Abstract

The high rate of unemployment is one of the socio-economic problems bedevilling the MENA region. Theoretical and empirical arguments remain divided regarding financial development’s role in addressing unemployment. In light of this, this study investigates the effect of financial development on different components of unemployment (total (adult and youth) and gender (male and female)) in MENA. To capture financial development, we used the IMF composite financial development index. For robustness, we also computed an index of financial development from different measures of financial development made available by the World Bank. These measures of financial development include financial depth, financial efficiency, financial stability and financial access. By the panel quantile via the method of moment (Machado & Silva, 2019), our results show that financial development has a significant negative effect on unemployment across the quantiles, but the impact reduces as we move from the lower quantiles to the higher quantiles. Also, using heterogeneous panel causality (Dumitrescu and Hurlin (2012)), our findings are further highlighted as follows: First, in most cases, there is a unidirectional causality between financial development and unemployment, especially total and male unemployment for youths and adults. The direction of causality runs from financial development to unemployment. Therefore, given that financial development lessens the rate of unemployment, our policy implication is that relevant authorities or policymakers need to implement sound financial development initiatives to reduce the levels of unemployment.

Similar content being viewed by others

Introduction

The role of financial development in spurring economic growth has been widely investigated since its importance to the economy was made bare by several scholars such as Walter Bagehot (1873), Joseph Schumpeter (1911), Ronald McKinnon (1973) and Edward Shaw (1973). Precisely, Schumpeter (1911) submits the financial sector brings innovative technological advancement that engenders investment and economic growth. Levine (1997, 2005) observes that financial development arises as a result of frictions in the financial market which lead to a high rate of information and transaction costs. A high rate of information and transaction costs leads to market risks (Aminu & Raifu, 2019; Raifu, 2019), Hence, Levine identifies five functions of financial market. These functions include the mobilisation of funds from the surplus sections of the economy to the cash-constrained sections of the economy, effective allocation of funds to several sectors of the economy, engaging in supervision and monitoring of investments used the borrowed money for, managing and diversifying the investment risks and facilitating trading of goods and services (i.e., exchange of good and services). By performing these functions, financial markets engender capital accumulation and technological innovation that would spur economic growth (Raifu & Afolabi, 2022). Given these theoretical connections between financial development and economic growth, several studies have examined the influence of financial development on economic growth including other areas of the economy such as investment, total factor productivity, sectoral performance, trades, poverty and inequality, even though empirical findings appear to be mixed (Valickova et al., 2015; Isah and Soliu, 2016; Muyambiri and Odhiambo, 2018; Ni and Liu, 2019; Aminu et al., 2019a, 2019b; Raifu & Aminu, 2019; Raifu & Folarin, 2020; Adeboje et al., 2021, Afolabi, 2022).

In recent times, some researchers have begun to examine how financial development influences unemployment in different countries (Ajide, 2020; Bayar, 2016; Ibrahiem & Sameh, 2020; Ogbeide et al., 2016; Raifu, 2019; Raifu & Afolabi, 2022; Shabbir et al., 2012). However, these small but growing studies have yielded mixed empirical findings. For instance, Shabbir et al. (2012) investigate the effect of financial development on unemployment in Pakistan and submitted that financial development worsens unemployment. The findings by Bayar (2016) who examines the effect of financial development on unemployment in emerging market countries (EMCs) corroborated the findings of Shabbir et al. (2012). However, Raifu (2019) studies the effect of financial development on unemployment in Nigeria and submits that the effect of financial development on unemployment depends on the measures of financial development. In a comprehensive or an in-depth study on how financial development affects unemployment in EMCs using broad-based measures of financial development provided by the International Monetary Fund (IMF), Raifu and Afolabi (2022) find that even though financial development reduces unemployment, however, its negative effect varies across the distributions of different categories of unemployment. Apart from the mixed empirical findings from the existing studies, to the best of our knowledge, we do not come across any study that has verified how financial development affects unemployment in the Middle East and North African countries (MENA, hereafter). Hence, this is a gap that this study intends to fill.

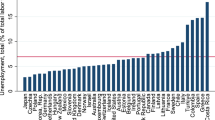

This study, therefore, focuses on MENA countries for the following reasons. First, the MENA region has been facing a chronic unemployment situation. Among the regions in the world, MENA has the highest rate of unemployment. Labour statistics from the World Bank, as shown in Table 1, shows that the unemployment rate in MENA stood at 9.60% in 2019 whereas other regions with similar unemployment problems such as Latin American and Caribbean, Europe and Central Asia, European Union and sub-Saharan Africa had an unemployment rate of 7.99%, 6.69%, 6.70% and 6.28% respectively. Unemployment problem is heterogeneous in the MENA region. For instance, unemployment is higher among women than men and among the youth than adults. Precisely, the female unemployment rate stood at 17.68% while the male unemployment rate stood at 7.59% in 2019. This shows a wide gender employment gap in MENA. The youth who form the larger proportion of the population is worst hit by the unemployment situation in the region. Table 2 shows that the youth unemployment rate stood at 25.70% in 2019. The female youth unemployment rate is also higher than the male youth unemployment rate. While the male youth unemployment rate was 21.18%, the female youth unemployment rate stood around 45.07%, representing about a 23.89% gap (see also Figs. 1 and 2).

Regional, total and gender adult unemployment rate 2019 (MENA and others). Source: World Bank (2020) version. MENA countries included for investigation consist of Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates and Yemen

Regional, total and gender youth unemployment rate 2019 (MENA and others). Source: World Bank (2020). MENA countries included for investigation consist of Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates and Yemen

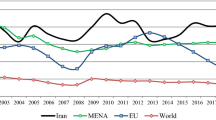

Second, a high rate of unemployment, especially among the youth, portends risks for the economic, social and political prosperity of the MENA region. With an increasing number of unemployed youths who are supposed to be engaging in productive activity, the future growth of the region could be in jeopardy. This is because unemployment is synonymous with the lost human capital available for economic growth and development (Keller & Nabli, 2002). Besides, unemployed persons lack income that can guarantee effective demand for goods and services. A lack of effective demand is deleterious to a firm’s productivity and profit. The high rate of unemployment has also been linked with social unrest or political instability in the MENA region. Studies have shown that there is a linkage between youth unemployment and socio-political instability in MENA (Al-Shammari & Willoughby, 2019; El-Katiri et al., 2014; Paasonen & Urdal, 2016). In fact, the Arab Spring that began in Tunisia in 2010 was associated with youth unemployment (Cordesman, 2011; Fakih et al., 2020). The untamed political unrest could have a future implication for the economy of the region. Thus, a study by Awdeh and Hamadi (2019) shows that political disturbance is one of the factors hindering the economic development of the MENA region (Fig. 3).

Regional domestic credit to private sector—% of GDP (MENA and other). Source: World Bank (2020). MENA countries included for investigation consist of Algeria, Bahrain, Egypt, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Pakistan, Qatar, Saudi Arabia, Syria, Tunisia, United Arab Emirates and Yemen

Third, governments in each of the MENA countries have made tremendous efforts to address the unemployment situation through several programmes and policy interventions, albeit the efforts appear to be yielding insignificant results as unemployment continues to rise year-in-year-out (see UNDP, 2016; Haouas et al., 2012; Zouari, 2014; von Braun & Kofol, 2017; Kabbani, 2019 for different employment programmes and policies across Arab countries). This suggests that governments’ efforts alone may not be sufficient enough to address the problem of unemployment in the region, hence, the need for the involvement of financial market which can make funds available at a relatively low cost to young entrepreneurs who have been facing the challenges of accessing credits in the financial market (Belwal et al., 2014; Erogul, 2014; Mohammadali & Abdulkhaliq, 2019). In fact, Roll (2010) asserted that finance matters in the development of entrepreneurship in Arab countries, especially in Egypt.

