Abstract

In 2019, CO2 emissions in Germany dropped by 40 Mt compared to the previous year, of which a major share was realized in the power sector. Many factors, such as carbon and fuel prices as well as the capacity expansion of renewable energy sources, influence Germany’s CO2 emissions. This ex-post regression analysis of the German power market from 2016 to 2019 investigates the contribution of each factor to the CO2 emissions reduction. The results suggest that short-term market developments for gas prices are responsible for a major share of 2019’s CO2 emissions reduction when compared to 2018 levels. The sustainable transition of the power system, in form of adequate CO2 prices and additional renewable energy capacities, becomes the dominating factor when analyzing the CO2 emissions reductions over the longer time span from 2016 to 2019. Exogenous factors, such as increasing gas prices, could raise Germany’s carbon emissions again. This reversion of carbon emissions reductions can be avoided if the overall-society compromise on the coal phase-out is realized sooner than later.

Zusammenfassung

Im Jahr 2019 sanken die CO2-Emissionen in Deutschland im Vergleich zum Vorjahr um 40 Mt, wobei der Stromsektor den größten Beitrag leistete. Viele Faktoren, wie CO2- und Brennstoffpreise, sowie der Ausbau der erneuerbaren Energien, beeinflussen die deutschen CO2-Emissionen. Die vorliegende Ex-Post-Regressionsanalyse des deutschen Strommarktes von 2016 bis 2019 untersucht den Beitrag der einzelnen Faktoren zur CO2-Emissionsreduktion. Die Ergebnisse deuten darauf hin, dass kurzfristige Marktentwicklungen, wie der Rückgang der Gaspreise, für einen wesentlichen Anteil der CO2-Emissionsreduktion im Jahr 2019 im Vergleich zu 2018 verantwortlich sind. Die nachhaltige Transformation des Energiesystems durch adäquate CO2-Preise und den Ausbau erneuerbarer Energien wird zum dominierenden Faktor des langfristigen Rückgangs der CO2 Emissionen von 2016 bis 2019. Exogene Faktoren, wie z. B. steigende Gaspreise, könnten die deutschen Kohlendioxidemissionen wieder erhöhen. Diese Rückabwicklung der Emissionsminderungen kann vermieden werden, wenn der gesamtgesellschaftliche Kompromiss zum Kohleausstieg zeitnah umgesetzt wird.

Similar content being viewed by others

This study investigates the causes for Germany’s carbon emissions reduction in the power sector. Based on a regression analysis, the emissions reduction effects of key impact factors of the power system are decomposed and quantified for 2019 and before.

1 Introduction

The reduction of carbon emissions is the key element of limiting global warming (IPCC 2015). Within several international treaties (e.g. Kyoto Protocol, Paris Agreement) Germany committed itself to reduce its carbon emissions step by step (UN 1998; UNFCCC 2015). For 2020, the goal of the German government is to reduce its emissions by 40% compared to 1990 (BMWi 2019). However, until recently Germany was not on track for reaching its goals. Therefore, the government undertook new measures, which are bundled in the climate protection program 2020 (‘‘Aktionsprogramm Klimaschutz 2020’’; BMU 2014. This had been widely criticized as insufficient (Horst et al 2016; Öko-Institut and Fraunhofer-ISI 2019). Hence, projections for the emissions in 2020 showed that Germany will fail to reach its climate targets (BMWi 2019).

In contrast to earlier projections, the carbon emissions decreased to a larger extent than expected in 2019, putting 2020 climate targets within reaching distance. A major share of the emissions reduction was realized in the power sector (Hain et al 2020). Here, the emissions dropped by 40 Mt CO2 which equals -15% compared to the previous year (UBA 2020a). Therefore, the question arises: What are the responsible factors for the large decrease in carbon emissions in the power sector and will this effect persist?

Klobasa and Sensfuß (2009, 2011, 2013, 2016) find that the expansion and increased generation of renewable energy sources (RES) continuously decreases German carbon emissions. Moreover, imports and exports play an important role regarding the power system’s emissions in Germany due to its position in central Europe with many interconnections (Abrell et al 2018). Further analyses showed that demand as well as fuel and carbon prices affect the carbon emissions because of their impact on power plant dispatch (Anke 2019; Hirth 2018; Bublitz et al 2017; Kallabis et al 2016).

