Abstract

This work exploits a large panel dataset on Italian manufacturing SMEs to examine the relationship between leverage and firms’ financial stability. Specifically, we evaluate whether and to what extent this link is affected by the degree of competition characterising the local credit market in which firms operate. Using two measures of local banking competition – the H-statistic and the Boone indicator – our evidence indicates that the negative impact of leverage on firms’ financial health is greater for firms operating in more competitive banking markets. A plausible interpretation of this finding is that the competition drawbacks could prevail on its expected advantages, leading banks to be less inclined to establish lending relationships with risky firms, thus exacerbating their financial vulnerability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The role of market competition in the banking sector is largely debated in the economic literature, as theoretical and empirical contributions do not provide univocal predictions. Indeed, the research on the topic ends up with mixed results, showing that bank competition may have either positive or negative effects – thus challenging the standard microeconomic view that higher competition in a market leads unequivocally to welfare gains. (e.g.: Cetorelli 1997; Marquez 2002; Dell'Ariccia and Marquez 2006; Hauswald and Marquez 2006).

Our paper aims to contribute to the literature by providing empirical evidence on the role that banking competition might play in affecting the financial stability of small and medium-sized enterprises (hereafter SMEs). More in detail, moving from considering the research predictions on the relationship between indebtedness and SMEs’ financial stability – according to which firms’ risk of bankruptcy rises at increasing debt levels (see, among others, Warner 1977; Kim 1978; Jensen 1986; Guariglia 1999) – we evaluate to what extent this link is affected by the degree of competition among banks in the local credit markets in which firms operate.

The expected results are not obvious, as two opposite scenarios can be envisaged on the theoretical ground. On the one hand, if banking competition leads to more favourable credit conditions, this should reduce borrowing costs, which might benefit both healthier and indebted firms – as they can access credit and pursue their investment projects more efficiently. Indeed, the Neoclassical Theory, namely the market power hypothesis, predicts that bank competition should increase access to finance, reduce interest rates and lower collateral requirements for SMEs (Besanko and Thakor 1992; Jimenez et al. 2006; Hainz et al. 2013; Ornelas et al. 2022). Therefore, higher competition might alleviate the negative effect of debt on firms’ financial health. On the other hand, following the arguments of the information-based hypothesis, in the presence of information asymmetries and agency costs, higher competition might reduce bank incentives to invest in relationship lending and, thus, lead to higher financial constraints (Marquez 2002; Dell'Ariccia and Marquez 2006; Hauswald and Marquez 2006; Wang et al. 2020). Petersen and Rajan (1995) claim that banks operating in less competitive markets, exploiting their greater market power, can avoid applying higher interest rates when lending to relatively more opaque or risky (young, small or distressed) firms. Furthermore, as competition increases, the effectiveness of banks’ screening technology tends to diminish to the point that, ceteris paribus, the expected benefits of the competition become negative (Gomez and Ponce 2014). In such cases, increasing competition might reinforce the effect of leverage on firms’ risk of failure, particularly for riskier ones due to higher indebtedness.

Our empirical analysis takes advantage of a large panel of Italian SMEs observed from 2003 to 2012. Several reasons drive this choice. First, SMEs rely on bank financing from local credit markets (i.e. Alessandrini et al. 2009; Castelli et al. 2012). Moreover, considering the local credit market, corporate finance decisions greatly vary compared to big firms, given their opacity and difficulty accessing external credit (Deloof et al. 2019). Lastly, SMEs represent the backbone of the Italian economy, about 99% of total enterprises, accounting for circa 68% of overall value-added and employing about 79% of the workforce in the country (ISTAT 2019; Agostino et al. 2022).

The indicator of financial health we employ is the Z-score, commonly adopted as a measure of the distance from insolvency (e.g., Laeven and Levine 2009; Houston et al. 2010; Kanagaretnam et al. 2014; Mihet 2013; Jin et al. 2013; Agostino and Trivieri 2018). Regarding local credit markets, we consider the level of aggregation to the existing administrative provinces. Indeed, according to Bonaccorsi di Patti and Dell’Ariccia (2004), Italian provinces are characterised by a different banking structure, providing relevant cross-section variability within a single institutional framework. As measures of local banking competition (LBC), we employ non-structural indicators: the H-statistic, proposed by Panzar and Rosse (1987) and the Boone indicator (2008). Both indexes have been proven to be precise and robust measures of bank market power and are often uncorrelated with concentration measures (Claessens and Laeven 2004; Maudos and De Guevara 2004, 2007).

The main results, robust to different econometric methodologies, indicate that leverage always negatively and significantly affects SMEs’ financial health, confirming the theoretical prediction about this relationship. Moreover, we find that the negative impact of leverage intensifies at increasing levels of competition. According to this evidence, the drawbacks seem to outweigh the benefits potentially associated with competitive banking markets, strengthening the negative effect of higher indebted levels on SMEs’ financial stability. Indeed, increasing banking competition may reduce the incentive to invest in monitoring and screening activities because of free-riding problems and might curtail the propensity to establish relationship lending as firms may easily switch banks. These factors could lead banks to ration risky firms, deteriorating, in turn, their financial health. Thus, our results suggest that a certain degree of monopolistic power in local banking markets does not necessarily entail welfare losses, corroborating the strand of literature that challenges the Neoclassical Theory.

The remainder of this paper is organised as follows: after this introduction, Section 2 provides an overview of the related literature and sets up the research hypothesis. Section 3 offers an overview of the Italian financial system. Section 4 presents the estimating model, the econometric methodology and the dataset. Section 5 shows the results, while Section 6 concludes.

2 A brief related literature and the research hypotheses

There is a large consensus in the economic literature about a positive relationship between firms’ indebtedness and failure probability: at increasing levels of debt, the likelihood that a firm’s financial distress occurs is also expected to increase (Warner 1977; Kim; 1978; Jensen 1986; Verwijmeren and Derwall 2010; Hovakimian et al. 2011; Di Patti et al. 2015). Indeed, worsening firms’ debt rating (Molina 2005) and a higher leverage ratio imply the rise of external funding costs, which – ceteris paribus – increases the probability of financial distress. In turn, financially distressed firms comply with more constraints in debt covenants (Bhattacharjee and Han 2014), further aggravating firms’ financial stability and bankruptcy probability (Cheng and Tzeng 2011).Footnote 1

In many countries, including Italy, external finance is essentially bank funding. The literature investigating the crucial factors that allow or prevent firms’ access to bank loans has shown that bank competition would play a relevant role – though the theoretical predictions and the empirical evidence are mixed (Berger and Udell 1998; Bonaccorsi di Patti and Dell’Ariccia 2004; Sutaria and Hicks 2004; Rogers 2012; Backman 2015). Indeed, according to the Neoclassical Theory (market power hypothesis), bank competition would increase access to finance by reducing interest rates and lower collateral requirements for SMEs (Besanko and Thakor 1992; Jimenez et al. 2006; Hainz et al. 2013). Koskela and Stenbacka (2000) claim that greater competition increases borrowers’ probability of repaying their loans due to lower interest rates. Beck et al. (2004) illustrate that bank concentration increases financing obstacles, particularly for SMEs, compared to large firms. Agostino et al. (2012) show that bank market concentration positively affects (Italian) SME default riskiness when they borrow heavily from their primary bank and have few credit relationships with other intermediaries. Recently, Papanikolaou (2019) found that boosted competition decreases lending costs, promoting the entry of new customers into credit markets. Similarly, Ornelas et al. (2022) show that lower competition between Brazil’s private banks increases firm financing costs. According to Moyo and Sibindi (2022), in studying African countries, higher competition in the banking sector leads to higher informal firms’ probability of getting financial access.

