Abstract

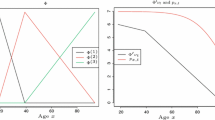

Persistency has always been the area of grave concern over the decades in insurance sector. To model the same one would initially make utilization of regression approach but that could not serve the purpose of identifying the risk factors and time trends which affect persistency. For this purpose, one should make use of survival models which account for censored data. But there are still certain concerns utilizing conventional survival models. One of which is left truncation of insurance data. Another concern is the large portfolios and absolute numbers involved in insurance sector. Thus, conventional survival models could not be adjusted for convergence when applied to such large portfolios and absolute numbers like amount of Sum Assured (SA), therefore, justifying the application of actuarial laws to model the problem. Objective of this paper is to make a comparative study between survival models and actuarial models to model persistency, so that the validity and robustness of the actuarial models may be established in case of analyzing the insurance phenomenon. Models which seem to be the best fitted models have been checked diagnostically for validity also. For this purpose, the plots of standardized residuals have been studied for randomness. To deal with dynamic structure of insurance data, stratifications have been used as per different criteria given by Insurance Regulatory and Development Authority of India (IRDAI) also. AIC values under each stratum have been weighted and then averaged to arrive at single value underneath each specification. It is found that actuarial models are robust in all cases and valid too. In fact, the choice of best fitted actuarial model has not been changed from case to case. Throughout our study only Gompertz curve fitted well to the data and is also found to be valid. The nature of relationships of Age and SA with persistency is found to be positive.

Similar content being viewed by others

References

Avraam D (2015) Modelling mortality dynamics in heterogeneous human populations. Thesis submitted in accordance with the requirements of the University of Liverpool for the degree of Doctor in Philosophy

Etzioni RD et al (1998) On the use of survival analysis techniques to estimate medical care costs. Journal of Health Economics 18(3):365–380

Gavrilova NS, Gavrilov LA (2011) Mortality laws and mortality forecasts for aging populations, enter on aging. NORC at the University of Chicago, Boston

Henderson AJ (1968) Actuarial methods for estimating mortality parameters of industrial property. IOWA State University, Ames

Kalaivani D, Sumathi P (2019) Factor based prediction model for customer behavior analysis. Int J Syst Assur Eng Manag 10:519–524. https://doi.org/10.1007/s13198-018-0739-4

Padmavathi V (2013) The lapsation of life insurance policies in india: causes and costs. http://www.cii.co.uk/knowledge/life-pensions/articles/the-lapsation-of-life-assurancepolicies-in-india-causes-and-costs/25229. Accessed 24 Apr 2015

Perez Marin AM (2005) Survival methods for the analysis of customer lifetime duration in insurance

Ravi V, Saini R, Varshney MK, Grover G (2019) Actuarial models v/s survival models for modelling the persistency in life insurance. Compliance Eng J 10(8):341–351

Richards SJ (2012) A handbook of parametric survival models for actuarial use. Scand Actuar J 4:233–257

Richards SJ, Kaufhold K, Rosenbusch S (2013) Creating portfolio-specific mortality tables: a case study. Eur Actuar J. https://doi.org/10.1007/s13385-013-0076-6

Richmond P, Roehner BM (2015) Predictive implications of Gompertz’s law. Physica A Stat Mech Appl 447:446–454

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ravi, V., Saini, R., Varshney, M.K. et al. Modelling of survival time of life insurance policies in India: a comparative study. Int J Syst Assur Eng Manag 12, 164–175 (2021). https://doi.org/10.1007/s13198-020-01026-2

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-020-01026-2