 December 2011 respectively. See also the EU Commission’s decision, Case COMP/M.6381 – Google/Motorola Mobility, para. 1; the Korea Fair Trade Commission Press Release of 8 March 2012.

For further information about the parties, see the EU Commission Decision, Google/Motorola, paras. 3–4.

MOFCOM did not clarify whether this concentration was a vertical merger, but it seemed to follow other competition authorities’ conclusions of the vertical relationship, as explained in its decision, e.g. the EU Commission Decision, Google/Motorola, para. 15.

E.g. the EU Commission also concluded that the relevant markets are the mobile OS markets and an EEA-wide or worldwide based market.

Although the OS code is released under the open source licence for free, the EU Commission also decided that Android’s market share attributed to Google’s market power for following reasons: (i) Google holds the IPR to the Android; (ii) it is responsible for releasing each new version of the Android; (iii) it has to approve each smartphone or tablet PC running on Android and its implementation; (iv) the OEMs rely on Google; and (v) it exerts control over Android. See the EU Commission Decision, Google/Motorola, paras. 64–72.

For providing robust arguments on unilateral effects from the merger, the plaintiff normally needs to provide some evidences, such as (i) large market shares, (ii) horizontal relations between merging parties, and (iii) existence of limited possibilities of switching supplier. See e.g. Kokkoris (2011), at 255. In this case, MOFCOM seemed to focus on the substitutability of the Android OS.

Unlike the MOFCOM’s conclusion, the EU did not accept the anti-competitive methods, such as (i) choosing a lead OEM for each new version of Android; (ii) interfering with the approval process for OMEs; and (iii) hindering innovation through its anti-fragmentation policy. In particular, the Commission reasoned that the methods above already existed prior to the concentration; thus, the possibilities of post-merger anti-competitive effects would not be reasonable. See the EU Commission Decision, Google/Motorola, para. 85.

The strategy of obtaining IPRs through merger may create a concern of foreclosure. It is possible that, when the merged enterprise has a specialised technology after the merger, it is likely to use this technology or IPR for engaging in both input and customer foreclosure. See Schwalbe and Zimmer (2009).

This type of remedy can be called “access remedy” where the remedy is behavioural but has a structural and long-lasting effect on the market. For further discussion, see Hoehn and Lewis (2013).

Hoehn and Lewis (2013), at 102.

E.g. the 2002 Draft of the AML already emphasised development of national economy. See Berry (2005), at 140.

Shan et al. (2012), at 34. However, there is no single voice about the definition of efficiency since the approaches of competition authorities around the world vary due to different welfare standards. The total welfare standard sometimes fails to make a clear distinction between aspects of competition policy and those of industrial policy as could be seen in China. See Kokkoris and Olivares-Caminal (2010), p. 435; Schwalbe and Zimmer (2009), at 336.

Furse (2010), at 105. Nevertheless, the narrow definition of ultimate competition law objective as efficiency does not fit into the political and social expectations in the transitional economy, especially in the light of socialist market economy. Some also argue that efficiency, as the primary objective, should be allowed in the AML. See also Gerber (2004), at 321; Jung and Hao (2003); Owen et al. (2005).

Some assert that Chinese lawmakers did not seem to realise the implications of harmonisation efforts for balancing consumer welfare and economic development. See Lin and Zhao (2012), at 131.

Choi (2010a).

It seemed that China used to express worries about significant job losses from following the international norms of competition that would bring vigorous competition in the Chinese market, thereby driving out Chinese firms from the market. See Blodgett et al. (2009), at 201.

Pate (2008), at 196, 200–202. With regards to the definition of stability, it seems possible that competition culture in China is different from those in other jurisdictions, particularly when it controls the transformation of state-owned industries towards market competition.

Wang (2004).

Bernitz and An (2010), at 250.

Zheng (2010), at 643.

Mehra and Meng (2009), at 385–386.

Wei (2011), 812–813.

Wei (2011), at 811–812.