Given the reasons above, this study adds to the existing studies in the following ways. First, this study does not only examine the effect of financial development on the aggregate unemployment rate but also on gender unemployment for adults and youths. Most of the existing studies used aggregate unemployment data. Such studies may suffer from policy generalisation bias or may not yield a policy that can effectively address unemployment from a financial sector perspective. Second, our study uses the financial development index provided by the International Monetary Fund. This measure of financial development is a broad-based that encompasses different financial sector indicators such as financial market depth, financial institution depth, financial market efficiency, financial institution efficiency, financial market access and financial institutions access (Svirydzenka, 2016). Second, for robustness, we also construct financial development index from the data obtained from the World Bank Global Financial Development Database (GFDD). The GFDD is also a broad-based financial development database broadly grouped into financial depth, financial efficiency, financial access and financial stability, and they captured both financial institutions and financial market indicators. The principal component analysis is used to compute the financial development index. Third, this study sets to achieve two principal objectives which include testing the Granger non-causality between financial development and unemployment and examining the effect of financial development on the distributions of unemployment. The first objective is achieved using a novel panel Granger non-causality estimation method developed by Elena-Ivona Dumitrescu and Christophe Hurlin in 2012. The method while testing the Granger non-causality test between the two variables takes into consideration the issue of heterogeneity among the panel of countries. The second objective is achieved using a novel panel quantile regression method developed by Machado and Silver in 2019. The panel quantile regression is known as the method of moments quantile regression method (Quantile via moment). According to Machado and Silva (2019), the method is quite different from the usual panel quantile regression methods because it does not only take into consideration the location and scale effects of financial development on unemployment but also provides information about how financial development affects the distribution of unemployment across different quantiles. Apart from this, it also addresses the issues of endogeneity, fixed effects and heterogeneity.

After the introduction, “Literature Review” reviews the existing studies. “Methodologies” presents methodologies. The empirical results are presented in “Empirical Findings” while “Conclusion” concludes with policy implications.

Literature Review

Theoretical Review

There are two theoretical perspectives on the way financial development affects the labour markets, especially unemployment (employment). One aspect of the theories which is based on frictionless financial markets posits that financial development has a reducing effect on unemployment. In the frictionless financial market, there are less credit constraints. In other words, there is no problem of asymmetric information between the borrowers (firms or households) and the lenders (financial institutions especially banks) about the availability of credit and the costs of the credit. Thus, financial development leads to an improvement in access to credits and a reduction in the costs of borrowing. Consequently, financial development ensures that firms have access to credit, which leads to an increase in firms’ investment, productivity and employment (Chen et al., 2021; Dromel et al., 2010). This implies that access to credit at relatively low costs enables firms to make informed investment decisions, boast their productivity and create more jobs in the economy (Raifu, 2019).

The second theoretical perspective through which financial development influences unemployment is credit market imperfections. When the financial market is characterised by imperfections, there is asymmetric information between the borrowers and lenders which in turn leads to credit constraints. When the firms face this situation, it becomes impossible for them to make investment decisions, produce output and provide employment opportunities. Lack of access to credit by young entrepreneurs discourages the development of new firms which could have brought about new investment and job opportunities. Hence, in the presence of credit constraints, financial development tends to worsen unemployment (Dromel et al., 2010; Wasmer & Weil, 2004). Apart from this, financial development restrictions can result in unemployment. Due to incumbent interest and political consideration, Acemoglu et al. (2005) argued that the incumbents (existing investors) who have been enjoying rent-seeking opportunities may oppose financial reforms that would raise the level of financial development and guarantee financial market competitiveness. With a low level of financial development, no new investment can be made, and no job opportunities can be created. Moreover, there are other scholars who argue that whether financial development would engender employment depends on the kind of investment the firms make. Pagano and Pica (2012) submitted that the effectiveness of financial development in reducing unemployment depends on whether the firms invest in labour-intensive technology or capital-intensive technology. If the firms use the credit obtained from the financial institutions on capital-intensive technology, the output can grow but jobs would not be created. However, if the firms invest in labour-intensive technology, both output and employment can grow. Thus, financial development can reduce unemployment when firms invest only in labour-intensive technology. Pagano and Pica (2012) further argued that the more the financial sector becomes sophisticated, the more it tends to become too risky to the economy. This is because the more the financial sector becomes more advanced the more it engages in excessive risk-taking which in turn can lead to instability in the sector. Thus, the economy that depends heavily on the proper functioning of the financial sector may experience severe damages by its collapse which could lead to employment losses. This connotes that too much finance can harm or hurt the economy and employment (Chen et al., 2021).

Empirical Review

On the empirical perspective, several studies have been conducted to examine the effect of financial development on unemployment; however, the findings remain inconclusive. The inconclusive findings in the existing studies could be attributed to several factors which include the choice of proxy for financial development, financial market conditions, country or countries selected for study, the estimation methods and labour market institutional arrangement (see Raifu, 2019).

Using annual data of 18 OECD countries and GMM as a tool of estimation, Gatti et al. (2012) investigated how financial sector and labour market variables interact to determine unemployment in some OECD countries. They concluded that whether the financial sector would reduce unemployment or not depends on labour market situations. Specifically, their results show that an increase in market capitalisation and a decrease in bank concentration will reduce unemployment provided that the level of labour market regulation, union density and wage bargaining power is very low. Similarly, Pagano and Pica (2012) developed a model that shows how financial sector development aids the provision of employment and reallocation of labour. Testing the outcome of the model with data of some groups of countries at the industrial level, they discovered that financial development indeed promotes employment, especially in non-OECD countries. However, the positive effect of financial development on employment occurs when the economy is in good condition. When the economy is in crisis or the financial sector is in crisis, employment grows less in the industries that depend more on an external source of financing and that are located in more financially developed countries.

Some studies documented that financial development worsens unemployment under some financial or labour market conditions. For instance, the availability of credit also determines the effect of financial development on unemployment. Borsi (2018) investigated the impact of credit contraction on labour market performance in 20 OECD countries. Using the local projection estimation method, they found that a decline in private credit raises the level of total, youth and long-term unemployment. The youth are affected more than the total and long-term unemployment. Besides, they also discovered that excessive credit booms are usually accompanied or followed by a significant rise in the level of unemployment. Thus, credit constrictions coupled with labour market rigidity tend to worsen unemployment in OECD countries. For ten European Union member countries, Çiftçioglu and Bein (2017) investigated the nexus between financial development and unemployment. After a running series of regressions and the use of different measures of financial development, they summarily concluded that even though the financial development tends to reduce unemployment, albeit their findings are not robust to the choice of financial development. In other words, their findings rest on the choice of financial development. Also, Kim et al. (2019), who investigated the effect of financial development and structure on unemployment for some advanced and developing countries, found that rigid market regulation and bank concentration tend to raise unemployment. However, bank orientation reduces unemployment. The effects are stronger for young workers than for female ones, especially in advanced countries. Bayar (2016), who studied the effect of financial development on unemployment for 16 emerging countries, found that there is no connection between financial development and unemployment. In other words, financial development does not have any significant effect on unemployment in emerging countries. This, notwithstanding, financial development Granger causes unemployment with the direction of causality running from financial development to unemployment. However, Raifu and Afolabi (2022) examined the effect of financial development on the distribution of employment in emerging market countries taking into consideration the age groups and gender dichotomy. Their findings show that financial development has a reducing effect on the distribution of unemployment, albeit the reducing effect of financial development on unemployment varies across the working-age population and youths. Chen et al. (2021) investigate whether too much finance hurts unemployment using the data of 97 OECD and non-OECD countries for the period of 1991–2015. Using the GMM estimation method, they documented three distinctive findings. First, they found that too much finance hurts unemployment, especially for countries with more rigid labour markets. Second, they discovered that too-centred or too little market-oriented financial systems worsen unemployment. Third, they showed that too much credit to private enterprises worsens unemployment, particularly in countries with more rigid labour markets.

