Abstract

This paper measured the significant factors leading to performance challenges across state-owned refineries in Nigeria based on experts’ views. The study was carried out with a view of making policy recommendations to help address these issues and thereby improve performance. A quantitative approach was adopted to sample the viewpoints of the professionals who work across the NNPC refineries. Using a Likert-type questionnaire, the professionals’ expert opinions were ranked across four main categories covering political, economic, social, and technical (PEST) factors. A Cronbach alpha test was performed to certify the consistency and reliability of the sub-category factors included on the Likert scale. In addition, a multivariate analysis of variance (MANOVA) was carried out to check for any statistically significant differences in the respondents’ opinions as a result of their different years of work experience. The study revealed that while all four PEST factors are crucial to the performance of the state-owned refineries in Nigeria, political, economic, and technical factors were viewed as more significant than the social factors. A comparative analysis of the sub-category factors using the relative significance index (RSI) and the respondents’ mean scores of importance (RMSI) revealed that government interference, funding issues, political indecision, theft and pipeline attacks, cost of spare parts, maintenance issues, operating capital, feedstock supply, staff training and competence issues are some of the significant factors that affect the performance of the refineries. The identified performance challenges from this study were used to inform policy recommendations to help address the problems of the refineries.

Similar content being viewed by others

Introduction

The poor performance of state-owned petroleum refineries in Nigeria has been the subject of much academic discourse [1, 26, 47, 71]. The interest generated by this industry is understandably underpinned by its impact on the average cost of living in Nigeria. This is because the non-availability of locally refined petroleum products (RPPs) in Nigeria usually result in their costly imports, thereby raising the cost of transportation and commodities with the consumer at the receiving end [64]. Essentially, the efficiency of this industry will positively contribute to the national economy by helping to stabilise the cost of businesses and save the nation unnecessary costs from imports [46, 61].

Nigeria has four State-owned refineries operated by its National Oil Company—Nigerian National Petroleum Corporation (NNPC). These refineries have a total installed capacity of 445,000 barrels per stream day (BPSD) and are strategically located across the country at Kaduna, Warri, and Port Harcourt. The Port Harcourt refineries comprise the two refineries built in 1965 and 1989 with a current capacity of 60,000-bpsd and 150,000-bpsd, respectively. The other two refineries were built in 1978 in Warri and 1980 in Kaduna with current capacities of 125,000-bpsd and 110,000-bpsd, respectively [69, 71].

With the total demand of RPPs in Nigeria in the range of 600,000–700,000 barrels per day (bpd) [47], it is surprising that the local refineries only function at less than 20% of their combined installed capacity [39]. According to Iheukwumere et al. [24], for more than 2 decades, the low productivity of these refineries has gradually created a significant gap of about 500,000–600,000 bpd of RPPs in the country. This gap is currently being filled by imports from northwestern Europe, the United States, and the Middle East [54].

By comparison, the performance of NNPC refineries lags significantly behind even by the standards of the Organisation of Petroleum Exporting Countries (OPEC) [54]. For instance, the data obtained from NNPC Annual Statistical Bulletins from 2001 to 2019, illustrate the extent of this decrease over time. Figure 1 shows that the average combined capacity utilisation (percentage ratio of production to installed capacity) of the four NNPC refineries has been below 20% since 2013. The few spikes in the chart represent occasional periods of improved performance brought about by short-term technical interventions in some of the refineries [11].

This decline is quite untypical for other State-run refineries within OPEC member states, such as Kuwait, Saudi Arabia, Iran, and others, with better utilisation rates [51]. According to reports from Oil and Energy Trends [48], the average capacity utilisation for Middle East refineries in 2018 was 86.4%, which is more than the global average of 83.5%. This implies that NNPC’s average refinery utilisation rate is only about 24% of the global average.

In addition, Nigeria’s per capita local refining capacity is currently the least amongst OPEC countries, except for Equatorial Guinea, which currently has no refineries [51]. Data obtained from OPEC statistical bulletin for 2019 show that while countries in the Middle East lead with impressive per capita refining margins, Nigeria lags significantly behind with about 0.04 barrels of locally refined petroleum products (RPPs) for every 1000 persons. This is a sharp contrast from the figures for other African OPEC member States like Algeria and Libya with per capita refining capacity of 15 and 9 bpd, respectively, for every 1000 persons [51]. It is, therefore, no surprise that Nigeria’s imports of RPPs are far more than those of other OPEC member States.

Clearly, Nigeria’s standard falls far below industry expectations and demands urgent corrective action. Expectedly, this issue has received much attention from the Nigerian government and certain efforts have equally been made in the past to address these problems, albeit without much success [21, 26, 71]. Some of the efforts made include the occasional refurbishment of the refineries, the award of licences to the private sector for the construction of small-to-medium-scale modular refineries and the attempted sale or acquisition of the refineries by the private sector [4, 37]. The failure of these initiatives has been linked to several factors, mainly within the categories of political, economic, social, and technical (PEST) issues [47, 54, 71].

Using the findings from research, this study identified the relevant performance challenges of the refineries as indicated by Table 1.

The identified factors as shown in Table 1 were measured using a Likert-type questionnaire to obtain the professional opinions of experts who work in the four State-run refineries. The study was limited in scope to the effects of the PEST factors on how they affect the performance of the refineries. PEST is a recognised tool for the analysis of relevant issues affecting an organisation’s performance with regards to its business environment [30]. According to Yuksel [73], the PEST framework helps focus research questions around relevant feasible issues.

In context, political factors (P) imply the various forms of government interventions, applicable national legislations, expert regional projections, and outlook. It also includes identified political factors from published sources, which directly or indirectly impact on the refineries’ performance. Economic factors (E) involve the macroeconomic conditions, such as project costs and expectations, competing factors for government resources and their implications on the refineries’ performance. Social factors (S) include the various social, cultural, behavioural, and other demographic factors of the external environment which bear direct or indirect consequences on the refineries, while technical factors (T) refer to the various technologically related activities, infrastructures, training, skills, including gaps in local capacity, which present challenges to the refineries’ operations.

