Abstract

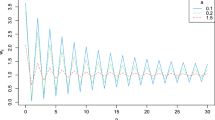

The purpose of this study is to characterize multivariate generalized hyperbolic (MGH) distributions and their conditionals by considering the MGH as a subclass of the mean-variance mixing of the multivariate normal law. The essential contribution here lies in expressing MGH densities by utilizing various integral representations of the Bessel function. Moreover, in a more convenient form these modified density representations are more advantageous for deriving limiting results. The forms are also convenient for studying the transient as well as tail behavior of MGH distributions. The results include the normal distribution as a limiting form for the MGH distribution. To support the MGH model an empirical study is conducted to demonstrate the applicability of the MGH distribution for modeling not only high frequency data but also for modeling low frequency data. This is against the currently prevailing notion that the MGH model is relevant for modeling only high frequency data.

Similar content being viewed by others

References

Abramowitz, M. and Stegun, I.A. (1968). Handbook of Mathematical Functions (5th Ed.) Dover, New York.

Adcock, C.J. (2010). Asset pricing and portfolio selection based on the multivariate extended skew-Student-t distribution. Ann. Oper. Res. 176, 1, 221–234.

Affeck-Graves, J. and McDonald, B. (1989). Nonnormalities and tests of asset pricing theories. J. Finance 44, 4, 889–908.

Barndorff-Nielsen, O.E. (1977). Exponentially decreasing distributions for the logarithm of particle size. Proc. Roy. Soc. Lond. Ser. A 353, 401–419.

Barndorff-Nielsen, O.E. (1978). Hyperbolic distributions and distributions of hyperbolae. Scand. J. Statist. 5, 151–157.

Barndorff-Nielsen, O.E. (1979). Models for non-Gaussian variation, with applications to turbulence. Proc. Roy. Soc. Lond. Ser. A 368, 501–520.

Barndorff-Nielsen, O. and Blaesild, P. (1981). Hyperbolic distributions and ramifications: contributions to theory and application, 4. D. Reidel, Dordrecht, Taillie, C. et al. (eds.), p. 19–44.

Breymann, W. and Lüthi, D (2013). Ghyp: A package on generalized hyperbolic distributions. Available at https://cran.r-project.org/web/packages/ghyp/ghyp.pdf.

Browne, R.P. and McNicholas, P.D. (2015). A mixture of generalized hyperbolic distributions. Canadian J. Stat. 43, 176–198.

Eberlein, E. (2001). Application of generalized hyperbolic Lévy motions to finance. Birkhäuser, Boston. In Lévy Processes: Theory and Applications, Barndorff-Nielsen, O. E., Mikosch, T. and Resnick, S. (eds.), p. 319–336.

Eberlein, E. and Keller, U. (1995). Hyperbolic distributions in finance. Bernoulli1, 281–299.

Eberlein, E. and Prause, K. (2002). The generalized hyperbolic model: Financial derivatives and risk measures. Springer, Berlin. In Mathematical Finance-Bachelier Congress 2000, Geman, H., Madan, D., Pliska, S. and Vorst, T. (eds.), p. 245–267.

Eberlein, E., Keller, U. and Prause, K. (1998). New insights into smile, mispricing, and value at risk: The hyperbolic model. J. Business 71, 371–405.

Fotopoulos, S.B. (2017). Symmetric Gaussian mixture distributions with GGC scales. J. Mult. Anal. 160, 185–194.

Fotopoulos, S.B., Jandhyala, V.K. and Luo, Y. (2015a). Subordinated Brownian motion: Last time the process reaches its supremum. Sankhya Ser. A 77, 46–64.

Fotopoulos, S.B., Jandhyala, V.K. and Wang, J. (2015b). On the joint distribution of the supremum functional and its last occurrence for subordinated linear Brownian motion. Statist. Prob. Lett. 106, 149–156.

Fotopoulos, S.B., Paparas, A. and Jandhyala, V.K. (2019). Multivariate generalized hyperbolic laws for modeling financial log-returns – empirical and theoretical considerations. J. App. M. Bus. Indus. (invited article: revised version under review).

Gradshteyn, I.S. and Ryzhik, I.M. (2000). Table of Integrals, Series, and Products, 6th Ed. Academic Press, San Diego.

Hammerstein, P. (2010). Generalized hyperbolic distributions: Theory and applications to CDO pricing. Ph.D. Thesis, Albert-Ludwigs-Universität Freiburg im Breisgau.

Korolev, V. Yu (2014). Generalized hyperbolic laws as limit distributions for random sums. Theor. Prob. Appl. 58, 63–75.

Korolev, V.Yu. and Zeifman, A.I. (2016). On normal variance-mean mixtures as limit laws for statistics with random sample sizes. J. Stat. Plan. Inf. 169, 34–42.

Korolev, V.Yu., Chertok, A.V., Korchagin, A.Yu., Kossova, E.V. and Zeifman, A.I. (2016). A note on functional limit theorems for compound Cox processes. J. Math. Sci. 218, 182–194.

Luciano, E. and Schoutens, W. (2006). A multivariate jump-driven financial asset model. Quant. Finance 6, 5, 385–402.

Madan, D.B. and Seneta, E. (1990). The variance gamma (V.G.) model for share market returns. J. Business 63, 511–524.

McAssey, M P (2013). An empirical goodness-of-fit test for multivariate distributions. J. App. Stat. 40, 5, 1120–1131.

McNeil, A., Frey, R. and Embrechts, P. (2005). Quantitative Risk Management. Princeton University Press, Princeton.

Olbricht, W. (1991). On mergers of distributions and distributions with exponential tails. Comp. Stat. Data Anal. 12, 315–326.

Prause, K. (1999). The generalized hyperbolic model: Estimation, financial derivatives, and risk measures. Ph.D. thesis, University of Freiburg.

Richardson, M. and Smith, T. (1993). A test for multivariate normality in stock returns. J. Business 66, 2, 295–321.

Semeraro, P. (2008). A multivariate variance gamma model for financial applications. Int. J. Theor. Appl. Finance 11, 1, 1–18.

Wei, Y., Tang, Y. and McNicholas, P.D. (2018). Mixtures of generalized hyperbolic distributions and mixtures of skew-t distributions for model-based clustering with incomplete data. arXiv:1703.02177v5.

Yu, Y. (2017). On normal variance-mean mixtures. Stat. Prob. Lett. 121, 45–50.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Fotopoulos, S.B., Jandhyala, V.K. & Paparas, A. Some Properties of the Multivariate Generalized Hyperbolic Laws. Sankhya A 83, 187–205 (2021). https://doi.org/10.1007/s13171-019-00173-4

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13171-019-00173-4

Keywords and phrases

- Scale mixture of multivariate distributions

- Generalized inverse Gaussian distributions

- Non Gaussian

- Conditional laws.