Abstract

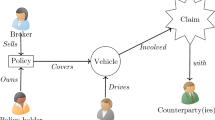

Digital transactions using credit cards are observed to be increasing day by day because of the convenience in operation. It is a matter of great concern for credit card users as well as financial institutions, providing credit card facilities for making the transactions free from possible frauds being carried out by fraudsters. The fraudsters apply different methodologies and alter their behaviours to undertake the fraudulent activities in both online and offline mode with some advanced techniques. Hence, developing a fraud detection system to identify the fraudulent activities is an important area of research to improve the credibility of credit card-based digital transactions. In this study, a fraud detection system has been proposed based on application of graph database model. The graph features being extracted using Neo4j tool are incorporated with several other features of transaction database. Subsequently, five supervised and two unsupervised machine learning algorithms are applied to them in order to detect fraudulent transactions explicitly. The features directly obtained from the transactional data are also tested with the classification models for detecting the fraudulent transactions. Critical assessment for performance of the machine learning algorithms has been carried out based on the features extracted from graph database and features extracted directly from the transaction database.

Similar content being viewed by others

References

Zojaji, Z., Atani, RE., Monadjemi, AH.: Survey of credit card fraud detection techniques: data and technique oriented perspective.” arXiv preprint arXiv:1611.06439, (2016)

Abdallah, A.; Maarof, M.A.; Zainal, A.: Fraud detection system: a survey. J. Netw. Computer Appl. 68, 90–113 (2016)

Lebichot, B., Braun, F., Caelen, O., Saerens, M.: “A graph-based, semi-supervised, credit card fraud detection system.”In: International Workshop on Complex Networks and their Applications, pp. 721–733. Springer, Cham, (2016)

Bhatla, T.P.; Prabhu, V.; Dua, A.: Understanding credit card frauds. Cards Bus. Rev. 1(6), 1–15 (2003)

Hussein, K.W.; Sani, N.F.M.; Mahmod, R.; Abdullah, M.T.K.: Enhance Luhn algorithm for validation of credit cards numbers. Int. J. Comput. Sci. Mob. Comput 2(7), 262–272 (2013)

Laleh, N., Azgomi, MA.: “A taxonomy of frauds and fraud detection techniques.” In: International Conference on Information Systems, Technology and Management, pp. 256-267. Springer, Berlin, Heidelberg, (2009)

Kavitha, M.; Suriakala, M.: Fraud detection in current scenario, sophistications and directions: a comprehensive survey. Int. J. Computer Appl. 975, 8887 (2015)

Sadowski, Gorka.; Rathle, Philip.: Fraud detection: discovering connections with graph databases. In: White Paper-Neo Technology-Graphs Everywhere, pp. 1–10 (2014)

Eifrem, E.: Graph databases: the key to foolproof fraud detection. Computer Fraud Secur. 2016, 5–8 (2016)

Schindler, Timo.: “Anomaly detection in log data using graph databases and machine learning to defend advanced persistent threats.” arXiv preprint, arXiv:1802.00259, (2018)

Needham, M.; Hodler, A.E.: Graph Algorithms: Practical Examples in Apache Spark and Neo4j. O’Reilly Media, Newton (2019)

Varmedja, D., Karanovic, M., Sladojevic, S., Arsenovic, M., Anderla, A.: “Credit card fraud detection-machine learning methods.” In: 2019 18th International Symposium INFOTEH-JAHORINA (INFOTEH), pp. 1–5. IEEE, (2019)

Jain, Y.; Namratatiwari, S.D.; Jain, S.: A comparative analysis of various credit card fraud detection techniques. Int. J. Recent Technol. Eng. 7(5S2), 402–407 (2019)

Akoglu, Leman; Tong, Hanghang; Koutra, Danai: Graph based anomaly detection and description: a survey. Data Min. Knowl. Discov. 29(3), 626–688 (2015)

Awoyemi, JO., Adetunmbi, AO., Oluwadare, SA.: “Credit card fraud detection using machine learning techniques: a comparative analysis.” In: 2017 International Conference on Computing Networking and Informatics (ICCNI), pp. 1–9. IEEE, (2017)

Sahin, Yusuf G., Duman, Ekrem.: “Detecting credit card fraud by decision trees and support vector machines.” In: Proceedings of the International MultiConference of Engineers and Computer Scientists, Vol I, (2011)

