Abstract

This paper examines the asymmetric impact of economic policy uncertainty (EPU) and oil price uncertainty (OPU) on inflation by using a Nonlinear ARDL (NARDL) model, which is compared to a benchmark linear ARDL one. Using monthly data from the 1990s until August 2022 for a number of developed and emerging countries, we find that the estimated effects of both EPU and OPU shocks are larger when allowing for asymmetries in the context of the NARDL framework. Further, EPU shocks, especially negative ones, have a stronger impact on inflation than OPU ones and capture some of the monetary policy uncertainty, thereby reducing the direct effect of interest rate changes on inflation. Since EPU shocks reflect, at least to some extent, monetary policy uncertainty, greater transparency and more timely communications from monetary authorities to the public would be helpful to anchor inflation expectations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Understanding the determinants of inflation is crucial for establishing the empirical relevance of alternative theoretical models and for designing appropriate policies. Numerous studies have analysed this topic and provided evidence on the importance of factors such as domestic demand shocks (Lim and Sek 2015; Deniz et al. 2016), domestic supply shocks (Boschi and Girardi 2007; Lagoa 2017), monetary policy changes (Dhakal et al. 1994; Baldini and Poplawski-Ribeiro 2011) and oil prices (Greenidge and DaCosta 2009; Eftekhari-Mahabadi and Kiaee 2015). In recent decades, the world economy has also experienced deeper uncertainty, which has affected the decision-making process of agents and thus the macroeconomy. Most existing studies, however, fail to take into account its possible effects on inflation – in particular, only a few of them have assessed the impact on inflation, as well as on economic activity, of economic policy uncertainty (EPU) (see Al-Thaqeb and Algharabali 2019 for a review of the literature), or of demand uncertainty related to output growth and inflation, which has been found to have mixed effects on the latter (Grier and Perry 1998; Neanidis and Savva 2013); more recent evidence suggests that the transmission of economic uncertainty shocks to inflation is asymmetric (Istiak and Serletis 2018; Wen et al. 2021; Long et al. 2022). Oil price uncertainty has also been shown to affect negatively economic activity, whilst its impact on inflation has often been overlooked (Elder and Serletis 2010; Jo 2014). To our knowledge, no existing study provides a comprehensive analysis of the impact of both types of shocks on inflation.

The present paper aims to fill this gap in the literature by assessing the possible role of both economic policy uncertainty (EPU) and oil price uncertainty (OPU) shocks as inflation drivers. The analysis is carried out for some of the main developed and emerging economies, namely the US, the UK, Canada, Australia, New Zealand, Denmark, Japan, Sweden, Brazil, Chile, Mexico and Russia, using monthly data spanning the period from the 1990s until August 2022. Initially, an Autoregressive Distributed Lag (ARDL) model is estimated as a benchmark. Then, given some recent evidence on asymmetries in the transmission of uncertainty shocks (see, e.g., Karaoğlu and Demirel 2021; Munir 2022), a Nonlinear ARDL (NARDL) model is also employed to allow for nonlinearities in the responses to shocks.

Economic policy and oil price uncertainty can affect the decision making of individual consumers, businesses and agents in the economy, which can result in financial crises and recessions as on various occasions in the past (Stock and Watson 2012). The relationship between uncertainty indicators and real economic variables has gained more importance over time; more specifically, the transmission of uncertainty shocks to the real economy has become of great interest to policymakers, especially central banks needing to identify the sources of inflationary pressures to formulate appropriate response policies to fulfil their mandate of inflation stability (Bloom 2009; Adeosun et al. 2022). Theory suggests that positive (negative) EPU and OPU shocks increase (decrease) the inflation rate; however, the transmission mechanism can differ in the short and long run and is not necessarily symmetric (Istiak and Alam 2019; Adeosun et al. 2022). Market rigidities can cause prices to be sticky in one direction or to respond more strongly to shocks in some cases compared to others. The presence of such asymmetries makes it more challenging for central banks to adopt appropriate policy responses in the event of a shock. In comparison to earlier studies ours makes a threefold contribution to this area of the literature. First, it considers asymmetries in the transmission of uncertainty shocks to inflation in both the short and the long run. Second, it includes uncertainty originating from both policymaking and the supply side, both of them having become increasingly relevant as inflation drivers in recent years, especially during the Covid-19 pandemic and the Russia-Ukraine conflict. Third, it covers a wide range of developed and emerging economies.

The remainder of this paper is structured as follows: Sect. 2 briefly reviews the relevant literature; Sect. 3 outlines the econometric methods used for the analysis; Sect. 4 describes the data and discusses the empirical results; Sect. 5 offers some conclusions and policy recommendations.

2 Literature review

There is a substantial body of literature analysing the pass-through of domestic and foreign shocks to inflation, but only recently the focus has shifted towards capturing asymmetries and nonlinearities in the transmission mechanism. In order to capture the asymmetric effects of a wide range of shocks on inflation the Nonlinear ARDL (NARDL) model is often estimated. This approach has been used to analyse the exchange rate pass-through for various countries (Karaoğlu and Demirel 2021; Munir 2022), economic activity shocks for the G7 economies (Laxton et al. 1995), and current account balance shocks on inflation in Turkey (Yildirim and Vicil 2022). All these studies found significant evidence of both short- and long-run asymmetries.