On the other hand, several theoretical and empirical works have challenged the neoclassical view, proposing an information-based hypothesis. They highlight the role of asymmetric information problems between lenders and borrowers (Stiglitz and Weiss 1981), showing that higher competition reduces bank incentive to invest in relationship lending, thus increasing financial constraints for firms (Marquez 2002; Dell'Ariccia and Marquez 2006; Hauswald and Marquez 2006). According to Boot and Thakor (2000), banks have fewer motivations to provide loans based on relationship banking in a lower concentrated market. Indeed, borrowers might easily switch from one bank to another in this type of environment, dispersing the borrower-specific information. Petersen and Rajan (1995) show that younger firms may receive more credit at better rates when bank monopoly power is relatively higher. They argue that a monopolistic bank might help young or distressed firms to extract rents from eventually successful ones. Higher banking competition might diminish the number of banks active in performing screening and competing in supplying credit, thus leading to higher interest rates and smaller credit quantities in a market (Di Patti and Gobbi 2001; Cao and Shi 2001; Gomez and Ponce 2014; Ryan et al. 2014; Rahman et al. 2019). Even worse, as competition intensifies, less information production means banks are more prone to make errors in their lending decisions, leading to access to credit for low-quality borrowers (Marquez 2002; Hauswald and Marquez 2006). In this vein, Wang et al. (2020) find that banking market power decreases the cost of debt for European SMEs, especially those less informationally transparent. They highlight the higher motivation of the bank to invest in soft information and lending relationships to reduce information costs. Accordingly, Ayalew and Xianzhi (2019) show that bank competition increases firm financing constraints in Africa.

What about the theoretical and empirical predictions on the relationship between bank competition and firms’ financial distress? In a scenario characterised by high monopolistic banking power, the Neoclassical Theory assumes banks might charge higher interest rates on loans. In this case, banks might ration especially indebted firms, more opaque and risky, requiring specific monitoring and screening activities (Pagano 1993; Cetorelli 1997; Cetorelli and Peretto 2000; Guzman 2000; Boyd and De Nicolo 2005). According to the information-based hypothesis, instead of exploiting their market power, monopolistic banks could have higher incentives to screen and monitor to better discriminate among borrowers, thus facilitating firms’ financing (Stiglitz and Weiss 1981; Diamond 1984; Udell 2008). Indeed, by establishing close lending relationships, monopolistic banks might require a lower interest rate to lock in the firm into the relationship and gain rents in the future. Moreover, any interest rate premiums – otherwise charged – might be sacrificed when lending to relatively opaque or risky firms (Petersen and Rajan 1995), which entail poorly performing firms that match banks with higher market power (Delis et al. 2017).

On the other hand, in banking markets characterised by higher competition, firms could play a role in determining the behaviour of banks. Indeed, in such a context, firms might borrow from several banks or switch banks, matching those that offer the most advantageous loan terms (Boot and Thakor 2000). From the supply side, banks might lower interest rates to grab customers. In this respect, following the market power hypothesis, bank competition should reduce interest rates and lower collateral requirements for SMEs, thus increasing access to finance (Besanko and Thakor 1992; Jimenez et al. 2006; Hainz et al. 2013; Ornelas et al. 2022). By contrast, according to the information-based hypothesis, higher competition may reduce bank incentive to invest in relationship lending because of free-riding problems (Marquez 2002; Dell'Ariccia and Marquez 2006; Hauswald and Marquez 2006; Wang et al. 2020).

To sum up, from one side, a credit market characterised by higher monopolistic power entails both benefits and drawbacks for indebted firms. If the gains prevail, they may alleviate the pressure of debt repayment. Vice versa, in a competitive market, banks’ incentive to undertake screening and monitoring activities is lower because each financial institution knows that the other competitors might take advantage of that information. Therefore, the banking market structure might alleviate or aggravate the negative effect of leverage on firms’ financial health.

The above controversial predictions justify the empirical research we carry out in this paper, which relies on the two following hypotheses:

-

Hp1: the leverage ratio is expected to impact firms’ financial stability negatively; therefore, the higher the level of leverage, the lower the Z-score.

-

Hp2: the adverse effects of leverage on firm financial stability could be either amplified or reduced by higher competition levels in local banking markets.

3 The Italian financial system: some key aspects

The dominance of the banking sector characterises the Italian financial system, whereas the market capitalisation of the stock market remains relatively modest. The importance of the Italian banking industry is on par with that of other European nations and Japan. For instance, Italy’s bank credit to GDP ratio stands at 70.33%, a figure akin to France (81.29%) and Belgium (77.34%) (D’ Onofrio et al. 2019).

Historically, the Bank of Italy maintained a centralised supervisory approach, retaining the authority to close undercapitalised banks and reject requests to establish new banks or branches. Similarly, prior authorisation was required for mergers and acquisitions (M&As) (Monticelli 1992; De Bonis et al. 2018). In the early 1990s, the Bank of Italy removed restrictions on opening new branches – thus ending over fifty years of entry barriers – with the aim of establishing a competitive market with fewer internal barriers and less fragmentation (De Bonis et al. 2018). Furthermore, profound changes in the national banking regulation beginning with the 1990 Amato-Carli law gave start to a considerable banking consolidation process, most notably during the 1990s/early 2000s and, to a lesser extent, in the last decade (e.g., Del Prete et al. 2022). As a result, according to the Bank of Italy (2015), the number of banks decreased by 17%, while employees and bank branches declined by around 17,900 units (-5.6%) and 3,400 units (-9%), respectively. The most pronounced reductions were observed among the five largest banking groups, which also experienced significant drops in their market shares. Concurrently, technological advancements led to the emergence of alternative distribution channels for banks, such as Internet banking, mobile banking, and phone banking (Coccorese and Santucci 2020).

