Abstract

We empirically study the impact of inflation targeting credibility on business cycle synchronization with G-7 economies. To do this, we use a sample of 15 inflation targeting countries to develop and calculate a reputation-based credibility measure for long- and short-term memory. By using dynamic multipliers through a panel vector autoregressive model, our main findings indicate that greater credibility allows for greater anchoring of inflation expectations by economic agents. This would lead to a greater effectiveness of monetary policy in stabilizing the evolution of prices, allowing the output gap to be more sensitive to external aggregate demand shocks. Therefore, countries with inflation targeting regimes must develop and maintain credibility for their monetary policy if they want to encourage greater interactions with the rest of the world.

Similar content being viewed by others

1 Introduction

Globalization, through its effects on both the real and the financial sectors, has increased the interaction between business cycle phases of different economies. This phenomenon is known as business cycle coupling or synchronization. Due to its importance in coordinating economic policies between countries (commercial, technological, financial, and monetary policies), business cycle synchronization (BCS, henceforth) has received considerable attention during the last decade, with an increasing amount of research but few conclusive results (Pesce 2017).

Theoretical foundations in BSC highlight trade intensity, for both inter-industry trade and intra-industry trade,Footnote 1 as a factor that affects the degree of synchronization between two economies (Frankel and Rose 1998). Moreover, the degree of production structure symmetry and levels of financial linkages between countries are additional factors explaining the synchronization of business cycle phases (Imbs 2004; Calderón et al. 2007; Schiavo 2008).

Macroeconomic policies can also have an effect on the level of BCS. Economic authorities define policy framework to achieve objectives associated with fiscal, trade, and exchange rates and monetary aspects. Among the latter, central banks primarily attempt to stabilize the evolution of aggregate price levels. Inflation targeting (IT, henceforth) has become a leading strategy for inflation stabilization. Since the 1990s, when the first countries began to use IT, the number of nations implementing this regime has increased drastically, especially in emerging economies (Schmidt-Hebbel and Carrasco 2016).

The existing evidence on the impact of IT on BCS has suggested that IT promotes synchronization among economies—although the evidence is neither abundant nor conclusive. Arguments in favor of a positive effect of IT on BCS state that by adopting IT central banks can set interest rates in order to stabilize inflation, resulting in a domestic output that is more sensitive to external shocks (Flood and Rose 2010). In the same vein, Inoue et al. (2012) present evidence that IT encourages BCS for some Asian countries.

Nowadays, there are an increasing number of countries that have adopted and maintained IT. Using IT, central banks have been able to make and prove their commitment to price-level stabilization, which has helped the strategy gain more credibility. Credibility is understood as the degree of expectations that agents have about whether inflation converges to target levels within the deadlines announced by policy makers (De Mendonça and E Souza 2009). Therefore, it is possible to conclude that IT’s effectiveness is driven by its degree of credibility.

In this paper, we focus on the impact of central bank credibility on BCS. To do this, we measure credibility based on the reputation of central banks. More specifically, we look at whether greater credibility allows for a better anchoring of inflation expectations toward inflation targets. In this way, increasing credibility would promote a coupling effect of business cycles phases as a positive externality of monetary policy in IT countries. We postulate that interest rate is a mechanism by which IT can impact BSC. A positive transitory shock that increases price levels also decreases expectation for future inflation. Therefore, policymakers decrease interest rate in order to maintain inflation expectations around the target level. In such an environment, interest rate reduction intensifies the effect on domestic output caused by a positive external shock. Thus, correlation between domestic and external outputs increases under IT regimes (see a deeper discussion about this issue in Flood and Rose 2010).

The objective of this paper is to study the impact of central banks’ degree of credibility on BCS. Our main contribution is focusing on the degree of credibility instead of focusing on IT, per se, as a factor affecting BCS. We also provide evidence on the explicit impact of IT credibility on BCS—evidence which is certainly not abundant. For instance, Flood and Rose (2010) show theoretically that IT promotes BCS by assuming perfect credibility. Empirically, mixed evidence for Asian economies is found by Inoue et al. (2012), whose alternative findings could have been driven by varying degrees of credibility on implemented policies.

