Abstract

In this paper, we use a unique hand-collected dataset on corporate litigation to examine the relationship between litigation risk and financial leverage. We find that an increase in litigation risk is associated with a significant decrease in total debt. Partitioning total debt into long-term debt and short-term debt, we find a negative relationship between litigation risk and long-term debt. There is no significant relationship between litigation risk and short-term debt.

Similar content being viewed by others

Notes

Tobit model is a censored regression methodology. This technique is designed to estimate linear relationships between variables when there is either left- or right-censoring in the dependent variable. The results continue to hold under this methodology.

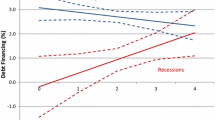

Surprisingly, the coefficient of the interacting between litigation risk and debt increasing event is positively related to leverage.

We thank an anonymous referee for bringing this to our attention.

References

Autore D, Hutton I, Peterson DR, Smith A (2014) The effect of securities litigation on external financing. J Corp Finan 27:231–250

Bhagat S, Bizjak JM, Coles JL (1998) The shareholder wealth implications on corporate lawsuits. Financ Manag 27(4):5–27

Bhattacharya U, Galpin N, Haslem B (2007) The home court advantages in international corporate litigation. J Law Econ 50:625–659

Bizjak JM, Coles JL (1995) The effect of private antitrust litigation on the stock market valuation of the firm. Am Econ Rev 85(3):436–461

Crane AD (2011) The litigation environment of a firm and its impact on financial policy. Working Paper, Rice University

Francis J, Philbrick D, Schipper K (1994) Shareholder litigation and corporate disclosures. J Account Res 32:137–164

Frank MZ, Goyal VK (2009) Capital structure decisions: which factors Are really important? Financ Manag 38:1–37

Gande A, Lewis CM (2009) Shareholder-initiated class action lawsuits: shareholder wealth effects and industry spillovers. J Financ Quant Anal 44(4):823–850

Jarrell G, Peltzman S (1985) The impact of product recalls on the wealth of sellers. J Polit Econ 93:512–536

Karpoff J (2011) Does reputation work to discipline corporate misconduct? in the The Oxford University handbook of corporate reputation. Oxford University Press, Oxford

Karpoff JM, Lott JR (1993) The reputational penalty firms bear for committing criminal fraud. J Law Econ 36:757–802

Karpoff JM, Lott JR (1999) On the determinants and importance of punitive damages awards. J Law Econ 62:527–573

Karpoff JM, Lee DS, Martin GS (2008) The cost to firms of cooking the books. J Quant Anal 43:581–612

Kim I, Skinner DJ (2012) Measuring securities litigation risk. J Account Econ 53(1):290–310

Klein B, Leffler KB (1981) The role of market forces in assuring contractual performance. J Polit Econ 89:615–641

Kraus A, Litzenberger RH (1973) A state‐preference model of optimal financial leverage. J Financ 28(4):911–922

Lemmon ML, Roberts MR, Zender JF (2008) Back to the beginning: persistence and the cross-section of corporate capital structure. J Financ 63:1575–1608

Lowry M, Shu S (2002) Litigation risk and IPO underpricing. J Financ Econ 65:309–335

Murphy DL, Shrieves E, Tibbs SL (2009) Understanding the penalties associted with corporate misconduct: an empirical examination of earnings and risk. J Financ Quant Anal 44:55–83

Niehaus G, Roth G (1999) Insider trading, equity issues, and CEO turnover in firms subject to securities class action. Financ Manag 28:52–72

Parsons C, Titman S (2008) Empirical capital structure: a review. Found Trends Finan 3:1–93

Rajan R, Zingales L (1995) What Do I know about capital structure? some evidence from international data. J Financ 50(5):1421–1460

Romano R (1991) The shareholder suit: litigation without foundation? J Law Econ Org 7(1):55–87

Shu S (2000) Auditor resignations: clientele effects and legal liability. J Account Econ 29:173–205

Skinner D (1994) Why firms voluntarily disclosure bad news. J Account Res 32(1):32–60

Yuan Q, Zhang Y (2015) Do banks price litigation risk in debt contracting? Evidence from class action lawsuit. J Bus Finan Account. doi:10.1111/jbfa.12164

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Malm, J., Krolikowski, M. Litigation risk and financial leverage. J Econ Finan 41, 180–194 (2017). https://doi.org/10.1007/s12197-015-9348-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-015-9348-0