Abstract

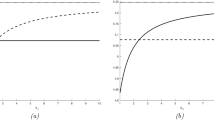

This paper considers an optimal investment and reinsurance problem for an insurance company, where the surplus follows a linear diffusion. Contrary to classical models the insurer can continue doing business even if the surplus becomes negative, but penalty payments occur depending on the level of the current surplus. The insurer can invest in n risky assets and reduce the insurance risk either by excess of loss or by proportional reinsurance. The aim is to find an optimal investment and reinsurance strategy which minimises the penalty payments. We consider various penalty functions and derive closed form solutions.

Similar content being viewed by others

References

Albrecher H, Gerber HU, Shiu ESW (2011) The optimal dividend barrier in the Gamma-Omega model. Eur Actuar J 1:43–55

Asmussen S, Højgaard B, Taksar MI (2000) Optimal risk control and dividend distribution policies. Example of excess-of loss reinsurance for an insurance corporation. Financ Stoch 4:299–324

Azcue P, Muler N (2005) Optimal reinsurance and dividend distribution policies in the Cramér-Lundberg model. Math Financ 15:261–308

Azcue P, Muler N (2010) Optimal investment policy and dividend payment strategy in an insurance company. Ann Appl Probab 20:1253–1302

Azcue P, Muler N (2014) Stochastic optimization in insurance. A dynamic programming approach. Springer, New York

Bai L, Guo J (2008) Optimal proportional reinsurance and investment with multiple risky assets and no-shorting constraint. Insur Math Econ 42:968–975

Eisenberg J (2010) On optimal control of capital injections by reinsurance and investments. Blätter der DGVFM 31:329–345

Eisenberg J, Schmidli H (2011) Optimal control of capital injections by reinsurance with riskless rate of interest. J Appl Probab 48:733–748

Højgaard B, Taksar MI (1997) Optimal proportional reinsurance policies for diffusion models. Scand Actuar J 2:166–180

Højgaard B, Taksar MI (1998) Optimal proportional reinsurance policies for diffusion models with transaction costs. Insur Math Econ 2:41–51

Højgaard B, Taksar MI (2004) Optimal dynamic portfolio selection for a corporation with controllable risk and dividend distribution policy. Quant Financ 4(3):315–327

Markussen C, Taksar MI (2003) Optimal dynamic reinsurance policies for large insurance portfolios. Financ Stoch 7:97–121

Paulsen J, Gjessing HK (1997) Ruin theory with stochastic return on investments. Adv Appl Probab 29(4):965–985

Schmidli H (1994) Corrected diffusion approximations for a risk process with the possibility of borrowing and investment. Schweiz Ver der Versicher Mitt 94:71–81

Schmidli H (2002) On minimising the ruin probability by investment and reinsurance. Ann Appl Probab 12:890–907

Schmidli H (2008) Stochastic control in insurance. Springer, London

Shreve SE, Lehocsky JP, Gaver DP (1984) Optimal consumption for general diffusions with absorbing and reflecting barriers. SIAM J Control Optim 22:55–75

Taksar MI (2000) Optimal risk and dividend distribution control models for an insurance company. Math Methods Oper Res 51:1–42

Taksar MI, Hunderup C (2007) Influence of bankruptcy value on optimal risk control for diffusion models with proportional reinsurance. Insur Math Econ 40:311–321

Vierkötter M, Schmidli H (2015) On optimal dividends with linear and exponential penalty payments. University of Cologne (Preprint)

Zhang XL, Zhang KC, Yu XJ (2009) Optimal proportional reinsurance and investment with transaction costs, I: maximizing the terminal wealth. Insur Math Econ 44:473–478

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Vierkötter, M. Minimisation of penalty payments by investments and reinsurance. Eur. Actuar. J. 6, 233–255 (2016). https://doi.org/10.1007/s13385-016-0128-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13385-016-0128-9