Out of the above-mentioned factors that affect carbon emissions, the literature so far focused on the carbon mitigation of RES. Oliveira et al (2019) show that in Ireland wind energy mitigates 0.459 t\({}_{\text{CO}_{2}}\) per MWh, an effect roughly equal to the emissions of a natural gas-fired power plant. Furthermore, their research indicates that with the expansion of RES the carbon mitigation effect is not reduced, as Clancy et al (2015) and Di Cosmo and Valeri (2014) suggest. Additionally, O’Mahoney et al (2017) find for Ireland that a one-unit increase in wind feed-in has only 65% of the carbon offsetting effect as a one-unit reduction of demand. For the German and Spanish market, Abrell et al (2018) analyze the carbon mitigation of wind and solar and find that the carbon mitigation costs of solar exceed the mitigation costs of wind by a factor of five to eight. This reflects the technologies’ different availability and the associated market conditions. The results for different market areas are not comparable since their power generation portfolios differ greatly. Thus, it is unsurprising that the avoided emissions from wind energy in Ontario, Canada (Amor et al 2014), where a lot of hydro power is installed, are substantially lower than, for instance, in Texas, USA (Novan 2015), where natural gas and coal fired power plants provide the most energy.

In contrast to the currently existing studies, this analysis deconstructs which of the above-mentioned impact factors are responsible for the carbon emissions decrease in 2019. The identification and quantification of effects are based on a regression model for the years 2016 to 2019. With the results, key drivers are evaluated and their contribution to a sustainable transition toward a decarbonized power system is discussed. The analysis contributes to the existing literature by determining which share of the decrease is a persisting effect and which share is driven by dynamic market developments. Furthermore, the impact of current climate policies on Germany’s carbon emissions is discussed.

The remainder of the paper is structured as follows: In Section 2 market fundamentals of the European Union Emission Trade System (EU ETS) are discussed and the research questions are derived. Section 3 describes the model and data. Following in Section 4, the model results are presented and discussed. Section 5 concludes this analysis and develops policy implications.

2 Background and research questions

In this section the energy economic background for this analysis is presented. From it hypotheses are derived, which will be evaluated on the basis of the regression model’s results. Here, the theoretical impacts of RES, fuel prices and carbon prices are discussed.

RES displace conventional power plants in the merit order because of their low operational costs. This leads to a reduction of power prices and is called ‘‘merit order effect’’ (Diekmann et al 2007; Weigt 2009; Cludius et al 2014). Furthermore, RES reduce the emissions of the power system due to lower power production of (the replaced) fossil fuel-based power plants. RES technologies are expected to have a different effect on CO2 emissions. Here, the focus lies on solar and wind power due to their supply dependence (non-dispatchable generating units) and significance in the German power system. The power production of PV and the peak demand is contemporaneous. Without RES, peak demand has been supplied by mid- and peak-load power plants, such as hard coal and gas power plants. In contrast to PV, wind power is not necessarily contemporaneous with peak demand. From this, these hypotheses follow:

- H1.1:

-

Solar energy not only displaces carbon-intensive mid-load technologies but also less carbon-intensive peak-load technologies, such as gas, and therefore mitigates less carbon emissions than wind power.

- H1.2:

-

Wind energy mostly replaces carbon-intensive base-load and mid-load generation, such as lignite and hard coal, and, thus, avoids more carbon emissions than solar power.

Beside the national replacement of conventional technologies and carbon emissions reductions through RES—the main focus of this analysis—, it is worth considering, how renewable power feed-in affects the export balance of Germany. Imported RES energy can potentially replace conventional power generation in the importing countries. For the effect of RES on Germany’s export balance, it is important to factor in that the power production during peak-load hours of PV leads to a large decrease in German power prices, resulting in a price difference to neighboring countries with lower installed PV capacities. This price difference is used by traders to import low-cost German power. Large price differences to neighboring countries due to PV are augmented by 1) the coinciding of power generation from PV with high demand that is usually met by more expensive peak-load technologies and 2) the large amount of installed PV capacities in Germany, relative to the neighboring countries.

- H1.3:

-

Solar energy leads to more exports from Germany to its neighbors than wind energy.

The operational costs of fossil power plants are mainly determined by fuel and carbon prices. This analysis focuses on gas and hard coal because their prices are determined by international markets.Footnote 1 When the market price for gas declines, the production of gas-fired power plants is expected to increase because their operational costs decrease, relative to other technologies, and the generating units move forward in the merit order and replace coal-fired power plants. This reduces carbon emissions because gas has a lower emission factor (UBA 2016) and typically a higher efficiency (UBA 2020b). Coal prices are expected to have the opposite effect, i.e. price declines enhance the competitiveness of coal-fired power plants and increase carbon emissions.

- H2.1:

-

The gas price positively affects CO2 emissions.

- H2.2:

-

The coal price negatively affects CO2 emissions.

The EU ETS introduces a carbon price in the power sector, leading to increased operational costs for fossil power generation. This effect is more substantial for coal-fired (compared to gas-fired) power plants due to their higher emission factor and typically lower efficiency, making gas-fired power plants more competitive. This is expected to increase their market participation and, in turn, lower carbon emissions.Footnote 2

- H3:

-

The CO2 price negatively affects CO2 emissions.