We used a sample of 15 countries that have adopted IT for a long period of time and have been successful in their convergence to their inflation targets. This sample includes both developed and emerging economies for the quarterly period 1985:Q1 to 2015:Q4 for real, seasonally adjusted GDP data. We focus on the synchronization of these economies with G-7 countries, which represent an appropriate proxy for world economic activity (Colomo 2015).Footnote 2

By computing a reputation-based credibility measure (following De Mendonça and E Souza 2009) and using a panel vector autoregressive model (PVAR, henceforth), we obtain dynamic multipliers to analyze the effect of the degree of credibility on BCS. Our main findings indicate that a greater degree of credibility allows for a greater anchoring of agent’s expectations and, thus, an increased effectiveness of monetary policy in stabilizing prices.

This paper is organized as follows: Sect. 2 presents the methodological approach, and Sect. 3 shows data used in this paper. Section 4 discusses our main results, and Sect. 5 concludes the paper.

2 Methodology

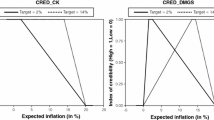

To quantify the degree of IT credibility for each country, we use the index proposed by De Mendonça and E Souza (2009). They argue that reputation is essentially a backward-looking variable, and hence, an IT regime gains credibility based on the past reputation of policy makers (De Mendonça 2007). Our reputation-based credibility measure allows us to compute two credibility indexes: long- and short-term memory. The central bank’s reputation of country \( i \) during period \( t \) is defined by

where \( \pi_{it} \) is the current inflation. \( \pi_{{it\;{\text{Min}}}}^{*} \) and \( \pi_{{it\;{\text{Max}}}}^{*} \) represent the lower and upper limits of the IT bands established by the central bank, respectively. Thus, a central bank has total reputation when current inflation is within the target range and loses reputation when inflation is outside that range. Following De Mendonça and E Souza (2009), we have assumed a 20% threshold for defining reputation loss.Footnote 3 From this measure of reputation, we calculate two reputation-based credibility indexes: long- and short-term memory. We measure reputation based on a weighted average of past reputations, giving more weight to more recent periods. This approach gives us a long-term memory (LTM) measure, i.e.,

where \( p_{j} = \frac{{k_{j} }}{n} \) is the weight given to reputation during period j, which corresponds to the ratio between \( k_{j} \) and \( n \) total periods. kj is a natural number that decreases on t; it begins with one for the first period of IT implementation and increases by one unit for each subsequent period.

Next, we develop a reputation-based credibility index focusing on agents’ short-term memory (STM) by calculating a moving average over six lagsFootnote 4 (one semester memory), i.e.,

To measure synchronization, we use the Hodrick and Prescott filter (1980) defined by \( y_{it}^{\text{HP}} \equiv y_{it} - \hat{y}_{it}^{\text{HP}} \), where \( y_{\text{it}} \) is the natural logarithm of real GDP during period \( t \) and \( \hat{y}_{it}^{\text{HP}} \) is its trend level. After obtaining the GDP’s cyclical component, we calculate the degree of BCS between the sample countries and the G-7 economies. To do this, we obtain a Pearson’s coefficient of sample correlation using 12, 16, and 20 previous observations of past data (including the contemporary period). Thus, our BCS measure, \( \hat{\rho }_{it}^{d} \), represents the correlation coefficient between country \( i \) and G-7 economies during period t for d past observations.

Because of the macropanel structure of data, we use a PVAR model to estimate dynamic multipliers.Footnote 5 Although these multipliers are analogous to impulse response functions, they are generated by an exogenous variable. The PVAR model used to investigate the effect of credibility on BCS is defined as follows:

where \( Y_{it} \) and \( X_{it} \) are vectors of endogenous and exogenous variables, respectively. Matrices \( A_{1} ,A_{2} , \ldots A_{p - 1} ,A_{p} \) and B contain the parameters to be estimated. \( \mu_{i} \) is a vector of country fixed effects, \( \varepsilon_{it} \) is a vector of error terms, and p is the maximum lag order for vector of dependent variables.

We control for the main factors that can explain BCS between countries. Firstly, greater intra-industry trade relationships between countries allow their trade balances to be more closely related, leading to a greater association of their business cycle phases. In contrast, this effect could be negative if intensity is generated mainly through inter-industrial trade, which encourages specialization and decoupling. Our measure of trade intensity for country i with G-7 economies, Tit, is computed as the ratio of trade flows between two economies and the sum of country i’s total trade flows with the rest of the world, that is,

where \( X_{G7,t}^{i} \) and \( X_{W,t}^{i} \) represent the flow of exports during period \( t \) from country \( i \) to G-7 economies and the rest of the world, respectively. Similarly, \( M_{G7,t}^{i} \) and \( M_{W,t}^{i} \) represent the flows of imports, respectively. The expression of Eq. (5) can be interpreted as the share of country i’s trade flows with G-7 economies compared to its trade flows with the rest of the world.Footnote 6

