Abstract

This paper examines whether the Covid-19 pandemic has had a homogeneous or heterogeneous effect on stock returns in India. We consider panel data by using 1,318 companies that are listed on the National Stock Exchange of India. We find that the daily growth rate in Covid-19 cases and Covid-19 deaths are negatively associated with stock returns. Further, we observe that the average stock returns during Lockdown 2 are positive and highly significant, while the returns during Lockdowns 3 and 4 are negative. Moreover, our results show that the chemical, technology, and food and beverage industries earn higher returns. In contrast, the banking and finance, automotive, services, and cement and construction industries yield lower returns for the overall period. Interestingly, all industry groupings in this study earn a positive return during the lockdown period. In particular, the chemical, technology, automotive, metals and mining, and food and beverage industries provide higher returns during the lockdown period. Finally, this study supports the claim that the Covid-19 pandemic has had a heterogeneous effect in the Indian stock markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Covid-19 pandemic has caused distress around the world since December 2019, gaining great momentum in number of reported cases and deaths globally. According to a World Bank report, around 10 million people have been infected and 2 million people have lost their life due to Covid-19. The World Health Organization (WHO) has suggested that governments follow uniform guidelines to control the disease. Governments around the world have implemented precautionary measures of travel restriction, social distancing, home quarantine, working from home, and shutting down businesses, among others. Covid-19 has brought about unprecedented challenges to people’s social, economic, and financial activities. Accordingly, global stock markets have quickly processed information regarding these upheavals and integrated it into stock prices, resulting in an over 30% decline in stock prices around the world. Some studies argue that the Covid-19 pandemic effect is homogeneous and stock returns have fallen across markets [Topcu and Gulal (2020); Ashraf (2020a, b; Phan and Narayan (2020); Erdem (2020); Alexakis et al. (2021)]. However, Covid-19 does not affect all stocks across sectors equally, with some stocks in the information technology, health, and consumer staples industries actually earning positive returns during the pandemic period. Therefore, the Covid-19 pandemic has a heterogeneous effect in the markets [Liu et al. (2020), Narayan et al. (2021), Mazur et al. (2020), Baek et al. (2020)]. Further, stock markets are affected negatively in the initial period of the pandemic and later react positively due to the relaxation of lockdowns and adoption of government stimulus packages [Narayan et al. (2020a, b; David et al. (2021); Ashraf (2020a, b; Fernandez-Perez et al. (2021)].

Of course, the Covid-19 pandemic also adversely affects people’s health. It incites fear in investors in the market. At the same time, the pandemic leads to heightened volatility in the global stock markets [Alexakis et al. (2021), Haroon and Rizvi (2020), Zhang et al. (2020), and Albulescu (2020)]. Moreover, to understand the psychology of people in the stock market, Isen and Simmonds (1978) provide evidence that people in a good mood make optimistic decisions, whereas people in a bad mood make pessimistic decisions. Similarly, Zhai et al. (2021) document that major events such as the global financial crisis of 2008, terrorist attacks of 2001, Ebola outbreak of 2014, and current Covid-19 pandemic induce pessimistic investment decisions. Thus, these adverse events affect investor psychology and lead to antagonistic changes in stock prices. Moreover, investor psychology increases the pressure to sell by both institutional and retail investors in the markets, hence increasing volatility. Fascinatingly, investors pay constant attention to Covid-19 health news and prices immediately respond to new information daily. This leads to information discovery and market efficiency (Vozlyublennaia 2014). Most existing studies document that such adverse events have homogeneous effects on stock prices [Topcu and Gulal (2020); Ashraf (2020a, b; Phan and Narayan (2020); Erdem (2020); Alexakis et al. (2021); Zhai et al. (2021); Dharani et al. (2022)]. Therefore, the present study examines whether the Covid-19 pandemic has homogeneous effects on stock returns in India.

In this study, we examine the impact of the Covid-19 pandemic on stock returns using panel data. This study contributes to the literature from three different perspectives. First, we investigate the relationship between the daily growth rate in Covid-19 cases (Gcases) and the daily growth rate in Covid-19 deaths (Gdeaths) on the one hand, and stock returns on the other. Secondly, we consider the overall lockdown period and four different phases of the lockdown (see Table 1) to examine the impact of lockdown on stock returns. Finally, we classify the stocks into different industries and examine which industry provides a higher return during the Covid-19 pandemic period.