From a policy perspective these impact factors can be categorized as exogenous and endogenous factors. Exogenous factors cannot be influenced by the national policies or only to a limited degree. This especially applies to fuel prices that represent an equilibrium of regional markets at a given time.Footnote 3 Whereas endogenous factors are the result of a political process, which will last for a longer time period. This applies to the RES generation since their expansion is supported by the government. A special case is the carbon price, a market price that strongly depends on the willingness of politics to further decarbonize the power system (Edenhofer et al 2019). Therefore, carbon mitigation through external factors is based on short-term market developments, which are volatile and do not lead to a transformation of the power system. In contrast, endogenous factors aim at a sustainable transformation and are therefore more persistent.

3 Methodology and data

The goal is to quantify the effects of the above-described factors on the reduction of carbon emissions. Several regression analyses are the basis to parse these effects.

3.1 Regression analysis-based method to estimate effects on CO2 emissions reduction

All regressions of this analysis follow Eq. 1 with changing dependent variables \(Y_{t}\), namely Germany’s 1) CO2 emissions, generation from 2) lignite, 3) gas and 4) hard coal as well as 5) the export balance. The subscript t indicates the hourly resolution of the underlying data for all variables. The independent variables are the electricity generation from solar energy and wind offshore and onshore turbines, electricity demand and prices for gas, hard coal and CO2. Including the load as well as renewable energy generation allows the regression to account for the given residual load, while quantifying the effect of individual renewable energy technologies. Consequently, the residual load is not directly included as an independent variable. To capture static effects, time categorical dummy variables are also included, namely months and years, summarized in \(\mathbf{M}\) and \(\mathbf{Y}\). The first year (2016) and first month (January) serve as reference categories and are omitted from the regression equations.

3.2 Description of underlying data

Table 1 summarizes all dependent and independent variables for the years 2016 to 2019. As indicated in Eq. 1, all generation variables, in addition to load and emissions, assume an hourly temporal resolution. The prices have a daily resolution and are replicated to match the hourly time series of the remaining variables. Price variables are only available from Monday to Friday. For Saturdays and Sundays the values of the previous Friday are used. The CO2 emissions are computed by multiplying the hourly time series of lignite, hard coal and gas with the technology-specific emission factors and dividing the products by the respective efficiency listed in Table 2. Constant emission factors are assumed for this analysis. Note that these can vary over time, e.g. due to a changing composition of fuels.

The time series for the German power generation are taken from Agora Energiewende (2020). They represents great parts of the German power sector and are based on data from ENTSO‑E that are further processed (Agora Energiewende 2019). Although the ENTSO‑E data set has weaknesses, it is one of the most extensive data set available (Hirth et al 2018) and many of the known flaws are corrected by the processing of Agora Energiewende (2019). Additionally, the fuel prices are taken from Thomson Reuters (2020)Footnote 4 and the emission factors are based on UBA (2016). The efficiencies for the power plants are calculated based on the data base of the Chair of Energy Economics (EE2 2019).

4 Results and discussion

4.1 Regression analysis preliminaries

All regressions suffer from heteroskedasticity and positive autocorrelation, determined by means of the Breusch-Pagan test (with and without normality assumption) and the Durbin-Watson test.Footnote 5 Thus, robust Newey-West standard errors are used to account for the presence of heteroskedasticity and positive autocorrelation. The variance inflation factors (VIFs) for the continuous explanatory variables range from 1.64 to 24.35, with the prices of CO2, gas and coal being most affected (in descending order). Although most VIFs are not extremely high, it is important to keep in mind that the presence of multicollinearity may reduce the significance of the affected variables’ regression coefficients. Note that all dependent variables are stationary times series, determined with the Augmented Dickey-Fuller test.

4.2 Regression analysis results

Table 3 displays the results of all five regressions which will be discussed in categories below. The evaluation follows the different categories, namely carbon emissions, conventional power generation and exports.

1) CO2 emissions: The variance in hourly CO2 emissions is captured well by the regression, with an adjusted R2 over 90%. As expected, higher amounts of renewable energy feed-in reduce CO2 emissions. This effect is larger for wind power than for PV generation, confirming hypotheses H1.1 and H1.2., which is mainly due to the lower mitigation of coal by solar and higher exports. The latter aspect confirms hypotheses H1.3. Overall, this means that wind onshore has 50% higher contribution to climate protection per MWh feed-in. As opposed to RES feed-in, higher demand increases emissions in the same magnitude that wind energy reduces emissions. The gas price is a large driver of CO2 emissions: An increase of 1 EUR is associated with 392 t more CO2 per hour, on average, which goes along with hypothesis H2.1. Increases in the coal price are associated with lower CO2 emissions as gas becomes more competitive and likely replaces hard coal-based power generation, thus affirming hypothesis H2.2.Footnote 6 Lastly, the CO2 price has a negative impact on emissions, confirming hypothesis H3. For each 1 EUR increase, on average, CO2 emissions are reduced by 112.5 t per hour.

