Abstract

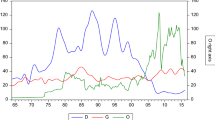

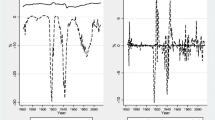

Based on the fiscal and economic data of the United States from 1962 to 2022, this paper first studies and analyzes the long-term equilibrium relationship and short-term fluctuation relationship among the three variables of the U.S. federal government debt, the federal government fiscal surplus (deficit), and the U.S. economic growth through the vector error correction model (VECM), then it makes a judgment of the historical performance of the federal government’s fiscal sustainability by using the financial sustainability conditions that derived from present value budget constraints, and at last, it infers the medium- and long-term sustainability of federal debt in the future through the trend forecast of federal government’s debt-to-GDP ratio under the different relative interest rate levels of the federal debt. The results indicate that, based on historical data, the fiscal sustainability of the federal government has shown positive performance. In the short term, federal finances remain sustainable, but the medium- to long-term sustainability would depend on the relative interest rate levels of the future federal government debt. However, considering the current environmental factors comprehensively, the medium- to long-term fiscal situation of the United States appears less optimistic. The subpar performance of fiscal discipline by the federal government and the political governance dysfunction caused by partisan conflicts makes it increasingly difficult to effectively control fiscal deficits. The debt financing model of “borrowing new debt to repay the old” is unsustainable in the long run. The United States is clearly entering a rising interest rate cycle, and the likelihood of continued increase in relative interest rates for U.S. Treasury bonds is higher. This raises concerns about the future medium- to long-term sustainability of U.S. Treasury bonds.

Similar content being viewed by others

Data Availability

Not applicable.

References

Akan, T., Hepsag, A., & Bozoklu, S. (2022). Explaining U.S. economic growth performance by macroeconomic governance, 1952–2018. Journal of Evolutionary Economics, 32, 1437–1465.

Aldama, P., & Creel, J. (2019). Fiscal policy in the US: Sustainable after all? Economic Modelling, 81, 471–479.

Amato, M., & Saraceno, F. (2022). Squaring the circle: How to guarantee fiscal space and debt sustainability with a European Debt Agency. BAFFI CAREFIN Centre Research Paper, 172.

Badia, M. M., Medas, P., Gupta, P., & Xiang, Y. (2022). Debt is not free. Journal of International Money and Finance, 127, 102654.

Belguith, S. O., & Gabsi, F. B. (2019). Public debt sustainability in Tunisia: Empirical evidence estimating time-varying parameters. Journal of the Knowledge Economy, 10(2), 550–560.

Berrada, A. (2022). Financial and economic modeling of large-scale gravity energy storage system. Renewable Energy, 192, 405–419.

Bi, H.-x, Shen, W.-y, & Yang, S.-C. (2022). Fiscal implications of interest rate normalization in the United States. Canadian Journal of Economics-Revue Canadienne D Economique, 55(2), 868–904.

Bian, W.-h, & Ma, H.-r. (2021). Analysis of the sustainability of US government debt. China Finance, 12, 87–90.

Bittencourt, M. (2015). Determinants of government and external debt: Evidence from the young democracies of South America. Emerging Markets Finance and Trade, 51(3), 463–472.

Bonizzi, B., & Kaltenbrunner, A. (2019) Liability-driven investment and pension fund exposure to emerging markets: A Minskyan analysis. Environment and Planning A: Economy and Space, 51 (2), 420–439.

Borsato, A. (2021). Does the secular stagnation hypothesis match with data? Evidence from USA (Bureau d’Economie Théorique et Appliquée, UDS, Strasbourg).

Canofari, P., Marini, G., & Piergallini, A. (2020). Financial crisis and sustainability of US fiscal deficit: Indicators or tests? Journal of Policy Modeling, 42(1), 192–204.

Cárdenas-Santamaría, M., Uribe, J. D., Cano-Sánz, C. G., Maiguashca-Olano, A. F., Meisel-Roca, A., Vallejo-Mejía, F. C., & Zárate-Perdomo, J. P. (2022). Report of the Board of Directors to the Congress of Colombia-March 2015. In Report of the Board of Directors to the Congress of the Republic-March of 2021. Banco de la República de Colombia.