Most of the studies reviewed above are conducted for panels of countries. The problem is that the findings from such studies cannot be generalised, and if generalised, this can lead to policy bias. The rationale for this is that the individual country has its financial structure and institutional arrangement and is at a different level of economic and financial development. These factors are likely to determine the final effect of financial development on unemployment. Consequently, some strands of studies have been conducted for an individual country. Shabbir et al. (2012) examined the effect of financial development on unemployment in Pakistan using the Autoregressive Distributed Lag method. Even though their findings showed financial development and other control variables are cointegrated with unemployment, financial development alone tends to worsen unemployment. While the studies conducted by Ogbeide et al. (2016) for Nigeria and Ibrahiem and Sameh (2020) for Egypt corroborated the Shabbir et al. (2012) for Pakistan, Aliero et al. (2013), however, found that financial development tends to reduce unemployment in Nigeria. This, notwithstanding, Raifu (2019) concluded that the effect of financial development depends on the choice of measures of financial development and also showed the effects differ in the short run from the long run. In specific terms, he discovered that of all measures of financial development used, only financial system deposit expressed as a percentage of GDP reduces the unemployment rate in the short-run and the long run. Other financial indicators such as credit to the private sector, financial liquidity, financial efficiency and financial stability only reduce the unemployment rate in the short run.

Some studies examined the asymmetric relationship between financial development and unemployment, arguing the relationship between the two variables is far from being linear. The asymmetric nexus between financial sector development and other macroeconomic variables including growth and unemployment is premised on two forms of arguments. The first one is that it is believed that financial market indicator, as well as unemployment, behaves asymmetrically throughout different economic conditions. Thus, modelling financial development and growth or unemployment linearly may yield low explanatory or testing power and an inferior coefficient (Tapa, et al. 2016). Second, the economic agents are said to respond differently to positive development in the financial sector than negative development in the financial sector. Thus, firms, the providers of employment, are more likely to respond urgently to negative development in the financial market than responding to positive news in the market (Shahbaz, et al. 2018). Given this, Ajide (2020) examined the asymmetric impact of financial development and unemployment in Nigeria using the nonlinear autoregressive distributed lag estimation method. His finding summarises that asymmetric exists between financial development and unemployment in the short run and the long run. Also, it was established that positive shocks to financial development reduce unemployment in the short run. However, positive and negative shocks to financial development worsen unemployment in Nigeria. Thus, financial development does not reduce the unemployment rate in Nigeria during the period they considered.

From the review so far, it is evident that the nexus between financial development and unemployment is far from being conclusive as many issues are yet to be addressed. It is not clear yet how financial development affects unemployment over some times or quantiles. Also, the issue of endogeneity between financial development and unemployment has not been adequately addressed in the literature. It is not only plausible for financial development to affect the economy and unemployment alone but also possible for the state of unemployment to affect the level of financial development. A state of unemployment is a signal of economic condition in any country. Thus, a high rate of unemployment is usually associated with a period of economic crisis or downturn which will, directly and indirectly, have a negative effect on the development of the financial sector. The period of economic booms, most of the time, often correlates with the period of employment growth. This period is highly associated with a period of greater demand for the services of the financial sector and financial reforms that are likely to revolutionise the financial sector and lead to financial development. Given this, this study examines how financial development affects the distribution of unemployment at different quantiles while taking into consideration the issues of endogeneity and heterogeneity in the panel of MENA countries.

Methodologies

To ascertain the effect of financial development on unemployment in MENA, we adopt two basic methodologies. The first methodology is the panel Granger non-causality test developed by Dumitrescu and Hurlin (2012). The method considers heterogeneity in panel data to test the direction of causality between two variables, say financial development and unemployment. In other words, the causality test considers cross-sectional dependence in the cross-section units of the panel dataset. The second method adopted in this study is the novel quantile regression via moment developed by Machado and Silva (2019). The method does not only estimate quantile regression taking into consideration fixed effects in the panel of countries but also taking into consideration endogeneity and heterogeneity. However, before we can apply these two methods, there is a need to test for cross-sectional dependence between financial development and unemployment. Cross-sectional dependence arises because of increasing interdependence among the countries in the world, particularly countries from the same regions. The increase in globalisation and economic integration among the countries tend to make these countries be affected by common shocks such as the global financial crisis and the COVID-19 pandemic. Thus, we present the three methodological frameworks in the study, and they include the cross-section dependence test framework, Dumitrescu and Hurlin’s (2012) Granger non-causality framework and Machado and Silva’s (2019) quantile regression framework. These three methods are presented one after the other as follows.

Cross-Section Dependence Tests

The presentation here benefits tremendously from De Hoyos and Sarafidis (2006) and Bakirtas and Akpolat (2020). In specific terms, we consider three types of cross-sectional dependence (CD) tests, and they include Breusch and Pagan’s (1980) CD LM test, Frees’ (1995) CD test and Pesaran’s (2004) CD LM test. Although the three tests assume no cross-sectional dependence between variables in panel structured form, albeit they differ in terms of the number of observations and time dimensions of the panel data. For instance, the Breusch-Pagan CD LM test is used when T is relatively larger than N (T ≻ N) while the Frees CD test is used when N is greater than T (N ≻ T). However, when N and T are sufficiently large, Pesaran’s CD method is used.

Following Pesaran (2004) and De Hoyos and Sarafidis (2006), we begin by considering a simple panel regression model specified as follows:

Here, xit is a Κx 1 vector of independent variables, β is a Κx 1 vector of coefficient parameters that would be estimated, αis the individual intercept and εit is assumed to be independently and identically distributed with zero mean and constant variance (i.e., \({\varepsilon}_{i t}\sim idd\left(0,{\delta}_{i\varepsilon}^2\right)\)) for each country. Even though there could be cross-sectional dependence among the countries, the null hypothesis of no cross-sectional dependence remains valid, and it is specified as follows:

The null hypothesis of no cross-sectional dependence is tested against the alternative hypothesis of cross-sectional dependence specified as follows:

where ρij is the estimated pairwise correlation coefficients of the residuals.

To test for the cross-sectional dependence, Breusch and Pagan (1980) proposed the LM test for small Nand large T, especially for SURE estimation given as follows:

where \({\overset{\wedge }{\rho}}_{ij}\) is referred to as the estimate of the pairwise correlation of the disturbances specified as follows:

In Eq. 5, T and N stand for time dimension and individual countries in the panel respectively. Each individual in the panel is denoted as i. For fixed Nand T~∞, the test converges to a chi-square distribution with degree of freedom of \(\frac{N}{\left(N-1\right)/2}\) (Bakirtas & Akpolat, 2020).

