Abstract

This paper extends the analysis of the effects of corporate social responsibility in a bilateral monopoly to the case where a manufacturer and a retailer engaged in a supply chain face competition from a vertically integrated firm. The paper finds that when the manufacturer and the retailer non-cooperatively select their degrees of social concern, they choose to pursue pure profit maximization, irrespective of the order in which they make their choices. These choices put them at a disadvantage with respect to their vertically integrated competitor, who produces more output than they do and obtains higher profits than their joint profits. The paper then shows that when they cooperatively choose their degrees of social concern, they both choose positive degrees of social concern and, therefore, deviate from pure profit maximization. These choices give them a competitive edge over their vertically integrated rival: they produce a higher output and obtain higher joint profits than their competitor. In comparison with the non-cooperative outcome, the positive degrees of social concern cooperatively chosen by the manufacturer and the retailer imply higher output and profits for the retailer and the manufacturer and lower output and profits for their competitor. They also imply lower prices and higher consumer surplus and social welfare.

Similar content being viewed by others

1 Introduction

In recent decades, there has been an increased awareness of the importance of firms’ Corporate Social Responsibility (CSR) (see for instance KPMG (2017); UN Global Compact and Accenture (2019)) and numerous studies devoted to the analysis of its different facets.Footnote 1 In particular, some of this literature studies the effects of CSR when a manufacturer and a retailer are engaged in a vertical supply channel in a bilateral monopoly. The present paper adds to this literature by introducing the existence of competition from a vertically integrated firm into the analysis.

The vertical relationship between a retailer and a manufacturer gives rise to the well-known problem of double marginalization, as studied in the seminal work by Spengler (1950) in the context of a linear bilateral monopoly. Brand and Grothe (2015) also consider this framework, where double marginalization leads to the famous statement phrased as the question “What is worse than a monopoly? A chain of monopolies” (Tirole 1988, p. 175). Brand and Grothe (2015) analyze the effects of firms’ social concern in this context.Footnote 2 They examine the endogenous non-cooperative choice of the degrees of social concern by the manufacturer and the retailer and show that both of them find it profitable to choose positive degrees of social concern. These choices soften the double marginalization problem and lead to a Pareto improvement relative to a situation where firms pursue pure profit maximization, since they result not only in higher profits for both the manufacturer and the retailer, but also in lower prices and higher consumer surplus and social welfare.

Ouchida (2019) extends Brand and Grothe’s (2015) analysis to consider the cooperative choice of firms’ degrees of social concern and finds that it leads to higher degrees of firms’ social concern than those under the non-cooperative scenario and that these choices completely solve the double marginalization problem.

The present paper extends Brand and Grothe’s (2015) study by introducing competition from a vertically integrated firm into the analysis. Just as in Brand and Grothe (2015), it considers a retailer and a manufacturer engaged in a supply chain, but it examines a situation where they face competition from a firm that is vertically integrated and therefore does not suffer from the double marginalization problem.Footnote 3 In this context, it is known that the retailer and the manufacturer are at a disadvantage in comparison with the vertically integrated firm and have incentives to integrate, as studied by Greenhut and Ohta (1979). Here, however, instead of considering vertical integration between the retailer and the manufacturer, the impact of introducing social responsibility into their objective functions is studied. Both non-cooperative and cooperative choices of their degrees of social concern are considered, as studied by Brand and Grothe (2015) and Ouchida (2019), respectively, for bilateral monopoly.

The aim of the current paper is to study how the effects of social responsibility on the double marginalization problem in a bilateral monopoly extend to the case where the vertical supply chain faces competition from another firm. It explores the simple case where this competitor firm is vertically integrated and thus does not face a double marginalization problem. This approach allows to study how the use of social responsibility by a manufacturer and a retailer engaged in a vertical supply chain compares with the use of simple vertical integration by a rival firm in a competitive environment.

The main results of the paper are as follows. In contrast to the bilateral monopoly case (Brand and Grothe 2015), a retailer and a manufacturer that are engaged in a supply chain and non-cooperatively select their degrees of social concern choose to pursue pure profit maximization if they face competition from a vertically integrated firm. This puts them at a disadvantage with respect to their vertically integrated competitor, who produces an output higher than theirs and obtains profits higher than their joint profits.

The paper also examines the case where the retailer and the manufacturer choose their degrees of social concern cooperatively, as in Ouchida (2019). It finds that in this case they do choose positive degrees of social concern and that these choices give them a competitive edge over their vertically integrated competitor, and both their output and their joint profits are higher than those of their competitor. The paper finds as well that, in comparison with the case of pure profit maximization, the positive degrees of social concern cooperatively chosen by the manufacturer and the retailer lead to higher output and profits for the retailer and the manufacturer and lower output and profits for their competitor. Moreover, they lead to lower prices and higher consumer surplus and social welfare.

The paper finally considers an extension where the vertically integrated firm also chooses its own degree of social concern. It turns out that this choice depends on whether the retailer and the manufacturer choose their degrees of social concern on a cooperative or a non-cooperative fashion, adding another dimension to the difference between these two frameworks.

It is worthwhile to remark that among the different approaches to CSR that emphasize its various different aspects,Footnote 4 in this paper CSR refers to a firm incorporating into its objective function the interests of parties different from its shareholders. More specifically, this paper concentrates on the firm’s commitment to incorporate consumers’ interests,Footnote 5 in the form of a fraction of Consumer Surplus, into its objective function. It studies the use of this commitment for strategic purposes,Footnote 6 that is, it investigates the “profit-maximizing” caseFootnote 7 for the use of CSR (See Carroll and Shabana 2010).

The remainder of this introduction puts the present paper in the context of the general literature on CSR, reviewing the work most related to it. The profit-enhancing nature of CSR also appears in work by Lambertini and Tampieri (2015), Kopel and Brand (2012), Fanti and Buccella (2017a, b) and Planer-Friedrich and Sahm (2020), among others. For instance, Lambertini and Tampieri (2015) (see also Lambertini and Tampieri 2012) find that a firm that commits to being socially responsible, in the sense of taking into account environmental issues and consumer surplus, obtains higher profits than its profit-maximizing competitors provided that the market is large enough. This is in the same vein as Kopel and Brand (2012) who also find that a firm that incorporates a fraction of consumer surplus in its objective function obtains higher profits than its profit-maximizing competitor. Similarly, Fanti and Buccella (2017a) study firms’ decisions on whether or not to adopt CSR rules—where this means including an exogenous given fraction of Consumer Surplus in its objective function—for strategic reasons in a duopoly model with differentiated products. They find that, depending on the degree of product differentiation, different equilibria may arise, including both firms following CSR, none of them doing so, or having asymmetric equilibria where one firm follows CSR and the other one does not. Fanti and Buccella (2017b) also analyze the strategic adoption of CSR in a duopoly model, but they consider the case where firms are run by managers. They find that in equilibrium both managerial firms adopt CSR. On the other hand, Planer-Friedrich and Sahm (2020) also consider the strategic use of CSR in imperfectly competitive markets, but their study assumes an arbitrary number of firms in a continuous choice framework. They show that the endogenous level of CSR is positive for any number of active firms, but it is lower if this number is higher, and that equilibrium profits are smaller in comparison with a situation without CSR. They also consider an entry deterrence game and show that an incumbent monopolist can use CSR to deter the entry of another firm. The results in both cases reveal that the use of CSR may increase market concentration.

There are also papers where the profit-enhancing nature of CSR appears in the particular case of a manufacturer and a retailer engaged in a vertical relationship, in addition to the work by Brand and Groethe (2014)) and Ouchida (2019). They include García et al. (2018), who incorporate a manufacturer’s cost-reducing R&D investment in a non-cooperative framework and examine an endogenous timing game, and Li and Zhou (2019), who consider the joint effect of the manufacturer’s cost reduction and the retailer’s promotion effort in a cooperative scenario.

The rest of this paper is organized as follows. Section 2 presents the model. Section 3 undertakes its analysis: Sect. 3.1 studies the case where firms’ degrees of social concern are exogenous, Sect. 3.2 considers their endogenous choice under a non-cooperative scenario, and Sect. 3.3 turns to the case where they are cooperatively chosen. Section 3.4 extends the model to the case where the vertically integrated firm also chooses its own degree of social concern. Section 4 concludes.