The rest of the paper is formatted as follows. Section 2 explains the review of literature and research. Section 3 describes the data sources and methodology of the study. Section 4 discusses and interprets the empirical results. The summary and concluding remarks are presented in Sect. 5.

2 Review of literature

Previous research states that stock markets reflect all available information. Therefore, price responses occur immediately, based on the quality and strength of the information. Because the spread of Covid-19 is so devastatingly rapid, the World Health Organisation (WHO) suggested restricting people’s movement, greatly diminishing their ability to engage in social, economic, and financial activities. Due to these restrictions, stock markets around the globe reacted quickly and negatively, taken with fear and uncertainty.

Many studies document that Covid-19 negatively affects stock returns. For instance, Topcu and Gulal (2020) report that Covid-19 negatively influenced stock markets in emerging markets until April 10, 2020, with the impact tapering off gradually over the study period. Similarly, Ashraf (2020a, b) finds that daily Covid-19 cases and deaths negatively affected stock returns in 64 countries over the period of January 22, 2020 to April 17, 2020. Phan and Narayan (2020) observe that the market overreacts due to Covid-19 but corrects itself over time. Using a sample of 75 countries, Erdem (2020) reports that stock markets are negatively affected by the Covid-19 pandemic. Moreover, the growth in the number of cases of Covid-19 affects the stock markets three times more than the growth in the number of deaths caused by Covid-19. Alexakis et al. (2021) find that stock returns and lockdown are negatively related to Covid-19 for the initial period of lockdown. Similarly, Fernandez-Perez et al. (2021) find evidence that negative returns are observed over the first three weeks when infected cases were announced during the Covid-19 period.

On the other hand, some studies argue that the Covid-19 effect is not homogeneous for all stocks. To support this hypothesis, Liu et al. (2020) report that Covid-19 negatively affects the Chinese and Asian stock markets. However, the pharmaceutical, software, and information technology services industries earn positive returns over the study period. Likewise, Narayan et al. (2021) claim that the Covid-19 pandemic has a heterogeneous effect across sectors, with the information technology, health, and consumer staples industries gaining positive returns during the pandemic in the Australian stock market. Mazur et al. (2020) use S&P1500 stocks to investigate the effect of Covid-19 on the stock market. Their study reports that the stock market crash triggered by the Covid-19 pandemic is heterogeneous across sectors. For example, food, natural gas, healthcare, and software stocks earn high positive returns, whereas petroleum, entertainment, real estate, and hospitality stocks fall dramatically during the Covid-19 pandemic period. Further, Baek et al. (2020) examine the impact of Covid-19 on stock market volatility in the United States and find that risk is high in the petroleum and natural gas, restaurant, hotel, and lodging sectors.

While the Covid-19 pandemic negatively affected economic and financial activities, stock markets reacted positively to government stimulus packages. For example, Narayan et al. (2020a, b) support that lockdown, travel bans, and economic stimulus packages caused the stock markets to move positively in the G7 countries. David et al. (2021) find that the shocks caused by the Covid-19 pandemic increase risk in stock markets, with the markets later recovering gradually. Ashraf (2020a, b) reports that government social distancing actions negatively affect stock market returns, whereas awareness programs, testing and quarantining policies, and income support packages positively affect market returns.

Zhang et al. (2020) argue that the Covid-19 pandemic increases the market risk and stock risk in the global capital market. Further, Albulescu (2020) examines the impact of Covid-19 related official announcements on the S&P 500 realized volatility and finds that the reported new cases increase volatility. Additionally, the study reports that the fatality ratio positively influences financial volatility in the U.S. markets. Similarly, Okorie and Lin (2020) examine the fractal contagion effect of the Covid-19 pandemic on the stock market using the detrended moving cross-correlation analysis (DMCA) and detrended cross-correlation analysis (DCCA) techniques. Their study finds a significant fractal contagion effect on the return and volatility of the stock market, with the effect abating over the medium and long term. Similarly, Haroon and Rizvi (2020) document higher volatility in the U.S. stock market due to the Covid-19 related fear generated by news outlets over the period of January 2020 to April 2020.