Amongst the various possible determinants of inflation, economic uncertainty, despite its increasing relevance, has only been considered by a limited number of papers. For instance, Bloom (2009) found that macroeconomic uncertainty, which increases after major economic and political shocks, affects inflation significantly. Balcilar et al. (2014) used a vector fractionally integrated autoregressive moving average model and concluded that forecasting models of US inflation including economic policy uncertainty (EPU) outperform standard ones. Other studies have found evidence of asymmetries in the transmission of positive and negative economic uncertainty shocks to economic activity indicators (Foerster 2014; Istiak and Serletis 2018; Murad et al. 2021). Using a NARDL model, Wen et al. (2021) showed that negative EPU shocks have a stronger effect than positive ones on food price inflation in China. Long et al. (2022) applied the same methodology to assess the impact of global EPU on international grain prices, and reported that a rise (fall) in global EPU tends to increase (decrease) them, with the negative effect being stronger in the long run.

Oil price shocks have also been found to affect inflation.Footnote 1 Choi et al. (2018) ran a panel regression including 72 countries and estimated that a 10% increase in global oil inflation increases consumer price inflation in most developed and developing countries by 0.4 percentage points, but this effect declines over time with an increase in central bank credibility. Köse and Ünal (2021) estimated a structural VAR model and provided evidence that oil prices and oil price volatility are important determinants of inflation dynamics in Turkey. Several studies using the NARDL approach have shown that oil price shocks are the most important determinants of inflation and inflation variability in developed and emerging countries in both the short and the long run (Lily et al. 2019; Lacheheb and Sirag 2019; Ali 2020; Deluna et al. 2021). An exception are the BRICS countries, for which there is only limited evidence of an asymmetric impact of oil shocks on inflation (Li and Guo 2022), with only Abu-Bakar and Masih (2018) reporting an asymmetric pass-through for India, and Long and Liang (2018) for China. Finally, Bala and Chin (2018) showed that for African OPEC members higher rates of inflation are associated with a decrease in oil prices, while Husaini and Lean (2021) found that oil price shocks have a strong positive impact on inflation in the South East Asian economies.

The above mentioned studies assess the impact on inflation of oil price changes rather than oil price uncertainty. Various measures have been adopted in the literature for the latter. For instance, Elder and Serletis (2010) use the conditional standard deviation of the forecast error for the change in the real price of oil in the context of a bivariate GARCH-in-mean VAR, and find that it has a negative and statistically significant effect on investment, durables consumption, and aggregate output. Jo (2014) instead defines oil price uncertainty as the time-varying standard deviation of the one-quarter-ahead oil price forecasting error within a VAR with stochastic volatility in mean, and reports that it has a negative impact on world industrial production. Wang et al. (2017) use the standard deviation of daily returns of international oil prices or a GARCH(1,1) estimate of oil price uncertainty and conclude that either affects negatively corporate investment in China. In the first two studies the impulse responses are asymmetric, but all three analyse the asymmetric impact of oil price uncertainty on variables other than inflation. By contrast, we use a nonlinear framework to investigate possible asymmetries in the impact of both OPU and EPU shocks on inflation.

3 Empirical framework

3.1 The linear ARDL model

To investigate the issue of interest we begin by estimating a linear Autoregressive Distributed Lag (ARDL) benchmark model of the following form:

where \({y}_{t}\) is the regressand and \({x}_{t}\) is a vector of multiple regressors integrated of order \(I(0)\) or \(I(1)\). The specific model we estimate including an error correction term is the following:

where \({\pi }_{t}\) is the inflation rate, \({i}_{t}\) is the official central bank policy rate, \({y}_{t}\) is the output gap,Footnote 2\({epu}_{t}\) stands for economic policy uncertainty, \({opu}_{t}\) denotes oil price uncertainty, \({s}_{t}\) is the real effective exchange rate and \({u}_{t}\) is an iid error term; also, \(\Delta\) is the difference operator and \({ecm}_{t-1}\) the error correction term. We follow a similar approach to that of Shin et al. (2014) by initially setting the number of lags \(p\) and \(q\) equal to 4 and then dropping the insignificant ones.

Our measure of oil price uncertainty is the estimate of oil price volatility yielded by a Generalized Autoregressive Conditional Heteroscedasticity (GARCH) model of the following form:

where \({\sigma }_{t}^{2}\) is the conditional variance, \({e}_{t-i}^{2}\) are \(i\) lags of the past squared error terms and \({\sigma }_{t-i}^{2}\) are \(i\) lags of the past variance. The number of lags \(p\) and \(q\) is determined using the Akaike information criterion, with \(1\le p\le 4\) and \(1\le q\le 4\). The GARCH measure of oil price uncertainty is well known to be preferable to others, such as the standard deviation, since it can detect volatility clustering in oil returns (Wang et al. 2017).

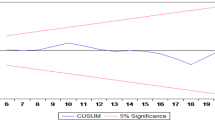

The ARDL model is a fairly novel addition to the class of cointegration models, previously including those by Engle and Granger (1987) and Johansen (1992), and is an attractive option to test for the presence of a long-run cointegration relationship between variables with mixed orders of integration, i.e. I(0) and I(1) (Aimer and Lusta 2021). However, it is unsuitable for variables with higher orders. For this reason, we test the order of integration of all variables in the model by using the Augmented Dickey-Fuller Generalised Least Squares (ADF-GLS) test for the unit root null against the alternative of trend stationarity. The lag structure is selected according to the Ng-Perron criterion and the model is estimated by Ordinary Least Squares (OLS). Since ARDL models can suffer from a range of misspecification issues, we carry out the Breusch-Pagan test for heteroscedasticity, the Breusch-Godfrey Lagrange Multiplier (LM) test for serial correlation and the Cumulative Sum (CUSUM) test of parameter constancy to assess data congruency.