In the case of Frees’ CD test, the statistic proposed by Frees is based on the sum of the squared rank correlation which is given as follows:

The function of Eq. 7 follows a joint distribution of two independently drawn χ2 random variables—\({x}_{1,x-1}^2\)and \({x}_{2,T\left(T-3\right)/2}^2\). This is drawn from Frees’ equation given as follows:

Given in Eq. 8, the null hypothesis of no cross-sectional dependence is rejected if \({R}_{ave}^2>{\left(T-1\right)}^{-1}+{Q}_q/N\). Here, (T − 1) and T(T − 3)/2 are degrees of freedom, and Qqdenotes the appropriate quantile of the Q distribution.

Pesaran (2004) proposes a novel cross-sectional dependence LM test, especially when both T and N are relatively large. The cross-sectional dependence LM test is given as follows:

As T and N →∞, the null hypothesis of no cross-sectional dependence converges to normal distribution assumed to have zero mean and constant variance.

Dumitrescu and Hurlin (2012) Panel Causality Test

Following Dumitrescu and Hurlin (2012), Lopez and Weber (2017) and other researchers, such as Aydin and Malcioglu (2016) and Sharma and Bardhan (2017) who had applied their causality method to test causality between economic relations, the panel Granger-causality test is specified as follows:

Suppose financial development is represented as fd, and unemployment is specified as un; Dumitrescu and Hurlin (2012) causality VAR framework begins as follows:

Here, αi and \({\alpha}_i^{\hbox{'}}\) are individual country-specific fixed effects. K is the lag length. The null hypothesis of Granger non-causality from financial development and unemployment can be stated as follows:

H 0 : βi = 0 for all countries (∀i = 1, …, N). This implies the homogenous non-causality between financial development and unemployment taking into consideration both the heterogeneity of the regression model and that of the causal relation. This is tested against the alternative hypothesis as H1 : βi ≠ 0 for at least one cross-sectional unit (∀i = N1 + 1, N1 + 2, …, N). Here, the unknown N satisfies the condition that \(^{0\le {N}_1}/_{N<1}\). Following Dumitrescu and Hurlin (2012), two statistic tests (\(\overline{Z}\) and \(\overset{\wedge }{Z}\)) based on the Wald test (\(\overline{W}\)) are computed to determine the direction of causality between financial development and unemployment. The Wald test is the average of the individual Wald test of Granger non-causality. The average Wald test is given as follows:

where wi refers to individual Wald statistic for ith cross-section unit. Given the assumption of the Wald test (\(\overline{W}\Big)\), that is, it is independently and identically distributed across individual countries, the standardised statistic of Z as T and N tend towards infinite converges to normal distribution. The Z statistic is specified as follows:

Similarly, for a fixed T dimension with T> 5 + 3K, the standard statistic \(\tilde{Z}\) that has normal standard distribution property can be specified as follows:

The null hypothesis of no-Granger causality between financial development and unemployment is tested based on \(\overline{Z}\)and \(\overset{\wedge }{Z}\). The computed values of the Z’s are greater than the critical value, then the null hypothesis of no cointegration is rejected meaning Granger causality exists. Otherwise, there is no causality between financial development and unemployment.

Machado and Silva (2019) Quantile Regression Method

To examine the conditional distribution effect of financial development in MENA taking into consideration fixed effect, heterogeneity and endogeneity in the panel data, we employ the novel quantile regression method developed by Machado and Silva (2019). This quantile regression is known as the method of moments quantile regression method with fixed effects (MMQR). Unlike the previous panel quantile regression methods whose root could be traced to the work of Koenker and Bassett Jr (1978), MMQR is capable of accommodating heterogeneity in the panel data form, that is, it is possible to ascertain the conditional heterogenous covariance effect of financial development and other control variables on unemployment. Most importantly, the MMQR is applicable where the panel data model contains fixed effects and is characterised by heterogeneous and endogenous regressors. The method is also useful for estimating non-crossing quantile regression. Like the other early quantile regression methods such as Koenker and Bassett Jr (1978), Koenker (2004), Canay (2011) and Powell (2016). Given its advantages, the estimation of a given random variable say unemployment whose distribution conditional or contingent on the vector of some regressors say financial development and other control variables with location-scale variant or family can be expressed as follows:

Here, unknown parameters to be estimated are given as the conditional probability is given by (α, β', δ, γ)' ∈ R2(k + 1), the individual fixed effects for i is designated as (αi, δi), i = 1, …, n, Z which is a k-vector component of X can be transformed by differentiation with element l is given by Zi = Zi(X), l = 1, …, k, σ(•) is a known c2 function such that the probability is given as \(P\left\{\delta +{Z}_{it}^{\hbox{'}}\gamma >0\right\}=1\). Xit follows a usual standard assumption of normality (independently and identically distributed for a fixed i) and is also independent across time, t. Uit possesses three characteristics. First, it follows a standard normal distribution assumption across individual, i and time. Second, it is orthogonal to Xit, that is, it is uncorrelated with Xit. Third, it satisfies moment conditions after being normalised. Equation 15 can be expressed in quantile regression form:

X it are the vectors of independent variables. In our study, we have three independent variables which include the logarithm of financial development, growth rate of real GDP and inflation rate. Apart from the main independent variable which is financial development, the inclusion of the other two independent variables is based on the theoretical nexus they have with unemployment. For instance, in the famous Okun’s law, economic growth captured by gross domestic product is inversely related to unemployment. Thus, on a priori ground, it is expected that economic growth should have a negative effect on unemployment, that is, as the economy is growing, unemployment is expected to reduce. Similarly, the inflation rate and unemployment rate are expected to have an inverse relationship because of the short-run trade-off that exists between the two variables as stipulated by the celebrated Phillips curve. The main independent variable, financial development, is also expected to have a negative effect on unemployment because it is believed that an improved financial sector should boost investment, economic growth and employment (Chen et al., 2021; Kim et al., 2019). QY(τ/Xit) reflects the quantile distribution of the dependent variable, the unemployment rate. It is contingent on the location of regressors, Xit. αi(τ) ≡ αi + δiq(τ) is a scalar coefficient which indicates the quantile-τ fixed effect of an individual country, i. The individual fixed effects are time-invariant parameters whose heterogeneous impacts are permitted to differ across the quantile of the conditional distribution of the endogenous variable, Y. q(τ) is the τ − th sample quantile estimated by solving the optimisation problem specified as follows:

where ρτ(A) = (τ − 1)AI{A ≤ 0} + TAI{A > 0}, and it denotes the check function.

Given the quantile econometric framework above, the estimated model following Kim et al. (2019) and Chen et al. (2021) is specified as follows:

In Eq. 18, unemployment denoted as y is expressed as a function of financial development (FD), real gross domestic product (GDP) and inflation rate (INF) and the error term. The error term εit is assumed to be normally distributed with zero mean and constant variance. The expected relationships between unemployment and the independent variables (FD, GDP and INF) in terms of signs remain as previously expounded in Eq. 16. Equation 18 is estimated for different quantiles such as 0.10, 0.25, 0.50, 0.75 and 0.90.