Additionally, Lyocsa et al. (2020) use Google search volume to measure fear of Covid-19 and determine its effect on stock markets in 10 countries. Their study finds that the fear index as measured by Google search volume predicts stock market volatility. Further, the study reports that when the Google search volume is high, the volatility of the market is high during the Covid-19 period. Interestingly, Ambros et al. (2020) show that changes in Covid-19 news do not affect stock returns, but do affect stock market volatility in the European market. In contrast, Engelhardt et al. (2020) report that stock market volatility due to the Covid-19 pandemic is significantly lower in high-trust countries.

Further, Salisu et al. (2020a, b) examine the relationship between oil and stock markets during the Covid-19 period and report that the oil-stock nexus is strongly negative during the Covid-19 period. In contrast, Narayan et al. (2020a, b) find a strong relationship between the Yen and Japanese stock returns over the Covid-19 period. Salisu and Akanni (2020) construct a new global fear index and examine whether the index predicts stock returns during the Covid-19 period. Their study finds that the index does significantly predict stock returns over the period. Further, Salisu et al. (2020a, b) apply the Covid-19 fear index to examine the performance of commodity returns and find that the fear index is positively related to commodity returns.

Previous studies focus on developed and emerging markets. Few studies have investigated the impact of Covid-19 on the Indian stock market and economy. For instance, Guru and Das (2021) find that the energy sector spills over volatility to other sectors during the Covid-19 pandemic. Further, Mishra and Rampal (2020) document the impact of the Covid-19 on food insecurity in India. Mahata et al. (2021) show that stocks with higher financial antifragility show V-shape recovery in the Indian stock market. Agarwalla et al. (2021) examine the impact of Covid-19 on the tail risk of Nifty index options and find that the volatility level remains elevated during the pandemic. Similarly, Sahoo (2021) investigates the day-of-the-week effect on selected Nifty indices before and after Covid-19 and finds that Monday’s return is positive before the Covid-19 period and negative after Covid-19.

Most of the existing research focuses on the impact of Covid-19 on stock returns by considering Covid-19 reported cases, reported deaths, industry grouping, stimulus packages, and government restrictions. The present study initially considers the impact of Covid-19 cases and deaths on stock returns in India based on available research in the global literature. Further, we contribute to the existing literature by studying the impact of the different phases of lockdown on stock returns in India. Additionally, we categorize 1,318 companies based on industry groupings and examine the impact of Covid-19 on stock returns of the different industry groupings during the overall and lockdown periods.

3 Data and methodology

The study examines whether the Covid-19 pandemic influences stock market returns. Initially, we consider 1,504 stocks from the National Stock Exchange of India (NSE). However, the data set is only available for 1,318 companies over the study period from January 2020 to October 2020. The data set includes daily return, market capitalization, and price-to-book value of the companies listed on the NSE India. The data is collected from the CMIE Prowess database. After verification of the availability of data, the study finalizes a sample of 1,318 stocks. Further, the daily Covid-19 cases and death details are collected from the European Centre for Disease Prevention and Control.

3.1 Methodology

Covid-19 is not a single-day event—its impact unfolds across the entire sample period. Therefore, to investigate the influence of Covid-19 on stock returns, we employ panel data models rather than event study methodology. Hsiao (1986), Kao and Chiang (1999), and Ashraf (2017) argue that the panel data models capture the time-varying relationship between dependent and independent variables and minimize heteroscedasticity, multicollinearity, and estimation bias in the framed models [Baltagi (2008), Wooldridge (2010), Ashraf (2020a, b)]. Initially, we frame the following model to understand the relationship between Covid-19 and stock returns:

Where Rit is the returns of stock i at time t; α is the intercept; β is the coefficient of Covid-19 which (1) denotes the daily growth rate in the number of confirmed cases (Gcases) and (2) the daily growth rate in the number of deaths (Gdeaths) over the study period; εi,t is the error term. Further, we add the lagged return of the stocks in the model and form the following equation:

Where Ri,t−1 is a lagged return of the stock at time t-1. We consider the lagged return of the stocks to control a piece of past information. Further, we expect a positive coefficient for the lagged return in the model. Moreover, we control the size and value effects and frame the following equations:

Where Size is the market capitalization of the stock i at day t; PB is the price-to-book value of the stock i at day t; βk and βj represent the coefficient of the size and value effects, respectively. We consider the growth rate in the size and the growth rate in the price-to-book value of the stocks.

