Abstract

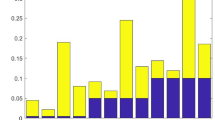

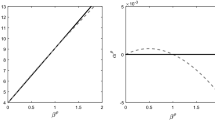

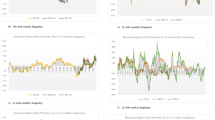

This paper provides a theory and evidence that the risk premium puzzle may be viewed mainly as a phenomenon pertaining to the unstable foreign exchange market. In an unstable market, errors uncompensated by an initial risk premium accrue due to consumer expectation revision about the ex ante uncertainty of the exchange rate. These revision errors are different from the forecasting errors, depending on the frequency of the consumer expectation revision and the degree of risk aversion. A simulation was discussed on how the risk premium actually deviates from an initial premium in the unstable market. Using the monthly data of the U.K., Japan, Australia, Korea, Malaysia, and Thailand from January 1994 to December 2008, it is shown that revision errors for risk premium were statistically significant and were non-trivial in magnitude and that the degree of absolute risk aversion went up during the Asian currency crisis as well as the recent financial crisis periods.

Similar content being viewed by others

Notes

See Engel (1996) for Jensen’s Inequality. Jensen’s inequality could exist regardless of Siegel’s paradox.

The second-order conditions are satisfied when the utility function is strictly concave and u″<0.

Refer to Dutton (1993) for the income effect of real and nominal shocks on premium.

In matching sampling data of the futures rate with those of the spot rate, we may lose lots of information on data. See Bekaert and Hodrick (1992).

When futures rate data were not available at the end of the month, these rates were sampled the day before the end of the month.

Using a survey data, Cavaglia and Wolff (1996) examined the movements of risk premium.

Use of a log variable instead of a level variable for the risk premium can eliminate Jensen’s inequality, which can arise from Siegel’s paradox.

References

Allayannis G, Ofek E (2001) Exchange rate exposure, hedging, and the use of foreign currency derivatives. J Int Money Finance 20:273–296

Backus D, Foresi S, Telmer C (1994) The forward premium anomaly: three examples in search of a solution. New York University, Stern School of Business, Working Papers Series FD-94-6

Baillie R, Bollerslev T (1990) A multivariate generalized ARCH approach to modeling risk Premia in forward foreign exchange rate markets. J Int Money Finance 9:309–324

Bekaert G (1994) Exchange risk volatility and deviations from unbiasedness in a cash-in-advance model. J Int Econ 36:29–52

Bekaert G (1996) The time variation of risk and return in foreign exchange markets: a general equilibrium approach. Rev Financ Stud 9:427–470

Bekaert G, Hodrick R (1992) Characterizing predictable components in excess returns on equity and foreign exchange market. J Finance 47:467–509

Bekaert G, Hodrick R, Marshall D (1997) The implications of first-order risk aversion for asset market risk premiums. J Monet Econ 40:3–39

Cavaglia S, Wolff C (1996) A note on the determinants of unexpected exchange rate movements. J Bank Finance 20:179–188

Chetty R (2003) A new method of estimating risk aversion. National Bureau of Economic Research, Working paper number 9988

Cumby R (1988) Is it risk? Explaining deviations from uncovered interest parity. J Monet Econ 22:279–299

Deaton A, Muellbauer J (1981) Economics and consumer behavior. Cambridge Univ. Press, Cambridge, pp 307–344

Domowitz I, Hakkio C (1985) Conditional variance and the risk premium in the foreign exchange market. J Int Econ 19:47–66

Dutton J (1993) Real and monetary shocks and risk Premia in forward markets for foreign exchange. J Money Credit Bank 25:731–754

Easly D, O’Hara M (2004) Information and the costs of capital. J Finance LIX(4):1553–1583

Engel C (1992) On the foreign exchange risk premium in a general equilibrium model. J Int Econ 32:305–319

Engel C (1996) The forward discount anomaly and the risk premium: a survey of recent evidence. J Empir Finance 3:123–192

Evans MD, Lewis K (1995) Do long term swings in the dollar affect estimates of the risk Premia? Rev Financ Stud 8:709–742

Fama EF (1984) Spot and forward exchange rates. J Monet Econ 14:319–338

Frankel J, Froot K (1987) Using survey data to test standard propositions regarding exchange rate expectations. Am Econ Rev 77:133–153

Gul F (1991) A theory of disappointment aversion. Econometrica 59(3):667–686

Hansen L, Hodrick R (1980) Forward exchange rates as optimal predicators of future spot rates: an econometric analysis. J Polit Econ 88:829–853

Hodrick RJ (1987) The empirical evidence on the efficiency of forward and futures foreign exchange markets. Harwood Academic, Chur

Hodrick R, Srivastava S (1986) The covariance of risk premiums and expected future spot exchange rates. J Int Money Finance 5:5–21

Kimball M (1990) Precautionary saving in the small and the large. Econometrica 58(1):53–73

Koutmos G (1998) The information content of the forward premium and forward forecast error. J Multinatl Financ Manag 8:381–391

Mark N (1988) Time varying betas and risk Premia in the pricing of forward foreign exchange contracts. J Financ Econ 22:335–354

Martin A, Mauer L (2003) Exchange rate exposures of us banks: a cash flow-based methodology. J Bank Finance 27:851–865

McCallum BT (1994) A reconsideration of the uncovered interest rate parity relationship. J Monet Econ 33:105–132

Mehra R, Prescott E (1985) The equality premium: a puzzle. J Monet Econ 15:145–161

Muller A (2000) Hedging price risk when real wealth matters. J Int Money Finance 19:549–560

Segal U, Spivak A (1997) First order risk aversion and non-differentiability. Econ Theory 9:179–183

Yee K (2006) Earnings quality and the equity risk premium: a benchmark model. Contemp Account Res 23(3):833–877

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kim, H. Uncertainty and risk premium puzzle. J Econ Finan 37, 62–79 (2013). https://doi.org/10.1007/s12197-010-9170-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-010-9170-7