To understand the challenges of the NNPC refineries, it is necessary to present brief information about these assets, including their process units.

Port Harcourt Refining Company (PHRC I and II)

The Port Harcourt refinery comprises the old refinery (PHRC I) with 60,000-bpsd and the new refinery (PHRC II) with 150,000-bpsd. According to Turner [69], PHRC I was built by a consortium of Shell-BP and initially had a shared ownership structure of 50% government stake and 25% stake each for Shell and BP. However, the facility was acquired by the Nigerian government in an outright buyout in 1979 due to geopolitical reasons [47].

According to information from NNPC website, NNPC [41], the Port Harcourt refineries houses several process units across five process areas 1–5. Some of the key units include the Crude Distillation Unit (CDU), Vacuum Distillation Unit (VDU), Naphtha Hydrotreating Unit (NHU), the Catalytic Reforming Unit (CRU), the Kero Hydrotreating Unit (KHU), and the Fluid Catalytic Cracking Unit (FCCU).

The PHRC produces a wide range of refined petroleum products (RPPs), such as Premium Motor Spirit (PMS), Liquified Petroleum Gas (LPG), Automotive Gas Oil (AGO), Kerosene (aviation and domestic), Low Pour Fuel Oil (LPFO) and High Pour Fuel Oil (HPFO).

According to data from NNPC Annual Statistical Bulletins (ASB) (2001–2019), PHRC I has remained mostly inoperative for the past 10 years while PHRC II continues to run at low capacity. Unfortunately, since 2019, these facilities have been mostly under a shutdown for a maintenance pre-inspection [58].

Warri Refining and Petrochemical Company (WRPC)

The Warri refinery (WRPC) is the first Nigerian government wholly owned refinery [69]. Built in 1978 by the Italian Snamprogetti at a cost of US $478M, WRPC has a current installed capacity of 125,000-bpsd [71]. Chima et al. [13] note that WRPC was installed as a complex conversion plant to process LPG, PMS, kerosene, AGO and fuel oil. It also produces propylene pellets from propylene-rich feed as well as carbon black from fuel oil. The facility was set up to take crude oil from a blend of Escravos and Ughelli crudes [40].

According to Chima et al. [13], the main process units at the Warri refinery include the Crude Distillation Unit, Naphtha Hydrotreating Unit, Catalytic Reformer Unit, Kerosene Hydrotreating Unit, Vacuum Distillation Unit, and the Fluid Catalytic Cracker Unit.

Recently, WRPC has experienced significant production interruptions due to several challenges arising from attacks on its crude oil supply pipelines and constant breakdown due to technical difficulties [47, 71]. Consequently, the capacity utilisation of this plant has fluctuated currently to sub-20% levels over the last decade (NNPC ASB 2001–2019).

Kaduna Refining and Petrochemical Company (KRPC)

The Kaduna refinery (KRPC) was built in 1979 by the Japanese Chiyoda Engineering and Construction Company at a cost of US $575M [71]. The facility has a current installed capacity of 110,000-bpsd. The refinery comprises two plants—a Fuels plant of 60,000-bpsd and a Lubes plant of 50,000-bpsd capacity. The main process units at the KRPC include the Crude Distillation Unit (CDU), Vacuum Distillation Unit (VDU), Fluid Catalytic Cracking Unit (FCCU), Naphtha Hydrotreating Unit (NHU), Kerosene Hydrotreater, Catalytic Reforming, and Sulphur Recovery unit [42]. KRPC was designed to process Nigerian crudes at the Atmospheric and Crude Distillation Unit (CDU) of its Fuels plant and imported heavy crudes at its Lubes plant. The Fuels plant of the refinery processes LPG, PMS, kerosene, and fuel oil. On the other hand, the Lubes plant, was designed to process heavy imported crude from Kuwait, Venezuela, Saudi Arabia, and Russia. It also has a capacity to produce lube-based oils, asphalts, and waxes [42].

However, according to Reuters [58], KRPC has also been under a shutdown since 2019 for a maintenance pre-inspection.

Based on these characteristics, the complexity of NNPC refineries may be classified using Gary et al. [20] complexity table as shown in Table 2.

Table 2 shows that the PHRC I can be classified as a simple topping/hydro-skimming refinery, while WRPC, KRPC and PHRC II were built as complex refineries with catalytic cracking capabilities. None of the NNPC refineries can be classified as very complex facilities as none is equipped with coking capabilities.

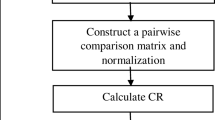

Experimental methods

This study was designed to identify the significant factors that lead to the performance challenges across all the state-owned refineries in Nigeria. Using the findings from literature and other relevant documents, the identified factors were categorised across political, economic, social, and technical (PEST) issues. The factors were first used to develop a pilot questionnaire to obtain the professional opinions of 25 senior staff members of the NNPC Group. The findings led to an improvement of the questionnaire, which was later deployed across the NNPC refineries (PHRC I and II (PHRC), WRPC and KRPC). The questionnaire targeted at least 200 personnel with a minimum of 3-year experience. This was to ensure that the survey respondents have a good grasp of knowledge about the challenges of the refineries. It is important to note that PHRC I and II are treated as a single unit (PHRC) given that the facilities are co-located and are managed as a single company by NNPC.

A five-point Likert-type questionnaire was designed to obtain the experts’ views of these professionals on which PEST factors have more significant impact on the performance of the refineries. Likert-type scale was used because they have been proven useful for evaluating interactive experiences of respondents to obtain quantified data regarding their attitudes, behaviours, and judgements [29, 32].

The questionnaire, which dealt on generic performance issues across the refineries, was deployed from 10 December 2018 to 30 June 2019 via an online platform using Google forms for ease of access. It was cascaded to members of the organisation using a purposive and snowballing sampling approach. This was to ensure that only the relevant experts, who are more familiar with the refinery issues were targeted [10].

Respondents were asked the following questions:

How would you rank the impact of political, economic, social, and technical factors on the performance of your refinery?

How would you rank the impact of the following sub-political factors on the refinery’s performance? [Govt interference, Funding issues, Political indecision, Government commitment/Political will, Managerial appointments].