Secondly, BCS’s behavior between countries differs significantly when pairs of developed countries are analyzed and compared to situations where developed economies are paired with emerging countries.Footnote 7 To capture this effect, we create a variable based on the Human Development IndexFootnote 8 (HDI):

We use a threshold of 0.8 because a country is considered “developed” when its HDI is very high, i.e., equal to or greater than 0.8. Therefore, our development variable, \( D_{it} \), is a dummy variable that takes a value of 1 if country i during period t fulfills the necessary conditions for a very high level of human development, and 0 otherwise.Footnote 9

Thirdly, it is possible that BCS can change structurally in situations of negative economic growth, especially if the situation triggers an economic recession (Inoue et al. 2012). We expect an increased coupling of business cycle phases during periods of negative economic growth. Therefore, we capture a world economic downturn by:

where \( g_{t}^{G7} \) is the real GDP growth rate of G-7 economies during period t. In this case, \( REC_{t}^{G7} \) captures temporary effects of G-7 economic recessions on synchronization from scenarios transmitted as aggregate demand shocks to the countries in our sample.

Finally, we control for exchange rate regime. Svensson (2000) shows that a flexible IT has less effect on macro variables like GDP as compared to strict IT since inflation targets are fixed over longer time horizons. A shock in domestic inflation that increases nominal and real interest rates (i.e., appreciation of the exchange rate) causes a more moderate impact on output gap; thus, inflation converges to its target at a more gradual pace. Similarly, a demand shock encourages restrictive monetary policies that stabilize output gap. Therefore, a flexible IT implies a more gradual return to target compared to strict IT. In the context of this paper, a flexible exchange rate acts as a shock absorber, reducing BCS. For this reason, we create a dummy variable \( {\text{FIX}}_{it} \) that takes the value 1 if country i in period t had a fixed exchange regime in place, and 0 otherwise.Footnote 10 Under the aforementioned context, we expect a positive effect of fixed exchange rate regimes on BSC (Flood and Rose 2010).

As a result, we define \( Y_{it} = \left( T_{it}, {\hat{\rho }_{it}^{d} } \right)\;{\text{and}}\;X_{it} = \left( {D_{it} ,REC_{t}^{G7} ,{\text{FIX}}_{it},{\text{CI}}_{it} } \right) \) for our model in Eq. (4). These variables are differentiated according to their order of integration, with the exception of dichotomous variables. We also applied a logarithmic transformation to our measures of trade intensity, synchronization, and credibility. Based on Granger (1969) causality tests, we observe some evidence that synchronization and trade intensity variables are affected by each other, while our reputation-based credibility index, development, and recession variables are not caused by synchronization and trade intensity variables. This evidence is in line with Frankel and Rose (1998), who hypothesize an endogeneity problem between the degree of coupling cycles and trade intensity; increases in the synchronization of business cycle phases encourage trade agreements and, therefore, greater intensity among their current account balances.

An important issue is that fixed effects of the model in Eq. (4) are correlated with X-variables due to lags in Y-variables. To deal with this problem, we remove fixed effects by performing an orthogonal transformation using mean deviations of those effects’ future values, as proposed by Arellano and Bover (1995). This technique allows us to use the lags of X-variables as instruments for estimating coefficients using the generalized method of moments (GMM). Since we have an unbalanced panel, it is possible to improve the efficiency of GMM by following Holtz-Eakin et al. (1988), who propose adding instruments using observed realizations and substituting missing values with zeros (based on the assumption of non-correlation of the set of instruments with error terms).

3 Data

We use a sample of 15 countries that implemented an IT regime between 1985:Q1 and 2015:Q4. GDP series are in quarterly frequency, seasonally adjusted, and measured in 2010 millions of US dollars adjusted by purchasing power parity. Data on real GDP were obtained from the OECD Quarterly National Accounts. We used the Hodrick and Prescott (1980) method to eliminate trend patterns, as widely seen in the literature.Footnote 11 Our choice of 15 sample countries was based on data availability for economies that had implemented IT regimes for over 10 years and had been effective in stabilizing inflation (Details on these countries are given in “Appendix A”). The formal initial period of IT implementation was based on Schmidt-Hebbel and Carrasco (2016).Footnote 12

Reputation measures are computed using monthly data for annual inflation rates, taking the official price index reference into account. In most cases, the official reference is the Consumer Price Index (CPI) (Details on calculating inflation rates and IT regimes are presented in “Appendix B”). If a country had a sporadic target for a certain quarter, we followed Brunila and Lahdenpera (1995) by including a fictitious band of one percentage point. Our sample contains a few countries that did not present inflation bands in some periods. Since agents expect a gradual adjustment of actual inflation to their target levels, we performed a linear interpolation for such cases. Our reputation-based credibility measure is computed using monthly data, so we calculate quarterly averages to make them comparable with BCS series.

