Abstract

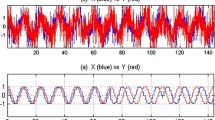

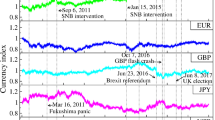

We used the detrended cross-correlation analysis (DCCA) method based on ensemble empirical mode decomposition (EEMD) to study the dynamic interdependence structure of daily domestic currency to US dollar exchange rates of 15 Southern African Development Community (SADC) exchange rate markets. We first decompose all series into intrinsic mode functions using EEMD and reconstruct the series into three frequency modes: high-, medium- and low frequency, and residue. The DCCA method was used to analyze the cross-correlation between the various frequencies, residues and original series. These were meant to address the nonlinearity and nonstationarity in observed exchange rate data. Finally, we formed a correlation network from the cross-correlation coefficients in all cases which revealed rich than would have been obtained from the original series. We observed similarities between the nature of cross-correlation between high-frequency series mimic the original series and the significant cross-correlation among the long-term trend of most SADC countries exchange rate markets. The innovation of this paper is to combine EEMD with DCCA to study the multifrequency cross-correlations of exchange rate markets, which can provide policymakers a deeper understanding of the dynamics of exchange rate markets toward the formation of currency unions.

Similar content being viewed by others

Notes

The IMFs of the remaining countries are available upon request to save space. In all, they look similar.

References

Abdalla SZS (2012) Modelling exchange rate volatility using GARCH models: empirical evidence from Arab countries. Int J Econ Financ 4:216

Adam AM, Agyapong D, Gyamfi EN (2010) Dynamic Macroeconomic convergence in the West Africa Monetary Zone (WAMZ). Int Business Manag 1:31–40. https://doi.org/10.3968/j.ibm.1923842820100101.006

Adam AM, Kyei K, Moyo S, Gill R, Gyamfi EN (2021) Similarities in Southern African Development Community (SADC) exchange rate markets structure: evidence from the ensemble empirical mode decomposition. J Afr Bus. https://doi.org/10.1080/15228916.2021.1874795

Agdeyegbe TD (2009) On the feasibility of a monetary union in the Southern Africa development community. Int J Financ Econ 13(2):150–157. https://doi.org/10.1002/ijfe.323

Alagidede P, Tweneboah G, Adam AM (2008) Nominal exchange rates and price convergence in the West African Monetary Zone. Int J Bus Econ 7(3):181–191

Asongu SA, Nwachukwu JC, Tchamyou VS (2015) A Literature Survey on Proposed African Monetary Unions, AGDI Working Paper, No. WP/15/042, African Governance and Development Institute (AGDI), Yaoundé

Baig MT (2001) Characterizing exchange rate regimes in post-crisis East Asia. International Monetary Fund. Retrieved from https://books.google.com/books?hl=en&lr=&id=Iohyl0oabrsC&oi=fnd&pg=PP2&dq=exchange+rate+comovement+in+middle+east&ots=hDYYF5DyY&sig=iMGqiQPWhaV07PZMCwW9jm7Wfw4. Accessed 10 Dec 2019

Bailliu J, King MR (2005) What Drives Movements in Exchange Rates? Bank of Canada Review Autumn, Ottawa: Bank of Canada.

Baxter M, Stockman AC (1989) Business cycles and exchange-rate regime: Some international evidence. J Monet Econ 23:377–400. https://doi.org/10.1016/0304-3932(89)90039-1

Bayoumi T (1994) A formal model of optimum currency areas. IMF Staff Pap 41:537–558. https://doi.org/10.2307/3867519

Bayoumi T, Eichengreen B (1994) One Money or Many? Analyzing the prospects for monetary unification in various parts of the world, Studies in International Finance, No. 76, Princeton, NJ: Princeton

Bildirici ME, Sonüstün B (2019) Chaos and exchange rates in economic issues: global and local perspectives, In: S. Koc, S. Y. Genc and V. F. Benli (eds), Cambridge International Academics, Cambridge, pp 70–76