Data Sources and Preliminary Findings

Data Sources

To investigate the effect of financial development on unemployment in the MENA countries, we employ a panel data of 19 MENA countries between 1991 and 2019. The data used are sourced from two three sources, namely, World Development Indicators (WDI), International Monetary Fund (IMF) and World Bank Global Financial Development Database (GFDD). Unemployment data which consist of the adult unemployment rate (total, female and male unemployment rate (15–65)) and youth unemployment rate (total, female and male unemployment rate (15–24)) are sourced from the WDI. The control variables which include the consumer price index, a proxy for the inflation rate, and real GDP, a measure of the performance of the economy, are also obtained from the WDI. For the main analysis, we used a broad-based financial development index collected from the IMF database. The financial development index comprises financial institution-based financial development indicators and financial market-based financial development indicators which cover financial indicators such as financial depth, financial access and financial efficiency (see Svirydzenka, 2016). For robustness, we also constructed financial development index from the series of financial development indicators obtained from the World Bank Global Financial Development Database (GFDD). The GFDD is broadly grouped into financial depth, financial efficiency, financial access and financial stability. Each of these broad financial development indicators also captured both financial institutions (banks and insurance companies) and financial markets (stock and bond markets). The financial development indicator is constructed using the principal component analysis (PCA). Following Raifu et al. (2021), the computed financial development index is winzorised and normalised. The purpose of winzorising the index is to remove the outliers in the index while normalising is to have a meaningful interpretation of financial development. The normalised financial development index ranges from 0 and 1. The preliminary analysis of the variables is presented in the following section.

Preliminary Analysis

Before we proceed with our empirical findings, we present some preliminary characteristics of our data. All variables are expressed in percentages except for the financial development indicator. Primarily, Table 3 displays the summary statistics of the series. As shown in the table, female youth unemployment has the highest average value of 26.6810 with a standard deviation of 17.5590. This is closely followed by youth unemployment that has a mean value of 20.1030 and a standard deviation of 12.6380. Also, male youth unemployment has an average value of 18.1350 with a variability value of 11.7900. Total female unemployment also has a mean value of 13.4160 with a standard deviation of 8.6350, while total unemployment and total male unemployment have average values of 8.8670 and 7.6950 with the variability levels at 6.3370 and 5.9730, respectively. The average value for the financial development index (FDI) is very low at 0.3020 with a low level of variability at 0.1470. Furthermore, the control variables, which include the growth rate of real GDP and consumer price index (CPI), both have mean values of 4.4060 and 91.0380, and standard deviations of 8.7880 and 64.8380, respectively. Moreover, considering the extremes, we discovered that female youth unemployment continues to present the highest minimum and maximum values at 0.5000 and 69.5200, respectively (with 0.5900 and 68.1900 at the 1st and 99th percentiles, respectively); total youth unemployment has the minimum value of 0.4500 and a maximum value of 51.9300 (with 0.8300 at the p1 percentile and 49.8900 at the p99 percentile). Male youth unemployment has a minimum unemployment value of 0.2100 and a maximum value of 53.5200 (the values at the p1 and p99 percentiles are 0.3400 and 47.3200, respectively), whereas total female unemployment presents minimum and maximum values of 0.2400 and 30.8100 (with 0.3100 at the 1st percentile and 30.2700 at the 99th percentile), respectively. Total unemployment and total male unemployment have minimum values of 0.1100 and 0.0500 and maximum values of 31.8400 and 32.0300 (with the unemployment values at 0.2800 and 27.3000, and 0.0900 and 27.2400 for the p1 and p99 percentiles), respectively.

Furthermore, FDI has minimum and maximum values of 0.0500 and 0.6560 (with the values at the p1 and p99 at 0.0650 and 0.5920), respectively, while real GDP growth rate has a minimum value of −62.0760 and a maximum value of 123.1400 (with the values at the 1st and 99th percentiles at −14.6930 and 26.6810) respectively. Lastly, CPI has a minimum value of 0.5230 and a maximum value of 890.2290 (with unemployment values of 4.9390 and 349.8190 at the p1 and p99, respectively). In terms of skewness and kurtosis, Table 3 shows that all the series as positively skewed, with fat tails in the cases of real GDP growth rate and CPI, where total male unemployment, real GDP and CPI all have excess kurtosis or highly peaked shapes, while the remaining variables are relatively flatter than normal. Overall, the characteristics of our data are consistent with a priori expectations—given that historically, female and female youth are always disadvantaged in terms of employability and employment opportunities. This provides the rationale behind the high average total female and female youth unemployment. However, further investigations would provide a detail and complete picturesque of the issue.

Furthermore, we present correlation analysis as displayed in the correlation matrix in Table 4. It should be noted that our present study has six dependent variables including total unemployment, male unemployment, female unemployment, youth unemployment, male youth unemployment and female youth unemployment, which culminate into six different models; hence, as observed in Table 4, our variables do not present any collinearity or multicollinearity problems. Specifically, financial development and real GDP growth rate have moderate and significant negative correlations with all the proxies for unemployment, while CPI has negative correlation in total unemployment and male unemployment, but positive correlation with the other levels of unemployment.

Next, for us in this study to comprehensively, objectively and robustly ascertain the features of integration of our variables examined, different panel unit root tests were performed. These include the Im et al. (2003) unit root test, Levin et al. (2002) unit root test, Breitung (2001) unit root test, Fisher (1932) unit root test, Hadri (2000) unit root test and Harris and Tzavalis (1999) unit root test. The results and the remarks/conclusion from the panel unit roots are displayed in Table 5. It is observed that total unemployment, male unemployment, female unemployment, youth unemployment, male youth unemployment, female youth unemployment and CPI are non-stationary at level (i.e., I(0)), but become stationary after first differenced, i.e., at I(1), whereas financial development and real GDP growth rate are stationary at first difference, i.e., I(0).

Furthermore, given the mixed order of integration, we conducted the different cross-sectional dependence tests. We performed the Breusch and Pagan (1980) LM test in the framework of seemingly unrelated regression estimation with the validity of a fixed number of sample (N) as the time (T) approaches infinity; the test has the possibility of exhibiting substantial size distortion when the sample size increases and T in infinite. As a form of robustness, Friedman’s nonparametric test which follows Spearman’s rank correlation coefficient (Friedman, 1937) was performed. We also conducted the Frees (1995) test that is based on the sum of the squared rank correlation coefficients and follows a joint distribution of two independently drawn chi-squared variables. Lastly, to deal with the shortcomings in the Breusch-Pagan tests, we carried out the Pesaran (2004) panel cross-sectional dependence test, which captures the situation of sufficiently large time periods as the sample size turns to infinity. Different from the Breusch-Pagan LM test, the Pesaran CD test has mean at exactly zero for fixed values of T and N, given a broad range of panel-data models such as homogeneous/heterogeneous dynamic models and non-stationary models (for details see, e.g., De Hoyos & Sarafidis, 2006). The cross-sectional dependence test results are presented in Table 6. As observed in all the six models, when we consider the Breusch-Pagan LM and Frees tests, the null hypothesis of cross-sectional independence is rejected in favour of the alternative cross-sectional dependence at the 1% level of significance. In the case of Friedman’s test, the H0 is rejected for the total unemployment model, total male unemployment model and total youth unemployment at the 10% and 1% significant levels, while it cannot be rejected for the total female unemployment model, total youth unemployment model and female youth unemployment model. Furthermore, the Pesaran CD test is significant at the 10% level only for the total unemployment model, whereas it is insignificant for all the other models.