2 The model

Consider a market where two firms, a retailer and a vertically integrated firm, sell a homogeneous product to final consumers with inverse demand given by

where \(p\) is the price paid for the final product and \(q_{r}\) and \(q_{v}\) are, respectively, the retailer and the vertically integrated firm sales of this product.

The retailer buys the product at wholesale price \(w\) from a manufacturer and then resells it to the final consumer. In contrast, the vertically integrated firm produces the good itself. Both the manufacturer and the vertically integrated firm incur a constant marginal cost \(c\) to produce the good, with \(c < a\).

The retailer profits are:

The manufacturer profits are:

and the vertically integrated firm profits are:

Consumer surplus is given by:

In contrast with the vertically integrated firm, that maximizes its profits \(\Pi_{v}\), the retailer and the manufacturer set for themselves objective functions \(V_{r}\) and \(V_{m}\), respectively, that take into account a fraction \(\theta_{i} \epsilon \left[ {0,1} \right]\), \(i = r,v\) of consumer surplus,Footnote 8 as follows:

In the polar case of \(\theta_{i} = 0\), firm i pursues simple profit maximization while, at the other extreme, when \(\theta_{i} = 1\), it fully incorporates consumer surplus into its objective function.

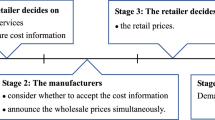

Consider the following three-stage game. In the first stage, the retailer and the manufacturer choose their degrees of social concern \(\theta_{r}\) and \(\theta_{m}\) to maximize their respective profits. These choices determine the objective functions \(V_{r}\), and \(V_{m}\) that they will have for the rest of the game. Both cooperative and non-cooperative choices of \(\theta_{r}\) and \(\theta_{m}\) are considered. In the second stage, the manufacturer chooses the wholesale price \(w\). In the third stage, the retailer and the vertically integrated firm choose their outputs.

3 Analysis

3.1 Exogenous degrees of social concern

Consider first the last two stages of the game for given exogenous degrees of social concern. The endogenous choice of firms’ degrees of social concern will be examined later.

The analysis proceeds backwards and starts examining the third stage of the game. In this stage, the retailer and the vertically integrated firm simultaneously choose \(q_{r}\) and \(q_{v}\) to maximize \(V_{r}\) and \(\Pi_{v}\), respectively. These simultaneous choices lead to the following outputs:

which imply:

In the second stage of the game, the manufacturer chooses \(w\) to maximize \(V_{m}\) as given in (10). Using the wholesale price that solves this maximization problem,\(w^{*}\), one can also find the equilibrium final price \(p^{*}\) and quantities \(q_{r}^{*}\) and \(q_{v}^{*}\), given exogenous values of \(\theta_{r}\) and \(\theta_{m}\). These equilibrium values, along with the resulting equilibrium values for profits \(\Pi_{m}^{*}\), \(\Pi_{r}^{*}\) and \(\Pi_{v}^{*}\), objective functions \(V_{m}^{*}\) and \(V_{r}^{*}\), Consumer Surplus \(CS^{*}\) and Social Welfare \(SW^{*}\), are shown in the appendix. Knowledge of the equilibrium values allows to examine how changes in the degrees of social concern \(\theta_{r}\) and \(\theta_{m}\) affect them,Footnote 9 as stated in the following proposition.

Proposition 1

A change in the parameters \(\theta_{r}\) and \(\theta_{m}\) has the following effects on the equilibrium variables:

-

i.

a change in \(\theta_{m}\): \(\frac{{\partial w^{*} }}{{\partial \theta_{m} }} < 0\), \(\frac{{\partial q_{r}^{*} }}{{\partial \theta_{m} }} > 0\), \(\frac{{\partial q_{v}^{*} }}{{\partial \theta_{m} }} < 0\), \(\frac{{\partial p^{*} }}{{\partial \theta_{m} }} < 0\), \(\frac{{\partial CS^{*} }}{{\partial \theta_{m} }} > 0\), \(\frac{{\partial V_{m}^{*} }}{{\partial \theta_{m} }} > 0\), \(\frac{{\partial V_{r}^{*} }}{{\partial \theta_{m} }} > 0\), \(\frac{{\partial SW^{*} }}{{\partial \theta_{m} }} > 0\)

-

ii.

a change in \(\theta_{r}\): \(\frac{{\partial w^{*} }}{{\partial \theta_{r} }} > 0\), \(\frac{{\partial q_{r}^{*} }}{{\partial \theta_{r} }} > 0\), \(\frac{{\partial q_{v}^{*} }}{{\partial \theta_{r} }} < 0\), \(\frac{{\partial p^{*} }}{{\partial \theta_{r} }} < 0\), \(\frac{{\partial CS^{*} }}{{\partial \theta_{r} }} > 0\), \(\frac{{\partial V_{m}^{*} }}{{\partial \theta_{r} }} > 0\), \(\frac{{\partial V_{r}^{*} }}{{\partial \theta_{r} }} > 0\), \(\frac{{\partial SW^{*} }}{{\partial \theta_{r} }} > 0\)

An increase in either \(\theta_{m}\) or \(\theta_{r}\) increases the amount of good sold by the manufacturer and the retailer, \(q_{r}^{*}\), but it reduces the amount sold by the rival firm, \(q_{v}^{*}\). It turns out that the former effect is stronger than the latter, since the equilibrium price diminishes, which implies that total output \(q_{r}^{*} + q_{v}^{*}\) increases. Thus, just as in the bilateral monopoly, an increase in either \(\theta_{m}\) or \(\theta_{r}\) increases total output, reduces final prices and increases consumer surplus. Moreover, as in that case, it also increases social welfare. With respect to the effect on the wholesale price \(w^{*}\) that the retailer pays to the manufacturer, there is a difference between the two cases: in the bilateral monopoly, an increase in either \(\theta_{m}\) or \(\theta_{r}\) reduces \(w^{*}\), while here an increase in \(\theta_{m}\) does reduce it, but an increase in \(\theta_{r}\) raises the wholesale price.

To understand the different effects of \(\theta_{r}\) and \(\theta_{m}\) on \(w^{*}\) with and without competition, notice first that when the manufacturer chooses the wholesale price, it faces the following tradeoff: by marginally raising w, it sells its product at a higher price, but it sells a smaller quantity, which not only affects its profits, but also reduces the CS term in its objective function. Importantly, under the presence of a rival firm, the reduction in CS is smaller than the reduction in the manufacturer’s production suggests, because CS depends on the whole market production and the reduction in the manufacturer’s production is accompanied by an increase (of a smaller magnitude) in its rival’s production.

Consider now how an increase in \(\theta_{r}\) affects the previous tradeoff. Both with and without competition from a rival firm, it sets in motion two opposing effects: first, it favors a higher w because with a higher \(\theta_{r}\) the retailer increases its production (\(q_{r}\) increases in \(\theta_{r}\) in Eq. (8)), and thus the manufacturer’s sales, and this means that any increase in w will apply to higher sales. There is also an effect of an opposite sign. In the case without competition, an increase in \(\theta_{r}\) increases the sensitivity of sales to w (\(\frac{{\partial^{2} q}}{{\partial \theta_{r} \partial w}} < 0\)) which affects both the manufacturer’s profits and CS, and thus tilts the tradeoff toward a lower w.Footnote 10 When there is competition from a rival firm, there is a similar negative effect. But, while the positive effect continues to depend on the positive effect of \(\theta_{r}\) on the manufacturer’s sales (\(\frac{{\partial q_{r} }}{{\partial \theta_{r} }}\) > 0 from (8)), part of the negative effect depends on the negative impact of \(\theta_{r}\) on CS, and it is therefore mitigated by the ameliorating impact that an increase in \(\theta_{r}\) has on the vertically integrated rival firm’s sales.Footnote 11 This mitigation of the negative part of the effect of \(\theta_{r}\) on w results in the whole effect of \(\theta_{r}\) on w turning positive under the presence of a rival firm.

Consider in contrast the effect of an increase in \(\theta_{m}\) on the manufacturer’s tradeoff. Regardless of whether there is competition from a vertically integrated firm or not, given w, this increase does not affect the retailer’s production (and thus the manufacturer’s sales) and it does not affect the sensitivity of the retailer’s production to w either (notice that \(q_{r}\) in (8) does not depend on \(\theta_{m}\)). The only effect of an increase in \(\theta_{m}\) on the manufacturer’s tradeoff is that the manufacturer attaches more importance to the negative impact that a marginal increase in w has on CS. Thus, an increase in \(\theta_{m}\) tilts the tradeoff in favor of a smaller w and thus reduces w, regardless of whether or not there is competition from a vertically integrated firm.

