Abstract

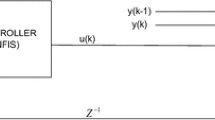

This paper presents a novel technique to forecast the price trend (direction) of 25 different commodities, listed on international markets, using a neuro-fuzzy controller. The forecasting system is based on two independent adaptive neural fuzzy inference systems (ANFISs) that form an inverse controller for each commodity. The ANFIS controller belongs to direct control and is based on inverse learning, also known as general learning. Daily data return sets, for the period 14th October 2009 until 28th September 2012 for 25 different commodities, are used to learn and evaluate the proposed system. The results of the trading simulation and the experimental investigations carried out in the laboratory are provided. The forecast accuracy of the proposed technique is evaluated by out-of-sample tests. The return on equity based on the hit rate and the comparison of equity with the buy and hold strategy are the central evaluation criteria. The results are very encouraging, showing high accuracy of the hit rate reaching 68.33 % and a notable superiority of the return on equity when compared with the buy and hold strategy. Also the performance of the model is compared with that of other approaches.

Similar content being viewed by others

References

Agnolucci, P.: Volatility in crude oil futures: a comparison of the predictive ability of GARCH and implied volatility models. Energy Econ. 31, 316–321 (2009)

Atsalakis, G.S., Valavanis, K.P.: Surveying stock market forecasting techniques—part II: soft computing methods. Expert Syst. Appl. 36, 5932–5941 (2009a)

Atsalakis, G.S., Valavanis, K.P.: Using neuro-fuzzy techniques to predict the stock market trend. Expert Syst Appl. 36, 10696–10707 (2009b)

Azadeh, A., et al.: A flexible neural network-fuzzy mathematical programming algorithm for improvement of oil price estimation and forecasting. Comput. Ind. Eng. 62, 421–430 (2012)

Buchananan, W.K., et al.: Which way the natural gas price: an attempt to predict the direction of natural gas spot price movements using trader positions. Energy Econ. 23, 279–293 (2001)

Cabedo, J., Moya, I.: Estimating oil price “Value at Risk” using the historical simulation approach. Energy Econ. 25, 239–253 (2003)

Chen, D., Bessler, D.: Forecasting monthly cotton price: structural and time series approaches. Int. J. Forecast. 6, 103–113 (1990)

Cheong, C.: Modeling and forecasting crude oil markets using ARCH-type models. Energy Policy 37, 2346–2355 (2009)

El Hedi Arouri, M., et al.: Forecasting the conditional volatility of oil spot and futures prices with structural breaks and long memory models. Energy Econ. 34, 283–293 (2012)

Fong, W.M., See, K.H.: A Markov switching model of the conditional volatility of crude oil futures prices. Energy Econ. 24, 71–95 (2002)

Garcia-Martos, C., et al.: Modeling and forecasting fossil fuels, CO\(_{2}\) and electricity prices and their volatilities. Appl. Energy 101, 363–375 (2012)

Haidar, I., Wolff, R.: Forecasting crude oil price. http://www.usaee.org/usaee2011/submissions/OnlineProceedings/Forecasting%20Crude%20Oil%20Price%20%28Revisited%29.pdf (2009)

He, K., et al.: Crude oil price analysis and forecasting using wavelet decomposed ensemble model. Energy 46, 564–574 (2012a)

He, K., et al.: Ensemble forecasting of value at risk via multi resolution analysis based methodology in metals markets. Expert Syst. Appl. 39, 4258–4267 (2012b)

Hu, J. et al.: Applying neural networks to prices prediction of crude oil futures. Math. Probl. Eng. 2012, Art. ID 959040, pp. 12 (2012). doi:10.1155/2012/959040

Hwa, E.C.: A model of price and quantity adjustments in primary commodity markets. J. Policy Model. 7(2), 305–338 (1985)

Jammazi, R., Aloui, A.: Crude oil price forecasting: experimental evidence from wavelet decomposition and neural network modeling. Energy Econ. 34, 828–841 (2012)

Jang, J. (ed.): Neuro-Fuzzy and Soft Computing. A Computational Approach to Learning and Machine Intelligence. Prentice Hall, Upper Saddle River (1997)

Kaboudan, M.A.: Compumetric forecasting of crude oil prices. In: Paper presented at Proceedings of the IEEE congress on evolutionary computation, Seoul, Korea (2001)