Xuan, Shiyang., Liu, Guanjun., Li, Zhenchuan., ShuoWang, Lutao Zheng., Jiang, Changjun.: “Random forest for credit card fraud detection.” In: 2018 IEEE 15th International Conference on Networking, Sensing and Control (ICNSC), pp. 1-6. IEEE, (2018)

Maes, S., Tuyls, K., Vanschoenwinkel, B., Manderick, B.: “Credit card fraud detection using Bayesian and neural networks.” In: Proceedings of the 1st International Naiso Congress on Neuro Fuzzy Technologies, pp. 261-270. (2002)

Bhattacharyya, S.; Jha, S.; Tharakunnel, K.; Westland, J.C.: Data mining for credit card fraud: a comparative study. Decis. Support Syst. 50(3), 602–613 (2011)

Carneiro, Nuno; Figueira, Goncalo; Costa, Miguel: A data mining based system for credit-card fraud detection in e-tail. Decis. Support Syst. 95, 91–101 (2017)

John, Hyder; Naaz, Sameena: Credit card fraud detection using local outlier factor and isolation forest. Int. J. Comput. Sci. Eng. 7, 1060–1064 (2019)

Vijayakumar, V.; Sri Divya, N.; Sarojini, P.; Sonika, K.: Isolation forest and local outlier factor for credit card fraud detection system. Int. J. Eng. Adv. Tech. 9(4), 261–265 (2020)

Buerli, M.; Obispo, C.P.S.L.: The current state of graph databases. Dep. Computer Sci. Cal Poly San Luis Obispo mbuerli@ calpoly Edu 32(3), 67–83 (2012)

Cattuto, C., Quaggiotto, M., Panisson, A., Averbuch, A.: “Time-varying social networks in a graph database: a Neo4j use case.” In: First international workshop on graph data management experiences and systems, p. 11. ACM, (2013)

Allen, D., Hodler, A., Hunger, M., Knobloch M., Lyon, W., Needham, M., Voigt, H.: “Understanding trolls with efficient analytics of large graphs in neo4j.” BTW (2019)

Kolomičenko, Vojtěch., Svoboda, Martin., Holubová Mlýnková, Irena.:“Experimental comparison of graph databases.” In: Proceedings of International Conference on Information Integration and Web-based Applications and Services, pp. 115-124. (2013)

Lopez-Rojas, Edgar Alonso., Stefan, Axelsson.: Banksim: A bank payments simulator for fraud detection research. In: Proceedings 26th European Modeling and Simulation Symposium, EMSS 2014, Bordeaux, France, Dime University of Genoa, 2014, ISBN: 9788897999324, pp. 144–152, (2014)

Vicknair, C., Macias, M., Zhao, Z., Nan, X., Chen, Y., Wilkins, D.: “A comparison of a graph database and a relational database: a data provenance perspective.” In: Proceedings of the 48th Annual Southeast Regional Conference, pp. 1–6, (2010)

Jouili, S., Vansteenberghe, V.: “An empirical comparison of graph databases.” In: 2013 International Conference on Social Computing, pp. 708-715. IEEE, (2013)

Sengupta, Srijan; Chen, Yuguo: A block model for node popularity in networks with community structure. J. R. Stat. Soc.: Ser. B (Stat. Methodol.) 80(2), 365–386 (2018)

Ren, Y. Zhu, H., ZHang, J., Dai, P., Bo, L.: “EnsemFDet: an ensemble approach to fraud detection based on bipartite graph.” arXiv preprint arXiv:1912.11113, (2019)

Kirchner, C.; Gade, J.: Implementing Social Network Analysis for Fraud Prevention. CGI Gr, Ind (2011)

Freeman, L.C.: Centrality in social network conceptual clarification. Soc. Netw. 1(3), 215–239 (1978)

Chen, C-J., Zaeem, RN., Barber, KS.: “Statistical analysis of identity risk of exposure and cost using the ecosystem of identity attributes.” In: 2019 European Intelligence and Security Informatics Conference (EISIC), pp. 32–39. IEEE, (2019)

Bangcharoensap, P., Kobayashi, H., Shimizu, N., Yamauchi, S., Murata, T.: “Two step graph-based semi-supervised learning for online auction fraud detection.” In: Joint European Conference on Machine Learning and Knowledge Discovery in Databases, pp. 165–179. Springer, Cham, (2015)