Data for trade intensity were obtained from the Direction of Trade Statistics (DOTS), International Monetary Fund. We use quarterly data on FOB export and CIF import flows, both measured in US dollars, from 1990 to 2015.Footnote 13 All these series are seasonally adjusted using the Census X-12 method. An important issue to consider is that export flows from one country to another are not necessarily equal to import flows from the same pair of countries. We dealt with this issue by considering the data reported by the country with the highest income level as more reliable. Data for HDI index were obtained from the United Nations Development Program (UNDP).Footnote 14

4 Stylized facts

Table 1 clearly shows the process of gradual convergence of inflation rates in response to the implementation of IT for countries in our sample. Some prominent cases are Chile and Hungary, which reduced their average inflation rates from more than two digits to their target levels. We can also observe that many countries experienced a rise in their inflation rates during the 2008–2011 period, i.e., the subprime crisis. Although countries in our sample show a general convergence of inflation rates, they present periods with different degrees of IT effectiveness. These different degrees of effectiveness are essential for the purpose of this paper.

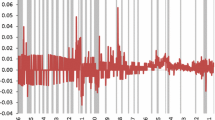

To analyze the dynamics of BCS and reputation-based credibility series overtime, we calculate the average values for these figures among all countries for each time period. Graphs of these series are presented in Fig. 1. We can see that both BCS and reputation-based credibility series have a fairly common pattern for a large part of the period under consideration. Another common characteristic is that during the first years, almost all series tended to increase, followed by a decreasing trend in later years. For the synchronization measures, changes in trend seemed to occur during economic crises, while those changes occurred more during subsequent years for the long-term reputation-based credibility measures. Short-term reputation-based credibility measures, in contrast, did not present changes in trend.

We also compute growth rates of these series, as presented in Fig. 2. Again, we can observe common patterns in the evolution of these series for a large extent of the sample period. Increases (decreases) in reputation-based credibility are consistent with increases (decreases) in the degree of BCS. To confirm these findings, we calculate correlation coefficients between these variables (both the level and growth rates), which are shown in Table 2. For all cases, we find positive correlations with relatively high values, most of them significant at the conventional levels. This evidence allows us to conclude that there is a positive and significant correlation between mean values of BCS with G-7 economies and credibility indexes for the sample of IT countries from 2006 to 2015.

5 Results from the PVAR model

To identify the order of integration for the series under analysis, we perform the stationarity test proposed by Im et al. (2003). This test assumes heterogeneous variances for the residuals of each single unit root test—an appropriate test for unbalanced panels. The results indicating that reputation-based credibility measures are integrated of order one are presented in Table 3. Synchronization series are stationary in levels when 12 quarters are used to calculate them. The rest of synchronization series, however, require a regular difference for stationarity. Finally, trade intensity series are stationary in levels. We follow Andrews and Lu (2001) and choose lag order for our model in Eq. (4) according to the Schwarz (1978) information criteria; all models require two lags (see Table 4). A set of transformed endogenous variables with four lags is used as a set of instruments.Footnote 15

Results of the PVAR estimation are presented in Table 5. Contemporary effects of credibility growth on the change of BCS are positive and significant in most cases. To analyze the robustness of these findings, we use synchronization measures based on two alternative filter methods. We consider the Christiano and Fitzgerald (2003) random walk band-pass filter and the Butterworth (1930) square wave high-pass filter. These estimates support the main results discussed in this paper, i.e., positive and significant.Footnote 16 Regarding our control variables, we find evidence of a negative relation between synchronization and commercial intensity changes. This finding suggests a greater effect of inter-industrial trade than intra-industrial trade, explained by differences between productive structures of the countries in our sample. Moreover, there is a negative and significant effect of economic development on BCS. Furthermore, regarding the effect of a negative growth shock in G-7 countries, we find that synchronization tends to be higher as aggregate demand disturbances are transmitted more quickly. Finally, the effect of the presence of a fixed exchange rate regime on BSC is positive and significant in most cases. Also, note that all PVAR models estimated meet the stability condition since all their eigenvalues are within the unit circle, and the six specifications are estimated controlling for heteroskedasticity using robust standard errors.