How would you rank the impact of the following sub-economic factors on the refinery’s performance?

[Cost of spare parts, Subsidy issues, Operating capital, Exchange rates, Profit margins].

How would you rank the impact of the following sub-social factors on the refinery’s performance?

[Theft/attacks on pipelines, Illegal refining, Security issues, Compensations, Collusion and sabotage, Grievances and community disputes].

How would you rank the impact of the following sub-technical factors on the refinery’s performance?

[Maintenance issues, Ageing facilities, Facility design, Feedstock supply, Staff training, Staff competence]

The options for ranking these factors ranged from Least Impact representing 1 and Highest Impact representing 5 on the Likert scale. However, 118 respondents (59%) of the targeted sample size completed the questionnaire. Overall, these respondents were made up of engineers/technicians (70%), administrators (24%), and Managers (6%). In addition, 65 (55%) of the respondents have 3–9 years of experience, while 53 (45%) have 10 + years of experience on the job as shown in Table 3.

Further indications from Table 3 reveal that 58% of the respondents were from Port Harcourt refineries (PHRC), 23% from Kaduna refinery (KRPC) and the remaining 22% from Warri refinery (WRPC). Most of the respondents (54%) hold at least a BSc/HND degree, while 46% hold a master's degree.

Multivariate analysis of variance (MANOVA)

To ensure there was no variation in the responses of the participants because of their different years of experience on the job (3–9 years and 10 + years), a MANOVA test was carried out.

Also, to ensure the equality of variance across all the variables, a conservative alpha level of 0.01 was used for determining significance [65].

To check for any statistically significant difference across the responses of the age groups, the Wilk’s Lambda value is calculated [53] using Eq. (1), as shown:

where \(\Lambda\) is equal to Wilk’s lambda, and \(\Pi\) is the multiplication equivalent of sum, while \(1 + \lambda \iota\) is the proportion of variance in the dependent variable.

With the aid of the Statistical Package for the Social Sciences (SPSS) software, the Wilks’ Lambda value was found to be 0.965 with a corresponding significance level of 0.400 (which is above 0.01) as shown in Table 4.

The result from Table 4 shows that there is statistically no significant difference across the participants’ responses because of their different years of experience on the job [53, 65].

Cronbach alpha test

To certify the consistency and reliability of all the sub-category factors in the questionnaire, the Cronbach alpha was calculated using Eq. (2), as shown. This is because, according to Santos [62], Cronbach alpha is useful for determining the internal consistency or average correlation of items on a multi-point survey instrument to gauge its reliability.

where α equals to the Cronbach alpha, N is the number of items, Ĉ is the average inter-item covariance among the items and Ṽ equals the average variance [66]. Using the SPSS, the results for \(\alpha\) were determined as shown in Table 5.

Table 5 shows Cronbach alpha values of 0.808, 0.796, 0.903, and 0.874 for the political, economic, social, and technical factors, respectively. Having exceeded the minimum acceptable value of 0.7, it then implies that all the category factors meet the acceptable level of reliability [44, 62].

Participants’ opinions

This study adopted two approaches for measuring the significant factors of the PEST variables based on the participants’ opinions. The first approach was to determine the Respondents Mean Scores of Importance (RMSI), while the second was to calculate the Relative Significance Index (RSI) of the responses. These two approaches were considered necessary to improve the level of detail for the results of the findings [22].

Respondents Mean Scores of Importance (RMSI)

Boateng et al. [8] applied the RMSI to determine the significant socio-technical risks in the construction industry. RMSI can be calculated by a weighted quantitative scoring (WQS) method using the respondents’ higher scores on the Likert scale. In this study, the higher scores on the Likert scale for High Impact represented by 4 and Highest Impact represented by 5 were used to calculate the RMSI of the PEST variables as well as their sub-category variables.

Using Eq. (3), RMSI can be calculated as shown:

where \(Y_{i}\) is the participant’s score of importance for each category/sub-category factor on the Likert scale, and n is the highest degree of ranking for items on the Likert scale (n = 5, for a Five-Point Likert Scale).

Relative Significance Index (RSI)

The Relative Significance Index (RSI) is a useful statistical measure for determining the most important criteria from a set of variables based on the participants’ responses [7, 28, 59]. It is also an appropriate tool for prioritising indicators rated on a Likert-type scale [31]. According to Gündüz et al. (2013), the values for RSI lie in the range of 0 ≤ RSI ≤ 1 with the higher values, especially greater than 0.6, as the more significant index. In this study, RSI is applied to obtain the more significant factors amongst the PEST factors as well as their sub-factors. The formula for RSI is as shown in Eq. (4):

where µ the weighting given to each factor by the respondents, ranging from 1 to 5, A highest value weight, which is 5 in this case, and N total number of respondents, which is 118, and n5, n4, n3, n2 and n1 = highest impact, high impact, moderate impact, low impact and lowest impact, respectively.

Results

Following the responses from the questionnaire, the Respondents’ Mean Scores of Importance (RMSI) were computed as demonstrated in Table 6. For example, following the question on the questionnaire:

How would you rank the impact of the following PEST factors on the refinery’s performance?

The weighted responses from the participants across the refineries are as shown in Table 6.

The results from Table 6 were plotted as shown in Figs. 2, 3, 4, 5 and 6 to show the percentage weight of the levels of importance of the PEST factors and the sub-factors according to the participants’ opinions.

Figure 2 shows that across the refineries, the respondents scored political factors highest at above 80%. For economic factors, respondents from KRPC scored it 59.26%, those from PHRC scored it 56.52% while those from KRPC scored 63.64%. Social factors appeared to score less with 48.15% for KRPC, 56.52% for PHRC and 54.55% for WRPC. On the other hand, technical factors appeared to score high with 62.96% for KRPC, 60.87% for PHRC, and 72.73% for WRPC.

For the political factors, the same process was repeated with the results for the three refineries plotted as shown in Fig. 3.