3.2 Non-cooperative choice of the degrees of social concern

The analysis can now turn to the endogenous choice of firms’ degrees of social concern. Consider first the non-cooperative scenario. Just as in Brand and Grothe (2015), the three possibilities for the order in which firms choose their degrees of social concern are examined: when the manufacturer chooses before the retailer, when the retailer chooses before the manufacturer, and when their choices are simultaneous. It turns out that firms’ choices do not depend on the order in which they are made, as the following proposition shows.

Proposition 2

When the retailer and the manufacturer choose their profit-maximizing degrees of social concern non-cooperatively, they choose a null degree of social concern, \(\theta_{m}^{N} = \theta_{r}^{N} = 0\), and therefore, they choose to pursue pure profit maximization, irrespective of whether \(\theta_{m}\) and \(\theta_{r}\) are chosen simultaneously or sequentially. This leads to the following equilibrium values:

\(w^{N} = \frac{3c + a}{4}\), \(p^{N} = \frac{7c + 5a}{12}\), \(q_{v}^{N} = \frac{{5\left( {a - c} \right)}}{12}\), \(q_{r}^{N} = \frac{a - c}{6}\)

\(CS^{N} = \frac{{49\left( {a - c} \right)^{2} }}{288}\), \(V_{m}^{N} = \frac{{\left( {a - c} \right)^{2} }}{24}\), \(V_{r}^{N} = \frac{{\left( {a - c} \right)^{2} }}{36}\), \(\Pi_{v}^{N} = \frac{{25\left( {a - c} \right)^{2} }}{144}\)

\(\Pi_{m}^{N} = \frac{{\left( {a - c} \right)^{2} }}{24}\), \(\Pi_{r}^{N} = \frac{{\left( {a - c} \right)^{2} }}{36}\), \(SW^{N} = \frac{{119\left( {a - c} \right)^{2} }}{288}\)

To put this result into perspective, notice that in the case of a bilateral monopoly Brand and Grothe (2015) show that when the manufacturer chooses its degree of social concern before the retailer, they both choose positive degrees of social concern. Here, in contrast, the retailer chooses a null degree of social concern whatever the choice of the manufacturer, because its profit function is strictly decreasing in its own degree of social concern irrespective of the choice of the manufacturer. Anticipating this retailer’s choice, the manufacturer also chooses a null degree of social concern, because given a constant degree of social concern for the retailer, its own profit is also decreasing in its own degree of social concern.

By choosing null degrees of social concern, which amounts to pursuing pure profit maximization, the manufacturer and the retailer put themselves at a disadvantage with respect to their vertically integrated competitor.Footnote 12 They are harmed by double marginalization, which translates into a competitive disadvantage against their competitor who, being vertically integrated, does not suffer from such a problem and thus produces more output than they do and earns profits higher than their joint profits.

3.3 Cooperative choice of the degrees of social concern

Assume now that the manufacturer and the retailer choose the degrees of CSR cooperatively. Their joint profits are given by

Similarly to Ouchida (2019) and Li and Zhou (2019), the first-order condition for joint profits to be maximized are obtained as:

or, equivalently, \(\theta_{r} = \frac{{8 - 3\theta_{m} }}{8}\). The maximum value of joint profits \(\Pi_{m}^{*} + \Pi_{r}^{*}\) is \(\frac{{\left( {a - c} \right)^{2} }}{8}\). Notice that, under the assumption \(\theta_{m} \epsilon \left[ {0,1} \right]\) and \(\theta_{r} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \ge 5/8\) is needed to achieve this amount of joint profits because \(\theta_{m} \le 1\) implies \(\theta_{r} = \frac{{8 - 3\theta_{m} }}{8} \ge 5/8\). Notice also that if \(\Pi_{r}^{*} > \frac{{\left( {a - c} \right)^{2} }}{64}\), the maximum value \(\frac{{\left( {a - c} \right)^{2} }}{8}\) of joint profits cannot be achieved, because i) when \(\theta_{m} = 1\) and \(\theta_{r} = 5/8\) the retailer’s profits are \(\Pi_{r}^{*} = \frac{{\left( {a - c} \right)^{2} }}{64}\) and ii) \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{m} }} > 0\) and \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{r} }} < 0\).

The following lemma provides the optimal way to set \(\theta_{m}\) and \(\theta_{r}\) for any given level of retailer profits \(\Pi_{r}^{*}\).

Lemma 1

Consider the problem of choosing \(\theta_{m}\) and \(\theta_{r}\) to maximize the manufacturer’s profits \(\Pi_{m}^{*}\) subject to providing the retailer with a level of profits \(\Pi_{r}^{*} = \bar{\Pi }_{r}\). Then,

-

i.

if \(\bar{\Pi }_{r} \le \frac{{\left( {a - c} \right)^{2} }}{64}\), it is optimal to set \(\theta_{m} = \frac{{8\left( {a - c} \right)^{2} + 64\bar{\Pi }_{r} }}{{9\left( {a - c} \right)^{2} }}\) and \(\theta_{r} = \frac{{2\left( {a - c} \right)^{2} - 8\bar{\Pi }_{r} }}{{3\left( {a - c} \right)^{2} }}\).

-

ii.

if \(\bar{\Pi }_{r} > \frac{{\left( {a - c} \right)^{2} }}{64}\), it is optimal to set \(\theta_{m} = 1\) and \(\theta_{r}\) such that \(\frac{{\left( {a - c} \right)^{2} \left( {2\theta_{r} + 3} \right)\left( {\theta_{r}^{2} - 5\theta_{r} + 3} \right)}}{{\left( {11 - 4\theta_{r} } \right)^{2} }} = \bar{\Pi }_{r}\)

When \(\bar{\Pi }_{r} \le \frac{{\left( {a - c} \right)^{2} }}{64}\), there exist \(\theta_{m} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \epsilon \left[ {0,1} \right]\) that both satisfy the condition (11) to maximize joint profits and provide the retailer with profits \(\bar{\Pi }_{r}\). These same values of \(\theta_{m}\) and \(\theta_{r}\) maximize the manufacturer’s profits subject to providing the retailer with profits \(\bar{\Pi}_{r}\).

When \(\bar{\Pi }_{r} > \frac{{\left( {a - c} \right)^{2} }}{64}\), any pair \(\theta_{m} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \epsilon \left[ {0,1} \right]\) that provides the retailer with profits \(\bar{\Pi }_{r}\) violates condition (11) and thus the maximum joint profits cannot be achieved. Among the pairs \(\theta_{m} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \epsilon \left[ {0,1} \right]\) that provide the retailer with profits \(\bar{\Pi }_{r}\), it is optimal to choose \(\theta_{m} = 1\) and \(\theta_{r}\) such that, together with \(\theta_{m} = 1\), yields \(\Pi_{r}^{*} = \bar{\Pi }_{r}\). The condition \(\frac{{\left( {a - c} \right)^{2} \left( {2\theta_{r} + 3} \right)\left( {\theta_{r}^{2} - 5\theta_{r} + 3} \right)}}{{\left( {11 - 4\theta_{r} } \right)^{2} }} = \bar{\Pi }_{r}\) finds such value for \(\theta_{r}\) because it expresses the constraint \(\Pi_{r}^{*} = \bar{\Pi }_{r}\) when \(\Pi_{r}^{*}\) is evaluated at \(\theta_{m} = 1\).