The calculated carbon mitigation of wind is higher in Germany than in Ireland (about \(0.460\,\mathrm{t}_{\text{CO}_{2}}\) per MWh that, for instance, Oliveira et al (2019), Di Cosmo and Valeri (2014) and Wheatley (2013) account for). For Germany, Abrell et al (2018) find a lower carbon mitigation effect of wind and solar than this work (wind: 0.233 vs. \(0.643\,\mathrm{t}_{\text{CO}_{2}}\) per MWh and solar: 0.175 vs. \(0.472\,\mathrm{t}_{\text{CO}_{2}}\) per MWh), which may be due to the fact that their model only explains 70 to 80% of the conventional displacement. This means that 1 MWh wind displaces only 0.8 MWh of conventional generation. Therefore, the estimated avoided emissions are lower. In contrast, this analysis explains 90%, 97% and 94%Footnote 7 of the displacement, resulting from solar, wind onshore and offshore, respectively. These figures include the exported share of renewable energy.

2)–4) Conventional power generation: The variation in generation of conventional power plants is captured to different degrees. The behavior of market-driven fuel types, hard coal and gas, is explained well, with adjusted R2-values over 80%. The magnitude and significance of the summer month dummy variables also attest to the larger seasonal changes in output based on these two fuels. For lignite-based generation, the explanatory power drops to 74%. This decline attests to the more inflexible operation of base-load units, whose output is seldom affected by market situations and renewable energy feed-in due to low variable costs.Footnote 8 Furthermore, the short-term flexibility is impeded by technical constraints and obligations, such as heat production.

Generally, renewable energy feed-in replaces conventional power generation but with different effects. Solar predominantly replaces hard coal power plants. It has smaller but substantial and significant effects on gas and lignite-fired units as well. This partially confirms hypothesis H1.1, but the effect on gas-fired power plants was expected to be higher. Wind offshore mostly replaces hard coal-based generation. The effects on the remaining technologies are small and partially insignificant. Wind onshore replaces both, lignite and hard coal power plants as well as gas, but to a smaller extent, which attests to hypothesis H1.2.

Rising gas prices make all other technologies more attractive, expressed by positive coefficients for lignite and hard coal and a negative coefficient for gas-based power generation. The same logic applies to coal prices (cf. hypothesis H2.1 and H2.2). The CO2 price positively affects the generation from gas-fired power plants and reduces generation from lignite power plants, affirming hypothesis H3. A surprising and somewhat counter-intuitive result is the insubstantial and insignificant effect of the carbon price on generation from hard coal power plants. The a priori expectation was a larger negative and significant effect, similar to lignite.

5) Export balance: Renewable energy feed-in leads to higher export balances, on average. The coefficients 0.319, 0.426 and 0.210 for solar, wind offshore and wind onshore can be interpreted as the share of renewable energy feed-in that is exported, on average. The effect is larger for solar than for wind onshore, along the lines of hypothesis H1.3. The effect is even higher for wind offshore. This goes against the stated hypothesis if wind onshore and offshore are taken as a combined technology. However, generation from offshore wind turbines fundamentally differs from wind onshore due to higher full load hours as well as less intermittent and more centralized feed-in of energy. This likely affects how much of energy from wind offshore turbines can be integrated in Germany’s energy system.

The first regression helps to identify measures for carbon emissions reduction of ‘‘equal effects’’. On average, a 1 EUR increase in CO2 price has the same effect as ca. 238 MWh of solar energy, ca. 262 MWh of wind offshore energy and ca. 175 MWh of wind onshore energy. With capacity factors of 0.110, 0.376 and 0.217 in 2019Footnote 9, the necessary additional installed capacities to achieve these average effects would be 2,167 MW, 696 MW and 806 MW, respectively. These ‘‘equal effects’’, however, have different monetary implications, i.e. there are different abatement costs associated with the discussed measures. For instance, the above-mentioned 175 MWh of onshore wind energy replaces \(112.5\,\mathrm{t}_{\text{CO}_{2}}\), equal to the average effect of a 1 EUR increase in the carbon price. Assuming levelized cost of energy of 60 EUR/MWh for wind energy (Fraunhofer ISE 2018), the abatement costs come out to be over 90 EUR per \(\mathrm{t}_{\text{CO}_{2}}\), as roughly 1.5 MWh of additional wind energy are needed to replace reduce emissions by \(1\,\mathrm{t}_{\text{CO}_{2}}\). Notably, current CO2 prices are far from these values, which means that a carbon price is the advantageous measure. It is also important to consider that renewable energy generation is associated with costs, possibly subsidized by the government. Carbon prices, on the other hand, can be a source of revenue for governments.