Chauhan, V., & Bakshi, A. (2021). COVID-19 pandemic: Concerns, impact and continuity strategies for small businesses in India. Indian Journal of Economics and Development, 17(3), 681–692.

Chen, P.-f. (2016). US fiscal sustainability and the causality relationship between government expenditures and revenues: A new approach based on quantile cointegration. Fiscal Studies, 37(2), 301–320.

De Mendonca, H.F, & Simao, J. (2024). Fiscal standards and the trade-off between public debt sustainability and output growth: Empirical evidence. Applied Economics Letters, 1–6.

De Jong, M., & Ho, A. T. (2021). Emerging fiscal health and governance concerns resulting from COVID-19 challenges. Journal of Public Budgeting, Accounting & Financial Management, 33(1), 1–11.

Ding, Y.-q., Hu Y.-f., & Zhang, Z.-b. (2023). The impact of the triangular US dollar, oil, and gold model on global inflation. Applied Economics Letters, 1–5.

Đuričin, D., & Herceg-Vuksanović, I. (2022). Envisioning a new economic system after the transition from pandemic to endemic: Serbia’s perspective. Ekonomika Preduzeća, 70(1–2), 1–22.

Fabris, N. (2024). Monetary policy between stability and growth. Journal of Central Banking Theory and Practice, 13(1), 27–42.

Futagami, K., & Konishi, K. (2023). Comparative analyses of fiscal sustainability of the budgetary policy rules. Journal of Public Economic Theory, 25(5), 944–984.

Galbraith, J. K. (2023). The quasi-inflation of 2021–2022: A case of bad analysis and worse response. Review of Keynesian Economics, 11(2), 172–182.

Garg, S., & Sushil, S. (2022). Impact of de-globalization on development: Comparative analysis of an emerging market (India) and a developed country (USA). Journal of Policy Modeling, 44(6), 1179–1197.

Ge, Q. (2023). Based on fiscal theory to research the causes and future of US inflation after COVID-19 pandemic. Studies of International Finance, 06, 38–46.

Gustot, T., Stadlbauer, V., Laleman, W., Alessandria, C., & Thursz, M. (2021). Transition to decompensation and acute-on-chronic liver failure: Role of predisposing factors and precipitating events. Journal of Hepatology, 75, S36–S48.

Hao, Y.-b, & Guo, L. (2016). Is the social security system the reason for the prominent risk of government debt - Taking the United States as an example. Social Sciences International, 04, 97–106.

Khemraj, T., & Yu, S. (2024). Inflation dynamics and quantitative easing. Eastern Economic Journal, 49(4), 613–638.

Kitchen, J., & Chinn, M. (2011). Financing US debt: Is there enough money in the world and at what cost? International Finance, 14(3), 373–413.

Kokores, I. T. (2023). Monetary policy crisis in the Eurozone. In Monetary policy in interdependent economies (pp. 99–136). Springer.

Lee, C. C., Yahya, F., & Razzaq, A. (2023). Greening South Asia with financial liberalization, human capital, and militarization: Evidence from the CS-ARDL approach. Energy & Environment, 34(6), 1957–1981.

Levy, Y. E., & Sturzenegger, F. (2023). A balance-sheet approach to fiscal sustainability. Fiscal Studies, 44(1), 61–84.

Li, B.-w, Zhang, Y., Wang, X., & Xu, H. (2020). Issue on the international currency status and monetary financial advantages of the US dollar. China Review of Political Economy, 04, 134–160.

Lima, K. P. F. (2022). Sovereign solvency as monetary power. Journal of International Economic Law, 22(3), 424–446.

Mao, R., Shen, W., & Yang, S.C.S. (2024). Can passive monetary policy decrease the debt burden? Journal of Economic Dynamics and Control, 159, 104802.

Marin-Rodriguez, N. J., Gonzalez-Ruiz, J. D., & Botero, S. (2023). Assessing fiscal sustainability in the landscape of economics research. Economies, 11(12), 300.