Davis (2010), at 306; Gerber (2010), p. 223. According to Gerber, there are two important aspects regarding global competition in China: (i) globalisation has provided the impetus for the AML; and (ii) the Chinese role of enforcement refers to its important results throughout the global economy for the development of international competition law.

Hamp-Lyons (2009), at 1580.

Blodgett et al. (2009), at 231.

In practice, it seems somewhat difficult to apply the same rule to foreign enterprises. For example, the EU competition authority seemed cautious when it applied the legal standards to a Chinese state-owned enterprises’ merger. See e.g. Stemsrud (2011).

For instance, unlike the Korean competition authority’s scrutiny of unilateral and coordinated effects from the Google/Motorola merger, MOFCOM focused mostly on unilateral effects.

Wang (2008), at 150.

Bernitz and An (2010), at 248.

See e.g. Zhang and Zhang (2010).

Shan et al. (2012), at 51.

Wang (2008), at 140.

Song (1995).

Kokkoris (2011), at 47.

The AML describes broad principles, which provide guidance of enforcement. In addition, the legal provisions of merger control are open to interpretation, which can possibly bring uncertainties such as: (i) whether the substantive principles will be publicly articulated in detail; (ii) whether a rigorous process will develop for ensuring that these principles are applied objectively; and (iii) the extent to which economic analysis of the effect on competition will or will not come to predominate over other factors. See Furse (2009), at 14; Fosh et al. (2009), at 125.

Zhan (2009), at 246.

Pate (2008), at 209.

See Hittinger and Huh (2007).

Ross (2008), at 71.

Emch (2011).

Song (1995), at 393.

Owen et al. (2008).

Wei (2011), at 843.

It is possible that MOFCOM took a free riding on the scrutiny of the Google/Motorola merger decisions in other jurisdictions, but its outcome was somewhat different from others.

Wang (2008), at 134.

Wei (2011), at 841.

Choi (2010b).

Zhang and Zhang (2010), at 496.

See the US DOJ Press Release of 13 February 2012, available at http://www.justice.gov/atr/public/press_releases/2012/280190.htm. Accessed 9 March 2013.

Wei (2011), at 807.

Pate (2008), at 195. Pate points out that there are some fundamental aspects of Chinese culture and government that will make competition law and policy somewhat unique, compared with that of Western competition regimes.

Unlike the Western market economies, a transitional economy country such as China should take the heavy task of creating competitive market, which is not easy for China for the short term. See Song (1995), at 387–388.

References

Bernitz U, An S (2010) Convergence or parallel paths? Comparison of substantive tests of merger control in EU and China. ECLR 31:248

Berry JA (2005) Anti-monopoly law in China: a socialist market economy wrestles with its antitrust regime. Int Law Manag Rev 2:134

Blodgett MS et al (2009) Foreign direct investment, trade, and China’s competition laws. Denver J Int Law Policy 37:203

Brook T (2011) China’s anti-monopoly law: history, application, and enforcement. Appeal Rev Curr Law Law Reform 16:48

Bu Q (2010) Coca-Cola v. Huiyuan—market-economy driven or protectionism? IIC 41:203

Chin YW (2010) M&A under China’s anti-monopoly law: emerging patterns. Bus Law Today 2010:3–4

Choi YS (2010a) The enforcement and development of Korean competition law. World Compet 33:301

Choi YS (2010b) Analysis of the Microsoft, Intel and Qualcomm decisions in Korea. ECLR 31:475

Dabbah MM (2010) Competition law and policy in developing countries: a critical assessment of the challenges to establishing an effective competition law regime. World Compet 33:470

Dabbah MM (2010) International and comparative competition law. Cambridge Univ. Press, Cambridge

Davis B (2010) China’s anti-monopoly law: protectionism or a great leap forward? Boston Coll Int Comp Law Rev 33:308

Emch A (2008) Abuse of dominance in China: a paradigmatic shift? ECLR 29:615

Emch A (2011) Antitrust in China—the brighter spots. ECLR 32:138

Ezrachi A (2006) Merger control and cross-border transactions: a pragmatic view on cooperation, convergence and what is in between. In: Marsden P (ed) Handbook of research in Trans-Atlantic antitrust. Edward Elgar, Cheltenham, pp 632–633