Empirical Findings

Results for the Quantile via Moment Regression

Our present study investigates whether financial development reduces the different categories of unemployment for panel of MENA countries by focusing on the Machado and Silva (2019) quantiles via moment methodology. Table 7 exhibits the results of the MMQR estimations from our six models—total unemployment, male unemployment, female unemployment, youth unemployment, male youth unemployment and female youth unemployment models. The results are presented for the 10th, 25th, 50th, 75th and 90th quantiles of the conditional/structural unemployment distribution. The lower quantiles (10th and 25th) are linked to economies with comparatively high amounts of different categories of unemployment within the MENA region. The upper quantiles (75th and 90th) designate MENA economies with a comparatively low amount of unemployment. As stated earlier, we estimated six models, and each of these models has two equations, one equation without the control variables and the second equation with the control variables (Real GDP growth rate and CPI). Empirically, we expect the effect of financial development on the diverse categories of unemployment to be heterogeneous. It should be noted that our benchmarked estimated results used the FDI constructed by the IMF, whereas as a form of robustness, we further used World Bank data to construct a similar financial development index based on the PCA approach (see Kumeka et al., 2023; Adeniyi et al., 2021 for details).

Starting with the model for total unemployment in panel A of Table 7, we observed that in the model without control variables, the effect of financial development on unemployment is heterogeneous. It is seen that financial development impacts with contrasting signals on the location and scale, which is an indication that as the concentration level increases, the average amount of total unemployment decreases (location shift); on the other hand, it further increases the distribution of the perceived total unemployment (scale shift). Considering the structure of distribution, we observed that stronger financial development has a significant negative impact on total unemployment across the quantiles, though there are substantial dissimilarities across the different quantiles in the conditional distribution of total unemployment. The coefficient of financial development is greatly significant at all the quantiles (10th to 90th), and the significance level and the effect of the coefficients of financial development on the structural distribution of total unemployment decrease steadily as one moves from the lower quantiles to the upper quantiles. Precisely, the influence declines from −2.0063 at a 1% significant level to −0.4152 at a 1% significant level. That is, financial development reduces total unemployment in high unemployment economies by 2.0063 and 1.0000 for the 10th and 25th quantiles, while it reduces total unemployment in low unemployment economies by 0.5526 and 0.4152 for the 75th and 90th percentiles, respectively. Moreover, when we estimated the model for total unemployment with some control variables, our results for the location and scale shift in terms of financial development retain their signs and magnitude, but are statistically insignificant. The results across the different quantiles are qualitatively similar with those without the control variables. In the case of control variables, we find that real GDP growth has decreasing impact on total unemployment in terms of location shift and increasing impact in terms of scale shift, but statistically significant only in the scale shift at 10%. CPI on the contrary has an insignificant increasing and decreasing impact on total unemployment in terms of location and scale shifts respectively. On the structure of dependence across the different quantiles, RGDP negatively influences total unemployment across quantiles, while CPI has a positive impact on all quantiles except the 90th quantile, with a 5% statistical significance only at the 10th quantile. These indicate that economic growth reduces the levels of total unemployment, while inflation exacerbates it, especially in economies with high amount of total unemployment. What these portend is that developing a sound/robust financial development structure in MENA countries with low and high total unemployment levels could considerably diminish the levels of total unemployment in those economies.

Next, we present results for the male unemployment model in panel B Table 7. Similar to the total unemployment model, the male unemployment model shows that financial development has a heterogeneous impact on male unemployment. Consistently, when the model is estimated without control variables, financial development has opposite signs on the location and scale with increasing level of concentration decreases the male unemployment rate (location shift) and also escalates the distribution of the observed male unemployment (scale shift). Regarding the quantile results, we find that financial development has a positive impact on male unemployment. The coefficients are statistically significant at the 1% significance level for all the quantiles. Also, the significance level and the effect of the coefficient of financial development on the structure of distribution of male unemployment decline as we move from the lower quantiles to the upper quantiles. Improvement in financial development reduces male unemployment by 2.4709 at the 10th quantile and thereafter the impact dropped gradually to 1.9929, 1.1401, 0.6302 and 0.4365 at the 25th, 50th, 75th and 90th quantiles respectively. In addition, the second model where we include controls shows similar outcomes in terms of location shift and scale, but only significant at the 1% in the case of scale shift. The results from the quantiles also show negative relationship between financial development and male unemployment across the quantiles and moderately significant at the 5% and 10% levels at the 10th, 25th and 50th quantiles, whereas the upper quantiles are not statistically significant. The results from the controls show that RGDP has positive and insignificant location shift impact on male unemployment, but negative and 1% significant impact in terms of the scale shift. Across the quantiles, RGDP has positive and insignificant impact on male unemployment, even though the impact diminishes as one move from the higher unemployment countries to the low unemployment countries. Conversely, inflation has negative and insignificant location effect and positive and insignificant scale shift impact on male unemployment. The results across the quantiles show that inflation has negative insignificant impact at the 10th and 25th quantiles, while the effect is positive and insignificant from the intermediate to the upper quantiles.

Furthermore, we present the outcomes from the female unemployment model in Panel C. Similarly, the impact of financial development on female unemployment is observably mixed. It can be seen that there is significant negative location shift impact and significant positive scale shift impact on female unemployment, which means that boosting concentration level deteriorates the average female unemployment, but then increases the spread of the female unemployment rate. Turning to the results across the quantiles, we also find that financial development has highly significant impact on female unemployment on all the quantiles and the effect also tapers off as we transit from the lower quantiles associated with high levels of unemployment to the upper quantiles related to the low levels of unemployment. Specifically, this reduces from −1.2910 at the 10th quantile to −0.3235 at the 90th quantile. Additionally, when we introduce controls into this model, we find qualitatively similar results in terms of the location shift and scale shift with the same significant levels. However, concerning the quantile results, financial development has negative and insignificant impact on female unemployment across all quantiles and the impact also drops as we move from the 10th quantile to the 90th quantile. The result from the controls shows that RGDP also has negative location shift effect and positive scale shift effect, but the coefficients are statistically insignificant. Also, RGDP has negative and insignificant impact across all the quantiles. Inflation on the contrary has positive and insignificant location shift impact on female unemployment and negative significant scale shift impact. In terms of dependence structure, inflations have positive and insignificant impact in the 10th, 25th and 50th quantiles, but negative insignificant impact in the 75th and 90th quantiles.