Cappiello C, Engle R, Sheppard K (2006) Asymmetric dynamics in the correlations of global equity and bond returns. J Finan Econometr 4:557–572

Cheung YW, Ng LK (1996) A causality-in-variance test and its application to financial market prices. J Econometr 72:33–48

Corrales JS, Imam PA, Yehoue E WS (2016) Dollarisation in Sub-Saharan Africa. J Afr Econ 25(1):28–54. https://doi.org/10.1093/jae/ejv020

Coulibaly I, Gnimassoun B (2013) Optimality of a monetary union: New evidence from exchange rate misalignments in West Africa. Econ Model 32:463–482. https://doi.org/10.1016/j.econmod.2013.02.038

De Grauwe P (2001) The Political Economy of Monetary Union. Elgar Reference Collection. International Library of Critical Writings in Economics, vol. 134. Cheltenham, U.K. and Northampton, Mass.: Elgar.

Edwards S (2006) Monetary unions, external shocks and economic performance: a latin American perspective. IEEP 3(3):225–247. https://doi.org/10.1007/s10368-006-0056-2

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Business Econ Statist 20:339–350

Fama E (1970) Efficient capital markets: a review of theory and empirical work. J Financ 25:383–417

Ferreira A, Moore M, Mukherjee S (2019) Expectation errors in the foreign exchange market. J Int Money Financ 95:44–51. https://doi.org/10.1016/j.jimonfin.2019.03.005

Flandrin P, Rilling G, Goncalves P (2004) Empirical mode decomposition as a filter bank. Signal Process Lett IEEE 11(2):112–114. https://doi.org/10.1109/LSP.2003.821662

Fritz B, Mühlich L (2010) South-south monetary integration: the case for a research framework beyond the theory of optimum currency areas. Int J Public Policy 6:118–135

Ghosh AR Gulde-Wolf AM Wolf HC (2002) Exchange rate regimes: choices and consequences (vol. 1). MIT press. Retrieved from https://books.google.com/books?hl=en&lr=&id=lnDFKt0S48UC&oi=fnd&pg=PA1&dq=exchange+rate+movement+in+europe&ots=B9PmCIAec4&sig=Dv_tIODqPZ1ese1O3E7dc7vKRLM. Accessed 10 Dec 2019

Hitaj E Kolerus C Shapiro D Zdiziencka A (2013) Responding to shocks and maintaining stability in the west african economic and monetary union. African Departmental Paper, (13/07)

Honohan P, Lane, PR (2000) Will the Euro Trigger More Monetary Unions in Africa?, World Bank Country Economics Paper No. 2393

Horvatic D, Stanley HE, Podobnik B (2011) Detrended cross-correlation analysis for non-stationary time series with periodic trends. EPL Eur Lett 94:18007. https://doi.org/10.1209/0295-5075/94/18007

Hsing Y (2007) The roles of the exchange rate and the foreign interest rate in Estonia’s money demand function and policy implications. Appl Financ Econ Lett 3:221–224. https://doi.org/10.1080/17446540600706916

Huang NE, Shen Z, Long SR, Wu MC, Shih HH, Zheng Q, Yen N-C, Tung CC, Liu HH (1998) The empirical mode decomposition and the Hilbert spectrum for non-linear and non-stationary time series analysis. Proc R Soc London Ser A Math Phys Eng Sci 454:903–995. https://doi.org/10.1098/rspa.1998.0193

Ibhagui O (2017) Linking fiscal policy and external competitiveness in Sub-Saharan Africa—does government spending drive the real exchange rate in Sub-Saharan Africa, MPRA Paper 77291, University Library of Munich

Inci AC, Lu B (2004) Exchange rates and interest rates: can term structure models explain currency movements? J Econ Dyn Control 28:1595−624

Jefferis KR (2007) The Process of Monetary Integration in the SADC Region. J South Afr Stud 33(1):83–106. https://doi.org/10.1080/03057070601136590