Firms chooseFootnote 13\(\theta_{m}\) and \(\theta_{r}\) so as to maximize the Nash product P, with:

The factors in the Nash product P are the profits that firms receive in the cooperative solution minus the profits that they would receive if there were no agreement—in what is known as the disagreement utility point—which in this case correspond to the non-cooperative profits \(\Pi_{m}^{N}\), \(\Pi_{r}^{N}\). The solution to such maximization problem is known as the Nash bargaining solution, which can be obtained as the equilibrium of a thoroughly specified bargaining game in which the two parties bargain to reach an agreement.Footnote 14

Notice that to maximize the Nash Product P, since \(\Pi_{r}^{N} = \frac{{\left( {a - c} \right)^{2} }}{36} > \frac{{\left( {a - c} \right)^{2} }}{64}\), firms do not choose \(\theta_{m}\) and \(\theta_{r}\) in the zone \(\Pi_{r}^{*} \le \frac{{\left( {a - c} \right)^{2} }}{64}\) where maximum joint profits \(\frac{{\left( {a - c} \right)^{2} }}{8}\) are achieved, because in this zone the retailer obtains less profits than in the non-cooperative equilibrium: \(\left( {\Pi_{r}^{*} - \Pi_{r}^{N} } \right) < 0\). So, the cooperative equilibrium lies in the zone \(\Pi_{r}^{*} > \frac{{\left( {a - c} \right)^{2} }}{64}\) where it is optimal to set \(\theta_{m} = 1\). Inserting this value into \(\Pi_{m}^{*}\) and \(\Pi_{r}^{*}\) and simplifying, the Nash Product can be rewritten as:

Maximization of the Nash Product P given in (13) yields \(\theta_{r} = 0.4015\) and thus one obtains:

Proposition 3

When the retailer and the manufacturer choose their profit-maximizing degrees of social concern cooperatively, the equilibrium values are \(\theta_{m}^{C} = 1\) and \(\theta_{r}^{C} = 0.4015\), which yield:

In contrast to the non-cooperative equilibrium, in the cooperative equilibrium both the manufacturer and the retailer choose positive degrees of social concern. These choices give them a competitive edge over their vertically integrated competitor. Their output is higher than that of their competitor (\(q_{r}^{C} > q_{v}^{C}\)), and their joint profits are also higher than their competitor’s (\(\Pi_{m}^{C} + \Pi_{r}^{C} > \Pi_{v}^{C}\)).

Figure 1 graphically shows how the manufacturer and the retailer choose their CSR levels. Point N \(\left( {\theta_{m} ,\theta_{r} } \right) = \left( {0,0} \right)\) represents the non-cooperative equilibrium. Notice that the manufacturer’s reaction curve is simply \(\theta_{m} = 0\), while the retailer’s reaction curve is simply \(\theta_{r} = 0\). Both the retailer’s isoprofit curve \((\Pi_{r} N)\) and the manufacturer’s isoprofit curve \((\Pi_{m} N)\) that pass through N have positive slopes because when each of these firms raises its level of CSR, it reduces its own profits, but it raises the profits of the other firm in the supply chain. Points in the area below the retailer’s isoprofit curve \((\Pi_{r} N)\) and above the manufacturer’s isoprofit curve \((\Pi_{m} N)\) increase the profits for both firms in the supply chain, relative to the non-cooperative equilibrium. The existence of this area in Fig. 1 shows that there is room for mutually beneficial agreements between the manufacturer and the retailer. In these agreements each of these firms chooses a positive degree of CSR and, in exchange, the other firm in the supply chain also chooses a positive degree of CSR. The cooperative equilibrium is the point in this area that maximizes the Nash Product. It is represented by point C. The line depicting equation \(8\theta_{r} + 3\theta_{m} - 8 = 0\) (Eq. 11) shows the points where the joint profits of the firms in the supply chain are maximized. Since this line lies above the isoprofit curve \((\Pi_{r} N)\), Fig. 1 shows that whenever joint profits are maximized, the retailer’s profits are smaller than its non-cooperative profits. Since maximizing the joint profits of the firms in the supply chain is not compatible with having a mutually beneficial agreement, the cooperative equilibrium does not maximize joint profits.

The following proposition compares the cooperative equilibrium with a situation where both the manufacturer and the retailer pursue pure profit maximization, which coincides with the non-cooperative equilibrium.

Proposition 4

The equilibrium results satisfy the following relationships:

-

i.

\(\theta_{m}^{C} > \theta_{m}^{N}\), \(\theta_{r}^{C} > \theta_{r}^{N}\), \(q_{r}^{C} > q_{r}^{N}\), \(q_{v}^{C} < q_{v}^{N}\),

-

ii.

\(\Pi_{m}^{C} > \Pi_{m}^{N}\), \(\Pi_{r}^{C} > \Pi_{r}^{N}\), \(\Pi_{v}^{C} < \Pi_{v}^{N}\), \(V_{m}^{C} > V_{m}^{N}\), \(V_{r}^{C} > V_{r}^{N}\)

-

iii.

\(p^{C} < p^{N}\), \(CS^{C} > CS^{N}\), \(SW^{C} > SW^{N} ,\) \(w^{C} < w^{N}\)

In comparison with a situation where the manufacturer and the retailer pursue pure profit maximization, under the cooperative equilibrium the amount they sell is higher, while the amount their vertically integrated competitor sells is lower. Also, both the manufacturer’s profits and the retailer’s profits are higher and their competitor’s profits are lower. The increase in the output sold by the manufacturer and the retailer is higher than the reduction in the output sold by their competitor, and so under the cooperative equilibrium total output is higher, the price paid by consumers is lower, consumer surplus is higher and, moreover, social welfare is also higher. Finally, the wholesale price paid by the retailer to the manufacturer is lower.Footnote 15

The results obtained compare with those in Ouchida (2019), where the manufacturer and the retailer do not face competition but act instead as a bilateral monopoly, as follows. First, in Ouchida (2019) (as in Brand and Grothe (2015)), the non-cooperative equilibrium exhibits positive degrees of CSR: \(\theta_{m} = 2/3\) and \(\theta_{r} = 1/3\). Here, in contrast, when firms in the supply chain face competition from a vertically integrated firm, the non-cooperative equilibrium yields simple profit maximization: \(\theta_{m}^{N} = \theta_{r}^{N} = 0\). Second, in Ouchida (2019) the cooperative equilibrium maximizes the joint profits of the manufacturer and the retailer and, relative to the non-cooperative equilibrium, shows higher levels of CSR, output and profits for both firms as well as higher Consumer Surplus and Social Welfare. Here, in contrast, in the cooperative equilibrium the joint profits of the firms in the vertical supply chain are not maximized. However, relative to the non-cooperative equilibrium, it continues to happen that in the cooperative equilibrium profits for both firms are indeed higher, as higher are also both firms’ levels of CSR and output, Consumer Surplus and Social Welfare. Third, the present model also yields results for which there is no counterpart in Ouchida (2019): those related to the vertically integrated firm and the comparisons involving this firm and the firms in the supply chain.

3.4 A socially concerned vertically integrated firm

Consider now the following extension of the model. Assume that, just as the manufacturer and the retailer, the vertically integrated competitor also chooses its own degree of social concern \(\theta_{v} \epsilon \left[ {0,1} \right]\) and that all firms simultaneously choose their degrees of social concern. The vertically integrated firm sets for itself the objective function

In the last stage of the game, the retailer and the vertically integrated firm simultaneously choose \(q_{r}\) and \(q_{v}\) to maximize \(V_{r}\) and \(V_{v}\), respectively, leading to:

which imply:

In the second stage of the game, the manufacturer chooses \(w\) to maximize \(V_{m}\) as given in (17). One can use the wholesale equilibrium price that solves this maximization problem, \(w^{**}\), to obtain the equilibrium profits \(\Pi_{m}^{**}\), \(\Pi_{r}^{**}\) and \(\Pi_{v}^{**}\), as functions of \(\theta_{m}\), \(\theta_{r}\) and \(\theta_{v}\) and then use these profit functions to examine the endogenous choice of firms’ degrees of social concern and obtain the following result:

Proposition 5

Assume that the vertically integrated firm also chooses its own degree of social concern. If the retailer and the manufacturer make their choices non-cooperatively, they choose null degrees of social concern, \(\theta_{m}^{NV} = \theta_{r}^{NV} = 0\), while their vertically integrated competitor chooses \(\theta_{v}^{NV} = 0.2439\). These choices lead to outputs \(q_{r}^{NV} = 0.1372\left( {a - c} \right) < q_{r}^{N}\) and \(q_{v}^{NV} = 0.5104\left( {a - c} \right) > q_{v}^{N}\) and to profits \(\Pi_{m}^{NV} = 0.0295\left( {a - c} \right)^{2} < \Pi_{m}^{N}\), \(\Pi_{r}^{NV} = 0.0188\left( {a - c} \right)^{2} < \Pi_{r}^{N}\) and \(\Pi_{v}^{NV} = 0.1799\left( {a - c} \right)^{2} > \Pi_{v}^{N}\). They also lead to prices \(p^{NV} = 0.6476c + 0.3524a < p^{N}\) and \(w^{NV} = 0.7847c + 0.2153a < w^{N}\), to Consumer Surplus \(CS^{NV} = 0.2097\left( {a - c} \right)^{2} > CS^{N}\) and to Social Welfare \(SW^{NV} = 0.4379\left( {a - c} \right)^{2} > SW^{N}\)

Therefore, when the vertically integrated firm also chooses its own degree of social concern, it chooses a strictly positive degree, while the manufacturer and the retailer continue to pursue pure profit maximization. Under this scenario, the manufacturer and the retailer not only suffer from the double marginalization problem that their competitor does not face, now their competitor’s choice of a positive degree of social concern coupled with their non-cooperative choices further reduces their profits while increasing those of their competitor. Compared with a situation where all firms pursue simple profit maximization, these choices lead to smaller output and profits for the retailer and the manufacturer and higher output and profits for their rival firm. They also lead to smaller prices (both the price paid by consumers and the wholesale price), higher Consumer Surplus and higher Social Welfare.