Despite the aforementioned findings, evidence is analyzed not only for contemporary effects, but also for the total effect of credibility on BCS over time. We estimate dynamic multiplier functions of reputation-based credibility on the degree of BCS with G-7 economies (see Fig. 3). We use Cholesky’s decomposition and Monte Carlo simulation techniques with 500 iterations for estimating 90% confidence intervals.

Figure 3 shows BCS’s responses to a shock in the degree of reputation-based credibility. All effects are significant at conventional levels, with a greater magnitude in the case of long-term memory credibility compared to that of short-term memory. Expanding agents’ memory seems to intensify the effect on BCS. Our results also show an average contemporary effect of a long-term memory credibility shock that is five times greater than the short-term one. It would seem that credibility shocks are more drastic when agents consider the entire history of the central banks’ IT regime rather than just the recent history. From another perspective, shocks tend to be considered more permanent than transitory with long-term memory since credibility is less stable with short-term memory.

Finally, we can also observe that the duration of responses to the shocks is between three and five quarters. Our findings imply that a decline in reputation-based credibility would cause a reduction in BCS growth; thus, synchronization response is reduced, at most, to five quarters.Footnote 17 These results expand the existing empirical evidence on BCS determinants. Previous authors and the available evidence had focused on the mere implementation of IT regime and its impact on BCS instead of the degree of credibility. Our findings, on the other hand, suggest that a fall in credibility will impact agents’ expectations, affecting the effectiveness of central banks’ announcements. With lower IT credibility, output lowers its sensitivity to external shocks on aggregate demand, leaving the output gap less sensitive to replicate patterns of external business cycles.

6 Conclusions

In this paper, we presented new empirical evidence on the effect of reputation-based credibility on BCS with G-7 economies. To do this, we built two measures of credibility, long- and short-term memory, for a sample of 15 countries with IT regimes. By estimating a PVAR model, we obtained dynamic multipliers, indicating a significant effect of the degree of reputation-based credibility on BCS. Our results show that not only the adoption of IT allows for greater synchronization, but also the degree of credibility of IT announcements is relevant and significant for cycle coupling. This means that a higher degree of credibility allows for a greater anchoring of inflation expectations, a better stabilization of price levels, and an output gap that is more sensitive to the external shocks of aggregate demand. In addition, our findings indicate that the effect on synchronization is greater if agents adopt a long-term memory in determining the credibility of inflation expectations.

Countries with IT regimes must develop and maintain credibility for their monetary policy if they want to achieve greater interactions with the rest of the world. This is especially important for emerging countries that aim to have stronger links with developed economies. Without enough credibility, these economies could experience cycle decoupling, leading to disharmonization between economic and commercial agreements.

Finally, this analysis can be extended to compare the impact of different monetary regimes and credibility levels on BCS by using theoretical and empirical models, taking into account the measure of credibility introduced in this paper. Our empirical model could also be assessed with a different framework of expectations formation for inflation, transitioning from backward-looking expectations to forward looking ones.

Notes

In relation to Heckscher–Ohlin's theory, Calderón et al. (2007) state that a pattern of inter-industrial trade is one that is generated by different industries (different kinds of products) and favors specialization. In contrast, intra-industry trade is one that assumes a given country imports and exports goods and/or services of the same nature, simultaneously.

According to Colomo (2015), the GDP of G-7 economies accounted for more than 60% of the world’s GDP. G-7 countries are: Germany, Canada, the USA, France, Italy, Japan, and the UK.

De Mendonça and E Souza (2009) claim that inflation rates above 20% produce a loss of regulatory control by the monetary authority.

We used three and twelve lags without significant changes in our main findings.

The PVAR model was estimated using the Abrigo and Love (2016) package.

Different measures of trade intensity consider the total trade flows of the second country in the denominator. We do not add this flow for G-7 economies since the focus of this study is country i and also because G-7 economies are larger economy compared to the countries in the sample. Thus, trade flows from the G-7 would cause values of this ratio to be quite small, which could distort the interpretation of our results.

This phenomenon is explained by asymmetry in production structures.