3.2 The nonlinear ARDL (NARDL) model

There are various possible reasons why the response of inflation to various types of economic shocks might not be linear. If, for instance, interest rate decreases lead to higher prices by stimulating investment, there is no guarantee that equivalent increases will result in price falls of the same size (Deluna et al. 2021). The linear ARDL model does not allow for the possibility of positive and negative shocks affecting the inflation rate differently, and thus it overlooks any asymmetries in the short- and long-run transmission of uncertainty shocks. By contrast, the NARDL framework accounts for hidden cointegration (i.e. between the positive and negative components of individual time series), and therefore it is an attractive extension to the linear ARDL model allowing for possible nonlinearities (Liang et al. 2020). It also has advantages over other nonlinear frameworks. First, it distinguishes between short- and long-run asymmetries. Second, it estimates separately the impact of positive and negative shocks under non-stationarity. Third, it provides a flexible approach to establishing long-run relationships between variables with mixed integration orders.

As a starting point we test for nonlinear dependence in the ARDL model residuals using the Brock, Dechert, Scheinkman and LeBaron (BDS) test (Brock et al. 1996). Under the null hypothesis the residual sequence is independent and identically distributed; therefore a rejection of the null implies that a nonlinear model is more suitable than a linear one, given the existing dependence structure.

The general Nonlinear ARDL model takes the following form:

where \({y}_{t}\) is the regressand and \({x}_{t}\) is a vector of multiple regressors integrated of order \(I(0)\) or \(I\left(1\right)\) defined as before, but now the \({x}_{t}\) are decomposed into their partial sum processes of negative and positive changes around a threshold of zero as \({x}_{t}={x}_{0}+{x}_{t}^{+}+{x}_{t}^{-}\). Also, \({\gamma }_{i}\) is the autoregressive parameter on the lagged dependent variable, \({\theta }_{i}^{+}\) and \({\theta }_{i}^{-}\) are the asymmetric distributed lag parameters, and \({u}_{t}\) is an iid error process.

The specific NARDL model with error correction specification we estimate can be represented as follows:

where all variables are defined as before. \({\varphi }_{i}^{+}\) and \({\varphi }_{i}^{-}\) are the asymmetric short-run parameters and \({ecm}_{t-1}\) is the nonlinear error correction term, where \({\beta }^{+}=\frac{-{\theta }^{+}}{\rho }\) and \({\beta }^{-}=\frac{-{\theta }^{-}}{\rho }\) are the asymmetric long-run parameters. We allow for asymmetries in both the short and the long run by capturing “reaction asymmetry” with the long-run parameters and “impact asymmetry” with the asymmetric short-run coefficients of the short-run first differences. In addition, “adjustment asymmetry” is measured by taking into account the interaction between impact and reaction asymmetries through the adjustment parameter \(\rho\) defined as \(\rho ={\pi }_{t}-{\beta }^{{+}^{^{\prime}}}{x}_{t}^{+}-{\beta }^{{-}^{^{\prime}}}{x}_{t}^{-}\). In this way, the model does not directly estimate asymmetric error correction, but rather evaluates patterns of dynamic adjustment towards equilibrium (Shin et al. 2014). Similarly to the linear ARDL model, the NARDL one can be estimated using standard OLS, since the it is nonlinear in the variables only, but linear in the parameters. We also calculate asymmetric cumulative dynamic multipliers, which show the asymmetric adjustment patterns of inflation following positive and negative shocks to economic policy and oil price uncertainty, where the positive and negative values are defined relative to their sample averages.

One can test for the existence of a long-run relationship by using the dynamic bounds testing procedure which is based on an F-test with the null hypothesis \({H}_{0}=\rho ={\theta }^{+}={\theta }^{-}=0\). This test is adapted to account for hidden cointegration. Pesaran et al. (2001) suggest two sets of asymptotic critical values, the first assuming that all variables are \(I(0)\) and the other that they are all \(I(1)\). The null hypothesis of no cointegration is rejected if the computed F-statistic exceeds the upper bound of the critical value. However, in small sample sizes the asymptotic critical values are unsuitable and thus empirical critical values should be used (Pesaran and Shin 1998). Therefore we compute the latter and their confidence intervals by using the recursive bootstrap method suggested by McNown et al. (2018).

3.3 Model mis-specification and robustness tests

When employing a NARDL model, one needs to test for short- and long-run asymmetries in the parameters of the positive and negative partial sum components by using a Wald test of for the null of symmetry against the alternative of asymmetry. If \({\mathrm{\varphi }}_{i}^{+}={\mathrm{\varphi }}_{i}^{-}\), the effect is symmetric in the short run, and similarly, if \({\theta }_{i}^{+}={\uptheta }_{i}^{-}\), the effect is symmetric in the long run. In such a case the linear ARDL model is sufficient to capture the behaviour of the variables.

In order to test the adequacy of the NARDL model, we carry out a number of mis-specification tests. In particular, we test for serial correlation of the residuals by using the Lagrange Multiplier (LM) test; for ARCH effects by carrying out the ARCH-LM test; for parameter stability by implementing the Cumulative Sum (CUSUM) test. We also implement a Likelihood Ratio (LR) test to compare the unrestricted NARDL model with the restricted ARDL model. Finally, we compare the in-sample and out-of-sample predictive accuracy of the forecasts generated by the NARDL model with those from the linear ARDL model by performing the Diebold and Mariano test (Diebold 2015), which uses the Mean Square Prediction Error (MSPE) to test the null of equal predictive accuracy of both forecasts against the one-sided alternative of higher predictive accuracy of the nonlinear model forecast. As an additional robustness check, we also estimate the NARDL model in (5) with a money supply variable in order to allow for the asymmetric impact of monetary factors on inflation.