Glancing at Fig. 3, reveals that the higher scoring sub-political factors across the refineries were Government interference with 66.67% for KRPC, 81.16% for PHRC and 77.27% for WRPC. Also, Funding issues with 62% (KRPC), 73% (PHRC) and 72% (WRPC). Similarly, Political indecision scored 70% for KRPC, 75% for PHRC and 72% for WRPC. This is followed by Government commitment with 51%, 59% and 54% at KRPC, PHRC and WRPC, respectively. Lastly, Managerial appointments scored 44% at KRPC, 49% at PHRC and 45% at WRPC.

For the economic factors, Fig. 4 represents the plot for the participants’ responses.

The plot for the sub-economic factors as shown in Fig. 4 reveals that Cost of spare parts scored high across the refineries with approximately 70%. Operating capital appeared to score high as well with PHRC leading with a score of 69% above KRPC and WRPC with 62% and 63%, respectively. Exchange rates appeared to score high as well with scores of 60%, 63.77% and 63.64% across KRPC, PHRC and WRPC, respectively. Profit margins also scored 55%, 47% and 54% for KRPC, PHRC and WRPC, respectively. While Subsidy issues scored 44% (KRPC), 42% (PHRC), and 45% (WRPC).

For the social factors, the plot for the respondents’ ranking on the refinery’s performance is as shown in Fig. 5.

Figure 5 shows that scores for Theft/attacks on pipelines, varied across the refineries with 66.67% at KRPC, 73.91% at PHRC and 81.82% at WRPC. Similarly, the scores for illegal refining were 14.81% at KRPC, 42.03% at PHRC and 45.45% at WRPC. Security issues scored 55.56% (KRPC), 66.67% (PHRC) and 68.18% at WRPC. Scores for Compensations were all below 20% across the refineries. Collusion and sabotage also ranked between 25% (KRPC) and 28% (PHRC) across the refineries. Grievances and community disputes also registered a varied score of 29% (KRPC), 52% PHRC and 54% (WRPC). Lastly, Stakeholder involvements registered a moderate score that fell between 25% at KRPC and 31% at PHRC.

For the technical factors, the rankings of the respondents are tabulated and plotted as shown in Fig. 6.

Figure 6 indicates that Maintenance issues scored 74% at KRPC, 71% at PHRC and 81.8% at WRPC. Ageing refinery plant scored between 70% (KRPC) to 73% (PHRC) across the refineries. For Limited plant capacity, the scores were 59% for both KRPC and WRPC, and 53% at PHRC. Feedstock supply registered a score of 81%, 72% and 81% for WRPC, PHRC and WRPC, respectively. Staff training scored between 51% (KRPC) to 63% (WRPC), while staff competence registered a score of 70% (KRPC), 65% (PHRC) and 72% (WRPC).

To provide an overall comparison of the relative significance of the entire sub-factors, the RSI is employed to calculate these values. First, we compute Table 7 for the main PEST factors as well as the sub-factors using the RSI formula shown in Eq. (4) (Sect. 2.4).

The result of the RSI for the PEST factors and sub-factors is as shown in Table 7.

Table 7 shows that while all the main PEST factors appear significant with values above 0.6, political factors scored 0.8864; technical, 0.7814; economic, 0.7136; and social, 0.6847.

Discussion and analysis

The overall results show that the refinery experts view political factors as the most significant factor leading to the performance challenges of the refineries. This is followed by the technical, economic, and social factors.

Political factors

All the political factors measured by this study appeared to have much significance to the refineries’ performance, except managerial appointments. The leading political factors appear to be government interference, funding issues and political indecision. Ogbuigwe [47] report that since the refineries lost control of their self-governing authorities in the early 1990s, they have struggled with funding issues for regular repairs and maintenance. This is further supported by Wapner [71], who suggests that there is a high level of government interference with its multilayer of administrative bureaucracy required to obtain funding approval for any major repairs/maintenance at the refineries. Essentially, interference from the government on the refineries usually delays decision-making processes and prolongs intervention time. The consequence of this is the eventual breakdown of the plants, which could otherwise be avoided. It is important to note that these factors appear to affect all the NNPC refineries significantly, given the nature of their central control by the government via the NNPC Group.

Unfortunately, the Petroleum Industry Bill (PIB) drafted by the Nigerian government more than a decade ago to address these lapses failed for 17 years to secure parliamentary approval [15, 34, 47, 49]. This provides evidence why Political indecision also ranks high on the significance scale. Although a re-worked version of a segment of the PIB is to be reconsidered by the Nigerian parliament, experts suggest many opportunities have already been lost because of this delay [34, 54]. According to projections from McKinsey [35], demand patterns for RPPs vary across regions. While Europe and North America are likely to continue on a decline of about 0.3% per annum in RPP demand up to the year 2035, demand for RPPs in developing regions like Africa, Asia and Latin America will likely continue to grow at about 2% per annum for the same period. These projections appear to be consistent with global developments around refinery projects across Middle East, Asia, and Africa [68]. For example, the ongoing construction of Dangote refinery in Nigeria, is expected to add about 650,000 bpd of capacity to the country by 2022 [54, 56].

To address political issues on the performance of Nigeria’s refineries, some studies have suggested privatisation as an outright solution for the NNPC refineries [1, 47]. However, this move has been previously opposed in 2007 by the Nigerian public and some civil society groups like the Nigerian Labour Congress, when the refineries had been put up for outright sale [55]. A review of this option is worth investigating, including suggestions to adopt the operating model of the Nigerian Liquefied Natural Gas (NLNG) Company in which the ownership of the assets would be shared by multi-nationals. As in September 2020, there were talks within the management of NNPC to give up a controlling stake of the refineries to private foreign and local investors [54]. This could be a viable alternative, especially when regulations on the Nigerian downstream market for fixed petroleum pump price is fully lifted. Although this initiative could further raise the prices of refined petroleum products in the country; however, it appears to be an appropriate way a private sector can profitably run the assets on a sustainable basis.