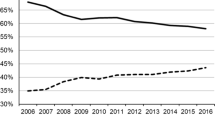

A comprehensive overview of the period from 1989 to 2016 reveals two noteworthy trends (Bank of Italy 1990, 2017): an expansion in the number of branches and substantial sector consolidation. Specifically, the number of banks declined by over 40%, plummeting from 1,085 to 604, while the count of bank branches nearly doubled, surging from approximately 15,500 to 29,000 (Coccorese and Santucci 2020).

Despite the considerable changes in the market structure over time, certain distinctive features have persisted. Indeed, a total of 70 banking groups and 475 banks were active in Italy by the close of 2016. Among these, 53 were commercial banks, 15 were Banche di Credito Popolare (popular banks), 325 were Banche di Credito Cooperativo (mutual banks), and 82 were branches of foreign banks. Notably, there were 14 Italian banking groups identified as significant by the Single Supervisory Mechanism, collectively holding 74% of the total assets (Bank of Italy 2017). Moreover, Banche di Credito Cooperativo (BCCs) maintains a significant market share, which commands approximately 40% of all active branches.

4 Empirical analysis

4.1 The estimating model

To test the above hypotheses, we estimate the following model:

where the dependent variable is the Z-score (ZSCORE) of firms i at time t, calculated as the sum of return on assets plus the capital asset ratio divided by the standard deviation of return on assets, the latter being computed over three-year rolling time windows (Panetta and Pozzolo 2010; Schaeck et al. 2012; Agostino and Trivieri 2018; Schulte and Winkler 2019; Banna et al. 2021; Phan et al. 2021; Marcelin et al. 2022).Footnote 2 Such a variable is widely used as a measure of distance from insolvency (Roy 1952), as its value is negatively associated with the probability of default if profits follow a normal distribution.Footnote 3 Stated differently, higher values of Z-score individuate healthier and more stable firms (Roy 1952; Laeven and Levine 2009; Schaeck et al. 2012; Mihet 2013). Indeed, the Z-score increases with profitability and solvency and decreases as the return’s standard deviation increases. A higher Z-score implies a lower probability of failure (Kasman and Carvallo 2014).Footnote 4

Focusing on the right-hand side variables, the firm’s leverage ratio (LEV) – expressed as the sum of current and non-current liabilities over total assets – has been used to account for the level of firm’s debt.Footnote 5 The variable LBC denotes one of the banking competition measures computed at the provincial level, either the H-statistic (Panzar and Rosse 1987) or the Boone indicator – both described in the next subsection. INTE is the interaction term between one of the LBC measures and LEV. As far as the X vector is concerned – following the contributions on the determinants of firms’ insolvency/failure (see, among others, Taffler 1982; Cuthbertson and Hudson 1996; Lennox 1999; Bhattacharjee et al. 2009) – it comprises a set of control variables that can be categorised into two groups. The first one accounts for firms’ characteristics and includes: the log of total sales (SIZE), CASHFLOW, collateralisable assets (TANGIBLE), productivity (PRODU), debt sustainability (DEBT_SUST) and AGE. Previous contributions show that small firms are more likely to fail than experienced companies because their access to credit markets is limited (Altman and Hotchkiss 1993; Bernanke and Gertler 1995; Geroski and Gregg 1996; Caves 1998; Pakes and Ericson 1998; Jovanovic and Rousseau 2002). Cash flow from operations is an essential determinant of firms’ financial health (Jensen 1986). Furthermore, a low debt-to-equity ratio is an attractive factor for investors as it signals a lower financial risk, ensuring higher chances of debt financing in the future (Bhattacharjee and Han 2014). The second group of regressors in the X vector includes provincial characteristics, such as the real gross domestic product (GDP) and the Jacob index (JACOB); this latter is used to proxy for inter-industry externalities. Lastly, \({IND}_{s}\) are sector dummies, controlling for unobserved heterogeneity at the sector level, \({T}_{t}\) is a set of time-fixed effects and \({\epsilon }_{it}\) is the error term. Table 1 reports the main summary statistics of the sample, and Table 8 (in the Appendix) provides a correlation matrix.

4.2 Measuring banking competition

The LBC indicators we employ – the H-statistic (Panzar and Rosse 1987) and the Boone indicator (Boone 2008) – are non-structural measures of banking competition, which directly quantify the competitive behaviour of banks without relying on structural dimensions (such as concentration) of credit markets.Footnote 6

A reduced-form revenue equation is applied to build the H-statistic (or H-test), defined as the sum of the elasticities of the total revenues to factor input prices.Footnote 7 The H-statistic is equal to 1 when firms operate under perfect competition, zero (or negative) in the case of monopoly or perfectly collusive oligopoly. Any value in between denotes monopolistic competition with freedom of entry. The H-statistic is an increasing function of the absolute price elasticity of demand (Vesala 1995): any value between 0 and 1 can be interpreted as a continuous measure of the level of competition (Bikker and Haaf 2002), denoting monopolistic competition with freedom of entry. We derive the H-statistic by estimating the following model:

All the variables appearing in Eq. (2) are described in Table 2 and are analogous to those employed by De Bandt and Davis (2000). Then, the H-statistic is obtained as: \({{H}_{it}=\beta }_{1}+{\beta }_{2}+{\beta }_{3}\) for each province p at time t. The equilibrium test is carried out by replacing TGR with ROA.Footnote 8

Passing to consider the Boone indicator (Boone 2008), it relies on the idea that competition increases the market shares of more efficient firms and reduces the market shares of the inefficient ones. Indeed, the larger the impact of efficiency on rising firms’ market shares, the higher the degree of competition in that market and vice versa. To support this market characteristic, Boone (2001, 2008), through a set of theoretical models shows that higher profits or market shares are obtained by more efficient firms (with lower marginal costs).

To derive the Boone indicator, we adopt the empirical specification of Schaeck and Čihák (2010)Footnote 9:

where \({\pi }_{it}\) measures profits of bank i at time t (ROA), \({c}_{it}\) the marginal costs, and \(\beta\) is the Boone indicator. Since marginal costs are not directly observable, we approximate them by average costs (Planbureau 2000; Griffith et al. 2005; Bikker and Van Leuvensteijn 2008; Schaeck and Čihák 2010).Footnote 10

Market shares rise for more efficient banks (i.e., with lower marginal costs, \(\beta <0)\). This negative relationship between market share and costs is amplified by the degree of competition characterising the market. Thus, a larger negative value of \(\beta\) indicates a higher degree of competition in the banking market (Van Leuvensteijn et al. 2011; Kasman and Carvallo 2014) .