Kenen PB (1969) The theory of optimum currency areas: an eclectic view. In: Mundell R, Swoboda A (eds) Monetary problems of the international economy. University of Chicago Press, Chicago

Khamfula Y, Huizinga H (2004) The Southern African development community: suitable for a monetary union? J Dev Econ 73(2):699–714. https://doi.org/10.1016/j.jdeveco.2003.06.003

Kim N-S, Chung K, Ahn S, Yu JW, Choi K (2014) Denoising traffic collision data using ensemble empirical mode decomposition (EEMD) and its application for constructing continuous risk profile (CRP). Accid Anal Prev 71:29–37. https://doi.org/10.1016/j.aap.2014.05.007

Kreinin ME, Plummer MG (2002) Economic integration and development: has regionalism delivered for developing countries? Edward Elgar, London

Kumo WL (2011) Working Paper 130-Growth and Macroeconomic Convergence in Southern Africa. African Development Bank

Lin CH (2012) The comovement between exchange rates and stock prices in the Asian emerging markets. Int Rev Econ Financ 22:161–172. https://doi.org/10.1016/j.iref.2011.09.006

Luukko PJJ, Helske J, Räsänen E (2016) Introducing libeemd: a program package for performing the ensemble empirical mode decomposition. Comput Statist 31:545557. https://doi.org/10.1007/s00180-015-0603-9

Mai Y, Chen H, Zou JZ, Li SP (2018) Currency co-movement and network correlation structure of foreign Exchange market. Phys A 42:65–74. https://doi.org/10.1016/j.physa.2017.09.068

McKinnon RI (1963) Optimum currency areas. Am Econ Rev 53:717–725

Meng X, Huang C-H (2019) The time-frequency co-movement of Asian effective exchange rates: a wavelet approach with daily Data. North Am J Econ Finan 48:131–148. https://doi.org/10.1016/j.najef.2019.01.009

Mpofu T (2016) The Determinants of Exchange Rate Volatility in South Africa, Economic Research Southern Africa (ERSA) Working Paper, 604

Müller UA, Dacorogna MM, Dave RD, Pictet OV, Olsen RB and Ward JR (1993) Fractals and intrinsic time: a challenge to econometricians. Unpublished manuscript, Olsen & Associates, Zurich

Mundell RA (1961) A theory of optimum currency areas. Am Econ Rev 51:509–517

Nakajima T, Hamori S (2012) Causality-in-mean and causality-in-variance among electricity prices, crude oil prices, and yen-us dollar exchange rates in Japan. Res Int Bus Financ 26(4):371–386

Nzimande NP Ngalawa H (2016) Is there a SADC business cycle? Evidence from a dynamic factor model (No. 651). Cape Town: Economic Research of Southern Africa.

Orlov AG (2009) A Spectral analysis of exchange rate comovements during Asian financial crisis. J Int Finan Markets Inst Money 19:742–758. https://doi.org/10.1016/j.intfin.2008.12.004

Owusu Junior P, Adam AM, Tweneboah G (2017) Co-movement of real exchange rates in the West African Monetary Zone. Cogent Econ Financ 5(1):1351807. https://doi.org/10.1080/23322039.2017.1351807

Pereira EJAL, Ferreira PJS, da Silva MF, Miranda JGV and Pereira HBB (2019) Multiscale network for 20 stock markets using DCCA. P hysica A 529:121542

Piao L, Fu Z (2016) Quantifying distinct associations on different temporal scales: comparison of DCCA and Pearson methods. Sci Rep 6:36759. https://doi.org/10.1038/srep36759

Podobnik B, Stanley HE (2008) Detrended cross-correlation analysis: a new method for analyzing two nonstationary time series. Phys Rev Lett 100:084102

Prass TS, Pumi G (2021) On the behavior of the DFA and DCCA in trend-stationary processes. J Multivar Anal 182(2021):104743

Reboredo JC, Rivera-Castro MA (2013) A wavelet decomposition approach to crude oil price and exchange rate dependence. Econ Model 32:42–57. https://doi.org/10.1016/j.econmod.2012.12.028