It should be noted, however, that contrary to common views that state-owned enterprises generally lack efficiency because of their bureaucratic nature, which informs their poor management and lack of coherent strategy [36]. More recent studies have, however, contended these views with the evidence that some state-owned enterprises have overcome some of these shortcomings and have rather emerged as global leaders in their business sector [14]. For example, state-owned Chinese refineries operated by Sinopec, PetroChina, CNOOC and SinoChem have continued to dominate most of the regional East Asian market and have continued to perform well above 80% utilisation rates (S&P Global 2020). In addition, Brazil’s Petrobras owns a 100,000-bpd refinery in Texas; 100,000 bpd refinery in Okinawa, Japan and another 30,000-bpd refinery in Bahia Blanca, Argentina. Saudi Aramco, on the other hand, owns about 1.2 mn distillation capacity through outright ownership or joint ventures in Japan, South Korea, and the United States. Kuwait Petroleum International (KPI) owns about 200,000 bpd refining capacity in Italy and Vietnam [48]. It is, therefore, not impossible for NNPC to also operate in the multinational arena by expanding its operations first to neighbouring West African countries where there is an additional 39 billion litres (245 million barrel) annual demand for RPPs [54]. To achieve this leap, however, a major restructure of NNPC Group incorporating partnerships with multinational organisations would be essential.

Technical factors

A glance of the chart for technical factors (Fig. 6) may reveal some of the sub-factors with more significance, except for their order. However, Table 7 indicates that the leading technical factors with significant performance challenges are ageing refinery plants, maintenance issues, feedstock (crude oil) supply and staff competence and training, while limited plant capacity appears the least. It is important to note that except for slight variations across the refineries (Fig. 6), these factors appear to mainly affect the refineries in much the same way. This observation is quite consistent with the views of Eti et al. [18], and Ogbuigwe [47] that ageing refinery equipment accompanied by a lack of regular maintenance leads to frequent breakdowns of the facilities. In addition, Akinola [1], Ambituuni et al. [2], and Ogbuigwe [47] note that difficulties in accessing crude oil supplies via pipelines constitute a major challenge for the refineries.

A robust maintenance culture across the entire organisation will be crucial to run the refineries effectively. Eti et al. [19] suggest that a condition-based maintenance (CBM) in which the plants receive the required intervention when failure is imminent, will be a more cost-effective approach to manage the refineries. For this to be effective, there must, however, be a scheduled approach for equipment monitoring and inspection on a regular basis. It may be worth re-engaging NNPC refineries with their original equipment manufacturers (OEMs) on a new contractual arrangement, such that their operations can be supported on an ongoing basis with their foreign manufacturers. The Nigerian Liquefied Natural Gas (NLNG) company have such arrangements in place, whereby their operations are continually technically supported by their OEMs. Some OEMs, such as GE and Rolls Royce, have advanced technologies that implement digital twins (remote electronic replica) of their onsite equipment that receive signals in real time, which help provide informed decisions on the mechanical conditions of operating equipment [16]. This arrangement has particularly helped NLNG to perform at optimum levels in meeting their business expectations. It would be beneficial for future contracts for building refineries in Nigeria to consider the incorporation of such arrangements over the useful life of the assets.

In addition, the training of refinery engineers and technicians can be upgraded from mere operational capabilities to target more expertise for troubleshooting, fault detection, and replacement/repairs of affected parts. The cooperation of the OEMs must, however, be required to facilitate this.

Economic factors

Using the plot for the economic factors (Fig. 4) alongside the RSI Table (Table 7), it can be observed that the most significant economic performance challenges are spare parts cost, operating capital, exchange rates and subsidy issues. While profit margins rank the least. Although NNPC does not normally publish their financial accounts in the public, fortunately, the organisation released its first audited account to the public in mid-2020 for the years 2018 and 2019. It is important to note that this was the first time the company released such documents in its 47 years of operations and was reportedly done to initiate transparency and accountability in its operations [38, 42]. The released accounts validate operating losses across the refineries. For example, the three refineries reported a combined operating loss of 170 billion naira (bn) (US $404.2 m) for the year 2018 and 147bn (US $439.47) for the year 2019 [58]. Specifically, PHRC made a loss of N45.5bn (US $119.5 M) in 2018 and N46.9bn (US $123 M) in 2019. The KRPC lost some N80.095bn (US $210 M) in 2018 and N51.3bn (US $134.5 M) in 2019, while WRPC recorded a loss of 44.43bn (US $117 M) in 2018 and 49.28bn (US $129.6) in 2019 [43, 52]. It is equally important to note that the naira to the dollar exchange rate at the time the documents were released in June 2020 was about 380 naira to a dollar. All these losses were accrued despite the refineries not producing up to 5% of their installed capacity. Particularly, KRPC did not record any production in 2018 and had a reported zero revenue for that year. The same situation was applicable to PHRC in 2019 with a reported zero revenue for the year [52]. Although not many inferences can be drawn with just a 2-year financial record; however, it is important to note that these refineries lost nearly a billion dollars in combined operating expenses in the 2 years from 2018 to 2019, which is quite significant.

For exchange rates, Wapner [71] and CBN (2020) report that the Nigerian naira fell more than 90% from 199 naira per dollar in 2015 to about 380 naira per dollar presently. Since NNPC buys its crude oil in dollars and sells the refined products in naira, it implies the company also incurs net losses due to currency fluctuations with time.

Subsidy issues and profit margins were observed to have scored a bit less. This may be because subsidy issues do not have much direct impact on the refineries performance but escalates as a result of the poor performance of the refineries. Although high figures for petroleum subsidies may compete with the refineries for government funds; however, clear government priorities targeted at increasing local production of RPPs will eliminate the need for such expenses.

Social factors

On social issues, the experts appear to consider attacks on pipelines, security issues and grievances and community disputes to be the most challenging factors. These factors are particularly important to the operations of the refineries given their design to be supplied crude oil through pipelines. As such, the findings appear to be consistent with a McKinsey report [35], that supply chain issues associated with NNPC pipeline breakdown accounted more for the shutdown and low-capacity utilisation of the refineries with 53% of the cases, while equipment failure accounted for 47%. This implies that security of product movements via the pipelines is as vital as routine maintenance checks to keep the refinery equipment fully functional.