4.3 Data

The econometric analysis is based on data coming from several sources. Balance-sheet information on Italian manufacturing firms is retrieved from the database Orbis, held by Bureau van Dijk. Since, as mentioned above, we focus on SMEs, our sample comprises only firms with (a maximum of) 249 employees.Footnote 11 Data on Italian banks and information on the provincial distribution of their branches come from the ABI Banking dataset provided by the Italian Banking Association. Since balance sheet data are only available at the bank level, to retrieve our indicators of bank competition at the local credit market level (provincial level), we employ the criterion suggested by Carbò Valverdie et al. (2003).Footnote 12 Lastly, information on the local characteristics used as control variables is collected from the Italian National Institute of Statistics. Our final estimated sample is made up of an unbalanced panel of 296,828 firm-year observations in the period 2003–2012 concerning the manufacturing industry.Footnote 13

4.4 Econometric strategy

On a methodological ground, we adopt Pooled OLS, Random and Fixed effect estimators to account for the panel structure of the data. Besides, we run a Multilevel model to consider the data’s hierarchal structure. Indeed, the dependent variable (individual firms’ Z-score) is related to explanatory variables defined at different levels (i.e. firm and province). Using mixed models ensures a proper examination of the influence of specific provincial characteristics (such as bank competition) on firms’ financial stability. Specifically, these models allow correlation among the residuals of observations belonging to the same cluster, leading to more efficient estimates (De Leeuw et al. 2008).Footnote 14

The models mentioned above do not account for potential endogeneity problems. Indeed, some unobservable cultural and historical determinants might influence both firms’ financial stability and banking market structure. Furthermore, some firms’ characteristics, such as know-how and managers’ experience, which may represent a value-added, are not observable (Thompson 2005; Bhattacharjee et al. 2009). To consider the endogeneity issue, we employ an instrumental variable approach. Following Guiso et al. (2004), we use the geographical distribution of Italian banks (and branches) in 1936 to retrieve our instrumental variables. Indeed, Guiso et al. (2004, p. 946) argue that the territorial structure of the Italian banking system in 1936.Footnote 15 “was the result of historical accidents and forced consolidation, with no connection to the level of economic development at that time”. Moreover, the 1936 regulation was not driven by different regional needs, “but it was random” (2004, p. 943). Hence, the geographical distribution of banks and branches in 1936 can be considered exogenous concerning firm performance in subsequent years, while it is significantly correlated with local banking development in the 1990s (Guiso et al. 2004).Footnote 16

Lastly, as other variables, such as leverage, could be affected by endogeneity, we estimate Eq. (1) by the SYS-GMM estimator developed for dynamic panel models by Arellano and Bover (1995) and Blundell and Bond (2000). This methodology – employed in the related literature by Noman et al. (2017), among others – jointly estimates Eq. (1) in difference and level, using lagged levels as instruments for the regression in difference and lagged differences as instruments for the regression in level. This procedure allows the capture of the persistence of financial stability (Lee et al. 2014), accounts for unobserved firm-specific effects and addresses the potential endogeneity of all financial variables in the model.Footnote 17

5 Estimation results

5.1 Baseline results

Table 3 reports the estimates without interacting LEV and (a measure of) LBC. Columns 1 and 2 show the results when employing the H-statistic (H), while columns 3 and 4 report the estimates using the Boone indicator (BOONE). At the bottom of columns 2 and 4, which display the IV estimates, the Durbin-Wu-Hausman test does not reject the null hypothesis of LBC exogeneity, so we focus on discussing the results in columns 1 and 3.

Table 3 shows that the LEV parameter is negative and statistically significant at a 1% level. Thus, in line with our Hp1, leverage increases SMEs’ default probability (as the Z-score measures the distance from insolvency or failure), ceteris paribus. In this respect, as pointed out by Levine and Warusawitharana (2021), Huynh and Petrunia (2010) and Huynh et al. (2010), there could be a non-linear relationship between leverage and firms’ performance, growth, and survival prospects. Thus, we replicate the estimations in Table 3 by adding the squared value of the leverage ratio (LEV2). Results in Table 4 suggest an inverse U-shaped relationship between leverage and z-score, as the LEV coefficient is positive, while the square term parameter is negative. However, calculating the marginal effect of LEV on ZSCORE as LEV changes (Fig. 3 in the Appendix, based on estimation of column 1 of Table 4), no observation falls in the region where the marginal effect is positive, as the minimum level of leverage in our sample is 22.36 (in percentage).Footnote 18 As a result, given that the positive relationship is related to a level of leverage ratio not reached by the firms in our sample, we exclude the squared term of the leverage in the specification with interaction.

Regarding the control variables, our findings fall along the expected lines: according to Tables 3 and 4, increasing SIZE, AGE and CASHFLOW reduces SMEs’ default risk. Also, in line with Agostino and Trivieri (2018), TANGIBLE and PRODU positively affect SMEs’ financial stability. The impact of debt sustainability (DEBT_SUST) is non-linear, following an inverted U shape. Finally, while agglomeration spillovers (JACOB) negatively influence firms’ Z-score, increasing provincial real GDP reduces the SME’s default probability.

Table 5 estimations are performed to assess the effect of LEV on ZSCORE as LBC changes (Hp2). While columns 1–4 in Table 5 consider the H-test, columns 5–8 show the Boone indicator results. As displayed by the title of each column, findings are obtained by employing different estimators: Pooled, RE, FE and Mixed models.

The parameter of LEV is found, once again, negative and significant in all the estimations, as well as the INTE coefficient.Footnote 19 We then compute the marginal impact of LEV on ZSCORE for all the sample levels of LBC, showing these results in Figs. 1 (for the H-statistic) and 2 (for the Boone indicator).Footnote 20 According to these figures, the LEV marginal effect on ZSCORE is always statistically significant, rising in absolute value as the LBC measures increase. This finding indicates that indebtedness might negatively influence SMEs’ financial health more harshly when the banking market becomes more competitive. Or that, in line with the information-based hypothesis (Marquez 2002; Dell'Ariccia and Marquez 2006; Gomez and Ponce 2014), higher degrees of monopolistic power could overcome their costs and benefit firms’ financial stability.Footnote 21

Lastly, results concerning the control variables confirm those obtained in Tables 3 and 4 in terms of statistical significance, and only slight differences occur in the magnitude of the estimated parameters (Fig. 2).

5.2 Dynamic panel results and further insights

This section first discusses the results obtained using a SYS-GMM approach. Indeed, the analysis performed so far models firm stability as a static variable and endogeneity issues are not fully addressed.

Table 6 shows that the previously discussed results are qualitatively confirmed: LEV negatively affects ZSCORE, and this effect tends to be amplified (in absolute value) at increasing levels of competition.Footnote 22 Moreover, the Z-score of the previous year positively affects the current level of the Z-score. It is important to mention that AR(2), at the bottom of Table 6, does not indicate that the instruments would be correlated with the error term. The null hypothesis of no second-order serial correlation cannot be rejected in all our regressions. Also, the null hypothesis of instrument validity, known as the Hansen test of overidentifying restrictions (Hansen test), cannot be rejected in all our specifications.