Further, we examine the impact of national lockdown on the returns of the stocks. This study investigates whether Covid-19 has a homogeneous or heterogeneous effect on stock returns across the different lockdown periods by using the following regression with dummy variables:

Where α1 is the average stock return during the non-lockdown period; LD is a dummy variable that equals 1 if the day falls under the lockdown period, and 0 otherwise. LD1, LD2, LD3, and LD4 are the four different phases of the lockdown (see Table 1). Further, we incorporate the control variables of size and price-to-book values and form the following equation:

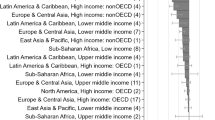

Where LDk is the lockdown. We consider the entire lockdown and the four different phases of the lockdown imposed by the Government of India (see Table 1). Additionally, we examine the impact of Covid-19 on stock returns by industry grouping. Particularly, this study examines whether Covid-19 has a homogeneous or heterogeneous effect on stock returns across different industry groupings. We identify ten different industries based on the CMIE classifications and frame the following model:

Where Industry is a dummy variable that equals 1 if the stocks fall under a particular industry, and 0 otherwise. We consider the Automotive, Banking and finance, Cement and construction, Chemical, Consumer durables, Food and beverages, Manufacturing, Metals and mining, Services, and Technology industries over the study period. We expect that a particular industry provides a positive return during the lockdown periods.

4 Empirical results and discussion

4.1 Summary statistics

Table 2 reports the summary statistics for stock returns (RET), market capitalization (size), price-to-book value (PB), daily number of Covid-19 cases (cases), and daily number of Covid-19 deaths (deaths) over the study period. The results show that the average return of the stocks is 0.061 with a standard deviation of 3.846. Further, the values of the skewness and kurtosis are 0.783 and 20.538, respectively. This shows that the return series is not normally distributed. As shown in Table 2, the average number of daily reported Covid-19 cases and deaths are 26,935 and 408, respectively. This reveals that around 1.5% of Covid-19 deaths to the daily number of cases are reported daily in India.

4.2 Correlation matrix

Table 3 presents the results of the correlation analysis for the returns, size, PB, cases, and deaths. As shown in Table 3, we observe that the association of stock returns with Covid-19 cases and deaths are 0.024 and 0.044, respectively. We find nearly the same level of association of the cases and deaths with the size and PB. Further, the results show a strong association between the daily number of Covid-19 cases and deaths. The Covid-19 pandemic spreads fear among investors in global markets. Hence, volatility in the stock markets is increased during this period.

4.3 Stock returns with daily number of Covid-19 reported cases and deaths

In this section, we examine the impact of the daily growth rate in the Covid-19 cases (Gcases) and the daily growth rate in the Covid-19 deaths (Gdeaths) on stock returns. We employ four different models. The results of the models are presented in Table 4. Moreover, we verify the results by incorporating the control variables of the lagged return, size, and PB. The results show that the coefficient of Gcases for the four different models are − 0.005, -0.006, -0.002, and − 0.002, respectively. The results are highly significant at the 1% level and indicate that Gcases are negatively associated with stock returns. Additionally, we investigate the impact of Gdeaths on stock returns and the results are reported in Table 4. The coefficients for Gdeaths under the four different models are − 0.003, -0.003, 0.001, and 0.001, respectively. The results reveal that Gdeaths are also negatively associated with the stock returns under Models 1 and 2. This shows that when Gcases increase, stock returns decrease during the study period. However, this study finds mixed results between Gdeaths and stock returns. Further, Covid-19 is a global pandemic and affects all activities around the world. Moreover, vaccinations were not available during the initial stage of the pandemic. Due to this, fear among investors was heightened. These factors led to heavy selling pressure by foreign institutional investors (FII), domestic institutional investors (DII), and retail investors in the Indian market as well as in the global markets. Therefore, stock returns are associated negatively with Gcases in India during the study period.