However, the chart for social factors (Fig. 5), further reveals an important variation across the refineries for some of the sub-factors. Particularly, respondents from the two refineries located in Nigeria’s Niger Delta region (PHRC and WRPC) appear to consider the effects of pipeline attacks, illegal refining, security issues and grievances and community disputes as much more significant than respondents from KRPC. For instance, the issue of illegal refining appears to be more significant for WRPC and PHRC with 42% and 45%, respectively, as opposed to that for KRPC with only 14%. The same applies to Grievances and community disputes with 52% (PHRC) and 54% (WRPC) against 29% for KRPC. This may be because the incidents of pipeline attacks and its associated communal grievances, including illegal/artisanal refining occur mostly in the Niger Delta region [6, 9, 23, 71]. As such, these incidents are hardly observed for the Northern Kaduna refinery. The effect of these occurrences, however, is only felt at the KRPC through the inability to receive feedstock via pipelines due to breaches at the southern sections of the pipelines located within the Niger Delta.

The seriousness of pipeline disruptions to the refineries’ operations is buttressed by the statement of former NNPC Group Managing Director (GMD) that only 2.4% of the company’s pipeline breakdowns occurred due to rupture while the other 97.5% were as a result of vandalization by hoodlums [47].

Although, there have been calls to legalise the practice of illegal/artisanal refining in the Niger Delta and assist the local artisans to upgrade their refining operations to achieve an increased yield of RPPs in Nigeria [3, 70]. Unfortunately, this debate has been hard to win given other efforts the government is making with its support for private sectors to build small-to-medium scale modular refineries, which conform better to standard practice. It will be more beneficial, though, to engage these illegal/artisanal refiners in associated technology practices like welding, fabrication, and other technical skills useful to Nigeria’s oil and gas sector. Some of these initiatives have already been championed by Nigeria’s Petroleum Technology Development Fund (PTDF) and should be improved to benefit more Nigerian youths.

Security over pipelines can be stepped up with modern technology. Aside from the use of military checkpoints to monitor encroaching vandals. The use of CCTV cameras, drones and satellite technologies can also be deployed to defeat the hoodlums. Yaacoub and Salman [72] report that drones have been proven effective as a faster and cheaper means of responding to crimes. More importantly, the effective enforcement of laws to investigate and punish offenders when caught in such practices will be crucial to stemming the tide. Though the suggested technologies may be more expensive, the savings accruing from plugging the losses from oil pipelines in Nigeria will justify their cost over time.

The issue of compensations may have ranked low since the refineries have hardly suffered from any forms of compensation payments in Nigeria because of their operations. The only recent rumour of such compensation claims seemed to have stemmed from a leader in the Alesa-Eleme community and was eventually proven to be false by officials [67].

Conclusion

This study identified the significant factors leading to performance challenges across state-owned refineries in Nigeria. Using a framework of Political, Economic, Social and Technical (PEST) factors, the challenging factors identified from the literature were categorised and measured via a Likert-type questionnaire. The result indicates that, although, the effects of all the PEST factors were considered important to the refineries’ performance; however, political, technical, and economic factors, were viewed as more significant than the social factors.

Overall, the emergent significant factors from the study include government interference, funding issues, political indecision, theft and pipeline attacks, cost of spare parts, maintenance issues, operating capital, feedstock supply, staff training and competence issues.

Considering these results, it will, therefore, be rational to make the following recommendations:

-

A structural change in the ownership and control of the refineries would be required to drive positive change. A transition from total government control to a private sector-led partnership arrangement between the government and industry would be essential to infuse the necessary technical, financial, and managerial capabilities required to overcome unnecessary bureaucratic barriers. Essentially, this will promote faster decision-making and financial independence to effectively manage the refineries.

-

The complete removal of regulations on the downstream petroleum market in Nigeria would be necessary to attract the interest of the private sector for any partnership arrangements.

-

Consideration should be given for re-engaging the refineries with their original equipment manufacturers (OEMs) for an ongoing technical assistance.

-

The interest of oil thieves and illegal/artisanal refiners can be re-channelled towards more productive endeavours that will benefit the industry. This can be achieved through improved training programmes (both local and international) that will encourage the development of relevant skills to the oil and gas sector, such as welding, fabrication and other technical crafts, that will enable more youths to gain meaningful employment in the industry.

-

Aside from the use of military checkpoints to checkmate the activities of unrepentant vandals, the use of technology, such as drones, CCTV, and other internet of things (IoT) devices, can be deployed to beat the hoodlums. The savings accruing from plugging additional oil losses due to pipeline damage would justify the cost of such technology deployment.

This study contributes to the academic discourse towards achieving efficiency in the management and operations of NNPC refineries. The findings of this study alongside its recommendations will benefit policy-makers while seeking to address the challenges of the refineries.

References

Akinola AO (2018) Oil subsidy administration in Nigeria In Globalization, democracy and oil sector reform in Nigeria African histories and modernities. Palgrave Macmillan, Cham

Ambituuni A et al (2014) Analysis of safety and environmental regulations for downstream petroleum industry operations in Nigeria: problems and prospects. Environ Dev 9:43–60

Angela M, Emeka O, Kevin I, Oluwasanmi O, Francis E, Olayemi O (2019) Challenges and prospects of converting Nigeria illegal refineries to modular refineries. Open Chem Eng J 13(1)

Atumah S (2017) Nigeria’s oil refineries in Oblivion. The Vanguard Newspapers. Accessed July 2018

Bazilian M, Onyeji I (2012) Fossil fuel subsidy removal and inadequate public power supply: implications for businesses. Energy Policy 45:1–5

BBC (2012) Rare look at an illegal oil refinery. https://www.bbc.co.uk/news/av/world-africa-19082609. Accessed Feb 2021

Bing MN (1999) Hypercompetitiveness in academia: achieving criterion-related validity from item context specificity. J Pers Assess 73:80–99

Boateng P, Chen Z, Ogunlana SO (2015) An analytical network process model for risks prioritisation in megaprojects. Int J Proj Manag 33(8):1795–1811

