Abstract

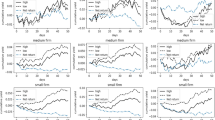

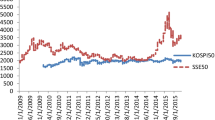

We argue that continuous rising (falling) share prices might cause herding behaviors due to investors’ sentiments aroused. To my best of our understanding, we argue that this study pioneers to explore the trading performance after continuous rising (falling) prices, which might contribute to the existing literature in finance. By employing the constituent stocks of DJ 30, FTSE 100, and SSE 50 as our samples, we reveal that contrarian strategies are proper for continuous falling prices instead of continuous rising prices. We argue that the results reveled might benefit for investors to trade these constituents’ stocks.

Similar content being viewed by others

Notes

We might exclude 2 days regarded as rather general cases due to occurring frequently. In addition, we should focus continuous rising share prices for several days, especially for more than 2 days, since continuous rising prices for 2 days would be regarded as general cases due to abundant samples.

i.e. continuous rising or falling prices.

These constituent stocks are heavy weighted stocks, which might exclude the size effect and value/growth stock effect in term of momentum/overreaction.

In this study, we also collect the data over the period 2009–2015, and the results revealed are almost the same as employing the data over the period 2009–2013. In addition, we use the data after 2009 due to concerning stock market crisis occurred in 2008.

References

Balcilar M, Demirer R, Hammoudeh S (2013) Investor herds and regime-switching: evidence from gulf Arab stock markets. J Int Financ Mark Inst Money 23:295–321

Bigalow SW (2011) Profitable candlestick trading: pinpointing market opportunities to maximize profits. John Wiley & Sons Publishing

Chalmers J, Kaul A, Phillips B (2013) The wisdom of crowds: mutual fund investors’ aggregate asset allocation decisions. J Bank Financ 37(9):3318–3333

Chopra N, Lakonishok J, Ritter JR (1992) Measuring abnormal performance: do stocks overreact? J Financ Econ 31(2):235–268

Chordia T, Roll R, Subrahmanyam A (2008) Liquidity and market efficiency. J Financ Econ 87(2):249–268

Chuang WI, Lee BS (2006) An empirical evaluation of the overconfidence hypothesis. J Bank Financ:2489–2515

Chui AC, Titman S, Wei KJ (2010) Individualism and momentum around the world. J Financ 65(1):361–392

Daniel K, Hirshleifer D, Subrahmanyam A (1998) A theory of overconfidence, self-attribution, and security market under- and overreaction. J Financ 53:1839–1886

De Bondt WFM, Thaler R (1985) Does the stock market overreact? J Financ 40:793–805

De Bondt WFM, Thaler R (1987) Further evidence on investor overreaction and stock market seasonality. J Financ 42:557–581

De Haan L, Kakes J (2011) Momentum or contrarian investment strategies: evidence from Dutch institutional investors. J Bank Financ 35(9):2245–2251

Dennis PJ, Strickland D (2002) Who blinks in volatile markets, individuals or institutions? J Financ 57(5):1923–1949

Dissanaike G, Lim KH (2010) The sophisticated and the simple: the profitability of contrarian strategies. Eur Financ Manag 16(2):229–255

Economou F, Kostakis A, Philippas N (2011) Cross-country effects in herding behaviour: evidence from four south European markets. J Int Financ Mark Inst Money 21(3):443–460

Fama EF (1965) The behavior of stock market prices. J Bus 38:34–105

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Financ 25:383–417

Fama EF (1991) Efficient capital markets: II. J Financ 46(5):1575–1617

Fama EF (1998) Market efficiency, long-term returns, and behavioral finance. J Financ Econ 49(3):283–306

Fock JH, Klein C, Zwergel B (2005) Performance of candlestick analysis on intraday futures data. J Deriv 13(1):28–40

Frey S, Herbst P, Walter A (2014) Measuring mutual fund herding–a structural approach. J Int Financ Mark Inst Money 32:219–239

Griffin JM, Harris JH, Topaloglu S (2003) The dynamics of institutional and individual trading. J Financ 58(6):2285–2320

Grinblatt JM, Titman S, Wermers R (1995) Momentum investment strategies, portfolio performance, and herding: a study of mutual fund behavior. Am Econ Rev 85(5):1088–1105

Hsieh MF, Yang TY, Yang YT, Lee JS (2011) Evidence of herding and positive feedback trading for mutual funds in emerging Asian countries. Quant Financ 11(3):423–435

Lakonishok J, Shleifer A, Vishny RW (1992) The impact of institutional trading on stock prices. J Financ Econ 32(1):23–43

Lewellen J, Shanken J (2002) Learning, asset-pricing tests, and market efficiency. J Financ 57(3):1113–1145

Malin M, Bornholt G (2013) Long-term return reversal: evidence from international market indices. J Int Financ Mark Inst Money 25:1–17

Marshall BR, Young MR, Rose LC (2006) Candlestick technical trading strategies: can they create value for investors? J Bank Financ 30(8):2303–2323

Mendel B, Shleifer A (2012) Chasing noise. J Financ Econ 104(2):303–320

Menkhoff L, Sarno L, Schmeling M, Schrimpf A (2012) Carry trades and global foreign exchange volatility. J Financ 67(2):681–718

Ni Y, Liao YC, Huang P (2015) MA trading rules, herding behaviors, and stock market overreaction. Int Rev Econ Financ 39:253–265

Nofsinger JR, Sias RW (1999) Herding and feedback trading by institutional and individual investors. J Financ 54(6):2263–2295

Salm CA, Schuppli M (2010) Positive feedback trading in stock index futures: international evidence. Int Rev Financ Anal 19(5):313–322

Schwert GW (2003) Anomalies and market efficiency. Handbook of the Economics of Finance 1:939–974

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wu, M., Huang, P. & Ni, Y. Investing strategies as continuous rising (falling) share prices released. J Econ Finan 41, 763–773 (2017). https://doi.org/10.1007/s12197-016-9377-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-016-9377-3

Keywords

- Continuous rising (falling) prices

- Momentum strategies

- Herding behaviors

- Contrarian strategies

- Investors’ sentiments