Then, we consider that our sample refers to 2003–2012, thus including the years before, during and after the Great Financial Crisis (GFC) of 2008–2009. Therefore, it could be possible that there might be a change in the relationships being investigated due to the GFC. To test this hypothesis, we estimate the equation using only data from the years before the GFC (period 2003 – 2007) and using only data from the years after the GFC (period 2010 – 2012). The results reported in Table 7 show that the main result is confirmed only at regular times (i.e. before the GFC); indeed, LEV negatively affects ZSCORE, and this effect increases (in absolute value) at higher levels of competition (Columns 1 and 3).Footnote 23 On the other hand, competition does not affect the relationship under scrutiny after the crises, as both the LBC measures and the interaction with LEV are not statistically significant (Columns 2 and 4). In our view, these results highlight that in a period of uncertainty and economic instability, higher indebted firms are rationed out from the credit market regardless of its structure in terms of competition, thus increasing firms’ chances to fail.

Further, to deepen the investigation, we consider four sub-samples according to the Italian macro-areas: Northeast, Northwest, Central and Southern Italy. The main results are confirmed in Tables 10, 11, 12, and 13 in the Appendix. Indeed, the LEV marginal effect on ZSCORE – summarised in Figs. 4, 5, 6, and 7 (also in the Appendix) – is always statistically significant, increasing in absolute value as the LBC measure increases.Footnote 24 Only slight differences in the magnitude of the effect arise: LEV seems to have a greater impact on ZSCORE in Central and Southern Italy compared to the Northern area.Footnote 25 In other words, the impact of indebtedness appears somewhat related to the economic conditions of regions where SMEs operate: in more developed and economically stable areas, firms’ debt might play a less significant role in determining their default probability than in poorer regions.

6 Conclusion

Using a large panel dataset of Italian manufacturing SMEs in the period 2003–2012, this work has investigated the impact of leverage on SMEs’ financial stability, gauging whether local banking competition may influence this relationship.

In line with the extant literature, our evidence confirms the role played by indebtedness in deteriorating SMEs’ financial stability (Warner 1977; Kim 1978; Jensen 1986). Credit markets could detect potential firms’ financial difficulties through higher leverage ratios. To protect themselves from the firms’ insolvency risk, banks may require additional collateral and higher interest rates, increasing the cost of external financing and, thus, exacerbating firms’ financial instability.

Moreover, our results indicate that the relationship between leverage and firms’ financial health seems to be affected by the degree of competition characterising the local credit market. Indeed, we find that the negative impact of indebtedness on SMEs’ financial stability tends to be weaker as monopolistic power in the credit market increases. Our interpretation of this finding relies on the information-based hypothesis: banks with higher market power would be more inclined to help more vulnerable firms, as lenders have sturdier incentives to maintain lasting lending relationships from which extracting rents.

Our main finding is confirmed only before the GFC, corroborating the idea that uncertainty leads banks to not assist indebted firms in periods of financial turmoils irrespectively of the banking market structure. In this vein, the evidence of this work is confirmed when splitting the sample according to the four Italian macro-regions. Nevertheless, we also find that the impact of indebtedness on firms’ financial stability seems to be more severe in poorer areas, giving further support to the idea that local conditions matter.

In terms of policy, a first indication offered by the present research is that interventions to ensure and consolidate the relations between vulnerable enterprises and banks could be designed. Indeed, establishing and maintaining interactions among these agents might ensure lower fluctuations in firms’ stability, especially those highly indebted. Moreover, our work suggests that restructuring processes oriented to a more concentrated banking system could benefit vulnerable firms. In this vein, the introduction of a recent reform (law 49/2016) about reinforcing and re-centralising the cooperative banks’ system could represent a starting point for future evaluation of banking concentration and its effect on enterprises. Similarly, whether and to what extent our conclusions hold by using other firms’ financial stability and indebtedness measures and employing Artificial Intelligence techniques are relevant topics for future research.

Data Availability

The data that support the findings of this study are available upon reasonable request.

Notes

A considerable number of studies documents the role of financial constraints in affecting firms’ failure risk (Cowling and Mitchell 2003; Farinha 2005; Hutchinson and Xavier 2006; Bottazzi et al. 2007; Petrunia 2007; Musso and Schiavo 2008). The degree of access to external sources of finance directly entails firms’ activities growth and, in turn, their survival (Oliveira and Fortunato 2006; Musso and Schiavo 2008).

As a sensitivity check, the Z-score has also been computed considering a larger time window of 5 years (ZSCORE2).

Because of missing information on some financial ratios (such as retained profits to total assets), we are precluded from also using the Altman Z-scores (Altman 1968; Altman and Hotchkiss 1993; Altman et al. 1998). In addition, even though it is a dated measure of financial stability, it still represents one of the main approaches employed in the recent literature. Indeed, when searching for studies using this approach (after 2018), we found 105 papers. The great majority of these works (76%) are above the median ranking quality according to Scopus, accessed on 08/09/2023.

It is important to mention that firms’ financial stability/distress can also be studied by applying Artificial Intelligence methods, such as machine learning and some specific branches, among which artificial neural networks (e.g., Duarte and de Moraes Barboza 2020; Dube et al. 2023). The potential advantage of adopting deep learning for predicting financial distress over the more traditional models may be diverse. First, they can easily capture non-linearity in financial data, and further, they are not sensitive to outliers and multicollinearity among attributes (Eliasy and Przychodzen 2020). Second, no strict a priori assumptions are required for data distribution (Shi 2009). Although there are these advantages, we discard these approaches because we are interested in isolating the causal effect of our main regressors on the observed outcome.

We employ LEV instead of a bank debt ratio since, in the latter case, we lack many observations.

It has been shown that banking sectors are simultaneously concentrated and competitive, so that concentration might be considered a poor proxy for explaining market power (Ryan et al. 2014).

A crucial feature of the H statistic is that it must be undertaken on observations that are in long-run equilibrium. Indeed, as Panzar and Rosse (1987) explain, this hypothesis is important for the cases of perfect competition and monopolistic competition, while it does not constitute a fundamental prerequisite in the case of monopoly since H ≤ 0 is a long-run condition for monopoly. To test if observations are in long-run equilibrium, one can assume that competitive markets equalize the return rates across firms, so that in equilibrium, these rates should not be correlated with input prices. Empirically, this test can be carried out by using an indicator of firm return as dependent variable in the estimation of H. In this context, H = 0 implies that the data are in equilibrium (Shaffer 1982).

The average cost is expressed by the ratio between variable costs to total income.

It is worth mentioning that the excluded (large) firms are around 1% of the sample. When replicating the main estimations, including all sample firms, the results are both qualitatively and quantitatively unchanged. For the sake of brevity, these results are available upon request.