Boris OH (2015) The upsurge of oil theft and illegal bunkering in the Niger Delta region of Nigeria: is there a way out? Mediterr J Soc Sci 6(3 S2):563

Bryman A (2016) Social research methods. Oxford University Press

Busch G (2007) How Emeka Offor ruined the National Refineries. An interview with Sahara reporters. http://saharareporters.com/2007/06/20/how-emeka-offor-ruined-national-refineries-dr-gary-k-busch. Accessed Jan 2019

Chikwem FC (2016) The political economy of fuel importation probes and development of refineries in Nigeria. Insight Afr 8(1):18–39

Chima RI, Owioduokit EA, Ogoh R (2002) Technology transfer and acquisition in the oil sector and government policy in Nigeria. African Technology Policy Studies, Nairobi

Cuervo-Cazurra A, Inkpen A, Musacchio A, Ramaswamy K (2014) Governments as owners: state-owned multinational companies. Springer, New York

De Montclos M (2014) The politics and crisis of the petroleum industry bill in Nigeria. J Mod Afr Stud 52(3):403–424

El Saddik A (2018) Digital twins: the convergence of multimedia technologies. IEEE Multimed 25(2):87–92

Eti MC, Ogaji SOT, Probert SD (2004) Implementing total productive maintenance in Nigerian manufacturing industries. Appl Energy 79(4):385–401

Eti MC, Ogaji SOT, Probert SD (2006) Development and implementation of preventive-maintenance practices in Nigerian industries. Appl Energy 83(10):1163–1179

Eti MC, Ogaji SOT, Probert SD (2006) Reducing the cost of preventive maintenance (PM) through adopting a proactive reliability-focused culture. Appl Energy 83(11):1235–1248

Gary JH, Handwerk GE, Kaiser MJ (2007) Petroleum refining: technology and economics. CRC Press

Gillies A (2009) Reforming corruption out of Nigerian oil? Part one: Mapping corruption risks in oil sector governance. CHR Michelsen Institute. Norway. Retrieved from: https://www.cmi.no/publications/3295-reforming-corruption-out-of-nigerian-oil-part-one. Accessed Sept 2020

Harris-Kojetin BA et al (2017) Statistical methods for combining multiple data sources. In Federal statistics, multiple data sources, and privacy protection: next steps. National Academies Press, Washington, DC

Ibeanu O (2000) Oiling the friction: environmental conflict management in the Niger Delta, Nigeria. Environ Change Secur Proj Rep 6(6):19–32

Iheukwumere OE, Moore D, Omotayo T (2020) Investigating the challenges of refinery construction in Nigeria: a snapshot across two-timeframes over the past 55 years. Int J Constr Supply Chain Manag 10(1):46–72

Ikelegbe A (2005) The economy of conflict in the oil rich Niger Delta region of Nigeria. Nord J Afr Stud 14(2):208–234

Iwayemi A (2008) Nigeria’s dual energy problems: policy issues and challenges. In: Proceedings of the 31st international conference of the international association for international association for energy economics, vol 53, pp 17–21

Izere I (2010) “2010 Oil Blocs Sale: another impending fraud?” [Online]. http://www.ngex.com/news/public/article.php?ArticleID=1644#. Accessed 12 May 2011

James LR (1998) Measurement of personality via conditional reasoning. Organ Res Methods 1:131–163

Jamieson S (2004) Likert scales: how to (ab) use them. Med Educ 38(12):1217–1218

Johnson G, Scholes K, Whittington R (2009) Fundamentals of strategy. Prentice Hall, Harlow

Johnson JW, Lebreton JM (2004) History and use of relative importance indices in organizational research. Organ Res Methods 7:238–257. https://doi.org/10.1177/1094428104266510

Kaptein MC, Nass C, Markopoulos P (2010) Powerful and consistent analysis of Likert-type rating scales. In: Proceedings of the SIGCHI conference on human factors in computing systems, pp 2391–2394. ACM

Kennedy-Darling J, Hoyt N, Murao K, Ross A (2008) The energy crisis of Nigeria: an overview and implications for the future. The University of Chicago, Chicago, pp 775–784

KPMG (2017) The Petroleum Industry Governance Bill. [Online]. https://assets.kpmg/content/dam/kpmg/ng/pdf/tax/ng-kpmg-newsletter-on-the-petroleum-industry-governance-bill.pdf. Accessed Sept 2020

McKinsey and Company (2019) Global refining: profiting in a downstream downturn. [Online]. https://www.mckinsey.com/~/media/McKinsey/Industries/Oil%20and%20Gas/Our%20Insights/Global%20refining%20Profiting%20in%20a%20downstream%20downturn/Global-refining-Profiting-in-a-downstream-downturn-vF.pdf?shouldIndex=false. Accessed Nov 2020

Megginson WL, Netter JM (2001) From state to market: a survey of empirical studies on privatization. J Econ Lit 39(2):321–389

Nkaginieme U (2005) The challenges of building a new refinery in Nigeria with limited energy infrastructure and regulated petroleum products market. In: 18th World Petroleum Congress

NNPC (2021b) NNPC Releases 2019 Audited Financial Statement, Reduces Loss by 99.7%. https://nnpcgroup.com/News-and-Media/newsupdate/Pages/NNPC%20Releases%202019%20Audited%20Financial%20Statement.aspx#:~:text=Barely%20five%20months%20after%20publishing,%E2%82%A61.7bn%20in%202019. Accessed Feb 2021

NNPC ASB (2018) Annual Statistical Bulletin. [Online]. https://www.nnpcgroup.com/NNPCDocuments/Annual%20Statistics%20Bulletin%E2%80%8B/ASB%202018%201st%20Edition.pdf. Accessed Dec 2019

NNPC (2018) Warri refining and petrochemical company, limited. A subsidiary of Nigerian National Petroleum Corporation. [Online]. http://wrpcnnpcng.com/about2.htm. Accessed July 2018

NNPC (2019) Port Harcourt Refining Company (PHRC). https://nnpcgroup.com/Refining/Pages/PHRC.aspx. Accessed June 2020