Kang, S., et al.: Forecasting volatility of crude oil markets. Energy Econ. 31, 119–125 (2009)

Kohzadi, N., et al.: A comparison of artificial neural network and time series models for forecasting commodity prices. Neurocomputing 10, 169–181 (1996)

Kumar, M.: The forecasting accuracy of crude oil futures prices. International Monetary Fund, Research Department, Working Paper (1991)

Li, G., et al.: Short-term price forecasting for agro-products using artificial neural networks. Agric. Agric. Sci. Procedia 1, 278–287 (2010)

Li, J., Thompson, H.: A note on the oil price trend and GARCH shocks. Energy J. 31(3), 159–166 (2010)

Malik, F., Nasereddin, M.: Forecasting output using oil prices: a cascaded artificial neural network approach. J. Econ. Bus. 58, 168–180 (2006)

Murat, A., Tokat, E.: Forecasting oil price movements with crack spread futures. Energy Econ. 31, 85–90 (2009)

Mutafoglu, T.: Forecasting precious metal price movements using trader positions. Resour. Policy 37, 273–280 (2012)

Nomikos, N., Pouliasis, P.: Forecasting petroleum futures markets volatility: the role of regimes and market conditions. Energy Econ. 33, 321–337 (2011)

Parisi, A., et al.: Forecasting gold price changes: rolling and recursive neural network models. J. Multinatl. Financ. Manag. 18, 477–487 (2008)

Pierdzioch, C., et al.: Forecasting metal prices: do forecasters herd? J. Bank. Financ. (2012). doi:10.1016/j.jbankfin.2012.08.016

Sadorsky, P.: Modeling and forecasting petroleum futures volatility. Energy Econ. 28, 467–488 (2006)

Shafiee, S., Topal, E.: An overview of global gold market and gold price forecasting. Elsevier Resour. Policy 35, 178–189 (2010)

Shiang, T.: Forecasting volatility with smooth transition exponential smoothing in commodity market. Working paper, University Putra, Malaysia (2010)

Slade, M.: Trends in natural resource commodity prices: an analysis of the time domain. J. Environ. Econ. Manag. 9, 122–137 (1982)

Souza e Silva, E., et al.: Forecasting oil price trends using wavelets and hidden Markov models. Energy Econ. 32, 1507–1519 (2010)

Wan, J., Liu, L.: A study of Shanghai fuel oil futures price volatility based on high frequency data: long-range dependence, modeling and forecasting. Econ. Model. 29, 2245–2253 (2012)

Xu, B.X., Ouenniche, J.: A data envelopment analysis-based framework for the relative performance evaluation of competing crude oil prices’ volatility forecasting models. Energy Econ. 34, 576–583 (2012)

Ye, M., et al.: A monthly crude oil spot price forecasting model using relative inventories. Int. J. Forecast. 21, 491–501 (2005)

Ye, M., et al.: Forecasting short-run crude oil price using high- and low-inventory variables. Energy Policy 34, 2736–2743 (2006)

Ye, P., et al.: Forecasting crude oil spot price by WNN using OECD petroleum inventory levels. In: Proceedings of IWIF-II, Chengdu, China (2007)

Yu, L., et al.: Forecasting crude oil price with an EMD-based neural network ensemble learning paradigm. Energy Econ. 30, 2623–2635 (2008)

Yu, W., et al.: Forecasting crude oil market volatility: further evidence using GARCH-class models. Energy Econ. 32, 1477–1484 (2010)

Yu, W.: Forecasting volatility of fuel oil futures in China: GARCH-type, SV or realized volatility models? Physica A 391, 5546–5556 (2012)

Zamani, M.: An econometrics forecasting model of short term oil spot price. 6th IAEE European conference (2004)

Zhou, S., et al.: A dynamic meta-learning rate-based model for gold market forecasting. Expert Syst. Appl. 39, 6168–6173 (2012)

Zou, H.F., et al.: An investigation and comparison of artificial neural network and time series models for Chinese food grain price forecasting. Neurocomputing 70, 2913–2923 (2007)

Zunino, L., et al.: Commodity predictability analysis with a permutation information theory approach. Physica A 390, 876–890 (2011)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Atsalakis, G., Frantzis, D. & Zopounidis, C. Commodities’ price trend forecasting by a neuro-fuzzy controller. Energy Syst 7, 73–102 (2016). https://doi.org/10.1007/s12667-015-0154-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12667-015-0154-8