Abstract

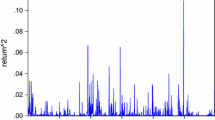

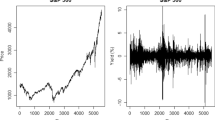

The fluctuation of the freight rates is an important source of risk for all participants in the tanker shipping markets including ship-owners, charterers, traders, hedge funds, banks, etc. This study examines the freight rate risk involved in the most popular clean tanker route and the most popular dirty tanker route using historical prices from April 2008 to September 2015 for the routes TC5 and TD7 which are further divided into an in-sample period from 24 April 2008 to 7 November 2013, to estimate the coefficients and an out-of-sample period from 8 November 2013 to 2 September 2015, to measure the day to day Value at Risk performance. The analysis of the historical returns of both spot and future prices reveals historical distributions with high peaks and fat tails. The establishment of a risk management method that could capture these distribution characteristics is of paramount importance. For the quantification of the risk, the Value at Risk approach is applied. More specifically, a range of parametric (multiple GARCH family) and non-parametric (i.e. historical simulation) Value at Risk models are applied on the returns of both TC5 and TC7 spot and one and three months future markets. The results suggest substantial freight rate risk at both routes. The backtesting of the Value at Risk models is applied in two stages, firstly by the means of statistical accuracy of the results and secondly by the means of economic accuracy, in order to track down the best VAR models in the case of our research. According to the results, the simple GARCH and non-parametric models are proposed for risk management purposes, for both spot and future markets. The results are consistent for both long and short positions. According to the results, simple GARCH non-parametric models perform better in risk management, for both spot and futures markets. The results are consistent for both long and short positions.

Similar content being viewed by others

Notes

It should be mentioned that their conclusion that simpler risk measurement methods should be selected in preference to more complex methods for freight rates are compatible with the conclusions of our study.

This is an index provided as a joint venture between two non-profit organizations, the Worldscale Association Limited (London) and the Worldscale Association Inc. (New York). Both companies are under control of a Management Committee, consisting of senior brokers from leading tanker broking firms in London and New York.

If the quoted price for TD3 is 65 Worldscale points it means 65% of the flat rate. If the flat rate is 10 USD/mt per day it means that the actual price per metric ton is USD 10 * 65% = 6.5 USD/mt per day. In order to obtain the amount of freight this rate has to be multiplied by the total tons of the cargo. If an FFA contact is the case, then actual contract value results from the product of this rate with the lot size and the number of lots.

For example, a Panamax vessel with a voyage from Middle East Gulf to North Asia will be fixed with a higher Worldscale points from a VLCC due to the economies of scale that must favor the charterer of the second one. Similarly, if the demand for tanker transportation decreases within a year, the Worldscale points will be decreased as well.

References

Abouarghoub W (2008) Measuring shipping tanker freight risk

Abouarghoub WM, Mariscal IBF (2011) Measuring level of risk exposure in tanker Shipping freight markets. Int J Bus Soc Res 1(1):20–44

Afzal F, Haiying P (2021) Value-at-risk analysis for measuring stochastic volatility of stock returns: using GARCH-based dynamic conditional correlation model. SAGE Open. https://doi.org/10.1177/21582440211005758

Alizadeh A, Nomikos N (2009) Shipping derivatives and risk management. Palgrave Macmillan, London

Andriosopoulos K, Nomikos N (2013) Risk management in the energy markets and Value-at-Risk modelling: an hybrid approach. https://doi.org/10.1080/1351847X.2013.862173, pp. 548-574

Angabini A Wasiuzzaman S (2011) GARCH models and the financial crisis-a study of the malaysian stock market. Int J App Econ Fin 5(3):226–236. https://doi.org/10.3923/ijaef.2011.226.236

Angelidis T, Skiadopoulos G (2008) Measuring the market risk of freight rates: a value-at-risk approach. Int J Theor Appl Finance 11:447–469