Lawrence, P.; Brin, S.; Motwani, R.; Terry, W.: Bringing order to the web. Stanford InfoLab, The PageRank citation ranking, pp. 1–17 (1999)

Gleich, David F.: PageRank beyond the Web. SIAM Rev. 57(3), 321–363 (2015)

Van Belle, Rafaäl., Mitrović, Sandra., Weerdt, Jochen De.: “Representation learning in graphs for credit card fraud detection.” In: Workshop on Mining Data for Financial Applications, pp. 32–46. Springer, Cham, (2019)

Raghavan, U.N.; Albert, R.; Kumara, S.: Near linear time algorithm to detect community structures in large-scale networks. Phys. Rev. E 76(3), 036106 (2007)

Peng, L., Lin, R.: “Fraud phone calls analysis based on label propagation community detection algorithm.” In: 2018 IEEE World Congress on Services (SERVICES), pp. 23–24. IEEE, (2018)

Luan, T., Yan, Z., Zhang, S., Zheng, Y.: “Fraudster detection based on label propagation algorithm.” In: 2018 IEEE 20th International Conference on High Performance Computing and Communications; IEEE 16th International Conference on Smart City; IEEE 4th International Conference on Data Science and Systems (HPCC/SmartCity/DSS), pp. 346–353. IEEE, (2018)

Wheeler, R.; Aitken, S.: Multiple algorithms for fraud detection. In: Ellis, R., Moulton, M., Coenen, F. (eds.) Applications and Innovations in Intelligent Systems VII, pp. 219–231. Springer, London (2000)

Li, Z., Zhang, H., Masum, M., Shahriar, H., Haddad, H.: “Cyber Fraud Prediction with Supervised Machine Learning Techniques.” In: Proceedings of the 2020 ACM Southeast Conference, pp. 176–180. (2020)

Magomedov, S.; Pavelyev, S.; Ivanova, I.; Dobrotvorsky, A.; Khrestina, M.; Yusubaliev, T.: Anomaly detection with machine learning and graph databases in fraud management. Int. J. Adv. Computer Sci. Appl. 9(11), 33–38 (2018)

Akinyelu, Andronicus A.; Adewumi, Aderemi O.: Classification of phishing email using random forest machine learning technique. J. Appl. Math. 2014, 1–6 (2014)

Prusti, D., Rath, SK.: Fraudulent Transaction detection in credit card by applying ensemble machine learning techniques.” In: 2019 10th International Conference on Computing, Communication and Networking Technologies (ICCCNT), pp. 1–6. IEEE, (2019)

Masoumeh, Z.; Seeja, K.R.; Afshar Alam, M.: Analysis on credit card fraud detection techniques: based on certain design criteria. Int. J. Computer Appl. 52(3), 35–42 (2012)

Kiran, S.; Kumar, N.; Guru, J.; Katariya, D.; Kumar, R.; Sharma, M.: Credit card fraud detection using Naïve Bayes model based and KNN classifier. Int. J. Adv. Res., Ideas Innov. Technol. 4(3), 44–47 (2018)

Mishra, Mukesh Kumar., Dash, Rajashree.: “A comparative study of chebyshev functional link artificial neural network, multi-layer perceptron and decision tree for credit card fraud detection.” In: 2014 International Conference on Information Technology, pp. 228-233, (2014)

Hearst, Marti A.; Dumais, Susan T.; Osuna, Edgar; Platt, John; Scholkopf, Bernhard: Support vector machines. IEEE Intell. Syst. Appl. 13(4), 18–28 (1998)

Stackelberg, BV.; Avrutin, V.; Levi, P.; Schanz, M.; Wackenhut, G.: Reconstruction of dynamical systems using constructive neural networks, pp. 1–15 (2004)

Webber, J.:‘A programmatic introduction to neo4j.” In: Proceedings of the 3rd Annual Conference on Systems, Programming, and Applications: Software for Humanity, pp. 217–218. (2012)

Miller, JJ.: “Graph database applications and concepts with Neo4j.” In: Proceedings of the Southern Association for Information Systems Conference, Atlanta, GA, USA, 2324 (S 36). (2013)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Prusti, D., Das, D. & Rath, S.K. Credit Card Fraud Detection Technique by Applying Graph Database Model. Arab J Sci Eng 46, 1–20 (2021). https://doi.org/10.1007/s13369-021-05682-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13369-021-05682-9