4.4 Stock returns and four phases of the national lockdown

National lockdown was imposed by the Government of India and respective State Governments to control Covid-19. Due to lockdown, many economic and business activities were affected. Therefore, stock markets around the world decreased by around 30 to 40%. Initially, we test the impact of the lockdown on stock returns by considering the four national lockdowns (see Table 1). To examine the lockdown effect, this study runs the regression with a dummy variable and presents the results in Table 5. We assign a dummy variable that equals 1 if the day falls under the Lockdown 1 (LD1) period, and 0 otherwise. We follow the same procedure to assign the dummy variables for the lockdowns of LD2, LD3, and LD4 (see Table 1). The results of Table 5 reveal that the intercept of the stock returns of the model is insignificant, with a value of 0.074 that explains the average return of stocks during non-lockdown periods. The average stock returns during Lockdown 2 is 0.834 and highly significant at the 1% level. This indicates that the stock markets recovered slowly during this period. Interestingly, the average stock returns during Lockdown 3 is negative. At the same time, the average growth rate in Gcases is high. We observe a negative relationship between stock returns and Covid-19 cases in India. Further, this study detects negative returns for LD 3 and LD 4 due to the negative results reported by many Indian companies and strict lockdowns during the same period.

4.5 Stock returns, lockdown, and daily reported Covid-19 cases and deaths

Further, we examine the impact of Covid-19 cases, deaths, and lockdown on the stock returns. We consider our six different models, with the results of the models presented in Table 6. The results show that the intercepts range from − 0.068 to 0.160 and are highly significant for all models except Models 2 and 5. Importantly, the coefficients of Gcases and Gdeaths are negative and highly significant at the 1% level. This shows that stock returns are negatively associated with the daily growth rate of Covid-19 cases and deaths during the study period. Moreover, this study examines the different lockdown effects on stock returns. The results reveal that the coefficient of Lockdown 2 is highly significant with values of 0.746 and 0.749 for the Gcases and Gdeaths, respectively. This reflects that the stock market increased in mid-April 2020 after an adverse initial pandemic period. We hypothesize that fear in the minds of investors has fluctuated frequently in the stock markets during the pandemic period. Restriction on economic activities and negative financial performance of companies led to the negative coefficients for Lockdown 3 and Lockdown 4 in the study.

4.6 Stock returns, industry grouping, and lockdown

This part of the study focuses on the beahviour of stock returns based on industry grouping during the overall and lockdown periods. We employ a regression model with a dummy variable that equals 1 if a stock is classified under a particular industry grouping, and 0 otherwise. We classify the stocks into the automotive, banking and finance, cement and construction, chemical, consumer durables, food and beverages, manufacturing, metals and mining, services, and technology industries (see Table 1). The results are presented in Table 7. The results show that the chemical, technology, and food and beverage industries earn a higher return, whereas the banking and finance, automotive, services, and cement and construction industries yield a lower return for the overall period. Interestingly, all industry groupings in this study earn a positive return during the lockdown period. In particular, chemical, technology, automotive, metals and mining, and food and beverage industries provide higher returns for the lockdown period. Therefore, the present study supports that Covid-19 has a heterogeneous effect in the markets [Liu et al. (2020), Narayan et al. (2021), Mazur et al. (2020), Baek et al. (2020)].

5 Summary and conclusion

The present study examines whether Covid-19 has a homogeneous or heterogeneous effect on stock returns in India. We consider panel data by using 1,318 companies that are listed in the National Stock Exchange of India (NSE). The daily return, market capitalization, and price-to-book value of the companies are extracted from the CMIE database, which is one of the largest and leading databases in India. Further, the daily Covid-19 cases and deaths information are collected from the European Centre for Disease Prevention and Control. This study finds that the daily growth rate in Covid-19 cases (Gcases) and the daily growth rate in Covid-19 deaths (Gdeaths) are negatively associated with stock returns due to fear and heavy selling pressures by foreign institutional investors (FII), domestic institutional investors (DII), and retail investors. Further, we observe that the average stock returns during Lockdown 2 are positive and highly significant at the 1% level. This shows that the stock market began to recover in mid-April 2020 after an adverse impact during the initial phase of the pandemic. We hypothesize that fear in the mind of investors has fluctuated frequently in the stock markets during the pandemic period. Restriction on economic activities and negative financial performance of companies led to the negative coefficients for Lockdown 3 and Lockdown 4 in this study.