4.3 Computation of carbon emissions reduction effects

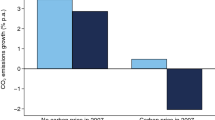

Figure 1 depicts the composition of CO2 emissions reductions, from 2016 to 2019 as well as from 2018 to 2019. Complementary, Table 4 lists all annual mean values of the explanatory factors. The effects on CO2 emissions reductions are computed by multiplying the time series of the respective year and variable with the corresponding coefficient of the first regression and subtracting the sum of the second year from the sum of the base year.Footnote 10

It is important to note that the depicted total annual emissions are exceeded by total emissions stated in UBA (2020a). The reasons for this are threefold. First, electricity generation from oil-fired and non-renewable waste power plants is not included in this analysis due to missing data. Second, the assumption of a static efficiency for each fuel type does not reflect inefficiencies during partial load operation of power plants. Third, the used dataset has known flaws (cf. Section 1).

It becomes evident that the CO2 emissions are reduced between 2016 and 2019 largely due to an increase in wind onshore generation (from below 8 GW, on average, in 2016 to 11.6 GW in 2019) as well as a substantial increase in CO2 price (from \(5.37\,\mathrm{EUR}/\mathrm{t}_{\text{CO}_{2}}\) to \(24.86\,\mathrm{EUR}/\mathrm{t}_{\text{CO}_{2}}\)). A reduced load also contributed substantially to the emissions reduction. The drop from 64.5 GW to 62.7 GW average load is relatively small compared to the substantial avoided emissions of 11 Mt, attesting to the influence of this factor. The gas price is almost the same in both years. Therefore, its slight increase only has a small positive effect on CO2 emissions. The coal price plays a minute role due to a virtually equal price in both years.

The CO2 emissions reductions from 2018 to 2019 are mostly driven by a substantial drop in gas prices, from an average of 22.34 EUR/MWh in 2018 to 15.08 EUR/MWh in 2019. The decline in gas prices causes gas-fired power plants to push CO2-intensive coal-fired power plants out of the merit order, which reduces the overall emissions. This effect is not sustainable since an increase in gas prices would reverse the CO2 savings. Therefore, it is necessary to phase-out the carbon-intensive coal-fired power generation, although it leads to higher compensations for the industry (Breitenstein et al 2020). Renewable energy feed-in has a relatively smaller effect due to similar generation levels in both years. The CO2 price is still one of the larger factors due to an increase between both years. The substantial drop in coal price from 2018 to 2019 has a relatively small positive effect on emissions.

Finally, there are limits to this analysis. Utilizing regression analysis and the computation of average values provides reduction effects that are valid in the current system but may not extend to changing systems. Therefore, the effects may not be static. For instance, the emissions reduction effect of the carbon price may increase or decrease with a changing system, e.g. more renewable expansion and reduced load. This means that the carbon price may become a more or less effective policy tool. Another limitation of this analysis lies in the temporal scope. Future research could include more years, e.g. re-conducting the analysis, once 2020 data is available. Also, an expansion of the method could help to identify more emissions reduction effects, i.e. a different specification of the regression model, which could include interaction terms, e.g. making emissions reduction effects dependent on the given situation of load and renewable energy feed-in. An alternative approach could be the use of multivariate regressions to simultaneously model carbon emissions and generation from conventional power plants to depict the mitigation effects more completely.

5 Conclusion and policy implications

This analysis investigates the CO2 emissions drop in 2019. Therefore, it hypothesizes and quantifies how fuel and carbon prices as well as load and renewable energy feed-in affect carbon emissions in Germany. For this, regression analyses are used to parse and explain the drivers of the carbon emissions reduction from 2016 to 2019 and from 2018 to 2019.

The analysis suggests that the 2019 drop in carbon emissions is rooted, to a large degree, in short-term market developments since the gas price declined substantially, when compared to 2018 levels. When juxtaposing carbon emissions in 2019 and 2016, the gas price effect is negligible due to near-constant levels. Here, the effect of increased renewable energy feed-in is more noticeable, although it is substantial for both year-to-year comparisons. Importantly, the carbon price is a large driver in both cases but especially for the 2016/19 comparison due to a great price increase over the three-year interval. Also, reductions in load have substantial negative effects on emissions. These three factors are key elements of the sustainable transition of the power system and are responsible for 80% of the emissions reduction from 2016 to 2019. For securing the emissions reduction by means of the CO2 price, the introduction of a minimum price can make a great contribution.