Angelidis T, Benos A, Degiannakis S (2004) The use of GARCH models in VaR estimation. Stat Methodol 1(1):105–128

Argyropoulos C, Panopoulou E (2015) Measuring the market risk of freight rates: a forecast combination approach, Available at SSRN: https://ssrn.com/abstract=2211583 or http://dx.doi.org/https://doi.org/10.2139/ssrn.2211583

Baillie RT, Bollerslev T (1991) Intra-day and inter-market volatility in foreign 19 exchange rates. Rev Econ Stud 58:565–585

Bodie Z, Kane A, Marcus AJ (2009) Investments. Mc Graw Hill, New York

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31:307–327

Bonett DG, Seier E (2002) A test of normality with high uniform power. Comput Stat Data Anal 40:435–445

Bookstaber RM, Pomerantz S (1989) An information-based model of market volatility. Finance Anal J 45:37–46

Bowman KO, Shenton LR (1975) Omnibus test contours for departures from normality based on b1 and b2. Biometrika 62:243–250

Brooks C (2008) Introductory econometrics for finance. Cambridge University Press, Cambridge

Çanakoglu E, Adıyeke E (2020) Comparison of electricity spot price modelling and risk management applications. Energies 13:4698. https://doi.org/10.3390/en13184698

Danielsson J (2011) Financial risk forecasting. Wiley, London

Ding Z, Granger CW, Engle RF (1993) A long memory property of stock market returns and a new model. J Empir Finance 1(1):83–106

Diongue AK, Guegan D, Wolff RC (2008) Wolf exact maximum likelihood estimation for the BL-GARCH model under elliptical distributed innovations, Centre National de la Resherche Scientifique, HAL Id: halshs-00270719 https://halshs.archives-ouvertes.fr/halshs-00270719

Diongue AK, Guegan D, Vignal B (2009) Forecasting electricity spot market prices with a k-factor GIGARCH process. Appl Energy 86(4):505–510

Engle R (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50(4):987–1007

Füss R, Adams Z, Kaiser DG (2008) The predictive power of value-at-risk models in commodity futures markets. J Asset Manag. https://doi.org/10.1057/jam.2009.21

Gel YR, Gastwirth JL (2008) A robust modification of the Jarque-Bera test of normality. Econ Lett 99:30–32

Gel YR, Miao W, Gastwirth JL (2007) Robust directed tests of normality against heavy-tailed alternatives. Comput Stat Camp Data Anal 51:2734–2746

Glosten L, Jagannathan R, Runkle D (1993) On the relation between the expected value and the volatility of the nominal excess return on stocks. J Finance XL VIII:1779–1801

Goerlandt F, Montewka J (2015) A framework for risk analysis of maritime transportation systems: a case study for oil spill from tankers in a ship–ship collision. Saf Sci 76:42–66. https://doi.org/10.1016/j.ssci.2015.02.009

Gupta A, Rajib P (2018) Do VaR exceptions have seasonality? An empirical study on Indian commodity spot prices. IIMB Manag Rev 30(4):369–384. https://doi.org/10.1016/j.iimb.2018.05.008

Hagan PS, Kumar D, Lesniewski AS, Woodward DE (2002) Managing smile risk. WILMOTT Mag 1:84–108

Haug EG (2007) The complete guide to option pricing formulas. The Mcgraw-Hill Companies Inc, New York

Heston S (1993) A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev Financ Stud 6:327–343

Hull JC (2012) Options, futures and other derivatives. Pearson Education Limited, Harlow

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6:255–259

Jensen A, Lange T (2007) Addressing the IGARCH puzzle, Department of Natural Sciences & Department of Mathematical Sciences, University of Copenhagen

Johansson A, Sowa V (2013) A comparison of GARCH models for VaR estimation in three different markets, Mathematics