Martell, C. R. (2024). The impact of inflation on local government fiscal health. Journal of Public Budgeting, Accounting & Financial Management.

Menand, L. (2023). The logic and limits of the Federal Reserve Act. Yale Journal on Regulation, 40(1), 197–276.

Nakano, T. (2021). War and strange non-death of neoliberalism: The military foundations of modern economic ideologies. International Relations, 35(2), 236–255.

Nakatani, R. (2023). Fiscal crises, decentralization, and indiscipline. Scottish Journal of Political Economy, 70(5), 459–478.

Özmen, İ., & Mutascu, M. (2023). Public debt and growth: New insights. Journal of the Knowledge Economy, 1–31.

Pérez-Montiel, J. A., Manera, C., Navinés, F., & Franconetti, J. (2023). Critical globalisation: Productive capacity and capital productivity in the United States, 1945–2020. The Economic and Labour Relations Review, 1–13.

Qin, W.-b, & Cai, E.-t. (2019). The impact of US public debt and foreign debt sustainability on the US dollar’s hegemonic position. Journal of Soochow University (Philosophy & Social Science Edition), 06, 77–84.

Redburn, F. S. (2021). Budgeting for existential crisis: The federal government as society’s guarantor. Public Budgeting & Finance, 41(3), 5–21.

Schwartz, H. M. (2019). American hegemony: Intellectual property rights, dollar centrality, and infrastructural power. Review of International Political Economy, 26(3), 490–519.

Shen, G.-b. (2020). Sustainability analysis of US treasury bond under the global spread of COVID-19. Journal of Guangxi University of Finance and Economics, 04, 10–24.

Srouji, J. (2022). Reframing the US dollar debate: What outlook for the US dollar as world money? (No. 2022–06). Groupe de REcherche en Droit, Economie, Gestion (GREDEG CNRS), Université Côte d'Azur, France.

Stiglitz, J. E. (2023). The causes of and responses to today’s inflation. Industrial and Corporate Change, 32(2), 336–385.

Sturzenegger, F., & Zettelmeyer, J. (2007). Debt defaults and lessons from a decade of crises. MIT Press.

Tarullo, D. K. (2019) Financial regulation: Still unsettled a decade after the crisis. Journal of Economic Perspectives, 33 (1), 61–80.

Uchida, Y., & Ono, T. (2024). Generational distribution of fiscal burdens: A positive analysis. International Economic Review, 65(1), 393–430.

Wang, G., & Hausken, K. (2024). Regression analysis of factors impacting interest rates. International Journal of Financial Engineering, 2350052.

Wang, C. (2015). Perspective on public debt of US: Estimation based on VECM model and simulations. Chinese Review of Financial Studies, 01, 114–123+126.

Xu, J.-w, & Wang, H.-n. (2021). The sustainability of the US public debt. Contemporary American Review, 01, 53–63+124-125.

Yu, Y.-d. (2022). The reemergence of the issue of US “external sustainability” and what should be China’s responses. China Economic Journal, 15(3), 263–276.

Yuan, D.-s, & Li, Z.-q. (2016). The formation mechanism and legal countermeasures of the U.S. sovereign debt crisis. Hebei Law Science, 06, 28–37.

Yusuf, A., & Mohd, S. (2021). The impact of government debt on economic growth in Nigeria. Cogent Economics & Finance, 9(1), 1946249.

Zhang, L.-j. (2023). The evolution of the international monetary system and the trend of “de dollarization.” Contemporary World, 07, 32–37.

Zhao, C.-m, & Li, H.-b. (2012). American debt problem: Formation path, economic influence, and China’s counter-measures. Journal of Beijing Normal University (Social Sciences), 03, 96–104.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics Approval

Not applicable.

Consent to Participate

Not applicable.

Consent for Publication

Not applicable.

Competing Interests

The authors declare that no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ma, G., Cui, Y. An Analysis of the Sustainability Issues of U.S. Treasury Bonds—A Study Based on the Vector Error Correction Model and Trend Forecasting. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-01960-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-01960-7