Assume now that the manufacturer and the retailer choose their degrees of CSR cooperatively. Notice that the disagreement utility point in the Nash Product will now be given by \((\Pi_{m}^{NV} , \Pi_{r}^{NV} )\) and not by \((\prod_{m}^{N} , \prod_{r}^{N} )\) because the manufacturer and the retailer know that if they fail to cooperate and follow pure profit maximization, their competitor will choose a positive degree of social concern which, together with their choice of a null degree of social concern, leads to profits \((\prod_{m}^{NV} ,\prod_{r}^{NV} )\). If the manufacturer and the retailer do cooperate, they choose their degrees of social concern \(\theta_{m}\) and \(\theta_{r}\) to maximize the Nash Product \(P^{V}\)

Notice that \(\Pi_{m}^{**}\) and \(\Pi_{r}^{**}\) in the Nash Product \(P^{V}\) depend not only on \(\theta_{m}\) and \(\theta_{r}\) but also on their competitor’s degree of social concern \(\theta_{v}\). Assume momentarily that this competitor chooses a null level of social concern \(\theta_{v} = 0\) (it will be later confirmed that it will be optimal for this firm to do so). Then, since \(\Pi_{m}^{**}\) coincides with \(\Pi_{m}^{*}\) and \(\Pi_{r}^{**}\) coincides with \(\Pi_{r}^{*}\) when \(\theta_{v} = 0\), one can write \(P^{V} = \left( {\Pi_{m}^{*} - \Pi_{m}^{NV} } \right)\left( {\Pi_{r}^{*} - \Pi_{r}^{NV} } \right)\) and make use of Lemma 1 to conclude that to provide the retailer with profits higher than \(\frac{{\left( {a - c} \right)^{2} }}{64}\), the optimal way to do so is by setting \(\theta_{m} = 1\). Since \(\Pi_{r}^{NV} = 0.0188\left( {a - c} \right)^{2} > \frac{{\left( {a - c} \right)^{2} }}{64}\), at the optimum it must indeed hold \(\Pi_{r}^{**} > \frac{{\left( {a - c} \right)^{2} }}{64}\) (otherwise, the retailer would obtain smaller profits than those at the disagreement point) and thus, it is optimal to set \(\theta_{m} = 1\). Replacing \(\Pi_{m}^{NV}\) and \(\Pi_{r}^{NV}\) with their expressions in Proposition 5 and setting \(\theta_{v} = 0\) and \(\theta_{m} = 1\), maximization of the Nash Product \(P^{V}\) with respect to \(\theta_{r}\) yields \(\theta_{r} = 0.4008\).

Reciprocally, when \(\theta_{m} = 1\) and \(\theta_{r} = 0.4008\), \(\Pi_{v}^{**}\) is strictly decreasing in \(\theta_{v}\) and, therefore, the vertically integrated firm indeed maximizes its profits by setting \(\theta_{v} = 0\). It thus follows:

Proposition 6

When the vertically integrated firm chooses its own degree of social concern and the manufacturer and the retailer cooperatively choose their degrees of social concern, it is an equilibrium that the vertically integrated firm chooses a null degree of social concern \(\theta_{v}^{CV} = 0\), while the manufacturer and the retailer choose positive degrees of social concern \(\theta_{m}^{CV} = 1\) and \(\theta_{r}^{CV} = 0.4008\). These choices lead to outputs \(q_{r}^{CV} = 0.4046\left( {a - c} \right) > q_{r}^{NV}\) and \(q_{v}^{CV} = 0.2977\left( {a - c} \right) < q_{v}^{NV}\) and to profits \(\Pi_{m}^{CV} = 0.0707\left( {a - c} \right)^{2} > \Pi_{m}^{NV}\), \(\Pi_{r}^{CV} = 0.0498\left( {a - c} \right)^{2} > \Pi_{r}^{NV}\) and \(\Pi_{v}^{CV} = 0.0886\left( {a - c} \right)^{2} < \Pi_{v}^{NV}\). They also lead to prices \(p^{CV} = 0.2977a + 0.7023c < p^{NV}\) and \(w^{CV} = 0.1746a + 0.8254c < w^{NV}\) and to Consumer Surplus \(CS^{CV} = 0.2466\left( {a - c} \right)^{2} > CS^{NV}\) and Social Welfare \(SW^{CV} = 0.4557\left( {a - c} \right)^{2} > SW^{NV}\)

The cooperative choices of positive degrees of social concern by the manufacturer and the retailerFootnote 16 contrast with their selection of null degrees of social concern in the non-cooperative equilibrium. These cooperative choices are accompanied by the choice of a null degree of social concern by their vertically integrated competitor, instead of its positive value in the non-cooperative equilibrium. In comparison with such equilibrium, these cooperative choices lead to higher output and profits for the retailer and the manufacturer and lower output and profits for the vertically integrated firm. They also lead to smaller prices, both the price paid by final consumers and the wholesale price, and to higher Consumer Surplus and Social Welfare.

4 Concluding remarks

This paper has extended the analysis of the effects of CSR in a bilateral monopoly to the case where a manufacturer and a retailer engaged in a supply chain face competition from a vertically integrated firm. It has been found that when the manufacturer and the retailer non-cooperatively select their degrees of social concern, they both choose null degrees of social concern, which amounts to pursuing pure profit maximization. These choices put them at a disadvantage with respect to their vertically integrated competitor, who produces more output than they do and obtains higher profits than their joint profits. The scenario where the manufacturer and the retailer cooperatively choose their degrees of social concern has then been considered, finding that they both choose positive degrees of social concern and, therefore, deviate from pure profit maximization. These choices give them a competitive edge over their vertically integrated rival: they produce a higher output and obtain higher joint profits than their competitor. In comparison with the non-cooperative outcome, the positive degrees of social concern cooperatively chosen by the manufacturer and the retailer imply higher output and profits for the retailer and the manufacturer and lower output and profits for their competitor. They also imply lower prices and higher consumer surplus and social welfare. Finally, an extension where the vertically integrated firm also chooses its own degree of social concern has also been considered, examining the consequences of this assumption both in a non-cooperative and in a cooperative framework.

Some potential future lines of research are now outlined. It has been assumed throughout the paper Cournot downstream competition. One extension worthwhile studying is comparing Cournot and Bertrand competition, which is best addressed in a model with heterogenous goods, as in Planer-Friedrich and Sahm (2020) and Fanti and Buccella (2017a), who consider the endogenous choice of CSR and in both cases show that the mode of competition does affect the equilibrium CSR levels. Another line of research has to do with the timing of the game. For instance, the consequences of having one firm acting as the leader in the downstream competition, instead of assuming simultaneous choices, could be examined. Yet another extension is to allow trade in the intermediate good, which could lead to a situation where the vertically integrated firm sells this good to its competitor (which is similar to a suggestion by Brand and Grothe (2015). See also Arya et al. (2008) and, in a different set-up, Gaudet and Van Long (1996)).

Availability of data and material

Not applicable.

Notes

For example Goering (2007), Kopel and Brand (2012), Manasakis et al. (2014) and Fanti and Bucella (2019, 2020) examine duopolies where a socially concerned firm competes either with a profit-maximizing firm or another socially concerned firm under a variety of circumstances. Goering (2008) also considers competition between a socially concerned firm and a public firm and competition when a public firm, a private firm and a socially concerned firm are all present.