Farmer SB (2009) The evolution of Chinese merger notification guidelines: a work in progress integrating global consensus and domestic imperatives. Tulane J Int Comp Law 18:45

Farmer SB (2010) The impact of China’s antitrust law and other competition policies on U.S. companies. Loyol Consum Law Rev 23:35–36

Fosh M et al (2009) Merger control. In: Johnston G (ed.) Competition law in China and Hong Kong. Sweet & Maxwell, Hong Kong

Fox E, Crane D (2010) Global issues in antitrust and competition law. West, St. Paul, pp 348–352

Furse M (2007) The law of merger control in the EC and the UK. Hart, Portland

Furse M (2009) Antitrust law in China, Korea and Vietnam. OUP, New York

Furse M (2010) Merger control in China: the first year of enforcement. ECLR 31:100

Gaens B (2009) The development of the EU’s Asia strategy with special reference to China and India: driving forces and new directions. In: Gaens B et al (eds) The role of the European Union in Asia: China and India as strategic partners. Ashgate, Surrey

Gerber DJ (2004) Constructing competition law in China: the potential value of European and U.S. Experience. Wash Univ Glob Stud Law Rev 3:321

Gerber DJ (2010) Global competition: law, markets, and globalization. OUP, New York

Hamp-Lyons C (2009) The dragon in the room: China’s anti-monopoly law and international merger review. Vand Law Rev 62:1597

Harris HS Jr (2006) The making of an antitrust law: the pending anti-monopoly law of the People’s Republic of China. Chic J Int Law 7:185

Himmelberger A (2010) Tripartite convergence for certainty in merger review under China’s anti-monopoly law. Suffolk Transnatl Law Rev 33:289

Hittinger CW, Huh JD (2007) The People’s Republic of China enacts its first comprehensive antitrust law: trying to predict the unpredictable. N Y Univ J Law Bus 4:275

Hoehn T, Lewis A (2013) Interoperability remedies, FRAND licensing and innovation: a review of recent case law. ECLR 34:102, 111

Howell TR et al (2009) China’s new anti-monopoly law: a perspective from the United States. Pac Rim Law Policy J 18:60

Huang Y (2008) Pursuing the second best: the history, momentum, and remaining issues of China’s anti-monopoly law. Antitrust Law J 75:122

Jones A, Sufrin B (2011) EU competition law: text, cases, and materials. OUP, New York, pp 1254–1255

Jung Y, Hao Q (2003) The new economic constitution in China: a third way for competition regime? Northwest J Int Law Bus 24:125

Kokkoris I, Olivares-Caminal R (2010) Antitrust law amidst financial crisis. Cambridge Univ. Press, Cambridge

Kokkoris I (2011) Merger control in Europe: the gap in the ECMR and national merger legislations. Routledge, Oxen

Li-Fen W (2010) Anti-monopoly, national security and industrial policy: merger control in China. World Compet 33:480

Lin P, Zhao J (2012) Merger control policy under China’s anti-monopoly law. Rev Ind Organ 41:112

Mattlin M (2009) Thinking clearly on political strategy: the formulation of a common EU policy toward China. In: Gaens B et al (eds) The role of the European Union in Asia: China and India as strategic partners. Ashgate, Surrey

Mehra SK, Meng Y (2009) Against antitrust functionalism: reconsidering China’s antimonopoly law. Va J Int Law 49:391

Mitnick J et al (2009) The dragon rises: China’s merger control regime one year on. Antitrust 23:53

Niels G et al (2011) Economics for competition lawyers. OUP, New York

Owen BM et al (2005) Antitrust in China: the problem of incentive compatibility. JCLE 1:148

Owen BM et al (2008) China’s competition policy reforms: the anti-monopoly law and beyond. Antitrust L J 75:242

Pate RH (2008) What I heard in the great hall of the people—realistic expectations of Chinese antitrust. Antitrust Law J 75:197

