Abstract

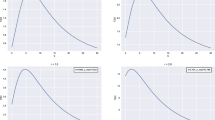

We find the optimal dividend strategy in two related risk models under an affine penalty for ruin. The first risk model is the classical Cramér–Lundberg risk model, and the second is the so-called dual risk model. Under both models, for exponentially distributed jumps, we show that the optimal dividend strategy is a barrier strategy and obtain the barrier explicitly. Moreover, we prove that the optimal barrier increases with respect to the parameters of the affine penalty, while the penalized value function decreases with respect to the penalty. We also compute the expected time until ruin and show that the expected time of ruin increases with respect to the parameters of the affine penalty. Finally, we present some numerical examples to demonstrate the relationship between the results for the classical and dual risk models. Our main contributions are in comparing the classical and dual risk models side-by-side and in obtaining explicit expressions for the penalized value functions, the optimal barriers, and the expected times of ruin. Also, we contrast the free-boundary condition associated with the barrier strategies in the two models.

Similar content being viewed by others

Notes

If we are referring to an insurance company, then “expenses” refers to aggregate claims.

Similarly, \(\tau ^{d, L} = \inf \{t \ge 0: X_t^{d, L} < 0 \} = \inf \{t \ge 0: X_t^{d, L} \le 0 \}\) is the time of ruin of the dual risk process \(X^{d, L}\). We can replace < by \(\le \) in the definition of \(\tau ^{d, L}\) because of the continual negative drift \(-\, c\) in the dual risk process.

We write negativek and positiveq in the penalty function because when ruin occurs, the deficit x will be negative. Also, we write P(x) with these signs so that increasing k and q leads to “more penalty” in an intuitive sense. Otherwise, if we were to write \(+\, k\) in place of \(-\, k\), increasing k would increase the reward for ruin; instead, we want to think of P(x) as a penalty function. Alternatively, we could have written \(P(x) = k - qx\) and subtracted P(x) in (2.4).

When Y is distributed according to the exponential with parameter \(\alpha \), then this positivity condition becomes \(\lambda - \alpha c > 0\).

Note that \(k = 0\) is consistent with (4.11) because we assume that \(\lambda - \alpha c > 0\).

In this section, we use a subscript or superscript d to distinguish quantities in the dual risk model from the corresponding ones in the classical risk model. So, for example, we will write \(R_1^d\) to mean \(R_1\), as given in (3.8), with c replaced by \(c_d\).

References

Avanzi, Benjamin: Strategies for dividend distribution: a review. N. Am. Actuar. J. 13(2), 217–251 (2009)

Avanzi, Benjamin, Gerber, Hans U.: Optimal dividends in the dual model with diffusion. ASTIN Bull. 38(2), 653–667 (2008)

Avanzi, Benjamin, Gerber, Hans U., Shiu, Elias S.W.: Optimal dividends in the dual model. Insur. Math. Econ. 41(1), 111–123 (2007)

Avram, Florin, Palmowski, Zbigniew, Pistorius, Martijn R.: On the optimal dividend problem for a spectrally negative Lévy process. Ann. Appl. Probab. 17(1), 156–180 (2007)

Avram, Florin, Palmowski, Zbigniew, Pistorius, Martijn R.: On Gerber–Shiu functions and optimal dividend distribution for a Lévy risk-process in the presence of a penalty function. Ann. Appl. Probab. 25(4), 1868–1935 (2015)

Albrecher, Hansjörg, Thonhauser, Stefan: Optimal dividend strategies for a risk process under force of interest. Insur. Math. Econ. 43(1), 134–149 (2008)

Hansjörg, Albrecher, Thonhauser, Stefan: Optimality results for dividend problems in insurance. RACSAM-Revista de la Real Academia de Ciencias Exactas, Fisicas y Naturales. Serie A. Matematicas 103(2), 295–320 (2009)

Azcue, Pablo, Muler, Nora: Optimal reinsurance and dividend distribution policies in the Cramér–Lundberg model. Math. Finance 15(2), 261–308 (2005)

Bayraktar, Erhan, Kyprianou, Andreas E., Yamazaki, Kazutoshi: Optimal dividends in the dual model under transaction costs. Insur. Math. Econ. 54, 133–143 (2014)

Bühlmann, Hans: Mathematical Methods in Risk Theory. Springer, Heidelberg (1970)

De Finetti, B.: Su unimpostazione alternativa della teoria collettiva del rischio. Trans. XVth Int. Congr. Actuar. 2(1), 433–443 (1957)

Dickson, David C.M., Waters, Howard R.: Some optimal dividends problems. ASTIN Bull. 34(1), 49–74 (2004)

Dixit, Avinash: A simplified treatment of the theory of optimal regulation of Brownian motion. J. Econ. Dyn. Control 15(4), 657–673 (1991)