When taking into account the emissions reduction targets, it becomes evident that carbon and gas prices as well as the electricity demand and expansion of renewable energy capacities are the main determinants of emissions reduction. The multitude of influential factors makes analyses difficult in times of various market changes, such as during the Covid-19 crisis. Here, demand and gas prices declined but so did carbon prices. Hence, counteracting tendencies occur, whose effects are less clear-cut.

While emissions in 2019 benefited from a low gas price, this is not a guaranteed effect because it is subject to world market-driven factors. While low gas prices and high coal prices surely benefit the carbon emissions in Germany, national policies cannot rely on these drivers. On the other hand, the CO2 price, renewable capacities and load can be influenced on the EU and national level. Therefore, policy makers should focus on these levers to bring about emissions reduction, implemented by efficiency gains for demand reduction, ambitious renewable energy goals and high CO2 prices. An appropriate CO2 price is an indicator of the ability of the EU ETS to mitigate CO2 emissions.

In contrast, policies to secure low gas prices for the German power sector are hard to imagine. However, a phase-out of power plant technologies, negatively affected by low gas prices, would secure the emissions reduction effect of low gas prices. In Germany, hard coal and lignite-fired power plants would have to be phased-out since higher gas prices increase their power production and thereby Germany’s carbon emissions. Although there is an overall-society compromise on the coal phase-out, the government is delaying the timely decommissioning of power plants. Regarding CO2 emissions, however, power plants need to be closed down as soon as possible.

Notes

Oil is excluded from the analysis because it is typically not in a competitive position in the power market.

The costs for carbon emissions per MWh are calculated by multiplying the carbon price with the related emission factor and dividing this product by the power plant efficiency.

Natural gas and coal, especially lignite, are segmented markets with different price developments and dynamics for various regional markets, such as continental Europe, UK, Japan, the US.

The following time series from Thomson Reuters have been used: EEXEUAS (daily CO2-price at EEX), EEXNNCG (daily gas price at NCG) and LMCYSPT (daily coal prices at ICE for ARA).

The tests’ null hypotheses of homoskedastic and uncorrelated error terms, respectively, are rejected at the 0.1% significance level for all five regressions.

Note that gas prices are denoted in EUR/MWh and coal prices in EUR/t, which is roughly equal 0.14 EUR/MWh (assuming an energy content of roughly 7 MWh per 1 t of coal, based on API2). Hence the coefficient of -20 has to be multiplied by ca. 7 to obtain the effect of a 1 EUR/MWh increase, which puts the effects of gas and coal prices in the same order of magnitude.

These numbers are calculated as the sums of coefficients in the first three lines in columns 2)–5) in Table 3 (columns 2)–4) with a positive instead of negative sign).

For generation from nuclear power plants, not detailed in this analysis, the adjusted R2-value is below 50%, which supports the notion of declining explanatory power for base-load power plants.

Summed up generation per technology in relation to installed capacities in 2019 from Fraunhofer ISE (2020).

For both year-to-year analyses, there is a static effect, which captures categorical changes between years, not captured by any other variable. These effects correspond to the year dummy variables of the regression.

References

Abrell J, Kosch M, Rausch S (2018) Carbon abatement with renewables : evaluating wind and solar subsidies in Germany and Spain. J Public Econ 169:1–49. https://doi.org/10.1016/j.jpubeco.2018.11.007

Agora Energiewende (2019) Agorameter – Dokumentation. Tech. rep. https://static.agora-energiewende.de/fileadmin2/Projekte/Agorameter/Hintergrunddokumentation_Agorameter_v36_web.pdf. Accessed 8 May 2020

Agora Energiewende (2020) Agorameter. https://www.agora-energiewende.de/service/agorameter/chart/power_generation/. Accessed 28 Apr 2020

Amor MB, Billette de Villemeur E, Pellat M, Pineau PO (2014) Influence of wind power on hourly electricity prices and GHG (greenhouse gas) emissions: Evidence that congestion matters from Ontario zonal data. Energy 66:458–469. https://doi.org/10.1016/j.energy.2014.01.059 (https://ac.els-cdn.com/S0360544214000814/1-s2.0-S0360544214000814-main.pdf?_tid=5bc99285-1491-40d1-94d6-7e042df03c7b&acdnat=1520924485_f48e3276efcf6926b5a6a5bb8fcf5ca5)

Anke CP (2019) How renewable energy is changing the German energy system—a counterfactual approach. Z Energiewirtsch 43(2):85–100. https://doi.org/10.1007/s12398-019-00253-w

BMU (2014) Aktionsprogramm Klimaschutz 2020 der Bundesregierung. Tech. rep., Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit, Berlin. https://www.bmu.de/fileadmin/Daten_BMU/Download_PDF/Aktionsprogramm_Klimaschutz/aktionsprogramm_klimaschutz_2020_broschuere_bf.pdf. Accessed 10 June 2020