4 Data and empirical results

4.1 Data description

We analyse monthly series over a sample period with a different start date for each country depending on data availability (see Appendix 1 for details) and ending in August 2022. The set of countries considered includes both developed and emerging economies, specifically the US, the UK, Canada, Australia, New Zealand, Denmark, Japan, Sweden, Brazil, Chile, Mexico and Russia. These countries have been chosen according to the availability of EPU data and to consider a wide range of developed and emerging economies with an independent monetary policy. Hence, European Monetary Union (EMU) countries have been excluded from the analysis owing to their lack of monetary independence. The NARDL model has been estimated for each country in a time series context rather than in a panel setting in order to obtain country-specific evidence which allows to draw policy implications for individual economies.

Inflation is measured as the percentage price change in the consumer price index (CPI) series obtained from the Organisation of Economic Cooperation and Development (OECD) inflation and CPI database for all countries except Australia and New Zealand, for which the series are taken from the Bank for International Settlements Consumer Price Index database. The source for the Brent oil price index (measured in US dollars per barrel) is the Federal Reserve Bank of St Louis (FRED) economic database. The output gap is constructed using the real normalised GDP series taken from the OECD Monthly Economic Indicators database. The central bank policy rates as well as the real effective exchange rate series are obtained from the Bank for International Settlements (BIS) Statistics database. The money supply variable is the M3 series obtained from the OECD Broad Money (M3) database for the US, the UK, Canada, Australia Japan and Russia. For New Zealand, the series is taken from the Reserve Bank of New Zealand (RBNZ) Depository Corporations – Money and Credit Aggregates (C50) dataset; for Sweden from the Statistics Sweden (SCB) Money Supply dataset; for Denmark from the FRED economic database; for Chile from the Central Bank of Chile (CBC) Monetary Aggregates dataset; for Brazil from the Central Bank of Brazil (CBB) Monetary and Credit Statistics database; finally, for Mexico from the Mexican Central Bank (MCB) Monetary Aggregates dataset. The economic policy uncertainty index data for all countries is from the Baker, Bloom and Davies websiteFootnote 3; as explained by Baker et al. (2016), it is based on the frequency of news coverage in the form of newspaper articles containing keywords concerning all components of economic policy uncertainty, and is the most comprehensive measure of this variable currently available. All series are transformed into logarithmic form. Links to the data sources for all variables are provided in Appendix 2.

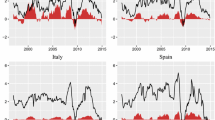

Oil price uncertainty (OPU) is the estimated oil price volatility from a GARCH (1,1) model selected on the basis of various selection criteria (these results are not reported to save space). This is consistent with most of the literature, which generally finds that the optimal lag length for GARCH models is 1 (Hansen and Lunde 2005). Figure 1 displays the inflation, EPU and OPU series for all countries. It can be seen that there are periods when inflation is stable and others when it falls, the latter coinciding with economic downturns such as the global financial crisis and the recent Covid-19 pandemic; further, this variable appears to be more volatile in some of the countries under examination, namely Canada, Japan and Sweden. Although OPU also fluctuates considerably, EPU is the most volatile series.Footnote 4 Formal ADF-GLS tests (see Table 1) indicate that all variables are at most \(I(1)\), as required for the estimation of an ARDL model.

4.2 Results for the linear ARDL model

The results of the linear ARDL estimation are reported in Table 2.

Economic policy and oil price uncertainty only affect inflation in some countries – specifically, EPU does not have any impact on inflation in the short run in the US, the UK, Canada, Denmark, Sweden and Chile, while OPU has no short-run effect in Australia, Denmark and Russia. Further, the estimated effect tends to be small, with inflation increasing by 0.5% to 0.7% respectively in response to a 1% short-run EPU and OPU shock. One percent changes in the output gap have a positive effect on inflation ranging between 0.07% and 0.25% in the short run in a number of countries, and none for Canada, Australia, Japan and Chile. Inflation decreases by up to 0.63% following a 1% increase in the short-run interest rate; this occurs only with a lag of one to two months, but indicates the effectiveness of contractionary monetary policy. Exchange rate changes of 1% have a strong negative impact of -0.58% on inflation in the short run with a two-month lag.Footnote 5

The long-run relationship between inflation and the other variables in model is weak and insignificant for most countries, which suggests that inflation is affected primarily by short-run changes in the fundamentals in the linear model. To assess the adequacy of the linear ARDL model, we conduct several mis-specification tests (also reported in Table 2) which imply that this specification is not data congruent. Given this evidence, we perform a BDS test of linear dependence in the variables and the residuals of the ARDL model; the null of linear dependence is strongly rejected (see Table 3), which suggests that a nonlinear model might be more suitable. Therefore, we proceed to estimate a nonlinear ARDL model in the following section.

