Abstract

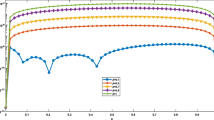

In this manuscript, a computational approach based on the combination of finite difference with the operational matrix approach is constructed for the time-fractional Black–Scholes model (TFBSM) arising in the financial market. We have applied the L1-2 scheme to approximate the Caputo derivative and the operational matrix method (OMM) by using shifted Legendre polynomials (SLP) and shifted Chebyshev polynomials (SCP) to approximate the space derivatives. The proposed algorithm easily transforms the TFBSM into a system of algebraic equations, which can be solved easily to get the numerical solution. Furthermore, theoretical unconditional stability and convergence of the numerical scheme are established for \(\alpha \in (0,{\bar{\alpha }}]\) and the stability of the proposed algorithm is also verified numerically. Finally, the scheme is tested on five numerical problems, including the European double barrier call option and the European call and put option. It is observed that this computational approach gives almost the same accuracy with both the basis functions, but the CPU time taken by scheme with SLP basis is less than the SCP basis function. The effect of different parameters like volatility, interest rate, fractional order, etc., on the option pricing, is also investigated. A comparative study of the numerical results by the proposed algorithm with the schemes given in Zhang et al. (Comput Math Appl 71(9):1772–1783, 2016) and De Staelen and Hendy (Comput Math Applic 74(6):1166–1175, 2017), is also provided to show its effectiveness and accuracy.

Similar content being viewed by others

Change history

12 June 2022

The original version of this article was revised to update the email id of the authors.

References

An, X., Liu, F., Zheng, M., Anh, V.V., Turner, I.W.: A space-time spectral method for time-fractional Black-Scholes equation. Appl. Numer. Math. 165, 152–166 (2021)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81(3), 637–654 (1973)

Bodie, Z., Kane, A.: Investments. McGraw-Hill/Irwin, New York (2008)

Carr, P., Wu, L.: The finite moment log stable process and option pricing. J. Finance 2(58) (2003)

Cartea, A.: Derivatives pricing with marked point processes using tick-by-tick data. Quant. Finance 13, 111–123 (2013)

Cen, Z., Huang, J., Xu, A., Le, A.: Numerical approximation of a time-fractional Black–Scholes equation. Comput. Math. Appl. 75(8), 2874–2887 (2018)

Chen, W., Xu, X., Zhu, S.P.: Analytically pricing double barrier options based on a time-fractional Black–Scholes equation. Comput. Math. Appl. 69, 1407–1419 (2015)

De Staelen, R.H., Hendy, A.S.: Numerically pricing double barrier options in a time-fractional Black-Scholes model. Comput. Math. Appl. 74(6), 1166–1175 (2017)

Dehghan, M., Manafian, J., Saadatmandi, A.: Solving nonlinear fractional partial differential equations using the homotopy analysis method. Numer. Methods Partial Differ. Equ.: Int. J. 26(2), 448–479 (2010)

Dehghan, M., Safarpoor, M., Abbaszadeh, M.: Two high-order numerical algorithms for solving the multi-term time fractional diffusion-wave equations. J. Comput. Appl. Math. 290, 174–195 (2015)

Del-Castillo-Negrete, D., Cartea, A.: Fractional diffusion models of option prices in markets with jumps. Physica A 374, 749–763 (2006)

Deng, W.: Finite element method for the space and time fractional Fokker-Planck equation. SIAM J. Numer. Anal. 47(1), 204–226 (2009)

Elbeleze, A.A., Kilicman, A., Taib, B.M.: Homotopy perturbation method for fractional Black-Scholes European option pricing equations using Sumudu transform. Math. Probl. Eng. 1(524852), 1–7 (2013)

Fadaei, Y., Khan, Z.A., Akgül, A.: A greedy algorithm for partition of unity collocation method in pricing American options. Math. Methods Appl. Sci. 42, 5595–5606 (2019)

Gao, G., Sun, Z., Zhang, H.: A new fractional numerical differentiation formula to approximate the Caputo fractional derivative and its application. J. Comput. Phys. 259, 33–50 (2014)

Golbabai, A., Nikan, O.: Numerical analysis of time fractional Black-Scholes European option pricing model arising in financial market. Comput. Appl. Math. 38(173), 1–24 (2019)

Joshi, V., Pachori, R.B., Vijesh, A.: Classification of ictal and seizure-free EEG signals using fractional linear prediction. Biomed. Signal Process. Control 9, 1–5 (2014)

Jumarie, G.: Stock exchange fractional dynamics defined as fractional exponential growth driven by (usual) Gaussian white noise. Application to fractional Black–Scholes equations. Insurance Math. Econom. 42, 271–287 (2008)

Jumarie, G.: Derivation and solutions of some fractional Black–Scholes equations in coarse-grained space and time. Application to Merton’s optimal portfolio. Comput. Math. Appl. 59, 1142–1164 (2010)

Kilbas, A.A., Srivastava, H.M., Trujillo, J.J.: Theory and Applications of Fractional Differential Equations, vol 204. Elsevier Science Limited (2006)