Redda EH and Muzindusti PF (2017) Does SADC constitute an optimum currency area? Evidence from generalised purchasing power parity. In Proceedings of economics and finance conferences (No. 4807771). International Institute of Social and Economic Sciences, London

Rose AK (2008) EMU, Trade and Business Cycle Synchronization. University of California, Berkeley working paper, mimeo

Schiller RJ (2000) Irrational exuberance. Princeton University Press, Princeton

Shin K-H, Lim G, Min S (2020) Dynamics of the global stock market networks generated by DCCA methodology. Appl Sci 10(6):2171. https://doi.org/10.3390/app10062171

Stošić D, Stošić D, Stošić T, Stanley HE (2015) Multifractal properties of price change and volume change of stock market indices. Phys A 428:13–18. https://doi.org/10.1016/j.physa.2015.02.046

Tamakoshi G, Hamori S (2013) An asymmetric dynamic conditional correlation analysis of linkages of European financial institutions during the Greek sovereign debt crisis. Eur J Financ 19(10):939–950

Tavlas GS (1993) The ‘New’ theory of optimum currency areas. World Econ 16:663–685. https://doi.org/10.1111/j.1467-9701.1993.tb00189.x

Tipoy CK (2015) Real convergence using TAR panel unit root tests: an application to Southern African Development Community (No. 536). Economic Research of Southern Africa.

Toyoshima y, Tamakoshi G and Hamori S, (2012) Asymmetric dynamics in correlations of treasury and swap markets: Evidence from the US market. J Int Finan Markets Inst Money 22(2):381–394

Wang J-Y, Masha I, Shirono K and Harris L (2007) The common monetary area in southern africa: shocks, adjustment, and policy challenges. IMF Working Paper 07/158. Washington, DC: International Monetary Fund

Wu Z, Huang NE (2009) Ensemble empirical mode decomposition: a noise-assisted data analysis method. Adv Adapt Data Anal 1:1–41. https://doi.org/10.1142/S1793536909000047

Xu M, Shang P, Lin A (2016) Cross-correlation analysis of stock markets using EMD and EEMD. Phys A Stat Mech Appl 442:82–90. https://doi.org/10.1016/j.physa.2015.08.063

Zebende GF (2011) DCCA cross-correlation coefficients: quantifying level of crosscorrelation. Physica A 390:614–618

Zehirun MF, Breitenbach MC, Kemegue F (2015) Assessment of Monetary Union in SADC: Evidence from Cointegration and Panel Unit Root Tests, Economic Research Southern Africa (ERSA) Paper No. 945.

Zehirun MF, Breitenbach MC, Kemegue F (2016) Exploring exchange rate-based policy coordination in SADC. Stud Econ Financ 33(4):576–594. https://doi.org/10.1108/SEF-03-2015-0089

Zerihun MF, Breitenbach MC, Kemegue F (2014) Greek wedding in SADC? Testing for structural symmetry toward SADC monetary integration. Afr Financ J 16(2):16–33

Zhang X, Lai KK, Wang SY (2008) A new approach for crude oil price analysis based on empirical mode decomposition. Energy Econ 30(3):905–918. https://doi.org/10.1016/j.eneco.2007.02.012

Zhou S (2002) The forward premium anomaly and the trend behavior of the exchange rates. Econ Lett 76(2):273–279. https://doi.org/10.1016/s0165-1765(02)00053-8

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Adam, A.M., Kyei, K., Moyo, S. et al. Multifrequency network for SADC exchange rate markets using EEMD-based DCCA. J Econ Finan 46, 145–166 (2022). https://doi.org/10.1007/s12197-021-09560-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-021-09560-w

Keywords

- Detrended cross-correlation analysis (DCCA)

- Ensemble empirical mode decomposition (EEMD)

- Intrinsic mode function

- Exchange rate

- Short data span

- Nonstationarity

- Nonlinearity

- Long memory

- Time series