Abstract

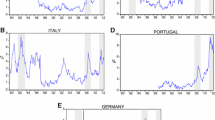

Several studies have established the predictive power of the yield curve in terms of real economic activity. In this paper we use data for a variety of E.U. countries: both EMU (Germany, France, Italy, Portugal and Spain) and non-EMU members (Norway, Sweden and the U.K.). The data used range from 1991:Q1 to 2009:Q3. For each country, we extract the long run trend and the cyclical component of real economic activity, while the corresponding ECB euro area government benchmark bond interest rates of long and short term maturities are used for the calculation of the yield spreads. We also augment the models tested with non monetary policy variables: the respective unemployment rates and stock indices. The methodology employed in the effort to forecast real output, is a probit model of the inverse cumulative distribution function of the standard distribution, using several formal forecasting and goodness of fit evaluation criteria. The results show that the yield curve augmented with the non-monetary variables has significant forecasting power in terms of real economic activity but the results differ qualitatively between the individual economies examined raising non-trivial policy implications.

Similar content being viewed by others

Notes

These are available from the authors upon request.

See Chionis, Gogas and Pragidis (2009) for an explanation for this selection.

“Comparing predictive accuracy”, Francis Diebold & Roberto Mariano, Journal of Business & Economic Statistics, July 1995, Vol. 13, No. 3

References

Ang A, Piazzesi M, Wei M (2006) What does the yield curve tell us about GDP? J Econom 131:1–2, March–April, 359–403

Bonser-Neal C, Morley TR (1997) Does the yield spread predict real economic activity? A multicountry analysis. Economic Review, Federal Reserve Bank of Kansas City, Third Quarter, 37–53

Bordo MD, Haubrich JG (2008) Forecasting with the yield curve; level, slope, & output 1875-1997. Econ Lett 99:48–50

Chauvet M, Potter S (2001) Forecasting recessions using the yield curve. Staff Reports, Federal Reserve Bank of New York, 134, August

Chionis D, Gogas P, Pragidis I (2009) Predicting European Union Recessions in the Euro Era: The Yield Curve as a Forecasting Tool of Economic Activity. International Advancesin Economic Research 16(1)

De Graeve F, Emiris M, Wouters R (2009) A structural decomposition of the U.S yield curve. J Monet Econ 56:545–559

Diebold F, Mariano A (1995) Comparing Predictive Accuracy. Journal of Business & Economic Statistics, 13(3)

Estrella A, Mishkin FS (1997) The predictive power of the term structure of interest rates in Europe and the United States: implications for the European Central Bank. Eur Econ Rev 41(7):1375–1401

Estrella A, Rodrigues AP, Schich S (2003) How stable is the predictive power of the yield curve? Evidence from Germany and the United States. Rev Econ Stat 85(3):629–644

Feitosa MA, Tabak BN (2007) Predictability of economic activity using yield spreads: the case of Brazil. Anais do XXXV EncontroNacional de Economia [Proceedings of the 35th Brazilian Economics Meeting], 029

Fisher C, Felmingham B (1998) The Australian yield curve as a leading indicator of consumption growth. Appl Financ Econ 8(6):627–635

Hamilton JD, Kim DH (2002) A reexamination of the predictability of economic activity using the yield spread. J Money Credit Bank 34(2):340–360

Hodrick R, Prescott EP (1997) Postwar business cycles: an empirical investigation. J Money Credit Bank 29(1):1–16

Kim A, Limpaphayom P (1997) The effect of economic regimes on the relation between term structure and real activity in Japan. J Econ Bus 49(4):379–392

Venetis IA, Paya I, Peel DA (2003) Re examination of the predictability of economic activity using the yield spread: a non linear approach. International Review of Economics and Finance 12(2):187–206

Wright J (2006) The yield curve and predicting recessions. Finance and Economics Discussion Series, Federal Reserve Board 2006–7, February

Acknowledgements

The authors would like to thank the participants at the 68th International Atlantic Economic Conference in Boston, 8–11 October 2009, and especially the organizer of the session “Recent Issues in Finance”, Prof. Nicholas Apergis.The comments and suggestions from two anonymous referees greatly improved the paper and we appreciate their input. We also thank Mr. HarroldPrins for kindly providing us with some of the data. Of course the usual caveat applies for any remaining errors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gogas, P., Pragidis, I. GDP trend deviations and the yield spread: the case of eight E.U. countries. J Econ Finan 36, 226–237 (2012). https://doi.org/10.1007/s12197-011-9176-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-011-9176-9