Formally, each variable of interest x for the branches (BRs) of bank i in province p in year t is retrieved as \({x}_{ipt}={X}_{it}*\left({BR}_{ipt}/{BR}_{it}\right)\), where: \({X}_{it}\) is the same variable as it is provided by the balance-sheet of bank i at time t; \({BR}_{ipt}\) is the number of branches of bank i in province p in year t; finally, \({BR}_{it}\) is the number of branches of bank i at time t.

To take into account the presence of potential outliers, the observations lying in the first and last percentile of the distribution of each variable involved in the econometric analysis have been dropped.

In 1936, in response to the Great Depression, strict banking regulations were introduced and remained substantially unchanged until the second half of the 1980s.

Building on these considerations, we instrument the LBC indicators by using provincial bank information in 1936: the share of banks owned by cooperative Popolari, the share of branches owned by cooperative Popolari, the number of mutual cooperative banks per million inhabitants, the share of branches owned by mutual cooperatives, the total number of banks in the province. The results of the Sargan-Hansen test of overidentifying restrictions suggest that the instruments we use are valid.

Estimating the regression in both differences and levels addresses the weak instrument problem that arises from using lagged levels of persistent explanatory variables as instruments for the regression in differences (Blundell and Bond 2000) and solves much of the efficiency problem in the first version of GMM estimators, namely the first difference (Arellano and Bond 1991).

Results also hold when considering the estimantion of column 3 of Table 4.

This evidence suggests that the leverage exerts a negative effect on SMEs’ financial stability when the local banking market is a monopoly (when H = 0, the estimated influence of LEV is -0.4878 – columns 1 of Table 5). Conversely, competition seems to decrease the probability of default when the firm shows a leverage equal to zero (when LEV = 0, the estimated influence of H is 0.0386 – columns 1 of Table 5). However, no firm presents a leverage value equal to zero, and the LBC indicators never assume a zero value in our sample. Hence, these results provide no valuable evidence. For more information on the distribution of LEV and LBC measures, see Table 1

Figures 1 and 2 are based on the estimation results reported in columns 1 and 5 of Table 5. The y-axis represents the marginal effect of ZSCORE for all the values of LBC, while the dashed lines define 95% confidence intervals. The use of a graphical illustration is worthwhile, as the effect of ZSCORE could change sign and/or become not statistically significant for different levels of LBC.

These results remain qualitatively unaltered, employing the Z-score computed over a five-year rolling time window (ZSCORE2) as the dependent variable (Table 9).

For the sake of brevity, the results obtained when using the alternative Z-score measure (5-year window) are omitted and available upon request.

The marginal effect appears statistically different among groups according to the Chow test.

By implementing a Chow test, the marginal effect appears statistically different among groups.

References

Agostino M, Trivieri F (2018) Who benefits from longer lending relationships? An analysis on European SMEs. J Small Bus Manage 56(2):274–293

Agostino M, Errico L, Rondinella S, Trivieri F (2022) Lending relationships and SMEs’ productivity. Does social capital matter? Int J Econ Bus 29(1):57–87

Agostino M, Gagliardi F, Trivieri F (2012) Bank competition, lending relationships and firm default risk: an investigation of Italian SMEs. Int Small Bus J 30(8):907–943

Alessandrini P, Presbitero AF, Zazzaro A (2009) Geographical organisation of banking systems and innovation diffusion. In: The changing geography of banking and finance. Springer, Boston, pp. 75–108

Altman EI, Hotchkiss E (1993) Corporate financial distress and bankruptcy. John Wiley & Sons, New York, pp 105–110

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Financ 23(4):589–609

Altman EI, Hartzell J, Peck M (1998) Emerging market corporate bonds—A scoring system. In: Emerging market capital flows. Springer, Boston, pp. 391–400

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68(1):29–51

Ayalew MM, Xianzhi Z (2019) Bank competition and access to finance: evidence from African countries. J Ind Compet Trade 19:155–184

Backman M (2015) Banks and new firm formation. J Small Bus Enterp Dev 22(4):734–761

Banna H, Hassan MK, Rashid M (2021) Fintech-based financial inclusion and bank risk-taking: evidence from OIC countries. J Int Finan Markets Inst Money 75:101447

Beck T, Demirguc-Kunt A, Maksimovic V (2004) Bank competition and access to finance: international evidence. J Money, Credit, Bank 36(3):627–648

Berger AN, Udell GF (1998) The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. J Bank Finance 22(6–8):613–673

Bernanke BS, Gertler M (1995) Inside the black box: the credit channel of monetary policy transmission. J Econ Perspect 9(4):27–48

Besanko D, Thakor AV (1992) Banking deregulation: allocational consequences of relaxing entry barriers. J Bank Finance 16(5):909–932

Bhattacharjee A, Han J (2014) Financial distress of Chinese firms: microeconomic, macroeconomic and institutional influences. China Econ Rev 30:244–262

Bhattacharjee A, Bonnet J, Le Pape N, Renault R (2009) Entrepreneurial motives and performance: Why might better educated entrepreneurs be less successful? halshs-00809745

Bikker JA, Haaf K (2002) Measures of competition and concentration in the banking industry: a review of the literature. Econ Financ Model 9(2):53–98

Bikker JA, Van Leuvensteijn M (2008) Competition and efficiency in the Dutch life insurance industry. Appl Econ 40(16):2063–2084

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Economet Rev 19(3):321–340

Bonaccorsi di Patti E, Dell’Ariccia G (2004) Bank Competition and Firm Creation. J Money, Credit, Bank 36(2):225–251

Boone J (2001) Intensity of competition and the incentive to innovate. Int J Ind Organ 19(5):705–726

Boone J (2008) A new way to measure competition. Econ J 118(531):1245–1261

Boot AW, Thakor AV (2000) Can relationship banking survive competition? J Financ 55(2):679–713

Bottazzi G, Grazzi M, Secchi A, Tamagni F (2007) Assessing the impact of credit ratings and economic performance on firm default (No. 2007/15). LEM Working Paper Series

Boyd JH, De Nicolo G (2005) The theory of bank risk taking and competition revisited. J Financ 60(3):1329–1343

Cao M, Shi S (2001) Screening, bidding, and the loan market tightness. Rev Financ 5(1–2):21–61

Castelli A, Dwyer GP, Hasan I (2012) Bank relationships and firms’ financial performance: the Italian experience. Eur Financ Manag 18(1):28–67

Caves RE (1998) Industrial organization and new findings on the turnover and. J Econ Lit 36(4):1947–1982

Cetorelli N, Peretto PF, Oligopoly Banking and Capital Accumulation (2000). FRB of Chicago Working Paper No. 2000-12, Duke Department of Economics Research Paper No. 19. Available at SSRN: https://ssrn.com/abstract=254343 or http://dx.doi.org/10.2139/ssrn.254343

Cetorelli N (1997) The role of credit market competition on lending strategies and on capital accumulation (No. WP-97–14). Federal Reserve Bank of Chicago