BMWi (2019) Deutsche Klimaschutzpolitik. https://www.bmwi.de/Redaktion/DE/Artikel/Industrie/klimaschutz-deutsche-klimaschutzpolitik.html. Accessed 25 May 2020

Breitenstein M, Anke CP, Nguyen DK, Walther T (2020) Stranded asset risk and political uncertainty: the impact of the coal phase-out on the German coal industry. SSRN Journal. https://doi.org/10.2139/ssrn.3604984

Bublitz A, Keles D, Fichtner W (2017) An analysis of the decline of electricity spot prices in Europe: Who is to blame? Energy Policy 107:323–336. https://doi.org/10.1016/J.ENPOL.2017.04.034

Clancy JM, Gaffney F, Deane JP, Curtis J, Gallachóir ÓBP (2015) Fossil fuel and CO2 emissions savings on a high renewable electricity system - A single year case study for Ireland. Energy Policy 83(2015):151–164. https://doi.org/10.1016/j.enpol.2015.04.011

Cludius J, Hermann H, Matthes FC, Graichen V (2014) The merit order effect of wind and photovoltaic electricity generation in Germany 2008-2016 estimation and distributional implications. Energy Econ 44:302–313. https://doi.org/10.1016/j.eneco.2014.04.020

Di Cosmo V, Valeri LM (2014) The effect of wind on electricity CO2 emissions: the case of Ireland. https://www.esri.ie/system/files?file=media/file-uploads/2015-07/WP493.pdf. Accessed 17 Oct 2018

Diekmann J, Krewitt W, Musiol F, Nicolosi M, Ragwitz M, Sensfuß F, Weber C, Wissen R, Woll O (2007) Abgestimmtes Thesenpapier. Tech. rep., Bundesministeriums für Umwelt, Naturschutz und Reaktorsicherheit, Berlin. https://www.bmu.de/fileadmin/bmu-import/files/pdfs/allgemein/application/pdf/thesenpapier_meritordereffekt.pdf. Accessed 3 Nov 2020

Edenhofer O, Flachsland C, Kalkuhl M, Knopf B, Pahle M (2019) Optionen für eine CO2-Preisreform. http://hdl.handle.net/10419/201374. Accessed 2 June 2020

EE2 (2019) Data base of the chair of energy economics

Fraunhofer ISE (2018) Levelized cost of electricity—renewable energy technologies. https://www.ise.fraunhofer.de/content/dam/ise/en/documents/publications/studies/EN2018_Fraunhofer-ISE_LCOE_Renewable_Energy_Technologies.pdf. Accessed 1 Oct 2020

Fraunhofer ISE (2020) Net installed electricity generation capacity in Germany. https://energy-charts.de/power_inst.htm. Accessed 26 May 2020

Hain F, Peter F, Graichen P (2020) Die Energiewende im Stromsektor: Stand der Dinge 2019. Tech. rep., Agora Energiewende, Berlin, 088/01-A-2016/DE. https://static.agora-energiewende.de/fileadmin2/Projekte/2019/Jahresauswertung_2019/171_A-EW_Jahresauswertung_2019_WEB.pdf. Accessed 28 Feb 2020

Hirth L (2018) What caused the drop in European electricity prices? A factor decomposition analysis. Energy J. https://doi.org/10.5547/01956574.39.1.lhir

Hirth L, Mühlenpfordt J, Bulkeley M (2018) The ENTSO‑E transparency platform—a review of Europe’s most ambitious electricity data platform. Appl Energy 225(May):1054–1067. https://doi.org/10.1016/j.apenergy.2018.04.048

Horst J, Hasuer E, Barbara D (2016) Reichen die beschlossenen Maßnahmen der Bundesregierung aus , um die Klimaschutzlücke 2020 zu schließen? Tech. rep. https://www.klima-allianz.de/fileadmin/user_upload/Dateien/Daten/Publikationen/Hintergrund/2016_11_Klimaschutzluecken_2020_Studie.pdf. Accessed 3 Nov 2020

IPCC (2015) Climate Change 2014: Synthesis Report. https://www.ipcc.ch/pdf/assessment-report/ar5/syr/SYR_AR5_FINAL_full_wcover.pdf. Accessed 3 Nov 2020

Kallabis T, Pape C, Weber C (2016) The plunge in German electricity futures prices—analysis using a parsimonious fundamental model. Energy Policy 95:280–290. https://doi.org/10.1016/J.ENPOL.2016.04.025

Klobasa M, Sensfuß F (2009) CO2-Minderung im Stromsektor durch den Einsatz erneuerbarer Energien im Jahr 2006 und 2007. Tech. rep., Fraunhofer ISI, Karlsruhe. https://www.erneuerbare-energien.de/EE/Redaktion/DE/Downloads/Gutachten/co2-minderung-stromsektor-2006-07.pdf. Accessed 3 Nov 2020