4.3 NARDL model results

The results for the NARDL model are reported in Tables 4 and 5 and show that the relationship between inflation and the explanatory variables is indeed asymmetric. The existing literature reports mixed effects of economic uncertainty on inflation (Grier and Perry 1998; Neanidis and Savva 2013). We find that both EPU and OPU shocks appear to be more important drivers of inflation in a nonlinear framework. More specifically, in the short run, positive EPU shocks of 1% increase inflation by up to 0.15%, and negative ones by 0.1% to 0.29%. The estimated stronger effect of negative EPU shocks is consistent with previous evidence (Wen et al. 2021; Long et al. 2022). Inflation in Chile is the most affected by economic policy uncertainty, with positive (negative) EPU shocks increasing it by up to 0.87% (1.27%). It is noteworthy that, although EPU shocks – positive and negative ones – increase inflationary pressures in most countries, in the US, Denmark, Brazil and Mexico the impact can also be negative. This possibly reflects heterogeneity in the behaviour of economic agents, which has been found to be irrational during times of uncertainty (Byrne and Davis 2005; Loxton et al. 2020). OPU shocks have a smaller impact on inflation, with increases between less than 0.01% and up to 0.19% resulting from positive one percent shocks, and decreases by up to 0.13% from negative ones. A plausible explanation for this finding is that oil prices and oil price uncertainty tend to affect producer prices rather than the consumer prices we investigate in this paper (Husaini and Lean 2021). The estimated coefficients imply that output now has a much stronger effect (ranging between 0.1% and 0.96%) on inflation compared to the linear case. Contrary to what one would expect (Watanabe 1997), a positive (negative) change in the output gap causes inflation to decrease (increase) in the short run with one lag. However, after more lags positive (negative) output gap changes tend to increase (reduce) inflation, which is in line with the previous findings in the literature (Clark and McCracken 2006; Calza 2009; Tiwari et al. 2014). This finding could be related to the extent to which inflation expectations are anchored or central banks provide transparent communications. If agents have well-anchored inflation expectations they expect policymakers to respond to a larger output gap through monetary tightening, thereby reducing inflation. Note that in the case of Mexico and Russia output shocks are transmitted after several years (Galindo and Ros 2009; Michaelides and Milios 2009), which is consistent with our general finding that they affect inflation only with a lag.

The effects of short-run interest rate changes on inflation are significant and of a similar size to the linear case, but only with a lag. Some of the uncertainty related to interest rate changes might in fact be captured by the now significant EPU variable. Uncertainty regarding the monetary policy stance or future policy decisions might delay or accelerate spending decisions by agents and therefore affect the inflation rate before any interest rate decision is made (Balcilar et al. 2014). As expected, interest rate decreases (increases) lead to a higher (lower) inflation rate in the short run, but only in some countries. For the US, the UK, Brazil and Chile inflation only reacts to negative interest rate changes in the short run, which indicates that prices are more sensitive to expansionary monetary policies, with a reduction in interest rates leading to higher inflation as expected. Finally, the exchange rate effect on inflation is similar to that in the linear model.

Table 6 reports the estimated long-run asymmetries, namely the coefficients associated with positive and negative long-run changes in the explanatory variables. In the long run, positive and negative EPU shocks affect inflation with the same sign and similar magnitude, more precisely, positive and negative EPU shocks increase inflation in the US, the UK, Australia, New Zealand, Denmark and Russia, while they both reduce it in all other countries. On the whole, in the long run inflation appears to be highly sensitive to changes in economic uncertainty. Positive and negative long-run OPU shocks both reduce inflation in the UK, Australia, Denmark and Russia but increase it in all other countries, although their effects are less significant than in the short run. The long-run relationship between the interest rate and inflation indicates that contractionary monetary policies influence inflation more strongly than expansionary ones, whilst the opposite holds in the short run. Output does not seem to have any significant long-run impact on inflation, while both appreciations and depreciations of the exchange rate have a negative effect.

The results of the diagnostic tests indicate that the nonlinear models are data congruent. In particular, the LR test suggests that the NARDL specification should be preferred to the linear ARDL one and confirms the presence of asymmetries. Table 7 reports the results of the Wald test of parameter symmetry, which provide clear evidence of both short- and long-run asymmetries and thus of the need for a suitable nonlinear model such as the NARDL one to capture them.

Figures 2 and 3 display the dynamic asymmetric multipliers for EPU and OPU shocks to inflation respectively.Footnote 6 The adjustment of inflation following an EPU shock appears to be rather slow, in most countries a new equilibrium being reached not before 15 months. Positive (negative) EPU shocks cause an increase (decrease) in inflation in the US, New Zealand, Denmark, Brazil and Russia, while the opposite holds for the UK, Canada, Australia, Japan and Sweden. In the UK and Australia positive EPU shocks increase inflation on impact, while in the long run they have a negative effect. The same holds for inflation in Denmark following a negative EPU shock. In Mexico and Chile both positive and negative EPU shocks reduce inflation initially, but in Chile the effect of a negative EPU shock increases inflation in the long run.

The adjustment of inflation to the new long-run equilibrium following an OPU shock takes longer than after an EPU one, and in some instances positive OPU shocks only have an impact after a few months. A positive (negative) OPU shock leads to higher (lower) inflation in Australia, Japan, Sweden, Brazil and Chile. In the UK and in New Zealand the effect of positive OPU shocks on inflation are neutral, while negative ones reduce inflation. In Mexico and Russia the opposite holds, namely positive OPU shocks increase inflation while negative ones have no significant impact. In the US, negative OPU shocks initially have a very strong negative effect, whilst the long-run ones are close to zero. In Canada and Denmark, positive OPU shocks have an initial strong positive effect on inflation, which converges to zero after two months in the former and after five months in the latter.