Brand and Grothe (2015) follow the analysis by Goering (2012), who begins to study the role of CSR in a bilateral monopoly allowing for the use of a two-part tariff that includes not only a wholesale price, as in Brand and Grothe (2015), but also a fixed fee. Brand and Grothe (2013) complete this analysis. Goering (2014) shows that a contract that includes a CSR component in the form of a fraction of Consumer Surplus allows the manufacturer to maximize its profits and fully control its retailer. Also related, but in a different set-up, is the study by Chen et al. (2016), who analyze the optimal degree of upstream firms’ CSR and its effects in a vertically related market with imperfect substitute products.

The apparel market in Mexico is one case where products manufactured and sold to final consumers by vertically integrated firms (like Zara, with its own chain of stores) compete with others sold by retailers that buy them from independent manufacturers (there are brands manufactured by independent firms—like Grupo Ismark—for exclusive sale at certain retailers. Notice, however, that no single retailer sells all the production of this particular manufacturer. See www.ismark.com.mx for details.).

This point is stressed by Goering (2014) and illustrated by the 37 different definitions of CSR examined by Dahlsrud (2008). Nonetheless, an analysis of these definitions shows that their differences are not as big as such high number might suggest, since they consistently refer to five dimensions and are largely congruent (Dahlsrud 2008).

Other parties—different from shareholders—often taken into account in the CSR literature are firm’s employees and agents affected by the environmental consequences of the firm’s decisions.

Another rationale for a profit-maximizing firm to engage in CSR behavior arises when consumers are willing to pay for products sold by firms practicing such behavior, as in García-Gallego and Georgantzís (2009).

Notice that there is in the literature an approach that refers to CSR as explicitly sacrificing profits. See Bénabou and Tirole (2010), who distinguish between this approach and other approaches compatible with profit maximization and provide an examination of them.

The proofs are in “Appendix”.

Moreover, the quadratic dependence of CS on sales implies that the marginal negative impact of w on sales becomes more important because it occurs at the higher level of sales resulting from the higher \(\theta_{r}\) (\(\frac{\partial q}{\partial w} < 0\) and \(\frac{\partial q}{{\partial \theta_{r} }}\) > 0).

Notice that \(\frac{{\partial^{2} q_{r} }}{{\partial \theta_{r} \partial w}} < \frac{{\partial^{2} \left( {q_{r} + q_{v} } \right)}}{{\partial \theta_{r} \partial w}} < 0\) because \(\frac{{\partial^{2} q_{v} }}{{\partial \theta_{r} \partial w}} > 0\) and, similarly, \(\frac{{\partial q_{v} }}{\partial w} > 0\) and thus \(\frac{{\partial q_{r} }}{\partial w} < \frac{{\partial \left( {q_{r} + q_{v} } \right)}}{\partial w}\) < 0 and also \(\frac{{\partial q_{v} }}{{\partial \theta_{r} }} < 0\) and thus 0 < \(\frac{{\partial \left( {q_{r} + q_{v} } \right)}}{{\partial \theta_{r} }}\) < \(\frac{{\partial \left( {q_{r} } \right)}}{{\partial \theta_{r} }}\).

This is what happens in Greenhut and Ohta (1979) when a downstream firm and an upstream firm engaged in a vertical supply chain compete with a vertically integrated firm.

To choose their degrees of social concern cooperatively, firms can rely on the two ways explained in Brand and Grothe (2015): (i) by placing consumer representatives in the Board of Directors, and (ii) by committing themselves to a social strategy through the publication of social long-term goals. Here, it is shown how much this can accomplish without the need to coordinate all other relevant variables.

It is shown in the appendix (Proposition A1) that if firms are allowed to choose degrees of social concern higher than unity, in which case a firm places a weight on consumer surplus higher than the consumers themselves, in the cooperative equilibrium the manufacturer’s degree of social concern is indeed higher than unity, and the changes in the values of the rest of the variables in comparison with the non-cooperative equilibrium have the same signs as those found above.

Notice that, in contrast to the previous scenarios, in this case uniqueness of equilibrium is not straightforward, and it is not examined.

It can be shown, using the same arguments as above, that when the manufacturer and the retailer are allowed to choose degrees of social concern higher than one the non-cooperative equilibrium continues to yield null degrees of social concern.

References

Arya A, Mittendorf B, Yoon DH (2008) Friction in related-party trade when a rival is also a customer. Manag Sci 54(11):1850–1860

Bénabou R, Tirole J (2010) Individual and corporate social responsibility. Economica 77(305):1–19

Binmore K, Rubinstein A, Wolinsky A (1986) The Nash bargaining solution in economic modelling. Rand J Econ 17(2):176–188

Brand B, Grothe M (2013) A note on ‘Corporate social responsibility and marketing channel coordination’. Res Econ 67(4):324–327

Brand B, Grothe M (2015) Social responsibility in a bilateral monopoly. J Econ 115(3):275–289

Carroll AB, Shabana KM (2010) The business case for corporate social responsibility: a review of concepts, research and practice. Int J Manag Rev 12(1):85–105

Chen CL, Liu Q, Li J, Wang LF (2016) Corporate social responsibility and downstream price competition with retailer’s effort. Int Rev Econ Financ 46:36–54

UN Global Compact and Accenture (2019) The Decade to Deliver. A Call to Business Action. United Nations Global Compact and Accenture Strategy

Dahlsrud A (2008) How corporate social responsibility is defined: an analysis of 37 definitions. Corp Soc Responsib Environ Manag 15(1):1–13

Fanti L, Buccella D (2017a) Corporate social responsibility in a game-theoretic context. Econ Polit Ind 44(3):371–390

Fanti L, Buccella D (2017b) Corporate social responsibility, profits and welfare with managerial firms. Int Rev Econ 64(4):341–356

Fanti L, Buccella D (2019) Managerial delegation games and corporate social responsibility. Manag Decis Econ 40(6):610–622

Fanti L, Buccella D (2020) Strategic trade policy with socially concerned firms. Int Rev Econ. https://doi.org/10.1007/s12232-020-00345-x

García A, Leal M, Lee SH (2018) Social responsibility in a bilateral monopoly with R&D. Econ Bull 38(3):1467–1475

García-Gallego A, Georgantzís N (2009) Market effects of changes in consumers’ social responsibility. J Econ Manag Strateg 18(1):235–262

Gaudet G, Van Long N (1996) Vertical integration, foreclosure, and profits in the presence of double marginalization. J Econ Manag Strateg 5:409–432

Goering GE (2007) The strategic use of managerial incentives in a non-profit firm mixed duopoly. Manag Decis Econ 28(2):83–91

Goering GE (2008) Welfare impacts of a non-profit firm in mixed commercial markets. Econ Syst 32:326–334

Goering GE (2012) Corporate social responsibility and marketing channel coordination. Res Econ 66(2):142–148

Goering GE (2014) The profit-maximizing case for corporate social responsibility in a bilateral monopoly. Manag Decis Econ 35(7):493–499

Greenhut ML, Ohta H (1979) Vertical integration of successive oligopolists. Am Econ Rev 69(1):137–141

Kopel M, Brand B (2012) Socially responsible firms and endogenous choice of strategic incentives. Econ Model 29(3):982–989

KPMG (2017) The road ahead. The KPMG survey of corporate responsibility reporting 2017. KPMG International, Amstelveen

Lambertini L, Tampieri A (2012) Corporate social responsibility and firms’ ability to collude. In: Boubaker S, Nguyen DK (eds) Board directors and corporate social responsibility. Palgrave Macmillan, Houndmills, Basingstoke, pp 167–178

Lambertini L, Tampieri A (2015) Incentives, performance and desirability of socially responsible firms in a Cournot oligopoly. Econ Model 50:40–48

Li C, Zhou P (2019) Corporate social responsibility: the implications of cost improvement and promotion effort. Manag Decis Econ 40(6):633–638

Manasakis C, Mitrokostas E, Petrakis E (2014) Strategic corporate social responsibility activities and corporate governance in imperfectly competitive markets. Manag Decis Econ 35(7):460–473

Nash J (1953) Two-person cooperative games. Econometrica 21(1):128–140

Ouchida Y (2019) Cooperative choice of corporate social responsibility in a bilateral monopoly model. Appl Econ Lett 26(10):799–806

Planer-Friedrich L, Sahm M (2020) Strategic corporate social responsibility, imperfect competition, and market concentration. J Econ 129(1):79–101

Rubinstein A (1982) Perfect equilibrium in a bargaining model. Econometrica 50(1):97–109

Spengler JJ (1950) Vertical integration and antitrust policy. J Polit Econ 58(4):347–352

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge

Acknowledgements

I am very grateful to three anonymous referees for helpful comments and suggestions.