Ross L (2008) China’s antimonopoly law. Antitrust 22:66

Ryberg B (2010) Pro-competitive or protective? The Chinese anti-monopoly law, Implications for the United States, and Bilateral Antitrust Cooperation as an Effective Response. Cardozo J Int Comp Law 18:529

Schwalbe U, Zimmer D (2009) Law and economics in European merger control. OUP, New York, pp 365–366

Schneider JS (2010) Administrative monopoly and China’s new anti-monopoly law: lessons from Europe’s State Aid Doctrine. Wash Univ Law Rev 87:874–876

Shan P et al (2012) China’s anti-monopoly law: what is the welfare standard? Rev Ind Organ 41:34

Snell SL (1996) The development of competition policy in the People’s Republic of China. N Y Univ J Int Law Polit 28:575

Song B (1995) Competition policy in a transitional economy: the case of China. Stanf J Int Law 31:391

Stemsrud O (2011) China inc under merger regulation review: the commission’s approach to acquisitions by Chinese public undertakings. ECLR 32:486

Student R (2008) China’s new anti-monopoly law: addressing foreign competitors and commentators. Minn J Int Law 17:505

Su J, Wang X (2013) China: the competition law system and the country’s norms. In: Fox EM, Trebilcock MJ (eds) The design of competition law institutions: global norms, local choices. OUP, Oxford, pp 201–202

Sun J et al. (2009) Thinking over the anti-monopoly law on China’s foreign investors’ merger and acquisition—taking coca-cola from America acquired Huiyuan in China as an example (in Chinese). J Xinjiang Univ Philos Humanit Soc Sci 37:50

Wang X (2008) Highlights of China’s new anti-monopoly law. Antitrust Law J 75:133

Wei D (2011) China’s anti-monopoly law and its merger enforcement: convergence and flexibility. J Int Econ Law 14:815

Weining Z, Chunsheng M (2010) China. In: Foer AA, Cuneo JW (eds) The international handbook on private enforcement of competition law. Edward Elgar, Cheltenham, pp 504–505

Williams M (2009) Foreign investment in China: will the anti-monopoly law be a barrier or a facilitator? Tex Int Law J 45:139

Wu H (2005) The relationship between antitrust law and goals of industrial policy and competition policy in China (in Chinese). Law Sci Mag 2:16–20

Wu Z (2008) Perspectives on the Chinese anti-monopoly law. Antitrust Law J 75:73–74

Xian-Chu Z (2009) An anti-monopoly legal regime in the making in China as a socialist market economy. Int Law 43:1489

Xiaoye W (2002) The prospect of antimonopoly legislation in China. Wash Univ Glob Stud Law Rev 1:201

Xiaoye W (2004) Issues surrounding the drafting of China’s anti-monopoly law. Wash Univ Glob Stud Law Rev 3:292

Ying P (2011) “Some thoughts about the proposed acquisition of Huiyuan by coca cola from the perspective of antimonopoly law” (in Chinese). J Southwest Univ Polit Sci Law 12:42–48

Yu T (1994) An anti-unfair competition law without a core: an introductory comparison between U.S. Antitrust Law and the new law of the People’s Republic of China. Ind Int Comp Law Rev 4:316

Zhan H (2009) Achievement to date and challenges ahead: China’s antitrust law and its implications. Syracus J Int Law Commer 36:230

Zhang X, Zhang VY (2010) Chinese merger control: patterns and implications. JCLE 6:492–493

Zheng W (2010) Transplanting antitrust in China: economic transition, market structure, and state control. Univ Pa J Int Law 32:650–651

Acknowledgments

This work was supported by Hankuk University of Foreign Studies Research Fund. The authors are thankful to Professor Mark Furse and Professor Ioannis Kokkoris for their helpful comments on earlier drafts. Of course, the authors are responsible for any possible mistakes or errors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Choi, Y.S., Youn, S.Y. The Enforcement of Merger Control in China: A Critical Analysis of Current Decisions by MOFCOM. IIC 44, 948–972 (2013). https://doi.org/10.1007/s40319-013-0128-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40319-013-0128-0