This index is available in annual frequency, but it was transformed to quarterly frequency through linear interpolations.

The advantage of our definition is that it provides time variability to our level development variable.

Data on exchange rate regimes were obtained from Reinhart and Rogoff (2009). Fixed exchange rate regimes include coarse classification codes 1 and 2. Dataset are available at: http://www.carmenreinhart.com/data/browse-by-topic/.

We use a smoothing parameter of 1600 for quarterly frequency data.

There is no consensus in the literature regarding formal dates of implementation of IT regimes for each country.

We define trade flows of G-7 economies as the sum of flows from each country in this economic block separately, previously seasonally adjusted.

Database reference: http://hdr.undp.org/en/data.

The use of additional instruments did not affect our main findings.

Results can be obtained from the authors upon request.

While the graphs show the impact of positive credibility growing shock, it is more reasonable to explain the effect of a negative shock, that is, a credibility reduction of central bank.

References

Abrigo MR, Love I (2016) Estimation of panel vector autoregression in Stata. Stata J 16:778–804

Andrews DW, Lu B (2001) Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econom 101:123–164

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68:29–51

Brunila A, Lahdenpera H (1995) Inflation targets: principal issues and practical implementation, pp 119–34. Targeting Inflation, Bank of England, London

Butterworth S (1930) On the theory of filter amplifiers. Wirel Eng 7:536–541

Calderón C, Chong A, Stein E (2007) Trade intensity and business cycle synchronization: are developing countries any different? J Int Econ 71:2–21

Christiano LJ, Fitzgerald TJ (2003) The band pass filter. Int Econ Rev 44:435–465

Colomo J (2015) G7 El poder de sancionar. http://www.javiercolomo.com/index_archivos/G_7.htm. Accessed 30 May 2017

de Mendonca H (2007) Towards credibility from inflation targeting: the Brazilian experience. Appl Econ 39:2599–2615

de Mendonça HF, e Souza GJDG (2009) Inflation targeting credibility and reputation: the consequences for the interest rate. Econ Modell 26:1228–1238

Flood RP, Rose AK (2010) Inflation targeting and business cycle synchronization. J Int Money Financ 29:704–727

Frankel JA, Rose AK (1998) The endogenity of the optimum currency area criteria. Econ J 108:1009–1025

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econom J Econom Soc 37:424–438

Hodrick RJ, Prescott EC (1980) Post-War US business cycles: an empirical investigation. J Money Credit Bank 29:1–16

Holtz-Eakin D, Newey W, Rosen HS (1988) Estimating vector autoregressions with panel data. Econom J Econom Soc 56:1371–1395

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115:53–74

Imbs J (2004) Trade, finance, specialization, and synchronization. Rev Econ Stat 86:723–734

Inoue T, Toyoshima Y, Hamori S (2012) Inflation targeting in Korea, Indonesia, Thailand, and the Philippines: the impact on business cycle synchronization between each country and the world. IDE Discussion Paper. No. 328

Pesce A (2017) The decoupling of emerging economies: theoretical and empirical puzzle. J Econ Surv 31(2):602–631

Reinhart CM, Rogoff KS (2009) This time is different: eight centuries of financial folly. Princeton University Press, Princeton

Schiavo S (2008) Financial integration, GDP correlation and the endogeneity of optimum currency areas. Economica 75:168–189

Schmidt-Hebbel K, Carrasco M (2016) The past and future of inflation targeting. http://www.bcb.gov.br/pec/depep/Seminarios/2016XVIIISemAnualMetasInfBCB/SMETASXVIII-%20Klaus%20Schmidt.pdf. Accessed 5 Aug 2016

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6:461–464

Svensson L (2000) Open economy inflation targeting. J Int Econ 50(1):155–183

Acknowledgements

The author Carlos Delgado appreciates the support of the Office of Research at Universidad de Concepción that funded this research (219.124.001-INI VRID Project).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Ethical approval

Also, authors testify that this paper complies with the ethical rules of the journal. Authors declare that the work described has not been published before; that it is not under consideration for publication anything else; that its publication has been approved by all co-authors and by the responsible authorities at the institute where this work has been carried out. The publisher will not be held legally responsible should there be any claims for compensation.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

See Table 6.

Appendix B

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Delgado, C., Araya, I. & Pino, G. Business cycle synchronization: is it affected by inflation targeting credibility?. SERIEs 11, 157–177 (2020). https://doi.org/10.1007/s13209-019-00206-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13209-019-00206-z