Abstract

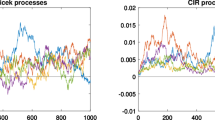

This paper mainly studies the pricing of credit default swap (CDS) with the loan as the reference asset, and gives a model based on the obtained conclusions. In the contract of CDS, we consider that the default of the protection’s seller is correlated with the stochastic interest rate following Vasicek model and the default state of the reference firm. We give the pricing formula of CDS and analyze the effect of the contagious risk between the counterparties on the pricing of CDS.

Similar content being viewed by others

References

BLACK F, SCHOLES M. The pricing of options and corporate liabilities [J]. Journal of Political Economy, 1973, 81(3): 637–654.

MERTON R C. On the pricing of corporate debt: The risk structure of interest rates [J]. Journal of Finance, 1974, 29: 449–470.

DUFFIE D, SINGLETON K J. Modeling term structures of defaultable bonds [R]. Stanford, California: Stanford University Business School, 1995.

JARROW R A, LNADO D, TURNBULL S M. A markov model for the term structure of credit risk spreads [J]. The Review of Financial Studies, 1997, 10(2): 481–523.

JARROW R A, TURNBULL S M. Pricing derivatives on financial securities subject to credit risk [J]. Journal of Finance, 1995, 50(1): 53–85.

DAVIS M, LO V. Infectious defaults [J]. Quantitative Finance, 2001, 1(4): 382–387.

JARROW R A, YU F. Counterparty risk and the pricing of defaultable securities [J]. Journal of Finance, 2001, 56(5): 1765–1799.

BAI Y F, HU X H, YE Z X. A model for dependent default with hyperbolic attenuation effect and valuation of credit default swap [J]. Applied Mathematics and Mechanics (English Edition), 2007, 28(12): 1643–1649.

HAO R L, YE Z X. The intensity model for pricing credit securities with jump-diffusion and counterparty risk [J]. Mathematical Problems in Engineering, 2011, 2011: 412565. 1–16.

HAO R L, LIU Y H, WANG S B. Pricing credit default swap under fractional Vasicek interest rate model [J]. Journal of Mathematical Finance, 2014, 4: 10–20.

HOWARD S, SHUNICHIRO U, ZHEN W. Valuation of loan CDS and CDX [EB/OL]. [2015-08-04]. http://ssrn.com/abstract=1008201.

ZHEN W. Valuation of loan CDS under intensity based model [R]. Palo Alto: Stanford University, 2007.

Author information

Authors and Affiliations

Corresponding author

Additional information

Foundation item: the National Natural Science Foundation of China (No. 11271259), the China Postdoctoral Science Foundation (No. 2014M551297), the Innovation Program of Shanghai Municipal Education Commission (No. 13YZ125) and the Funding Scheme for Training Young Teachers in Shanghai Colleges (No. ZZshjr12010)

Rights and permissions

About this article

Cite this article

Hao, R., Zhang, J., Liu, Y. et al. Pricing credit default swap with contagious risk and simulation. J. Shanghai Jiaotong Univ. (Sci.) 21, 57–62 (2016). https://doi.org/10.1007/s12204-016-1699-y

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12204-016-1699-y