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author(s) declare that they have no competing interests.

Code availability

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Equilibrium outcome for exogenous degrees of social concern

For any given degrees of social concern \(\theta_{r}\) and \(\theta_{m}\), the equilibrium values are as follows:

Proof of Proposition 1

The derivatives of the equilibrium variables are as follows:

To see that \(\frac{{\partial V_{r}^{*} }}{{\partial \theta_{r} }} > 0\) notice that the denominator is positive and the numerator is also positive because it is decreasing in \(\theta_{r}\) and it is positive even when \(\theta_{r} = 1\) (\(\frac{{\partial V_{r}^{*} }}{{\partial \theta_{r} }} > \frac{{\left( {a - c} \right)^{2} \left( {18\theta_{m}^{2} + 24\theta_{m} + 96} \right)}}{{2\left( {12 - 4\theta_{r} - \theta_{m} } \right)^{3} }} > 0\))

It is also of interest to note that:

Proof of Proposition 2

Assume first simultaneous choice of the degrees of social concern.

The derivatives of the profits of the manufacturer and the retailer with respect to their own degrees of social concern are given by:

Thus, it is optimal for the manufacturer to set \(\theta_{m} = 0\) because, for any \(\theta_{r} \epsilon \left[ {0,1} \right]\), \(\frac{{\partial \Pi_{m}^{*} }}{{\partial \theta_{m} }} = 0\) for \(\theta_{m} =\) 0 while \(\frac{{\partial \Pi_{m}^{*} }}{{\partial \theta_{m} }} < 0\) whenever \(\theta_{m} > 0\) and, reciprocally, it is optimal for the retailer to set \(\theta_{r} = 0\) because \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{r} }} < 0\) for all \(\theta_{m} \epsilon \left[ {0,1} \right]\) and \(\theta_{r} \epsilon \left[ {0,1} \right]\).

Assume now sequential choice of the degrees of social concern with the retailer as the leader.

The manufacturer chooses \(\theta_{m}\) knowing the retailer’s choice. The manufacturer’s reaction function is to set \(\theta_{m} = 0\) for all \(\theta_{r} \epsilon \left[ {0,1} \right]\) because, again, irrespective of the value of \(\theta_{r}\), \(\frac{{\partial \Pi_{m}^{*} }}{{\partial \theta_{m} }} = 0\) for \(\theta_{m} =\) 0 and \(\frac{{\partial \Pi_{m}^{*} }}{{\partial \theta_{m} }} < 0\) whenever \(\theta_{m} > 0\). Replacing the previous manufacturer’s reaction function \(\theta_{m} = 0\) into the retailer’s profits, the retailer chooses \(\theta_{r} = 0\) because \(\Pi_{r}^{*}\) is always strictly decreasing in \(\theta_{r}\).

Assume finally sequential choices of the degrees of social concern with the manufacturer as the leader.

The retailer chooses \(\theta_{r}\) knowing the manufacturer’s choice \(\theta_{m}\). The retailer chooses \(\theta_{r} = 0\) irrespective of the value of \(\theta_{m}\) because \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{r} }} < 0\) for all \(\theta_{m} \epsilon \left[ {0,1} \right]\) and \(\theta_{r} \epsilon \left[ {0,1} \right]\). Thus, the retailer’s reaction function is to set \(\theta_{r} = 0\) for all \(\theta_{m} \epsilon \left[ {0,1} \right]\). Replacing this reaction function into the manufacturer’s profits, the manufacturer chooses \(\theta_{m} = 0\) because it continues to hold that \(\frac{{\partial \Pi_{m}^{*} }}{{\partial \theta_{m} }} = 0\) for \(\theta_{m} =\) 0 and \(\frac{{\partial \Pi_{m}^{*} }}{{\partial \theta_{m} }} < 0\) whenever \(\theta_{m} > 0\).

Proof of Lemma 1

Consider the problem of choosing \(\theta_{m} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \epsilon \left[ {0,1} \right]\) to solve:

Notice that the constraint implicitly defines \(\theta_{r}\) as a function of \(\theta_{m}\) with \(\frac{{{\text{d}}\theta_{r} }}{{{\text{d}}\theta_{m} }} = \frac{{ - \frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{m} }}}}{{\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{r} }}}} > 0\) because \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{m} }} > 0\) and \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{r} }} < 0\). One can thus write \(\theta_{r}\) as a function of \(\theta_{m}\) in the objective function to simplify the maximization problem into one that has \(\theta_{m}\) as the only decision variable. The first-order condition of this simplified problem is:

with

Notice now that when \(\theta_{m} = 1\) and \(\theta_{r} = 5/8\), the retailer profits are \(\Pi_{r}^{*} = \frac{{\left( {a - c} \right)^{2} }}{64}\) and consider two different cases:

-

i.

Assume that \(\bar{\Pi }_{r} \le \frac{{\left( {a - c} \right)^{2} }}{64}\). In this case, there is a unique pair \(\theta_{m} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \epsilon \left[ {0,1} \right]\) that satisfies both the first-order condition, which amounts to \(8 - 8\theta_{r} - 3\theta_{m} = 0,\) and the constraint \(\Pi_{r}^{*} = \frac{{\left( {a - c} \right)^{2} \left( {2\theta_{r} + \theta_{m} + 2} \right)\left( {\theta_{r}^{2} - 5\theta_{r} + \theta_{m} + 2} \right)}}{{\left( {12 - 4\theta_{r} - \theta_{m} } \right)^{2} }} = \bar{\Pi }_{r}\). To see this, notice that replacing \(\theta_{m} = \frac{{8 - 8\theta_{r} }}{3}\) from the first-order condition into \(\Pi_{r}^{*}\) one can write the constraint as \(\frac{{\left( {a - c} \right)^{2} \left( {2 - 3\theta_{r} } \right)}}{8} = \bar{\Pi }_{r}\). Solving this equation for \(\theta_{r}\), one obtains \(\theta_{r} = \frac{{2\left( {a - c} \right)^{2} - 8\bar{\Pi }_{r} }}{{3\left( {a - c} \right)^{2} }}\), and replacing this back into the first-order condition, one obtains \(\theta_{m} = \frac{{8\left( {a - c} \right)^{2} + 64\bar{\Pi }_{r} }}{{9\left( {a - c} \right)^{2} }}\). When \(\bar{\Pi }_{r} \le \frac{{\left( {a - c} \right)^{2} }}{64}\), these two values satisfy \(\theta_{m} \epsilon \left[ {0,1} \right]\), \(\theta_{r} \epsilon \left[ {0,1} \right]\).

-

ii.

\(\bar{\Pi }_{r} > \frac{{\left( {a - c} \right)^{2} }}{64}\) implies \(\theta_{r} < 5/8\), because \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{m} }} > 0\) and \(\frac{{\partial \Pi_{r}^{*} }}{{\partial \theta_{r} }} < 0\). But \(\theta_{r} < 5/8\) implies that the first-order condition is never satisfied because it implies \(8 - 8\theta_{r} - 3\theta_{m} > 3 - 3\theta_{m} \ge 0\) and so the derivative of the objective function expressed as a function of \(\theta_{m}\), the only decision variable, is always positive. Thus, one has a corner solution with \(\theta_{m} = 1\)

Proof of Proposition 4

Proposition A1

When the degrees of social concern are allowed to be higher than one, then cooperative choice of these degrees results in \(\theta_{m}^{H} = \frac{104}{81}\), \(\theta_{r}^{H} = \frac{14}{27}\). These choices lead to:

\(q_{v}^{H} = \frac{a - c}{4}\), \(q_{r}^{H} = \frac{a - c}{2}\), \(w^{H} = \frac{31c + 5a}{36}\), \(p^{H} = \frac{3c + a}{4}\), \(CS^{H} = \frac{{9\left( {a - c} \right)^{2} }}{32}\), \(\Pi_{v}^{H} = \frac{{\left( {a - c} \right)^{2} }}{16}\), \(\Pi_{m}^{H} = \frac{{5\left( {a - c} \right)^{2} }}{72}\), \(\Pi_{r}^{H} = \frac{{\left( {a - c} \right)^{2} }}{18}\), \(SW^{H} = \frac{{15\left( {a - c} \right)^{2} }}{32}\), \(V_{m}^{H} = \frac{{31\left( {a - c} \right)^{2} }}{72}\), \(V_{r}^{H} = \frac{{29\left( {c - a } \right)^{2} }}{144}\)