The next model is the total youth unemployment model in panel D. It can be observed that financial development has impacts with conflicting signals on the location and scale signifying that buttressing the focus level shrinkages the average total youth unemployment level, a location shift, nonetheless further surges the distribution of the indicated total youth unemployment level, a scale shift. Moving to the structure of dependence results in our model without control variables, we find that financial development has a negative impact on total youth unemployment, therefore boosts youth employment. The coefficients are statistically significant at the 1% significance level across the whole quantiles of conditional distribution. Particularly, the degree of the effect reduces from the lower quantiles (10th quantile with −1.3340 to high unemployment economies) to the upper quantiles (90th quantile with −0.1852 to low unemployment economies). In addition, when we introduce controls into this model, we find that financial development also has negative significant location shift impact on total youth unemployment with a value of −0.8039 and positive significant scale shift effect on total youth unemployment with a value of 0.3649. The coefficients are significant at the 1% significance level. Also, in terms of the dependence structure, the results show that financial development has negative and significant impact on total youth unemployment on all the quantiles. However, the magnitude of the effect and significance level drops from the 10th quantile to the 90th quantile. The outcomes from the controls show that RGDP has negative and significant location shift impact, but positive and insignificant scale shift impact on total youth unemployment. Regarding the quantile results, RGDP has negative and significant impact on total youth unemployment at the 10th, 25th and 50th quantiles. At the 75th and 90th quantiles, the coefficients turn insignificant but consistently remain negative. This indicates that the RGDP growth rate increases the level of total youth employment, especially in economies with a high amount of total youth unemployment. Contrarily, it is revealed that inflation has positive and negative location and scale shifts effects, respectively on total youth unemployment, meaning that increasing the focus level in terms of inflation promotes total youth unemployment (location shift), while also reduces the spread of total youth unemployment (scale shift). This is however significant at the 5% level of significance for the scale shift only. The impact of inflation on the conditional distribution across quantiles shows that inflation has a positive impact on total youth unemployment. The coefficients are significant at the 1% level of significance for the 10th, 25th, 50th and 75th (at 5%) quantiles, but not significant for the 90th quantile. This suggests that the rise in the level of inflation rate fuels the escalation in the level of total youth unemployment, more especially in economies with very high levels of unemployment, and the impact reduces as we transit from the lower-to-middle quantiles to the upper and extreme higher quantiles.

In addition, the model for the male youth unemployment is presented in panel E. In parallel lines to the previous models, it is shown that financial development has impacts with heterogeneous indications on the location shift—shows that improving the concentration level enhances the average male youth employment (a negative relationship −1.1131 with male youth unemployment) and scale shift—shows the decreasing effect of the dispersion of perceived male youth employment (a positive impact 0.5285 on male youth unemployment). Considering the conditional dependence structure in the model without control variables, we find that financial development exerts a negative significant impact on male youth unemployment across all the quantiles, which indicates that financial development condenses male youth unemployment. The effect of the coefficients is significant but not consistent across the quantiles. Explicitly, the magnitudes of the coefficients drop as one moves from the lower quantiles (−2.1614 and −1.6148 at the 10th and 25th quantiles) to the higher quantiles (−0.6167 and −0.5066 at the 75th and 90th quantiles) of the distribution structure. This is an indication that the strength of financial development in reducing male youth unemployment is stronger in economies with a higher level of unemployment than in economies with a lower unemployment level. Additionally, we also present the male youth unemployment model with some controls and as observed, the location shift and scale continue to maintain their signs and size, but not significant statistically. Concerning the results from the quantiles, we find that financial development negatively impacts male youth unemployment on all the quantiles but the results are statistically significant only at the lower quantiles (−2.8493 at 1% for the 10th quantile and −2.0741 at 5% for the 25th quantile), whereas the 50th, 75th and 90th quantiles, respectively. This suggests that when RGDP and inflation are introduced into the male youth unemployment model, financial development substantially reduces male youth unemployment only in the economies with a higher level of unemployment. Furthermore, the outcomes from the controls show that RGDP has positive location shift and scale shift effects on male youth unemployment, with a 5% level of significance only on the scale shift, while the inflation rate has negative and insignificant impact on male youth unemployment in both the location shift and scale shift. In terms of the structure of dependence, RGDP has insignificant positive effect on male youth unemployment in all the quantiles with the exception of the 10th quantile. On the other hand, the inflation rate has positive impact on male youth unemployment at the 10th, 25th and 50th quantiles, but negative effect at the 75th and 90th quantiles. The coefficients are, however, not significant across all quantiles.

Furthermore, we present and discuss results for the female youth unemployment model in Panel F. As noticed in the last panel of Table 7, in the equation without control variables, financial development has impact with mixed signals on the location and scale. This submits that boosting the level of absorption makes the average female youth employment to proliferates, a negative significant effect on female youth unemployment (location shift), however further dampens the dispersion of female youth employment, a positive significant impact on female youth unemployment (scale shift). Concerning the outcomes from the quantiles, financial development has a significant negative effect on female youth unemployment on all quantiles, suggesting a reduction in female youth unemployment. That is, it boosts the levels of female youth unemployment. Again, the impact is dissimilar/heterogeneous across quantiles from the lower to the upper. The sizes of the coefficients condense as we travel from the 10th quantile to the 90th quantile. In specific terms, it is −0.8012 at the 10th quantile, −0.6190 at the 25th quantile, −0.4608 at the 50th quantile, −0.3043 at the 75th quantile and −0.1751 at the 90th quantile. The coefficients are highly significant at the 1% level of significance across the quantiles except at the 90th quantile, which is significant at the 5% level of significance. Moreover, when we included the controls in this model, financial development retained its location shift and scale shift effects on female youth unemployment, with significant negative and positive signals, respectively. Concerning dependence structure, we find that financial development has a negative and significant impact on female youth unemployment across all the quantiles except for the 90th quantile on the conditional distribution. This suggests that improvements in financial development have the potential to augmenting female youth employment. Combined with RGDP and inflation rate, the effects appear to be more significant and stronger in economies with a high amount of unemployment (at the lower quantiles). Precisely, the effect reduces from −0.8634 in the 10th quantile to −0.0907 in the 90th quantile. The results from the controls show that the RGDP growth rate does not exert any significant effect on the female youth unemployment in this model. It, however, displays a negative concentration level (location shift) and positive dispersion (scale shift). RGDP has a negative effect on female youth unemployment across all the quantiles. Conversely, the estimated results from the fixed effects panel quantile via the method of moments indicate that the inflation rate has positive significant location shift effect, but negative significant scale shift effect on female youth unemployment. Across the quantiles, the inflation rate has significant positive impact on female youth unemployment at the 10th, 25th and 50th quantiles of the conditional distribution. Nevertheless, at the conditional female youth unemployment distribution of the remaining quantiles, the coefficients of the inflation rate are positive and statistically insignificant. Remarkably, the degree of the impact is stronger in the lower quantiles. The implication is that it increases female youth unemployment. Therefore, this is an indication that the inflation rate, particularly persistent high inflation rate, worsens female employment levels, and the effect is intensified in economies with already high rates of unemployment.

Result of Dumitrescu-Hurlin Heterogeneous Panel Causality Test

Subsequent to the investigation of our long-run estimations above, we proceed to the next phase, which is the determination of the causal relations among the relevant series. This procedure is implemented with the Dumitrescu and Hurlin (2012) causality method. Our choice of arrangement which is in agreement with the heterogeneous model of evaluating the bivariate causal relationship of variables such as total unemployment, male unemployment, female unemployment, total youth unemployment, male youth unemployment and female youth unemployment, RGDP growth rate and inflation rate, becomes necessary along the cross-sections in the short-run. Also, a heterogeneous causality method that relies on panel data, the Dumitrescu-Hurlin allows all coefficients to retain their difference all over the cross-sections. In addition, it is essential for all series in this test to exhibit stationarity, and lastly, the null hypothesis suggests the Granger no-causality. The panel heterogeneous causality estimates are displayed in Table 8. We find one-way directional causality between financial development and total unemployment, financial development and male unemployment, financial development and total youth unemployment, and financial development and male youth unemployment. This portends that financial development significantly influences total unemployment, male unemployment, total youth unemployment and male youth unemployment whereas total unemployment, male unemployment, total youth unemployment and male youth unemployment do not have any significant influence on the exogenous variable (financial development). Put differently, our findings do not support the feedback hypothesis among these series. The changes and improvements in financial development will cause movements in the levels of total unemployment, male unemployment, total youth unemployment and male youth unemployment of MENA economies but not vice versa. This result is in support of the arguments presented in Bayar (2016) that investigated the relationship between financial development and unemployment in emerging countries by using the Dumitrescu and Hurlin (2012) panel heterogeneous causality and documented that there is a one-way causal association from financial development to unemployment. This knowledge would be interesting to the authorities and policymakers to enable them to formulate and implement appropriate policies. Furthermore, we do not find any significant causal relationship between financial development and female unemployment, financial development and female youth unemployment.