Finally, for robustness purposes we evaluate the in-sample and out-of-sample predictive accuracy of the NARDL model forecasts relative to those of the linear ARDL model by using a Diebold-Mariano test; these results are reported in Table 8. It can be seen that the NARDL model outperforms the linear ARDL one in terms of forecast accuracy. We also test for parameter constancy in the NARDL model by using the CUSUM test. The CUSUM graphs are reported in Figure D1 in Appendix 4 and suggest that none of the estimated models suffer from parameter instability.

We also estimate a NARDL model with the money supply included as an additional explanatory variable in its partial sum components and report the results in Appendix 5. This variable is found to be mostly insignificant, which reflects the shift by central banks in recent decades from the money supply to interest rates as their main policy tool. The exceptions are Sweden and Russia, where the money supply has an asymmetric long-run effect on inflation, and Australia, where only short-run effects are present; this finding is consistent with those of previous studies (Korhonen 1996; Belke and Polleit 2006; Makin et al. 2017) also reporting that the money supply is a key determinant of inflation in these countries.

5 Conclusions

This paper investigates the impact of EPU and OPU shocks on inflation using monthly data from the 1990s up until August 2022 for a number developed and emerging economies, specifically the US, the UK, Canada, Australia, New Zealand, Denmark, Japan, Sweden, Brazil, Chile, Mexico and Russia. It contributes to the existing literature by allowing for both short- and long-run asymmetries, considering two different types of uncertainty shocks, and providing wide country coverage. More specifically, in the first instance a benchmark ARDL model is estimated and found not to be data congruent. A nonlinear ARDL (NARDL) framework is then adopted with the aim of capturing possible asymmetries in the effects on inflation of the shocks considered. This specification is shown to have a superior in-sample and out-of-sample performance relative to the linear ARDL one and to be appropriate for modelling both short- and long-run asymmetric responses of inflation to uncertainty shocks.

The analysis produces the following findings. First, the estimated effects of both types of uncertainty shocks (EPU and OPU) are larger when using the NARDL model (which distinguishes between positive and negative ones) as opposed to the linear ARDL one (which does not allow for asymmetries). Second, although the nonlinear results imply that both EPU and OPU shocks are important drivers of inflation, the former are found to have more sizeable effects. Third, inflation responds more to negative than to positive EPU shocks, which is consistent with previous findings in the literature (Wen et al. 2021; Long et al. 2022). Fourth, inflation reacts more strongly to interest rate decreases in the short run and to interest rate increases in the long run.

On the whole, our results provide extensive evidence that economic policy uncertainty (EPU) is a key determinant of inflation, and have some important policy implications. In particular, since EPU reflects, at least to some extent, uncertainty related to monetary policy (which possibly influences inflation expectations, see Al-Thaqeb and Algharabali 2019), it would appear that a greater degree of transparency and more timely communications from monetary authorities to the public would be helpful to anchor inflation expectations (Istiak and Alam 2019). Central banks should be mindful of possible spillover effects of policies and uncertainty from other countries and take into account directly the possible impact of EPU when designing their own policies. The findings concerning the effects of the OPU shocks suggest that inflation is influenced not only by domestic factors. Therefore policymakers should also consider the global uncertainty environment in their stabilisation policies and possibly control directly for this source of uncertainty in their interest rate rules. Also, it is noteworthy that a shift towards lower domestic dependence on oil consumption can reduce the sensitivity of domestic inflation to OPU shocks. Future research could obtain further evidence on these issues by applying panel data methods and also by distinguishing between different groups of countries, such as oil importing versus oil exporting ones, inflation targeting versus non-targeting ones, and developed versus emerging economies, which would provide additional insights into the connectedness of EPU across countries.

Data availability

Data are available from the authors upon reasonable request.

Notes

The literature has provided different definitions of oil price shocks. For instance, some authors measure them by taking first differences of the logged oil price (e.g., Cong et al. 2008; Park and Ratti 2008), while others differentiate between demand- and supply-related oil market shocks in the context of a Structural VAR model (Arampatzidis and Panagiotidis 2022). In this paper, instead, we obtain first a measure of oil price uncertainty by estimating oil price volatility, and then define positive and negative (one-standard deviation) shocks to this variable; these are captured by the NARDL model through the decomposition of the oil price uncertainty variable into positive and negative partial sum components, the dynamic multipliers providing information about the asymmetric adjustment patterns.

The output gap is measured by using the Hodrick-Prescott filter for real GDP (Hodrick and Prescott 1997). We set the smoothing parameter λ equal to 129,600, which is the recommended value for monthly frequency suggested by Ravn and Uhlig (2002). For robustness proposes, we also estimate the one-sided Hodrick-Prescott Filter, which produces identical results when rounded off.

The OPU series is the same in all plots in Fig. 1; if it appears otherwise, this is due to the different scale used in each graph, which is chosen on the basis of the values of the inflation rate.

Heteroscedasticity- and autocorrelation-consistent (HAC) estimators of the variance–covariance matrix avoid the issue of misleading statistical inference resulting from the usual standard errors.

The asymmetry plots show the net effect of positive and negative shocks (calculated as the difference between the negative and positive multipliers) together with the corresponding 95% confidence intervals. Appendix 3 displays the dynamic multipliers alongside the HAC standard errors of the coefficients of the OLS regression used to calculate them (see Shin et al. 2014).

