Abstract

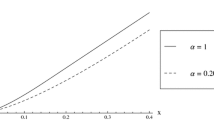

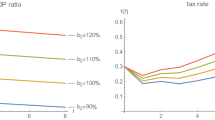

When optimal trajectories are followed, what is the appropriate income tax rate on external debt? This study offers explanation to this question from the perspective of optimal control of external debt for a developing economy. The study proposes to use the methods of continuous-time optimal control theory to determine the external debt path wherein the welfare of the household sector is maximised over a given horizon. The implications of the obtained results are stated. The utility of the optimal debt policy is illustrated for the Nigerian case and the income tax rate that is consistent with the optimal external debt path is identified using the Kolmogorov–Smirnov test statistic. The analysis finds that there is a tendency for the optimal debt stock to fall as the income tax rate is increased.

Similar content being viewed by others

Notes

Wages are determined on the basis of minimum wage legislation and implemented by the Income, Salaries and Wages Commission.

This is because there is no provision for interest cancellation in debt rescheduling.

Final consumption expenditure (formerly total consumption) is the sum of household final consumption expenditure (private consumption) and general government final consumption expenditure (general government consumption).

General government final consumption expenditure (formerly general government consumption) includes all government current expenditures for purchases of goods and services (including compensation of employees).

GDP is the sum of gross value added by all resident producers in the economy plus any product taxes and minus any subsidies not included in the value of the products.

Gross capital formation (formerly gross domestic investment) consists of outlays on additions to the fixed assets of the economy plus net changes in the level of inventories.

References

Abdullahi, M.M., Bt Abu Bakar, N.A., Hassan, S.B.: Determining the macroeconomic factors of external debt accumulation in Nigeria: an ARDL bound test approach. Proc. Soc. Behav. Sci. 211, 745–752 (2015)

Abutaleb, A.S., Hamad, M.G.: Optimal foreign debt for Egypt: a stochastic control approach. Econ. Model. 29, 544–556 (2012)

Adam, K.: Government debt and optimal monetary and fiscal policy. Eur. Econ. Rev. 55, 57–74 (2011). https://doi.org/10.1016/j.euroecorev.2010.11.003

Ajayi, S.I. (1991) Macroeconomic approach to external debt: the case of Nigeria. AERC Research Paper 8. Initiatives Publishers, Nairobi

Anita, S., Arnautu, V., Capasso, V.: An Introduction to Optimal Control Problems in Life Sciences and Economics. Springer, New York (2011)

Anyanwu, J.C.: Nigerian Public Finance. Joanes Educational Publishers Ltd, Onitsha (1997)

Brock, W.E.: Trade and debt: the vital linkage. Foreign Aff. 62(5), 1037–1057 (1984)

Casalin, F., Dia, E., Hallett, A.H.: Public debt dynamics with tax revenue constraints. Econ. Model. (2020). https://doi.org/10.1016/j.econmod.2019.11.035

Datta, M.: Measurement of capital stock: the PIM and the equivalent proportional depreciation approach. Indian Econ. Rev. 41(2), 173–194 (2006)

Edo, S., Osadolor, N.E., Dading, I.F.: Growing external debt and declining export: the concurrent impediments in economic growth of sub-Saharan African countries. Int. Econ. (2019). https://doi.org/10.1016/j.inteco.2019.11.013

Fleming, W.H., Stein, J.L.: Stochastic optimal control, international finance and debt. J. Bank. Financ. 28, 979–996 (2004)

Gemmell, N.: Debt and the developing countries: a simple model of optimal borrowing. J. Dev. Stud. 24(2), 197–213 (1988). https://doi.org/10.1080/00220388808422063

Guobadia, S.: Monetary policy, capital accumulation and output in the Nigerian economy. In: Iyoha, M.A., Itsede, C.O. (eds.) Nigerian Economy: Structure, Growth and Development, pp. 203–221. Mindex Publishing, Benin City (2002)

Greiner, A.: Human capital formation, public debt and economic growth. J. Macroecon. 30, 415–427 (2008)

Kamien, M.I., Schwartz, N.L.: Dynamic Optimization: The Calculus of Variation and Optimal Control in Economics and Management, 2nd edn. Elsevier, Amsterdam (1992)

Lee, C., Wills, D., Schluter, G.: Examining the Leontief paradox in U.S. agricultural trade. Agric. Econ. 2, 259–272 (1988)

Muhanji, S., Ojah, K.: Management and sustainability of external debt: a focus on the emerging economies of Africa. Rev. Dev. Fin. 1, 184–206 (2011)

Muhanji, S., Ojah, K.: External shocks and persistence of external debt in open vulnerable economies: the case of Africa. Econ. Model. 28, 1615–1628 (2011)

Nakajima, T., Takahashi, S.: The optimum quantity of debt for Japan. J. Jpn. Int. Econ. (2017). https://doi.org/10.1016/j.jjie.2017.08.002

Nemlioglu, I., Mallick, S.: Does multilateral lending aid capital accumulation? Role of intellectual capital and institutional quality. J. Int. Money Financ. (2020). https://doi.org/10.1016/j.jimonfin.2020.102155

Nikaido, H.: Prices and income distribution in a Leontief economy. J. Econ. Behav. Organ. 1, 61–79 (1980)

Obadan, M.I.: External debt and management policy. In: Iyoha, M.A., Itsede, C.O. (eds.) Nigerian Economy: Structure, Growth and Development, pp. 327–350. Mindex Publishing, Benin City (2002)

Obstfeld, M., Rogoff, K.: Foundation of International Macroeconomics. The MIT Press, Cambridge (1996)

Qureshi, I., Liaqat, Z.: The long-term consequences of external debt: revisiting the evidence and inspecting the mechanism using panel VARs. J. Macroecon. 63, 103184 (2020). https://doi.org/10.1016/j.jmacro.2019.103184

Raheem, M.I.: Assessing and managing external debt problems in Nigeria. World Dev. 22(8), 1223–1242 (1994)

Siddique, A., Selvanathan, E.A., Selvanathan, S.: The impact of external debt on growth: evidence from Highly Indebted Poor Countries. J. Policy Model. (2016). https://doi.org/10.1016/j.jpolmod.2016.03.011

Sanusi, G. P.: The impact of oil export earnings on Nigeria’s external debt. Working Paper, International Association for Energy Economics, USA (2010)

Thanh, S.D., Canh, N.P., Ha, N.T.T.: Debt structure and earnings management: a non-linear analysis from an emerging economy. Finance Research Letters (2020). https://doi.org/10.1016/j.frl.2019.08.031

Weber, T.A.: Optimal Control Theory with Applications in Economics. The MIT Press, Cambridge (2011)

Yakita, A.: Sustainability of public debt, public capital formation, and endogenous growth in an overlapping generations setting. J. Public Econ. 92, 897–914 (2008)

Funding

No funding applicable for this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ekhosuehi, V.U. Optimal control of external debt for a developing economy. OPSEARCH 58, 889–905 (2021). https://doi.org/10.1007/s12597-021-00514-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12597-021-00514-8