Abstract

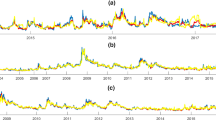

A model-free methodology is used for the first time to estimate a daily volatility index (VIBEX-NEW) for the Spanish financial market. We use a public data set of daily option prices to compute this index and show that daily changes in VIBEX-NEW display a negative, tight contemporaneous relationship with IBEX daily returns, contrary to other common volatility indicators, as an implied volatility indicator or a GARCH(1,1) conditional volatility model. This relationship is approximately symmetric to the sign on VIBEX-NEW changes and asymmetric to the IBEX-35 returns sign, which make it clearly a suitable volatility index for the Spanish stock market. We also examine the relationship between current VIBEX-NEW and future IBEX-35 volatility. Our results suggest that VIBEX-NEW can be used to produce IBEX-35 volatility forecasts at least as good as historical and conditional volatility measures. A feasible volatility correction methodology is proposed to achieve it.

Article PDF

Similar content being viewed by others

Avoid common mistakes on your manuscript.

References

Andersen TG, Bondarenko B (2007) Construction and interpretation of model-free implied volatility. CREATES Research Papers 2007-24, School of Economics and Management, University of Aarhus

Bali T, Weinbaum D (2007) A conditional extreme value volatility estimator based on high-frequency returns. J Econ Dyn Control 31(2): 361–397

Becker R, Clements A, White S (2007) Does implied volatility provide any information beyond that captured in model-based volatility forecasts?. J Banking Finance 31(8): 2535–2549

Black F (1976) The pricing of commodity contracts. J Financial Econ 3(1–2): 167–179

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Political Econ 81(2): 637–654

Blair B, Poon SH, Taylor S (2001) Forecasting S&P 100 volatility: the incremental information content of implied volatilities and high frequency index return. J Econ 105: 5–26

Bollerslev T, Tauchen G, Zhou H (2009) Expected stock returns and variance risk premia. Rev Financial Stud 22(11): 4463–4492

Box GEP, Jenkins GM, Reinsel GC (2008) Time series analysis, forecasting and control, 4th edn. Prentice Hall, Englewood Clifs

Britten-Jones M, Neuberger A (2000) Option prices, implied price processes and stochastic volatility. J Finance 22: 621–651

Corrado CJ, Miller TW (2005) The forecast quality of CBOE implied volatility indexes. J Futures Markets 25(4): 339–373

Demeterfi K, Derman E, Kamal M, Zou J (1999) More than you ever wanted to know about volatility swap. Goldman Sachs Quantitative Strategies Research Notes

Deutsche Borse (2007) Guide to the volatility indices of Deutsche Borse. Version 2.0. In: Nelken I (ed) Volatility as an asset class. Risk Books, London

Diebold F, Mariano R (1995) Comparing predictive accuracy. J Bus Econ Stat 13(3): 253–263

Engle R, Gallo G (2007) A multiple indicators model for volatility using intra-daily data. J Econ 131(1–2): 3–27

Figlewski S, Wang X (2000) Is the ‘leverage effect’ a leverage effect? Available at SSRN: http://ssrn.com/abstract=256109. doi:10.2139/ssrn.256109

Fleming J, Ostdiek B, Whaley R (1995) Predicting stock market volatility: a new measure. J Futures Mark 15(3): 265–302

Giacomini R, White H (2006) Tests of conditional predictive ability. Econometrica 74(6): 1545–1578

Giner J, Morini S (2004) El índice VIX para la predicción de volatilidad: un estudio internacional. Working paper 2004-10. Departamento de Economía Financiera y Contabilidad. Universidad de La Laguna

Giot P (2005) Relationships between implied volatility indices and stock index returns. J Portfolio Manag 31: 92–100

Giot P, Laurent S (2007) The information content of implied volatility in light of the jump/continuous decomposition of realized volatility. J Futures Markets 27(4): 337–359

Gonzalez-Perez M, Novales A (2009) Are volatility indices in international stock markets forward looking?. Revista Real Academia de Ciencias Serie A Matematica Aplicada/Appl Math 103(2): 339–352

Hibbert A, Daigler R, Dupoyet B (2008) A behavioral explanation for the negative asymmetric return- volatility relation. J Banking Finance 32: 2254–2266

Jiang G, Tian Y (2007) Extracting model-free volatility from option prices: an examination of the VIX index. J Deriv 14(3): 1–26

Noh J, Engle R, Kane A (1994) Forecasting volatility and option prices of the S&P 500 index. J Deriv 2(1): 17–30

Poon SH, Granger C (2008) Forecasting volatility in financial markets: a review. J Econ Lit 41: 478–539

Simon D (2003) The NASDAQ volatility index during and after the bubble. J Deriv Winter:9–24

Skiadopoulos G (2004) The Greek implied volatility index: construction and properties. Appl Financial Econ 14: 1187–1196

Whaley RE (2000) The investor fear gauge. J Portfolio Manag 26(3): 12–17

Whaley RE (2009) Understanding VIX. J Portfolio Manag 35(3): 98–105

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Gonzalez-Perez, M.T., Novales, A. The information content in a volatility index for Spain. SERIEs 2, 185–216 (2011). https://doi.org/10.1007/s13209-010-0031-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13209-010-0031-6