Cheng MC, Tzeng ZC (2011) The effect of leverage on firm value and how the firm financial quality influence on this effect. World J Manag 3(2):30–53

Claessens S, Laeven L (2004) What drives bank competition? Some international evidence. J Money, Credit, Bank 36:563–583

Coccorese P, Santucci L (2020) Banking competition and bank size: Some evidence from Italy. J Econ Financ 44(2):278–299. https://doi.org/10.1007/s12197-019-09488-2

Cowling M, Mitchell P (2003) Is the small firms loan guarantee scheme hazardous for banks or helpful to small business? Small Bus Econ 21(1):63–71

Cuthbertson K, Hudson J (1996) The determinants of compulsory liquidation in the UK. The Manchester School of Economic & Social Studies, 64(3), pp. 298-308

D’onofrio A, Minetti R, Murro P (2019) Banking development, socioeconomic structure and income inequality. J Econ Behav Organ 157:428–451

De Bandt O, Davis EP (2000) Competition, contestability and market structure in European banking sectors on the eve of EMU. J Bank Financ 24(6):1045–1066

De bonis R, Marinelli G, Vercelli F (2018) Playing yo-yo with bank competition: New evidence from 1890 to 2014. Explor Econ Hist 67:134–151. https://doi.org/10.1016/j.eeh.2017.10.002

De Leeuw J, Meijer E, Goldstein H (2008) Handbook of multilevel analysis. Springer, New York

Del Prete S, Demma C, Garrì I, Piazza M, Soggia G (2022) The heterogeneous effects of bank mergers and acquisitions on credit to firms: evidence from Italian macro-regions. Bank of Italy Working Paper, 1382

Delis MD, Kokas S, Ongena S (2017) Bank market power and firm performance. Rev Financ 21(1):299–326

Dell’Ariccia G, Marquez R (2006) Lending booms and lending standards. J Financ 61(5):2511–2546

Deloof M, La Rocca M, Vanacker T (2019) Local banking development and the use of debt financing by new firms. Entrep Theory Pract 43(6):1250–1276

Demidenko E (2013) Mixed models: theory and applications with R. Wiley

Di Patti EB, Gobbi G (2001) The changing structure of local credit markets: are small businesses special? J Bank Financ 25(12):2209–2237

Di Patti EB, D’Ignazio A, Gallo M, Micucci G (2015) The role of leverage in firm solvency: evidence from bank loans. Italian Econ J 1(2):253–286

Diamond DW (1984) Financial intermediation and delegated monitoring. Rev Econ Stud 51(3):393–414

Duarte DL, de Moraes Barboza FL (2020) Forecasting financial distress with machine learning–a review. Futur Stud Res J: Trends Strateg 12(3):528–574

Dube F, Nzimande N, Muzindutsi PF (2023) Application of artificial neural networks in predicting financial distress in the JSE financial services and manufacturing companies. J Sustain Financ Invest 13(1):723–743

Eliasy A, Przychodzen J (2020) The role of AI in capital structure to enhance corporate funding strategies. Array 6:100017

Farinha L (2005) The survival of new firms: impact of idiosyncratic and environmental factors. Financial Stability Report. pp 101–113

Geroski PA, Gregg P (1996) What makes firms vulnerable to recessionary pressures? Eur Econ Rev 40(3–5):551–557

Gomez F, Ponce J (2014) Bank competition and loan quality. J Financ Serv Res 46(3):215–233

Griffith R, Boone J, Harrison R, Measuring Competition (2005). Advanced Institute of Management Research Paper No. 022. Available at SSRN: https://ssrn.com/abstract=1307004 or http://dx.doi.org/10.2139/ssrn.1307004

Guariglia A (1999) The effects of financial constraints on inventory investment: evidence from a panel of UK firms. Economica 66(261):43–62

Guiso L, Sapienza P, Zingales L (2004) Does local financial development matter? Q J Econ 119(3):929–969

Guzman MG (2000) Bank structure, capital accumulation and growth: a simple macroeconomic model. Econ Theor 16(2):421–455

Hainz C, Weill L, Godlewski CJ (2013) Bank competition and collateral: theory and evidence. J Financ Serv Res 44(2):131–148

Hauswald R, Marquez R (2006) Competition and strategic information acquisition in credit markets. Rev Financ Stud 19(3):967–1000

Houston JF, Lin C, Lin P, Ma Y (2010) Creditor rights, information sharing, and bank risk taking. J Financ Econ 96(3):485–512

Hovakimian A, Kayhan A, Titman S (2011) Are corporate default probabilities consistent with the static trade-off theory? Rev Financ Stud 25(2):315–340

Hutchinson J, Xavier A (2006) Comparing the impact of credit constraints on the growth of SMEs in a transition country with an established market economy. Small Bus Econ 27(2–3):169–179

Huynh KP, Petrunia RJ (2010) Age effects, leverage and firm growth. J Econ Dyn Control 34(5):1003–1013

Huynh KP, Petrunia RJ, Voia M (2010) The impact of initial financial state on firm duration across entry cohorts. J Ind Econ 58(3):661–689

ISTAT (2019) Annuario Statistico Italiano, available at https://www.istat.it/it/files/2019/12/C14.pdf

Jensen MC (1986) Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev 76(2):323–329

Jimenez G, Salas V, Saurina J (2006) Determinants of collateral. J Financ Econ 81(2):255–281

Jin JY, Kanagaretnam K, Lobo GJ, Mathieu R (2013) Impact of FDICIA internal controls on bank risk taking. J Bank Financ 37(2):614–624

Jovanovic B, Rousseau PL (2002) The Q-theory of mergers. Amer Econ Rev: Pap Proc 92:198–204

Kanagaretnam K, Lim CY, Lobo GJ (2014) Influence of national culture on accounting conservatism and risk-taking in the banking industry. Account Rev 89(3):1115–1149

Kasman A, Carvallo O (2014) Financial stability, competition and efficiency in Latin American and Caribbean banking. J Appl Econ 17(2):301–324

Kim EH (1978) A mean-variance theory of optimal capital structure and corporate debt capacity. J Financ 33(1):45–63

Koskela E, Stenbacka R (2000) Is there a tradeoff between bank competition and financial fragility? J Bank Financ 24(12):1853–1873

Koutsomanoli-Fillipaki N, Staikouras CH (2006) Competition and concentration in the New European banking landscape. Eur Financ Manag 12(3):443–482

Laeven L, Levine R (2009) Bank governance, regulation and risk taking. J Financ Econ 93(2):259–275

Lee CC, Hsieh MF, Yang SJ (2014) The relationship between revenue diversification and bank performance: do financial structures and financial reforms matter? Jpn World Econ 29:18–35

Lennox C (1999) Identifying failing companies: a re-evaluation of the logit, probit and DA approaches. J Econ Bus 51(4):347–364

Levine O, Warusawitharana M (2021) Finance and productivity growth: firm-level evidence. J Monet Econ 117:91–107