NNPC (2019b) Kaduna Refining and Petrochemical Company (KRPC). [Online]. https://nnpcgroup.com/Refining/Pages/KRPC.aspx Accesses Dec 2019

NNPC (2021) Audited Financial Statements 2019. https://nnpcgroup.com/Pages/afs.aspx . Accessed Mar 2021

Nunnaly J (1978) Psychometric theory. McGraw-Hill, New York

Obi CI (2010) Oil extraction, dispossession, resistance, and conflict in Nigeria’s oil-rich Niger Delta. Can J Dev Stud Revue canadienne d’études du development 30(1–2):219–236

Odularu GO (2008) Crude oil and the Nigerian economic performance. Oil Gas Business. Retrieved from: http://ogbus.ru/files/ogbus/eng/authors/Odularo/Odularo_1.pdf. Accessed Mar 2020

Ogbuigwe A (2018) Refining in Nigeria, history, challenges and prospects. Appl Petrochem Res 8(4):181–192

Oil and Energy Trends (2019) Middle East oil producers move downstream. Wiley 44:4–7. https://doi.org/10.1111/oet.12634

Okoye A (2012) Novel linkages for development: corporate social responsibility, law and governance: exploring the Nigerian Petroleum Industry Bill. Corp Gov 12(4):460–547

Onuoha FC (2008) Oil pipeline sabotage in Nigeria: dimensions, actors and implications for national security. Afr Secur Stud 17(3):99–115

OPEC ASB (2019) OPEC Annual Statistical Bulletin 2019. https://www.opec.org/opec_web/en/publications/5360.htm. Accessed June 2020

Osae-Brown A, Alake T (2020) Nigeria’s State-Owned Oil Corp. Publishes Audited Accounts. https://www.bloomberg.com/news/articles/2020-06-14/nigeria-s-state-owned-oil-company-makes-audited-accounts-public. Accessed Mar 2021

Pallant J (2016) SPSS survival manual: A step by step guide to data analysis using IBM SPSS. Routledge.

PWC (2017) Nigeria’s refining revolution. PWC Nigeria. Insights and Publications. [Online]. https://www.pwc.com/ng/en/publications/nigeriasrefiningrevolution.html. Accessed Feb 2018

Reuters (2007) Obasanjo ally buys second Nigerian oil refinery. Retrieved from: https://uk.reuters.com/article/nigeria-refinery/obasanjo-ally-buys-second-nigerian-oil-refinery-idUKL2854224220070528. Accessed Nov 2020

Reuters (2017) UPDATE 2-Nigeria’s 650,000 bpd Dangote refinery seen onstream by end 2019. https://uk.reuters.com/article/africa-oil-nigeria/update-2-nigerias-650000-bpd-dangote-refinery-seen-onstream-by-end-2019-idUSL8N1MZ478

Reuters (2020) UPDATE 1-Nigeria in talks to give up majority stakes in refineries, NNPC chief says. [Online]. https://uk.reuters.com/article/nigeria-oil/update-1-nigeria-in-talks-to-give-up-majority-stakes-in-refineries-nnpc-chief-says-idUSL8N2G65WU. Accessed Oct 2020

Reuters (2021) Nigeria’s NNPC Seeking $1 Billion to Revamp Port Harcourt Refinery. https://inspectioneering.com/news/2021-01-07/9484/nigerias-nnpc-seeking-1-billion-to-revamp-port-harcourt-refinery. Accessed Feb 2021

Rooshdi RRRM et al (2018) Relative importance index of sustainable design and construction activities criteria for green highway. Chem Eng Trans 63:151–156

Sancino A, Sicilia M, Grossi G (2018) Between patronage and good governance: organizational arrangements in (local) public appointment processes. Int Rev Adm Sci 84(4):785–802

Sanni I (2014) The implications of price changes on petroleum products distribution in Gwagwalada Abuja, Nigeria. J Energy Technol Policy 4(7). https://www.iiste.org(ISSN 2224-3232 (Paper) ISSN 2225-0573)

Santos JRA (1999) Cronbach’s alpha: a tool for assessing the reliability of scales. J Ext 37(2):1–5

Sayne A, Gillies A, Katsouris C (2015) Inside NNPC oil sales: a case for reform in Nigeria. Natural Resource Governance Institute

Siddig K, Aguiar A, Grethe H, Minor P, Walmsley T (2014) Impacts of removing fuel import subsidies in Nigeria on poverty. Energy Policy 69:165–178

Tabachnick BG, Fidell LS (2013) Using multivariate statistics, 6th edn. Pearson Education, Boston

Tavakol M, Dennick R (2011) Making sense of Cronbach’s alpha. Int J Med Educ 2:53

The Guardian (2018) ‘NNPC not owing Rivers community N36 billion compensation’. [Online]. https://guardian.ng/news/nnpc-not-owing-rivers-community-n36-billion-compensation/. Accessed Sept 2020

Turner E (2020) Refinery news roundup: refineries back online in Middle East. https://www.spglobal.com/platts/en/market-insights/latest-news/oil/120720-refinery-news-roundup-refineries-back-online-in-middle-east. Accessed Mar 2021

Turner T (1977) Two refineries: a comparative study of technology transfer to the Nigerian refining industry. World Dev 5(3):235–256

Umukoro N (2018) Homegrown solution to African problem: harnessing innovation for petroleum refining in Nigeria. Strat Plan Energy Environ 37(4):58–73

Wapner A (2017) Downstream beneficiation case study: Nigeria. CCSI Policy Paper

Yaacoub J, Noura H, Salman O, Chehab A (2020) Security analysis of drones systems: Attacks, limitations, and recommendations. Internet Things 11:100218. https://doi.org/10.1016/j.iot.2020.100218

Yüksel I (2012) Developing a multi-criteria decision-making model for PESTEL analysis. Int J Bus Manag 7(24):52

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest for this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Iheukwumere, O., Moore, D. & Omotayo, T. A meta-analysis of multi-factors leading to performance challenges across Nigeria’s state-owned refineries. Appl Petrochem Res 11, 183–197 (2021). https://doi.org/10.1007/s13203-021-00272-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13203-021-00272-0