Abstract.

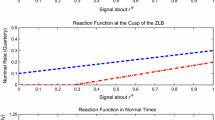

This paper analyses the effect of measurement error in the output gap on efficient monetary policy rules in a simple estimated model of the US economy. While it is a well-known result that such additive uncertainty does not affect the optimal feedback rule in a linear-quadratic framework, it is shown that output gap uncertainty can have a significant effect on the efficient response coefficients in restricted instrument rules such as the popular Taylor rule. Output gap uncertainty reduces the response to the current estimated output gap relative to current inflation and may partly explain why the parameters in estimated Taylor rules are often much less than what optimal control exercises which assume the state of the economy is known suggest.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

First version received: September 2000/Final version received: February 2001

Rights and permissions

About this article

Cite this article

Smets, F. Output gap uncertainty: Does it matter for the Taylor rule?. Empirical Economics 27, 113–129 (2002). https://doi.org/10.1007/s181-002-8362-4

Issue Date:

DOI: https://doi.org/10.1007/s181-002-8362-4