References

Abu-Bakar M, Masih M (2018) Is the oil price pass-through to domestic inflation symmetric or asymmetric? New evidence from India based on NARDL. MPRA Working Paper 87569

Adeosun OA, Tabash MI, Vo XV, Anagreh S (2022) Uncertainty measures and inflation dynamics in selected global players: a wavelet approach. Qual Quant 57:3389–3384

Aimer N, Lusta A (2021) The asymmetric impact of oil price shocks on economic uncertainty: evidence from the asymmetric NARDL model. OPEC Energy Rev 45(4):393–413

Ali IM (2020) Asymmetric impacts of oil prices on inflation in Egypt: A nonlinear ARDL approach. J Dev Econ Policies 23(1):5–28

Al-Thaqeb SA, Algharabali BG (2019) Economic policy uncertainty: A literature review. J Econ Asymmetries 20:e00133

Arampatzidis I, Panagiotidis T (2022) On the identification of the oil-stock market relationship. Rimini Centre for Economic Analysis, Working Paper series 22–15

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Bala U, Chin L (2018) Asymmetric impacts of oil price on inflation: An empirical study of African OPEC member countries. Energies 11(11):3017

Balcilar M, Gupta R, Jooste C (2014) The role of economic policy uncertainty in forecasting US inflation using a VARFIMA model. Univ Pretoria Depart Econ Working Paper (60)

Baldini A, Poplawski-Ribeiro M (2011) Fiscal and monetary determinants of inflation in low-income countries: Theory and evidence from sub-Saharan Africa. J Afr Econ 20(3):419–462

Belke A, Polleit T (2006) Money and Swedish inflation. J Policy Model 28(8):931–942

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Boschi M, Girardi A (2007) Euro area inflation: long-run determinants and short-run dynamics. Appl Financ Econ 17(1):9–24

Brock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Economet Rev 15(3):197–235

Byrne JP, Davis EP (2005) Investment and uncertainty in the G7. Rev World Econ/Weltwirtschaftliches Archiv 141(5):1–32

Calza A (2009) Globalization, domestic inflation and global output gaps: Evidence from the Euro area. Int Finance 12(3):301–320

Choi S, Furceri D, Loungani P, Mishra S, Poplawski-Ribeiro M (2018) Oil prices and inflation dynamics: Evidence from advanced and developing economies. J Int Money Financ 82:71–96

Clark TE, McCracken MW (2006) The predictive content of the output gap for inflation: Resolving in-sample and out-of-sample evidence. J Money Credit Bank 38(5):1127–1148

Cong RG, Wei YM, Jiao JL, Fan Y (2008) Relationships between oil price shocks and stock market: An empirical analysis from China. Energy Policy 36(9):3544–3553

Deluna RS Jr, Loanzon JIV, Tatlonghari VM (2021) A nonlinear ARDL model of inflation dynamics in the Philippine economy. J Asian Econ 76:101372

Deniz P, Tekçe M, Yilmaz A (2016) Investigating the determinants of inflation: A panel data analysis. Int J Financ Res 7(2):233–246

Dhakal D, Kandil M, Sharma SC, Trescott PB (1994) Determinants of the Inflation rate in the United States: A VAR Investigation. Q Rev Econ Finance 34(1):95–112

Diebold FX (2015) Comparing predictive accuracy, twenty years later: A personal perspective on the use and abuse of Diebold–Mariano tests. J Bus Econ Stat 33(1):1–1

Eftekhari-Mahabadi S, Kiaee H (2015) Determinants of inflation in selected countries. J Money Econ 10(2):113–143

Elder J, Serletis A (2010) Oil price uncertainty. J Money Credit Bank 42(6):1137–1159

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica: J Econ Soc 55(2):251–276

Foerster A (2014) The asymmetric effects of uncertainty. Econ Rev 99:5–26

Galindo LM, Ros J (2009) Alternatives to inflation targeting in Mexico. Edward Elgar Publishing, In Beyond Inflation Targeting

Greenidge K, DaCosta D (2009) Determinants of Inflation in Selected Caribbean Countries. J Bus Finance Econ Emerg Econ 4(2):371–397

Grier KB, Perry MJ (1998) On inflation and inflation uncertainty in the G7 countries. J Int Money Financ 17(4):671–689

Hansen PR, Lunde A (2005) A forecast comparison of volatility models: does anything beat a GARCH (1, 1)? J Appl Economet 20(7):873–889

Hodrick RJ, Prescott EC (1997) Postwar US business cycles: an empirical investigation. J Money Credit Bank 29(1):1–16

Husaini DH, Lean HH (2021) Asymmetric impact of oil price and exchange rate on disaggregation price inflation. Resour Policy 73:102175

Istiak K, Alam MR (2019) Oil prices, policy uncertainty and asymmetries in inflation expectations. J Econ Stud 46(2):324–334

Istiak K, Serletis A (2018) Economic policy uncertainty and real output: Evidence from the G7 countries. Appl Econ 50(39):4222–4233

Jo S (2014) The effects of oil price uncertainty on global real economic activity. J Money Credit Bank 46(6):1113–1135

Johansen S (1992) Cointegration in partial systems and the efficiency of single-equation analysis. J Econ 52(3):389–402

Karaoğlu N, Demirel B (2021) Asymmetric Exchange Rate Pass-Through into Inflation in Turkey: A NARDL Approach. Fiscaoeconomia 5(3):845–861

Korhonen I (1996) An error correction model for Russian inflation. Rev Econ Transit 4(96):53–61