Kumar, S., Kumar, D., Singh, J.: Numerical computation of fractional Black–Scholes equation arising in financial market. Egypt. J. Basic Appl. Sci. 1, 177–183 (2014)

Kumar, Y., Singh, V.K.: Computational approach based on wavelets for financial mathematical model governed by distributed order fractional differential equation. Math. Comput. Simul. 190, 531–569 (2021)

Kumar, Y., Singh, S., Srivastava, N., Singh, A., Singh, V.K.: Wavelet approximation scheme for distributed order fractional differential equations. Comput. Math. Appl. 80(8), 1985–2017 (2020)

Li, C., Deng, W.: Remarks on fractional derivatives. Appl. Math. Comput. 187(2), 777–784 (2007)

Liang, J.R., Wang, J., Zhang, W.J., Qui, W.Y., Ren, F.Y.: Option pricing of a bi-fractional Black-Merton-Scholes model with the Hurst exponent H in \(\left[\frac{1}{2},1\right]\). Appl. Math. Lett. 23, 859–863 (2010)

Lin, Y., Xu, C.: Finite difference/spectral approximations for the time-fractional diffusion equation. J. Comput. Phys. 225(2), 1533–1552 (2007)

Magin, R.L.: Fractional calculus models of complex dynamics in biological tissues. Comput. Math. Appl. 59(5), 1586–1593 (2010)

Maurya, R.K., Devi, V., Srivastava, N., Singh, V.K.: An efficient and stable Lagrangian matrix approach to Abel integral and integro-differential equations. Appl. Math. Comput. 374(125005), 1–30 (2020)

Meerschaert, M.M., Sikorskii, A.: Stochastic Models for Fractional Calculus. De Gruyter, Berlin, Boston (2012)

Merton, R.D.: Theroy of rational option pricing. Bell J. Econ. Manag. Sci. 4(1), 141–183 (1973)

Mirzaee, F., Samadyar, N.: Combination of finite difference method and meshless method based on radial basis functions to solve fractional stochastic advection–diffusion equations. Engineering with Computers pp 1–14 (2019)

Morgado, L., Rebelo, M.: Black–Scholes equation with distributed order in time. In :Progress in Industrial Mathematics at ECMI 2018. Springer, Amsterdam (2019)

Podlubny, I.: Fractional Differential Equations. Academic Press, San Diego (1999)

Qi, H., Xu, M.: Stokes’ first problem for a viscoelastic fluid with the generalized Oldroyd-B model. Acta. Mech. Sin. 23(5), 463–469 (2007)

Roul, P., Goura, V.P.: A compact finite difference scheme for fractional Black-Scholes option pricing model. Appl. Numer. Math. 166, 40–60 (2021)

Saadatmandi, A., Dehghan, M.: A new operational matrix for solving fractional-order differential equations. Comput. Math. Appl. 59(3), 1326–1336 (2010)

Samko, S.G., Kilbas, A.A., Marichev, O.I.: Fractional Integrals and Derivatives: Theory and Applications. Gordon and Breach Science Publishers, Amsterdam (1993)

Singh, O.P., Singh, V.K., Pandey, R.K.: A stable numerical inversion of Abel’s integral equation using almost Bernstein operational matrix. J. Quant. Spectrosc. Radiat. Transfer 111, 245–252 (2010)

Soleymani, F., Akgül, A.: Improved numerical solution of multi-asset option pricing problem: A localized RBF-FD approach. Chaos Solitons Fractals 119, 298–309 (2019)

Soleymani, F., Akgül, A.: European option valuation under the bates pide in finance: A numerical implementation of the gaussian scheme. Discrete Contin. Dyn. Syst.-S 13, 889–909 (2020)

Srivastava, N., Singh, A., Kumar, Y., Singh, V.K.: Efficient numerical algorithms for Riesz-space fractional partial differential equations based on finite difference/operational matrix. Appl. Numer. Math. 161(8), 244–274 (2021)

Srivastava, V., Rai, K.: A multi-term fractional diffusion equation for oxygen delivery through a capillary to tissues. Math. Comput. Model. 51(5–6), 616–624 (2010)

Wyss, W.: The fractional Black–Scholes equation. Frac. Calc. Appl. Anal. Theory Appl. 3(1) (2000)

Zhang, H., Liu, F., Turner, I., Yang, Q.: Numerical solution of the time fractional Black–Scholes model governing European options. Comput. Math. Appl. 71(9), 1772–1783 (2016)

Acknowledgements

N. Srivastava acknowledges the financial support from the Ministry of Education, Govt. of India, under Senior Research Fellowship (SRF) scheme. A. Singh acknowledges the financial support from Council of Scientific & Industrial Research (CSIR), India, under Senior Research Fellow (SRF) scheme.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Srivastava, N., Singh, A. & Singh, V.K. Computational algorithm for financial mathematical model based on European option. Math Sci 17, 467–490 (2023). https://doi.org/10.1007/s40096-022-00474-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40096-022-00474-0