Dufresne, Daniel: Fitting combinations of exponentials to probability distributions. Appl. Stoch. Models Bus. Ind. 23(1), 23–48 (2007)

Dumas, Bernard: Super contact and related optimality conditions. J. Econ. Dyn. Control 15(4), 675–685 (1991)

Gerber, Hans U., Sheldon Lin, X., Yang, Hailiang: A note on the dividends-penalty identity and the optimal dividend barrier. ASTIN Bull. 36(2), 489–503 (2006)

Gerber, Hans U., Shiu, Elias S.W., Smith, Nathaniel: Maximizing dividends without bankruptcy. ASTIN Bull. 36(1), 5–23 (2006)

Kulenko, Natalie, Schmidli, Hanspeter: Optimal dividend strategies in a Cramér–Lundberg model with capital injections. Insur. Math. Econ. 43(2), 270–278 (2008)

Kyprianou, Andreas E., Palmowski, Zbigniew: Distributional study of De Finetti’s dividend problem for a general Lévy insurance risk process. J. Appl. Probab. 44, 428–443 (2007)

Li, Yongwu, Li, Zhongfei, Zeng, Yan: Equilibrium dividend strategy with non-exponential discounting in a dual model. J. Optim. Theory Appl. 168(2), 699–722 (2016)

Liang, Zhibin, Young, Virginia R.: Dividends and reinsurance under a penalty for ruin. Insur. Math. Econ. 50(3), 437–445 (2012)

Loeffen, Ronnie L.: On optimality of the barrier strategy in De Finetti’s dividend problem for spectrally negative Lévy processes. Ann. Appl. Probab. 18(5), 1669–1680 (2008)

Loeffen, Ronnie L.: An optimal dividends problem with a terminal value for spectrally negative Lévy processes with a completely monotone jump density. J. Appl. Probab. 46(1), 85–98 (2009)

Loeffen, Ronnie L.: An optimal dividends problem with transaction costs for spectrally negative Lévy processes. Insur. Math. Econ. 45(1), 41–48 (2009)

Loeffen, Ronnie L., Renaud, Jean-François: De Finetti’s optimal dividends problem with an affine penalty function at ruin. Insur. Math. Econ. 46(1), 98–108 (2010)

Marciniak, Ewa, Palmowski, Zbigniew: On the optimal dividend problem for insurance risk models with surplus-dependent premiums. J. Optim. Theory Appl. 168(2), 723–742 (2016)

Ng, Andrew C.Y.: On a dual model with a dividend threshold. Insur. Math. Econ. 44(2), 315–324 (2009)

Scheer, Natalie, Schmidli, Hanspeter: Optimal dividend strategies in a Cramér–Lundberg model with capital injections and administration costs. Eur. Actuar. J. 1(1), 57–92 (2011)

Schmidli, Hanspeter: On capital injections and dividends with tax in a classical risk model. Insur. Math. Econ. 71, 138–144 (2016)

Shang, Yilun: Deffuant model with general opinion distributions: first impression and critical confidence bound. Complexity 19(2), 38–49 (2013)

Shang, Yilun: An agent based model for opinion dynamics with random confidence threshold. Commun. Nonlinear Sci. Numer. Simul. 19(10), 3766–3777 (2014)

Thonhauser, Stefan, Albrecher, Hansjörg: Dividend maximization under consideration of the time value of ruin. Insur. Math.Econ. 41(1), 163–184 (2007)

Vierkötter, Matthias, Schmidli, Hanspeter: On optimal dividends with exponential and linear penalty payments. Insur. Math. Econ. 72, 265–270 (2017)

Yao, Dingjun, Yang, Hailiang, Wang, Rongming: Optimal dividend and capital injection problem in the dual model with proportional and fixed transaction costs. Eur. J. Oper. Res. 211(3), 568–576 (2011)

Zhou, Ming, Yiu, Ka Fai Cedric: Optimal dividend strategy with transaction costs for an upward jump model. Quant. Finance 14(6), 1097–1106 (2014)

Acknowledgements

The authors would like to thank the anonymous referees for their careful reading and helpful comments on an earlier version of this paper, which led to a considerable improvement of the presentation of the work.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Zhibin Liang thanks the National Natural Science Foundation of China (Grant No. 11471165) for financial support.

Virginia R. Young thanks the Nesbitt Chair of Actuarial Mathematics for partial financial support.

Rights and permissions

About this article

Cite this article

Liang, Z., Young, V.R. Optimal dividends with an affine penalty. J. Appl. Math. Comput. 60, 703–730 (2019). https://doi.org/10.1007/s12190-018-01233-y

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12190-018-01233-y

Keywords

- Optimal dividend strategy

- Ruin penalty

- Classical risk model

- Dual risk model

- Instantaneous control

- Impulse control