Köse N, Ünal E (2021) The effects of the oil price and oil price volatility on inflation in Turkey. Energy 226:120392

Lacheheb M, Sirag A (2019) Oil price and inflation in Algeria: A nonlinear ARDL approach. Q Rev Econ Finance 73:217–222

Lagoa S (2017) Determinants of inflation differentials in the euro area: Is the New Keynesian Phillips Curve enough? J Appl Econ 20(1):75–103

Laxton D, Meredith G, Rose D (1995) Asymmetric effects of economic activity on inflation: Evidence and policy implications. IMF Econ Rev Staff Papers 42(2):344–374

Li Y, Guo J (2022) The asymmetric impacts of oil price and shocks on inflation in BRICS: a multiple threshold nonlinear ARDL model. Appl Econ 54(12):1377–1395

Liang CC, Troy C, Rouyer E (2020) US uncertainty and Asian stock prices: Evidence from the asymmetric NARDL model. North Am J Econ Finance 51:101046

Lily J, Kogid M, Nipo DT, Lajuni N (2019) Oil price pass-through into inflation revisited in Malaysia: the role of asymmetry. Malays J Bus Econ (MJBE) 2. https://doi.org/10.51200/mjbe.v0i0.2123

Lim YC, Sek SK (2015) An examination on the determinants of inflation. J Econ Bus Manag 3(7):678–682

Long S, Li J, Luo T (2022) The asymmetric impact of global economic policy uncertainty on international grain prices. J Commod Markets 100273

Long S, Liang J (2018) Asymmetric and nonlinear pass-through of global crude oil price to China’s PPI and CPI inflation. Econ Res-Ekonomska Istraživanja 31(1):240–251

Loxton M, Truskett R, Scarf B, Sindone L, Baldry G, Zhao Y (2020) Consumer behaviour during crises: Preliminary research on how coronavirus has manifested consumer panic buying, herd mentality, changing discretionary spending and the role of the media in influencing behaviour. J Risk Finan Manag 13(8):166

Makin AJ, Robson A, Ratnasiri S (2017) Missing money found causing Australia’s inflation. Econ Model 66:156–162

McNown R, Sam CY, Goh SK (2018) Bootstrapping the autoregressive distributed lag test for cointegration. Appl Econ 50(13):1509–1521

Michaelides P, Milios J (2009) TFP change, output gap and inflation in the Russian Federation (1994–2006). J Econ Bus 61(4):339–352

Munir K (2022) Linear and nonlinear effect of exchange rate on inflation in Pakistan. Theor Appl Econ 29(2 631 Summer):165–174

Murad SM, Salim R, Kibria M (2021) Asymmetric effects of economic policy uncertainty on the demand for money in India. J Quant Econ 19(3):451–470

Neanidis KC, Savva CS (2013) Macroeconomic uncertainty, inflation and growth: Regime-dependent effects in the G7. J Macroecon 35:81–92

Park J, Ratti RA (2008) Oil price shocks and stock markets in the US and 13 European countries. Energy Econ 30(5):2587–2608

Pesaran MH, Shin Y (1998) An autoregressive distributed-lag modelling approach to cointegration analysis. Econom Soc Monogr 31:371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Ravn MO, Uhlig H (2002) On adjusting the Hodrick-Prescott filter for the frequency of observations. Rev Econ Stat 84(2):371–376

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt (281–314). Springer, New York, NY

Stock JH, Watson MW (2012) Disentangling the Channels of the 2007–2009 Recession, National Bureau of Economic Research, Working Paper No. w18094

Tiwari AK, Oros C, Albulescu CT (2014) Revisiting the inflation–output gap relationship for France using a wavelet transform approach. Econ Model 37:464–475

Wang Y, Xiang E, Ruan W, Hu W (2017) International oil price uncertainty and corporate investment: Evidence from China’s emerging and transition economy. Energy Econ 61:330–339

Watanabe T (1997) Output gap and inflation: the case of Japan. Monet Policy Inflation Process 4:93–112

Wen J, Khalid S, Mahmood H, Zakaria M (2021) Symmetric and asymmetric impact of economic policy uncertainty on food prices in China: a new evidence. Resour Policy 74:102247

Yildirim Y, Vicil E (2022) The asymmetric effects of the current account balance on inflation: A NARDL approach for Turkish economy. Ekonomski Vjesnik: Rev Contemp Entrep Bus Econ Issues 35(1):87–97

Acknowledgements

We are very grateful to the Associate Editor and four anonymous referees for their useful comments on an earlier version of this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Table 9

Appendix 2

Variable | Data Source | Link |

|---|---|---|

CPI Inflation | OECD BIS | |

Brent Oil Price | FRED | |

GDP | OECD | |

Policy Rates | BIS | |

Money Supply M3 | OECD RBNZ SCB FRED CBC CBB MCB | https://data.oecd.org/money/broad-money-m3.htm https://fred.stlouisfed.org/series/MABMM301DKM189N https://www.bcentral.cl/en/monetary-aggregates-excel https://www.bcb.gov.br/en/statistics/monetarycreditstatistics |

EPU Index | BBD Website |

Appendix 3

Figure 4

Figure 5

Appendix 4

Figure 6

Appendix 5

Table 10

Table 11

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Anderl, C., Caporale, G.M. Asymmetries, uncertainty and inflation: evidence from developed and emerging economies. J Econ Finan 47, 984–1017 (2023). https://doi.org/10.1007/s12197-023-09639-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-023-09639-6