Discussion

The debate on the interaction between sound financial development and (un)employment among academic scholars and policy makers has been inconclusive over the years and the narrative is on-going. Theoretically, there are no direct postulations linking financial development with unemployment, but inferences could be made from some pieces of theories that establish the nexus between financial development, economic growth and investment. However, it is well established that there is a connection between investment and employment on the one hand (see Blanchard, 2000; Smith & Zoega, 2009) and economic growth and employment on the other hand (see Okun, 1963). Moreover, there are some theories that link investment, growth and employment together (see Keynes, 1937, 2018). Given this, some theorists argued in support of the fact that financial development spurs employment (tends to reduce unemployment) while some sets of other theorists also argued that the financial sector is characterised by some uncertainties that sometimes disrupt economic activities and worsen unemployment situation. This implies that financial development employment through the fostering of economic growth and investment and at the same time financial development can degenerate into a high rate of unemployment, especially during the financial crisis.

Hence, our current study examines the impact of a sound financial development on different measures of unemployment level in MENA economies, coupled with some control variables such as RGDP growth rate and inflation rate. The results reveal that sound financial development has a significant negative effect on all the proxies for unemployment (which means improvement in levels of employment) across the different conditional unemployment distributions. The effect of financial development on unemployment was stronger at the lower quantiles (10th and 25th, i.e., for economies with comparatively high levels of unemployment), and the effect reduces at the upper quantiles (75th and 90th, i.e., for economies with comparatively low levels of unemployment). In terms of theory, our findings are in consonance with the arguments presented in Keynes (1937), Keynes (2018), Blanchard (2000) and Smith and Zoega (2009). The results also support extant empirical works such as Raifu (2019) who concluded that the effect of financial development depends on the choice of measures of financial development and also showed the effects differ in the short-run from the long-run. Specifically, the study argued that of all measures of financial developed used, only financial system deposit expressed as percentage of GDP reduces the unemployment rate in the short-run and the long-run. Other financial indicators such as credit to private sector, financial liquidity, financial efficiency and financial stability only reduce the unemployment rate in the short-run. Ajide (2020) who examined the asymmetric impact of financial development and unemployment in Nigeria by using the NARDL technique, and documented that asymmetry exists between financial development and unemployment in the short-run and the long-run. Also, it was established that positive shocks to financial development reduce unemployment in the short-run. Further, Feldmann (2012, 2013) concluded that whether financial development will reduce unemployment or not depends on the level of sophistication of financial system. Consequently, the studies submitted that a higher level of financial system sophistication reduces the unemployment rate in 21 industrial countries, particularly among the total labour force and high-skilled workers. Similarly, Pagano and Pica (2012) developed a model that shows how financial sector development aids the provision of employment and reallocation of labour. Testing the outcome of the model with data of some groups of countries at the industrial level, they discovered that financial development indeed promotes employment, especially in non-OECD countries. However, the positive effect of financial development on employment occurs when the economy is in good condition. When the economy is in crisis or financial sector is in crisis, employment grows less in the industries that depend more on external source of financing and that are located in more financially developed countries. Lastly, Aliero et al. (2013) also posited that financial development tends to reduce unemployment in Nigeria.

Conversely, the results are in opposition to the findings documented in other studies who argued that financial development worsens unemployment under some financial or labour market conditions. For instance, Borsi (2018) investigated the impact of credit contraction on labour market performance in 20 OECD countries. Using Local Projection estimation method, they found that a decline in private credit raises the level of total, youth and long-term unemployment. The youth are affected more than the total and long-term unemployment. Besides, they also discovered that excessive credit booms are usually accompanied or followed by a significant rise in the level of unemployment. Thus, credit constrictions coupled with labour market rigidity tend to worsen unemployment in OECD countries. For ten European Union member countries, Çiftçioglu and Bein (2017) investigated the nexus between financial development and unemployment. After a running series of regressions and use of different measures of financial development, they summarily concluded that even though the financial development tends to reduce unemployment, albeit their findings are not robust to the choice of financial development. Also, Kim et al. (2019), who investigated the effect of financial development and structure on unemployment for some advanced and developing countries, found that rigid market regulation, bank concentration tend to raise unemployment. Others include Shabbir et al. (2012); Ogbeide et al. (2016) and more recently Ibrahiem and Sameh (2020); Chen et al. (2021) who analysed asymmetry in the impact of financial development and financial structure on unemployment, and made the following submissions: (a) excessive financial development is detrimental to unemployment in more inflexible labour markets economies; (b) focusing on bank-centred or inadequate market-oriented financial structures exacerbate unemployment, specifically in free labour markets economies; and (c) excessive female unemploymentds to private businesses worsens unemployment in more inflexible labour markets economies, while insufficient credit to households exacerbates unemployment in less rigid labour markets economies.

Robustness and Additional Results

For the purposes of robustness checks, we re-conducted all the preliminary tests – panel unit roots, cross-sectional dependence, and the empirical results – qunatile via method of moment and panel heterogeneous causality models by employing a different financial development index measure, which was constructed using World Bank data based on PCA approach. The PCA technique is extensively implemented by previous studies to construct various indices, see e.g., Kumeka et al. (2023) and Adeniyi et al. (2021). The results obtained with this index are presented in Tables 9, 10 and 11. By and large, the results here in this subsection and the ones presented in the previous subsection are qualitatively the same.

Conclusion

Sound financial development has heterogeneous significant consequences on the macroeconomy, which could be improvement or deterioration. It also agreed that there is progressive relation linking finance and growth in developed and developing economies (Bayar, 2016). Nevertheless, financial tumults which pose challenges in the financial sector can have negative impact on the general economy. Hence the net effect of financial development on the key macroeconomic indicators is based on the direction of the effect of financial development – whether the positive effect offsets the negative effect. Expectedly, theory suggests that sound financial development should cause reduction in unemployment through economic growth and the creation of job opportunities in the expansion of financial industry.

Therefore, our current study empirically investigates the relationship between financial development and unemployment among MENA economies. Primarily, our goal is to examine this relationship across the dynamic conditional unemployment distribution and the panel heterogeneous causality direction among the relevant variables. To accomplish the objective of the paper, we employed annual data for the time running from 1991 to 2019. We also used numerous proxies for the levels of unemployment such as total unemployment, male unemployment, youth unemployment, male youth unemployment and female youth unemployment, financial development was proxied by the IMF’s financial development index and a financial development index constructed with the World Bank data. We implemented the analyses by adopting the recent Machado and Silva (2019)’s quantile via the method of moment regression and the Dumitrescu and Hurlin (2012) heterogeneous panel causality approach.