Abstract

In this paper, we investigate a fully nonlinear evolutionary Hamilton–Jacobi–Bellman (HJB) parabolic equation utilizing the monotone operator technique. We consider the HJB equation arising from portfolio optimization selection, where the goal is to maximize the conditional expected value of the terminal utility of the portfolio. The fully nonlinear HJB equation is transformed into a quasilinear parabolic equation using the so-called Riccati transformation method. The transformed parabolic equation can be viewed as the porous media type of equation with source term. Under some assumptions, we obtain that the diffusion function to the quasilinear parabolic equation is globally Lipschitz continuous, which is a crucial requirement for solving the Cauchy problem. We employ Banach’s fixed point theorem to obtain the existence and uniqueness of a solution to the general form of the transformed parabolic equation in a suitable Sobolev space in an abstract setting. Some financial applications of the proposed result are presented in one-dimensional space.

Similar content being viewed by others

References

Abe, R., Ishimura, N.: Existence of solutions for the nonlinear partial differential equation arising in the optimal investment problem. Proc. Japan Acad., Ser. A 84(1), 11–14 (2008)

Bertsekas, D.P.: Dynamic programming and stochastic control. Academic Press, New York (1976)

Deelstra, G., Diallo, I., Vanmaele, M.: Bounds for Asian basket options. J. Comput. Appl. Math. 218, 215–228 (2008)

Federico, S., Gassiat, P., Gozzi, F.: Utility maximization with current utility on the wealth: regularity of solutions to the HJB equation. Finance Stoch 19, 415–448 (2015)

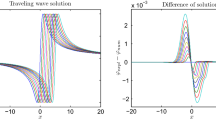

Ishimura, N., Ševčovič, D.: On traveling wave solutions to a Hamilton–Jacobi–Bellman equation with inequality constraints. Japan J. Ind. Appl. Math. 30(1), 51–67 (2013)

Kilianová, S., Ševčovič, D.: A transformation method for solving the hamilton-jacobi-bellman equation for a constrained dynamic stochastic optimal allocation problem. ANZIAM J. 55, 14–38 (2013)

Kilianová, S., Ševčovič, D.: Expected utility maximization and conditional value-at-risk deviation-based sharpe ratio in dynamic stochastic portfolio optimization. Kybernetika 54(6), 1167–1183 (2018)

Kilianová, S., Ševčovič, D.: Dynamic intertemporal utility optimization by means of Riccati transformation of Hamilton-Jacobi Bellman equation. Jpn. J. Ind. Appl. Math. 36(2), 497–517 (2019)

Kilianová, S., Melicherčík, I., Ševčovič, D.: Dynamic accumulation model for the second pillar of the slovak pension system. Finance a uver - Czech J. Econ. Fin. 56(11–12), 506–521 (2006)

Kilianová, S., Trnovská, M.: Robust portfolio optimization via solution to the Hamilton–Jacobi–Bellman equation. Int. J. Comput. Math. 93, 725–734 (2016)

Klatte, D.: On the Lipschitz behavior of optimal solutions in parametric problems of quadratic optimization and linear complementarity. Optimization 16(6), 819–831 (1985)

Macová, Z., Ševčovič, D.: Weakly nonlinear analysis of the Hamilton–Jacobi–Bellman equation arising from pension savings management. Int. J. Numer. Anal. Model. 7(4), 619–638 (2010)

Meyer, J.C., Needham, D.J.: Extended weak maximum principles for parabolic partial differential inequalities on unbounded domains. Proc. R. Soc. Lond. Ser. A Math. Phys. Eng. Sci. 470, 20140079 (2014)

Milgrom, P., Segal, I.: Envelope theorems for arbitrary choice sets. Econometrica 70(2), 583–601 (2002)

Post, T., Fang, Y., Kopa, M.: Linear tests for DARA stochastic dominance. Manage. Sci. 61, 1615–1629 (2015)

Protter, M.H., Weinberger, H.F.: Maximum principles in differential equations. Springer Science & Business Media, Berlin (2012)

Vickson, R.G.: Stochastic dominance for decreasing absolute risk aversion. J. Finan. Quant. Anal. 10, 799–811 (1975)

Showalter, R.E.: Monotone operators in Banach space and nonlinear partial differential equations. American Mathematical Soc.49, (2013)

Barbu, V.: Nonlinear differential equations of monotone types in Banach spaces. Springer Science & Business Media, Berlin (2010)

Wu, et al.: Blow-up of solutions for a semilieanr parabolic equation involving variable source and positive initial energy. Appl. Math. Lett. 26(5), 539–543 (2013)

Pao, C.V., Ruan, W.H.: Positive solutions of quasilieanr parabolic systems with Dirichlet boundary condition. J. Diff. Eq. 248(5), 1175–1211 (2010)

Acknowledgements

The authors were supported by VEGA 1/0062/18 (DŠ) and DAAD-MS MATTHIAS-2020 (CU) grants.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Udeani, C.I., Ševčovič, D. Application of maximal monotone operator method for solving Hamilton–Jacobi–Bellman equation arising from optimal portfolio selection problem. Japan J. Indust. Appl. Math. 38, 693–713 (2021). https://doi.org/10.1007/s13160-021-00468-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13160-021-00468-w

Keywords

- Hamilton–Jacobi–Bellman equation

- Riccati transformation

- Maximal monotone operator

- Dynamic stochastic portfolio optimization