Klobasa M, Sensfuß F (2011) CO2-Minderung im Stromsektor durch den Einsatz erneuerbarer Energien im Jahr 2008 und 2009. Tech. rep., Fraunhofer ISI, Karlsruhe. https://www.isi.fraunhofer.de/content/dam/isi/dokumente/ccx/2011/Abschlussbericht_Gutachten-CO2-ISI_2008-2009.pdf. Accessed 3 Nov 2020

Klobasa M, Sensfuß F (2013) CO2-Minderung im Stromsektor durch den Einsatz erneuerbarer Energien im Jahr 2010 und 2011. Tech. rep., Fraunhofer ISI, Karlsruhe. https://www.isi.fraunhofer.de/content/dam/isi/dokumente/ccx/2013/Abschlussbericht_Gutachten-CO2-ISI_2010-2011.pdf. Accessed 3 Nov 2020

Klobasa M, Sensfuß F (2016) CO2-Minderung im Stromsektor durch den Einsatz erneuerbarer Energien in den Jahren 2012 und 2013. Tech. rep., Umweltbundesamt. https://www.umweltbundesamt.de/sites/default/files/medien/378/publikationen/climate_change_11_2016_co2_minderung_im_stromsektor_durch_den_einsatz_erneuerbarer_energien_0.pdf. Accessed 3 Nov 2020

Novan K (2015) Valuing the wind: renewable energy policies and air pollution avoided. Am Econ Journal: Econ Policy 7(3):291–326. https://doi.org/10.1257/pol.20130268

Öko-Institut FISI (2019) Umsetzung Aktionsprogramm Klimaschutz 2020 – Begleitung der Umsetzung der Maßnahmen des Aktionsprogramms – 3. Quantifizierungsbericht. Tech. rep., Berlin, Karlsruhe. https://www.oeko.de/fileadmin/oekodoc/APK-2020-Quantifizierungsbericht-2018.pdf. Accessed 3 Nov 2020

Oliveira T, Varum C, Botelho A (2019) Wind Power and CO2 Emissions in the Irish Market. Energy Econ 80:48–58. https://doi.org/10.1016/J.ENECO.2018.10.033

O’Mahoney A, Denny E, Hobbs BF, O’Malley M (2017) The drivers of power system emissions: an econometric analysis of load, wind and forecast errors. Energy Syst. https://doi.org/10.1007/s12667-017-0253-9

Thomson Reuters (2020) Thomson Reuters Datastream. Subscription%0AService

UBA (2016) Emissionsfaktoren für fossile Brennstoffe. Tech. rep., Umweltbundesamt, Dessau. https://www.umweltbundesamt.de/publikationen/co2-emissionsfaktoren-fuer-fossile-brennstoffe. Accessed 3 Nov 2020

UBA (2020a) Entwicklung der spezifischen Kohlendioxid- Emissionen des deutschen Strommix in den Jahren 1990–2019. https://www.umweltbundesamt.de/sites/default/files/medien/1410/publikationen/2020-04-01_climate-change_13-2020_strommix_2020_fin.pdf. Accessed 19 May 2020

UBA (2020b) Konventionelle Kraftwerke und erneuerbare Energien. https://www.umweltbundesamt.de/daten/energie/konventionelle-kraftwerke-erneuerbare-energien#wirkungsgrad-fossiler-kraftwerke. Accessed 28 May 2020

UN (1998) Report of the Conference of the Parties on its third session, held at Kyoto from 1 to 11 December 1997. Tech. rep. https://unfccc.int/process-and-meetings/conferences/past-conferences/kyoto-climate-change-conference-december-1997/cop-3/cop-3-reports. Accessed 3 Nov 2020

UNFCCC (2015) Adoption of the Paris Agreement. Tech. rep. https://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf. Accessed 3 Nov 2020

Weigt H (2009) Germany’s wind energy: The potential for fossil capacity replacement and cost saving. Appl Energy 86(10):1857–1863. https://doi.org/10.1016/J.APENERGY.2008.11.031

Wheatley J (2013) Quantifying CO2 savings from wind power. Energy Policy 63:89–96. https://doi.org/10.1016/j.enpol.2013.07.123

Acknowledgments

We gratefully acknowledge the support of Fabian Hain from Agora Energiewende by providing data for the power generation in Germany. Further, we thank the reviewers for helpful comments and feedback on this work.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Both authors contributed equally to this work.

Rights and permissions

About this article

Cite this article

Anke, CP., Schönheit, D. What caused 2019’s drop in German carbon emissions: Sustainable transition or short-term market developments?. Z Energiewirtsch 44, 275–284 (2020). https://doi.org/10.1007/s12398-020-00289-3

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12398-020-00289-3