Proof

Replacing \(\theta_{m} = \frac{{8 - 8\theta_{r} }}{3}\) from Eq. (11) into \(\Pi_{m}^{*}\) and \(\Pi_{r}^{*}\), one can writeFootnote 17 the Nash Product P given in (13) as \(P = \frac{{\left( {a - c} \right)^{4} \left( {9\theta_{r} - 4} \right)\left( {16 - 27\theta_{r} } \right)}}{1728}\) which is maximized when \(\theta_{r} = 14/27\). Replacing this value back in Eq. (11) yields \(\theta_{m} = \frac{104}{81}\). These values can then be inserted into the equilibrium outcomes given in Proposition 1.□

The differences between the equilibrium values with and without cooperation when the degrees of social concern can be higher than unity are:

Proof of Proposition 5

Using this wholesale price, one obtains the equilibrium profits:

and using these profit functions one obtains the results in the proposition:

-

i.

given any \(\theta_{m}\) and \(\theta_{v}\), it is optimal for the retailer to set \(\theta_{r} = 0\) because \(\Pi_{r}^{**}\) is strictly decreasing in \(\theta_{r}\): \(\frac{{\partial \Pi_{r}^{**} }}{{\partial \theta_{r} }} = - \frac{{\left( {a - c} \right)^{2} N}}{{D^{3} }}\) with

\(D = 2\theta_{v} \theta_{r} - 4\theta_{r} - \theta_{m} + 2\theta_{v}^{2} - 10\theta_{v} + 12 > 0\) because it is decreasing in \(\theta_{v}\) and positive when \(\theta_{v} = 1\), and

-

ii.

N is strictly increasing in \(\theta_{r}\):

\(\frac{\partial N}{{\partial \theta_{r} }} = 2\left( {3\theta_{v}^{2} \theta_{r}^{2} - 12\theta_{v} \theta_{r}^{2} + 12\theta_{r}^{2} - 3\theta_{v} \theta_{m} \theta_{r} + 6\theta_{m} \theta_{r} + 6\theta_{v}^{3} \theta_{r} - 42\theta_{v}^{2} \theta_{r} + 96\theta_{v} \theta_{r} - 72\theta_{r} + \theta_{m}^{2} - 2\theta_{v}^{2} \theta_{m} + 11\theta_{v} \theta_{m} - 14\theta_{m} + 3\theta_{v}^{4} - 30\theta_{v}^{3} + 111\theta_{v}^{2} - 180\theta_{v} + 108} \right) > 0\) because it is decreasing in \(\theta_{m}\) (\(\frac{{\partial^{2} N}}{{\partial \theta_{m} \partial \theta_{r} }} = - 6\theta_{v} \theta_{r} + 12\theta_{r} + 4\theta_{m} - 4\theta_{v}^{2} + 22\theta_{v} - 28 < 0\) since it increases in \(\theta_{v}\) and it is negative even when \(\theta_{v} = 1\)) and it is positive even when \(\theta_{m} = 1\) (When \(\theta_{m} = 1\), \(\frac{\partial N}{{\partial \theta_{r} }} = 2\left( {3\theta_{v}^{2} \theta_{r}^{2} - 12\theta_{v} \theta_{r}^{2} + 12\theta_{r}^{2} + 6\theta_{v}^{3} \theta_{r} - 42\theta_{v}^{2} \theta_{r} + 93\theta_{v} \theta_{r} - 66\theta_{r} + 3\theta_{v}^{4} - 30\theta_{v}^{3} + 109\theta_{v}^{2} - 169\theta_{v} + 95} \right) > 0\) because it is decreasing in \(\theta_{r}\) (\(\frac{{\partial^{2} N}}{{\partial \theta_{r}^{2} }} = 6\left( {\theta_{v} - 2} \right)\left( {2\theta_{v} \theta_{r} - 4\theta_{r} + 2\theta_{v}^{2} - 10\theta_{v} + 11} \right) < 0 )\) and it is positive even when \(\theta_{r} = 1\): when \(\theta_{m} = 1\) and \(\theta_{r} = 1\),\(\frac{\partial N}{{\partial \theta_{r} }} = 6\theta_{v}^{4} - 48\theta_{v}^{3} + 140\theta_{v}^{2} - 176\theta_{v} + 82 > 0\))

-

iii.

\(N > 0\) when \(\theta_{r} = 0\), because then: \(N = \left( {\theta_{m} + \theta_{v}^{2} - 3\theta_{v} + 2} \right)\left( {5\theta_{v} \theta_{m} - 11\theta_{m} + 2\theta_{v}^{3} - 4\theta_{v}^{2} - 10\theta_{v} + 20} \right)\) is the product of two positive terms, since each term is decreasing in \(\theta_{v}\) and positive when \(\theta_{v} = 1\).

-

iv.

given any \(\theta_{r}\) and \(\theta_{v}\), it is optimal for the manufacturer to set \(\theta_{m} = 0\) because \(\Pi_{m}^{**}\) is decreasing in \(\theta_{m}\):\(\frac{{\partial \Pi_{m}^{**} }}{{\partial \theta_{m} }}\) = \(- \frac{{\left( {a - c} \right)^{2} \theta_{m} \left( {\theta_{r} + 3\theta_{v} - 7} \right)^{2} }}{{\left( {2\theta_{v} \theta_{r} - 4\theta_{r} - \theta_{m} + 2\theta_{v}^{2} - 10\theta_{v} + 12} \right)^{3} }}\) < 0 for \(\theta_{m} > 0\) (To see that the denominator is positive, notice that it is positive when \(\theta_{v} = 1\) and it is decreasing in \(\theta_{v}\))

-

v.

given \(\theta_{m} = \theta_{r} = 0\), \(\Pi_{v}^{**}\) is concave, and the first-order condition \(\frac{{\partial \Pi_{v}^{**} }}{{\partial \theta_{v} }} = \frac{{\left( {a - c} \right)^{2} \left( {13\theta_{v}^{4} - 93\theta_{v}^{3} + 231\theta_{v}^{2} - 215\theta_{v} + 40} \right)}}{{4\left( {\theta_{v} - 3} \right)^{3} \left( {\theta_{v} - 2} \right)^{3} }} = 0\) yields \(\theta_{v}^{NV} = 0.2439\).

Using the equilibrium degrees of CSR, one can obtain the equilibrium values for the rest of the variables. The inequalities in the proposition hold because:

Proof of Proposition 6

When \(\theta_{v} = 0\) and \(\theta_{m} = 1\), the Nash Product \(P^{V}\) can be written as:\(P^{V} = - \frac{{\left( {a - c} \right)^{4} AB}}{C}\), with

\(A = \left( {143825692\theta_{r}^{3} - 37939774\theta_{r}^{2} - 762154664\theta_{r} + 41182819} \right)\), \(B = \left( {1820162036\theta_{r}^{3} - 6644541894\theta_{r}^{2} - 6683867938\theta_{r} + 6118794979} \right)\), \(C = 65446516094957228\left( {4\theta_{r} - 11} \right)^{4}\) and it is maximized at the only point where its derivative vanishes, \(\theta_{r} = 0.4008\).

Reciprocally, given that \(\theta_{m} = 1\) and \(\theta_{r} = 0.4008\), it can be checked that \(\frac{{\partial \prod_{v}^{**} }}{{\partial \theta_{v} }} = - 0.0102 < 0\) when \(\theta_{v} = 0\) and that \(\frac{{\partial \prod_{v}^{**} }}{{\partial \theta_{v} }}\) has no roots in the interval \(\theta_{v} \in \left[ {0,1} \right]\) and thus, it is optimal for the vertically integrated firm to set \(\theta_{v} = 0\).

The inequalities in the proposition hold because:

Rights and permissions

About this article

Cite this article

Fernández-Ruiz, J. Corporate social responsibility in a supply chain and competition from a vertically integrated firm. Int Rev Econ 68, 209–233 (2021). https://doi.org/10.1007/s12232-020-00363-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12232-020-00363-9