Abstract

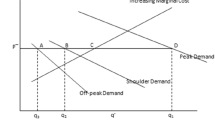

We determine the gains in efficiency accruing to a monopolist producer facing a non-linear market demand under a time-of-use (TOU) pricing structure as opposed to a flat rate pricing (FRP) structure. In particular, we consider the constant elasticity of demand function and the exponential demand function for this analysis. We estimate the price and quantity demanded for these two types of functions and optimize the profit earned by the producer. A comparison of the linear, exponential, and constant elasticity of demand functions shows that in cases of linear and exponential demand, the TOU pricing works to reduce the peak demand below the installed capacity and saves on additional investment and operation costs, while no such reduction takes place in the case of constant elasticity of demand. However, profit accruing to the monopolist under the TOU pricing structure exceeds that under FRP, irrespective of the form of the demand function. Thus, we conclude that regardless of the shape of the demand function, a time-varying pricing structure is better than the traditional FRP. Finally, we study some implications for the policy maker if such a pricing structure is implemented.

Similar content being viewed by others

Notes

Detailed solution available on request.

Detailed Proof available on request.

The value of p obtained after running the C program is 8.15 in contrast to the optimal value of 8.99 obtained through AMPL. Thus, the N-R method does not provide an optimal solution to the NLP problem but for the sake of theoretical completeness, it is applied to solve the non-linear equation in (8) that cannot otherwise be solved by usual mathematical methods. When the problem is fed into AMPL, the optimal solution of the non-linear programming problem is obtained, nevertheless.

The data on power generation and operating costs have been obtained by modelling a 500 MW generator in a power plant in central India. Each day has been divided into 9 h of off-peak, 8 h of shoulder, and 7 h of peak period, as assumed by Cellibi and Fuller (2001)..

References

Cellibi., E., and Fuller., J.D. : A model for efficient consumer pricing schemes in electricity markets. IEEE Trans. Power Syst. 22, 60–67 (2007)

Filippini, M.: Short-and long-run time-of-use price elasticities in Swiss residential electricity demand. Energy Policy 39, 5811–5817 (2011)

Hatami, A., Hossein, S., Mohammad, K.S.: A stochastic-based decision-making framework for an electricity retailer: time-of-use pricing and electricity portfolio optimization. IEEE Trans. Power Syst. 26, 1808–1816 (2011)

Herter, K., McAuliffe, P., Rosenfeld, A.: An exploratory analysis of California residential customer response to critical peak pricing of electricity. Energy 32, 25–34 (2007)

Kaicker, N., Dutta, G., Das, D.: Time-of-use pricing of electricity in monopoly and oligopoly. Opsearch 58, 1–28 (2021)

Reiss, P.C., Matthew, W.W.: Household electricity demand, revisited. Rev. Econ. Stud. 72, 853–883 (2005)

Roozbehani, M., Munther, A.D., Mitter, S.K.: Volatility of power grids under real-time pricing. IEEE Trans. Power Syst. 27, 1926–1940 (2012)

Funding

Not Applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Not Applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kaicker, N., Dutta, G. & Mishra, A. Time-of-use pricing in the electricity markets: mathematical modelling using non-linear market demand. OPSEARCH 59, 1178–1213 (2022). https://doi.org/10.1007/s12597-021-00564-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-021-00564-y