Marcelin I, Sun W, Teclezion M, Junarsin E (2022) Financial inclusion and bank risk-taking: the effect of information sharing. Financ Res Lett 50:103182

Marquez R (2002) Competition, adverse selection, and information dispersion in the banking industry. Rev Financ Stud 15(3):901–926

Maudos J, De Guevara JF (2004) Factors explaining the interest margin in the banking sectors of the European Union. J Bank Financ 28(9):2259–2281

Maudos J, De Guevara JF (2007) The cost of market power in banking: social welfare loss vs. cost inefficiency. J Bank Financ 31(7):2103–2125

McCulloch CE, Searle SR (2004) Generalized, linear, and mixed models. John Wiley & Sons

Mihet R (2013) Effects of culture on firm risk-taking: a cross-country and cross-industry analysis. J Cult Econ 37(1):109–151

Molina CA (2005) Are firms underleveraged? An examination of the effect of leverage on default probabilities. J Financ 60(3):1427–1459

Monticelli C (1992) How close is short-run co-ordination within financial groups? Oxf Econ Pap 44(4):750–766

Moyo B, Sibindi AB (2022) Does bank competition affect credit access in Sub-Saharan Africa? Evidence from World Bank informal firms surveys. J Afr Bus 23(1):180–198

Musso P, Schiavo S (2008) The impact of financial constraints on firm survival and growth. J Evol Econ 18(2):135–149

Noman AHM, Gee CS, Isa CR (2017) Does competition improve financial stability of the banking sector in ASEAN countries? An empirical analysis. PLoS One 12(5):e0176546

Oliveira B, Fortunato A (2006) Firm growth and liquidity constraints: a dynamic analysis. Small Bus Econ 27(2–3):139–156

Ornelas JRH, Da Silva MS, Van Doornik BFN (2022) Informational switching costs, bank competition, and the cost of finance. J Bank Financ 138:106408

Pagano M (1993) Financial markets and growth: an overview. Eur Econ Rev 37(2–3):613–622

Pakes A, Ericson R (1998) Empirical implications of alternative models of firm dynamics. J Econ Theory 79(1):1–45

Panetta F, Pozzolo AF (2010) Why do banks securitise their assets? Bank-level evidence from over one hundred countries. Bank-level evidence from over one hundred countries (March 16, 2010)

Panzar JC, Rosse JN (1987) Testing for" monopoly" equilibrium. J Ind Econ. pp 443–456

Papanikolaou NI (2019) How changes in market conditions affect screening activity, credit risk, and the lending behaviour of banks. Eur J Financ 25(9):856–875

Petersen MA, Rajan RG (1995) The effect of credit market competition on lending relationships. Q J Econ 110(2):407–443

Petrunia R (2007) Persistence of initial debt in the long-term employment dynamics of new firms. Can J Econ/Rev Can D’écon 40(3):861–880

Phan DHB, Iyke BN, Sharma SS, Affandi Y (2021) Economic policy uncertainty and financial stability–is there a relation? Econ Model 94:1018–1029

Pinheiro JC, Bates DM (2000) Linear mixed-effects models: basic concepts and examples. Mixed-effects models in S and S-Plus. pp 3–56

Planbureau C (2000) Measuring competition; how are cost differentials mapped into profit differentials’. CPB Working Document nr, 131

Rahman A, Tvaronaviciene M, Smrcka L, Androniceanu A (2019) The effect of bank competition on the cost of credit: empirical evidence from the Visegrad countries. Acta Polytech 16(4):175–195

Raudenbush SW, Bryk AS (2002). Hierarchical linear models: Applications and data analysis methods, vol 1. Sage

Rogers TM (2012) Bank market structure and entrepreneurship. Small Bus Econ 39(4):909–920

Roy AD (1952) Safety first and the holding of assets. Econometrica: Journal of the econometric society 431–449

Ryan RM, O’Toole CM, McCann F (2014) Does bank market power affect SME financing constraints? J Bank Financ 49:495–505

Schaeck K, Čihák M (2010) Competition, efficiency, and soundness in banking: an industrial organisation perspective. European banking center discussion Paper, (2010–20S)

Schaeck K, Cihak M, Maechler A, Stolz S (2012) Who disciplines bank managers? Rev Financ 16(1):197–243

Schulte M, Winkler A (2019) Drivers of solvency risk–are microfinance institutions different? J Bank Financ 106:403–426

Searle SR, Casella G, McCulloch CE (1992) Variance components. Wiley, New York

Shaffer S (1981) Banking: competition or monopoly power. Banking Studies Department, Federal Reserve Bank of New York

Shaffer S (1982) A non structural test for competition in financial markets. Bank Structure and Competition, Conference Proceedings. Federal Reserve Bank of Chicago, pp 225–243

Shi H (2009) Application of unascertained method and neural networks to quality assessment of construction project. 2009 Second International Conference on Intelligent Computation Technology and Automation, vol 1. IEEE, pp 52–55

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Sutaria V, Hicks DA (2004) New firm formation: dynamics and determinants. Ann Reg Sci 38(2):241–262

Taffler RJ (1982) Forecasting company failure in the UK using discriminant analysis and financial ratio data. J R Stat Soc Ser A (General) 145(3):342–358

Thompson P (2005) Selection and firm survival: evidence from the shipbuilding industry, 1825–1914. Rev Econ Stat 87(1):26–36

Udell GF (2008) What’s in a relationship? The case of commercial lending. Bus Horiz 51(2):93–103

Valverdie SC, Humphrey D, Fernandez FR (2003) Deregulation, bank competition and regional growth. Reg Stud 37(3):227–237

Van Leuvensteijn M, Bikker JA, Van Rixtel AA, Sørensen CK (2011) A new approach to measuring competition in the loan markets of the euro area. Appl Econ 43(23):3155–3167

Verwijmeren P, Derwall J (2010) Employee well-being, firm leverage, and bankruptcy risk. J Bank Finance 34(5):956–964

Vesala J (1995) Testing for competition in banking: Behavioral evidence from Finland. Bank of Finland, Helsinki

Wang X, Han L, Huang X (2020) Bank competition, concentration and EU SME cost of debt. Int Rev Financ Anal 71:101534

Warner JB (1977) Bankruptcy costs: Some evidence. J Financ 32(2):337–347

Funding

Open access funding provided by Università degli Studi di Napoli Federico II within the CRUI-CARE Agreement.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Declarations

The data that support the findings of this study are available upon reasonable request.

Competing interests

The authors have no competing interests to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Tables 8, 9, 10, 11, 12, and 13.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Agostino, M., Errico, L., Rondinella, S. et al. Leverage and SMEs financial stability: the role of banking competition. J Econ Finan 48, 345–376 (2024). https://doi.org/10.1007/s12197-023-09654-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-023-09654-7