Furthermore, the results of this study show that the chemical, technology, and food and beverage industries earn a higher return, whereas the banking and finance, automotive, services, and cement and construction industries yield a lower return for the overall period. Interestingly, all industry groupings in this study earn a positive return during the lockdown period. In particular, chemical, technology, automotive, metals and mining, and food and beverage industries provide higher returns during the lockdown period. Therefore, the present study supports the claim that Covid-19 has a heterogeneous effect in the markets [Liu et al. (2020), Narayan et al. (2021), Mazur et al. (2020), Baek et al. (2020)].

References

Agarwalla SK, Varma JR, Virmani V (2021) The impact of COVID-19 on tail risk: Evidence from Nifty index options.Economics Letters,109878

Albulescu CT (2020) COVID-19 and the United States financial markets’ volatility.Finance Research Letters,101699

Alexakis C, Eleftheriou K, Patsoulis P (2021) COVID-19 containment measures and stock market returns: An international spatial econometrics investigation. J Behav experimental finance 29:100428

Ambros M, Frenkel M, Huynh TLD, Kilinc M (2020) COVID-19 pandemic news and stock market reaction during the onset of the crisis: evidence from high-frequency data.Applied Economics Letters,1–4

Ashraf BN (2020a) Economic impact of government interventions during the COVID-19 pandemic: International evidence from financial markets. J Behav experimental finance 27:100371

Ashraf BN (2020b) Stock markets’ reaction to COVID-19: cases or fatalities?.Research in International Business and Finance,101249

Ashraf BN (2017) Political institutions and bank risk-taking behavior. J Financ Stab 29:13–35

Baek S, Mohanty SK, Glambosky M (2020) COVID-19 and stock market volatility: An industry level analysis. Finance Res Lett 37:101748

Baltagi BH (2008) Econometric Analysis of Panel Data. John Wiley and Sons, West Sussex

David SA, Inácio Jr CMC, Machado JAT (2021) The recovery of global stock markets indices after impacts due to pandemics. Res Int Bus Finance 55:101335

Dharani M, Hassan MK, Rabbani MR, Huq T (2022) Does the Covid-19 pandemic affect faith-based investments? Evidence from global sectoral indices. Res Int Bus Finance 59:101537

Engelhardt N, Krause M, Neukirchen D, Posch PN (2020) Trust and stock market volatility during the COVID-19 crisis.Finance Research Letters,101873

Erdem O (2020) Freedom and stock market performance during Covid-19 outbreak. Finance Research Letters

Fernandez-Perez A, Gilbert A, Indriawan I, Nguyen NH (2021) COVID-19 pandemic and stock market response: A culture effect. J Behav Experimental Finance 29:100454

Guru BK, Das A (2021) COVID-19 and uncertainty spillovers in Indian stock market. MethodsX 8:101199

Haroon O, Rizvi SAR (2020) COVID-19: Media coverage and financial markets behavior—A sectoral inquiry. J Behav Experimental Finance 27:100343

Hsiao C (1986) Analysis of Panel Data. Cambridge Univ. Press, New York

Isen AM, Simmonds SF (1978) The effect of feeling good on a helping task that is incompatible with good mood.Social Psychology,346–349

Kao C, Chiang M-H (1999) On the estimation and inference of a cointegrated regression in panel data. Available at SSRN 1807931

Liu H, Wang Y, He D, Wang C (2020) Short term response of Chinese stock markets to the outbreak of COVID-19. Appl Econ 52(53):5859–5872

Lyocsa S, Baumöhl E, Výrost T, Molnár P (2020) Fear of the coronavirus and the stock markets. Finance Res Lett 36:101735

Mazur M, Dang M, Vega M (2020) COVID-19 and the march 2020 stock market crash. Evidence from S&P1500.Finance Research Letters,101690