Katsampoxakis I, Basdekis H, Anathreptakis K (2015) How firm and markets characteristics affect profitability: an empirical study. Int J Corp Finance Account (IJCFA) 2(1):2015. https://doi.org/10.4018/IJCFA.2015010104

Kavussanos MG, Dimitrakopoulos DN (2011) Market risk model selection and medium-term risk with limited data: application to ocean tanker freight markets. Int Rev Finance Anal 20:258–268

Konstantakis K, Papageorgiou T, Christopoulos A, Dokas I, Michaelides P (2019) Business cycles in Greek maritime transport: an econometric exploration (1998–2015). Oper Res Int J 19:1059–1079

Lopez JA (1998) Methods for evaluating Value-at-Risk estimates. Federal Reserve. Bank of New York. Economic Policy Review

Mandelbrot B (1963) The variation of certain speculative prices. J Bus 36:394–419

Matei M (2009) Assessing volatility forecasting models: why GARCH models take the lead. J Econ Forecast Inst Econ Forecast 0(4):42–65

McAleer M (2005) Automated inference and learning in modeling financial volatility. Economet Theor 21:232–261

Nelson DB (1989) Modelling stock market volatility changes. In: Proceedings of the american statistical association, Business and Economic Statistics Section, pp 93–98

Nelson D (1990) ARCH mpdes as diffusion approximations. J Econ 45:7–38

Nelson D (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59(2):347–370

Orhan M, Koksal B (2012) A comparison of GARCH models for VaR estimation. Expert Syst Appl 39(3):3582–3592. https://doi.org/10.1016/j.eswa.2011.09.048

Pearson K (1895) Contributions to the mathematical theory of evolution. II. Skew variation in homogeneous material. Philos Trans R Soc Lond 186:343–414

Pearson K (1905) Das Fehlergesetz und Seine Verallgemeinerungen Durch Fechner und Pearson. A Rejoinder. Biometrika 4(1/2):169–212

Rehman A, Jian W, Khan N, Saqib R (2018) Major crops market risk based on value at risk model in P.R. China. Sarhad J Agric 34(2):435–442. https://doi.org/10.17582/journal.sja/2018/34.2.435.442

Ruppert D (1987) What Is kurtosis?: an influence function approach. Am Stat 41:1–5

Smolović JC, Lipovina-Božović M, Vujošević S (2017) GARCH models in value at risk estimation: empirical evidence from the Montenegrin stock exchange. Econ Res Ekon Istraž. https://doi.org/10.1080/1331677X.2017.1305773

Stopford M (2009) Maritime economics 3e. Routledge, England

Storti D, Vitale C (2003) BL-GARCH models and asymmetries in vitality. Stat Methods Appl 12:19–39. https://doi.org/10.1007/s10260-003-0048-0

Terasvirta T (2006) An introduction to univariate GARCH models. SSE/EFI Working papers in Economics and Finance, 646

Teräsvirta T (2009) An introduction to univariate GARCH models. In: Mikosch T, Kreiß J-P, Davis RA, Andersen TG (eds) Handbook of financial time series. Springer, Berlin Heidelberg, pp 17–42

Zhao LT, Meng I, Zhang YJ, Li YT (2018) The optimal hedge strategy of crude oil spot and futures markets: evidence from a novel method. Int J Finance Econ. https://doi.org/10.1002/ijfe.1656

Zivot E, Wang J (2005) Modeling financial time series with SPLUS. Springer, Berlin Heidelberg, New York

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 1,

2,

3,

4,

5,

6,

7,

8,

9,

10,

11,

12,

13,

14,

15,

16,

17,

18,

19,

20 and

21.

Rights and permissions

About this article

Cite this article

Basdekis, C., Christopoulos, A., Gkolfinopoulos, A. et al. VaR as a risk management framework for the spot and futures tanker markets. Oper Res Int J 22, 4287–4352 (2022). https://doi.org/10.1007/s12351-021-00673-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-021-00673-y