Mishra K, Rampal J (2020) The COVID-19 pandemic and food insecurity: A viewpoint on India. World Dev 135:105068

Narayan PK, Devpura N, Wang H (2020a) Japanese currency and stock market—What happened during the COVID-19 pandemic? Econ Anal Policy 68:191–198

Narayan PK, Gong Q, aliahmed HJ (2021) Is there a pattern in how COVID-19 has affected Australia’s stock returns?.Applied Economics Letters,1–4

Narayan PK, Phan DHB, Liu G (2020b) COVID-19 lockdowns, stimulus packages, travel bans, and stock returns.Finance research letters,101732

Mahata A, Rai A, Nurujjaman M, Prakash O (2021) Modeling and analysis of the effect of COVID-19 on the stock price: V and L-shape recovery, vol 574. Statistical Mechanics and its Applications, Physica A, p 126008

Okorie DI, Lin B (2020) Stock Markets and the COVID-19 Fractal Contagion Effects.Finance Research Letters,101640

Phan DHB, Narayan PK (2020) Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerg Markets Finance Trade 56(10):2138–2150

Sahoo M (2021) COVID-19 impact on stock market: Evidence from the Indian stock market.Journal of Public Affairs, e2621

Salisu AA, Akanni LO (2020) Constructing a global fear index for the COVID-19 pandemic. Emerg Markets Finance Trade 56(10):2310–2331

Salisu AA, Akanni L, Raheem I (2020a) The COVID-19 global fear index and the predictability of commodity price returns. J Behav Experimental Finance 27:100383

Salisu AA, Ebuh GU, Usman N (2020b) Revisiting oil-stock nexus during COVID-19 pandemic: Some preliminary results. Int Rev Econ Finance 69:280–294

Topcu M, Gulal OS (2020) The impact of COVID-19 on emerging stock markets. Finance Res Lett 36:101691

Vozlyublennaia N (2014) Investor attention, index performance, and return predictability. J Banking Finance 41:17–35

Wooldridge JM (2010) Econometric Analysis of Cross Section and Panel Data. The MIT Press, Cambridge, MA

Zhai H, Xiao M, Chan KC, Liu Q (2021) Physical proximity, corporate social responsibility, and the impact of negative investor sentiment on stock returns: Evidence from COVID-19 in China. International Review of Finance. In press

Zhang D, Hu M, Ji Q (2020) Financial markets under the global pandemic of COVID-19.Finance Research Letters,101528

Acknowledgements

The authors are grateful to the editor and anonymous referees for insightful comments that significantly improved the paper.

Funding

This research received no external funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Declaration of competing interest:

The authors declare no conflict of interest.

Note

*** represents significance levels at 1%.

Note

*, **, and *** represent significance levels at 10%, 5%, and 1%, respectively. The standard errors are reported in the parentheses. Gcases stands for the daily growth rate in Covid-19 cases and the daily growth rate in Covid-19 deaths. Further, Gsize and GPB stand for the growth rate in the size and the growth rate in the price-to-book value, respectively.

Note

*, **, and *** represent significance levels at 10%, 5%, and 1%, respectively. The standard errors are reported in the parentheses. The average values are reported in the square brackets. The Gcases and Gdeaths stand for the daily growth rate in Covid-19 cases and the daily growth rate in Covid-19 deaths, respectively. Further, Gsize and GPB stand for the growth rate in the size and the growth rate in the price-to-book value, respectively.

Note

*, **, and *** represent significance levels at 10%, 5%, and 1%, respectively. The standard errors are reported in the parentheses. Gcases stands for the daily growth rate in Covid-19 cases and the daily growth rate in Covid-19 deaths. Further, Gsize and GPB stand for the growth rate in the size and the growth rate in the price-to-book value, respectively.

Note

*, **, and *** represent significance levels at 10%, 5%, and 1%, respectively. The standard errors are reported in the parentheses.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Dharani, M., Hassan, M.K., Huda, M. et al. Covid-19 pandemic and stock returns in India. J Econ Finan 47, 251–266 (2023). https://doi.org/10.1007/s12197-022-09586-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-022-09586-8