Abstract

To investigate the efficiency and stability of Venezuela’s oil-oriented economy, this paper applied entropy to the analysis. Based on this method, Venezuela’s oil-centered industry, inefficient regulatory system, and insensitive response to external changes are recognized as an increase in the country’s entropy. According to these facts, a dissipative structure model is constructed to analyze the efficiency and stability of the Venezuela’s economic system. The results show that financial assistants (fund flow), policy reform (policy flow), and advanced technology (technology flow) can perform as negative entropy inflows (NEIFs). These NEIFs will promote a series of influence and feedback reactions, which will contribute to recovering Venezuela’s system efficiency and stability.

Similar content being viewed by others

1 Introduction

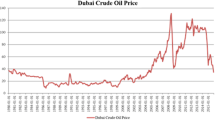

As one of the countries with world’s largest oil reserves, Venezuela’s recent economic performance has demonstrated an obvious negative relationship with its oil abundance. The “Resource Curse” has trapped Venezuela for decades and resulted in severe development trouble due to its extremely high oil dependency. In 2015, Venezuela’s oil dependency has reached an incredible level that 96% of Venezuela’s exports and over 60% of the government revenues rely on the oil industry. This means that the international oil price volatility can be directly reflected on Venezuela’s economic performance (see Fig. 1), which helps to explain the immediate shrinkage of Venezuela’s GDP after the 2014 oil price fall. To make matters worse, this shrinkage of Venezuela’s GDP is still ongoing and is expected to be more according to IMF (International Monetary Fund).Footnote 1

Many researches have been conducted to examine the contradictions between oil abundance and economic growth in Venezuela. Global oil markets, international economic environments, domestic political stability, welfare distribution, and many other factors have all shown connections with this issue (Wiens et al. 2014; Wiens 2014; Satti et al. 2014; Betz et al. 2015; Shao and Yang 2014; Moradbeigi and Law 2016). These factors, and many others unrecognized reasons, are believed to have brought Venezuela’s inflation, unemployment, poverty, and other problems, which is also known as the “Resource Curse.”

Researches have suggested that the “curse” happens when the resource countries do not have the capability to handle the huge resource revenue due to the low level of institutions. This helps to explain the strong contrast of the capital expenditure during the oil boom–bust cycle (Arezki and Ismail 2013), as it is easy for the government to increase its fiscal expenditure plan but hard to cut it back (Arezki and Bruckner 2010). Moreover, a general phenomenon is the scale of resource sectors is abnormally huge. This is usually related to “Dutch Disease,” which often results in over-valued domestic currencies, and the decline of other sectors like manufacture and agriculture (Kott 2012).

Reynolds and Pippenger (2010) suggested a possible interpretation of Venezuela’s behavior of exceeding OPEC production quotas because of its institutions and risk aversion especially when the oil price is high. Evidence can be easily found during the history of Venezuela’s state oil company (PDVSA), which directed Venezuela’s path to the oil-oriented economy (Zhao 2010). Indeed, Venezuela has been stressing the relationship between social organizations and government reforms and ruling. This interpretation is based on Wang’s (2011) analysis of Venezuelan society organizations during President Chavez’s time in power. According to Kolstad and Wiig (2009), the root of Venezuela’s dilemma lies in the government’s income-seeking behaviors, which result the dysfunction in the mechanism.

Although a series of articles and case studies (Stevens and Dietsche 2008; Bacon and Tordo 2006) have demonstrated that the level of institutions determines whether the “curse” happens, the principles behind this are far more obscure to discover. That is because a national economic system is constructed of uncountable compositions including sections, industries, and departments, which means it is impossible to apply analysis on each part of these compositions from a microscale perspective, especially when the connections, constraints, and dynamic feedbacks between these compositions are taken into account. Besides, these dynamic feedback processes not only multiply the complexity and difficulty of the analysis, but also make it impossible to balance the local optima results with the general equilibrium. As cross-effects accumulate and intrinsic uncertainty becomes unquantified, it is hard to avoid sweeping results only according to views from one or two perspectives while others are disregarded (Ren et al. 2001). Thus, we think that it is inappropriate to apply the structural decomposition method into the analysis of Venezuela’s resource curse.

Thermodynamic systems share many similarities with complex systems and provide inspirations and theories for complex analysis. Dissipative structure, proposed by Prigogine (1977), is a thermodynamic theory that explains whether a system of high energy and orderliness can sustain a steady state. Contrary to what is widely accepted that “the lower energy, the more stable is a system,” dissipative structure theory reveals the possibility of an unstable system restoring its efficiency and functionality (Ahn 1998). The formation and maintenance of a dissipative structure requires at least three conditions: (1) the system must be open so that it can continuously exchange matter and energy with the external environment; (2) the system should be in a “far from equilibrium” state; (3) the mechanism within the system must be nonlinear and dynamic.

Wang and Yan (2012) applied the dissipative structure to the study of monetary policy transmission mechanisms; Deng et al. (2017) used a brusselator model in the analysis on dissipative structure of China’s building energy service industry system. These articles approved the vitality of dissipative structure theory in empirical system research and might help shed light on the resource curse in Venezuela. Therefore, this paper aims to develop the dissipative system of Venezuela’s oil-oriented economy to verify whether Venezuela’s oil-oriented economic system is a dissipative system and how this system can maintain efficiency and functionality. In the second section, methodology of dissipative systems and collaborative fluctuations are proposed to support the whole research. In the third section, this paper develops a frame of analyzing Venezuela’s main problems to discover the entropy increase inside the system based on the second law of thermodynamics. In the fourth section, the NEIFs are introduced into the analysis of Venezuela’s dissipative structure. The NEIFs are interpreted into advisable suggestions to promote Venezuela’s economic recovery. Conclusions are given in the last section.

2 Dissipative system and collaborative fluctuations

A dissipative system is open and far from equilibrium, and it can exchange energy, matter, and information with external surroundings. Dissipative theory reveals that through these spontaneous exchanges, both spatial and temporal, the unbalanced system can evolve into a new ordered form.

According to the classical thermodynamics of Clausius, in an isolated system exchanging neither energy nor matter with outer environment, the sum \(S\) of all entropies is increased, that is:

where \(S\) denotes the total entropy of a system and \(S_{i}\) denotes a typical entropy \(i\).

In an open system, the entropy S should be distinguished into two parts: the internal and external parts. The internal part \(S_{\text{e}}\) is entropy produced within the system, which generally refers to the part that is produced in the irreversible processes according to the second thermodynamics law. Clearly, \(S_{\text{e}}\) is positive. The external part \(S_{\text{h}}\) refers to the entropy that transferred by energy, matter, or information from the external environment. The \(S_{\text{h}}\) may be positive or negative.

If \(\left| {S_{\text{e}} } \right| > \left| {S_{\text{h}} } \right|,\quad S_{\text{e}} + S_{\text{h}} > 0\), the external part cannot offset the entropy increase from the internal system, and self-organization will not be maintained. The system will stay in its current condition or get worse.

Otherwise, \(\left| {S_{\text{e}} } \right| < \left| {S_{\text{h}} } \right|,\quad S_{\text{e}} + S_{\text{h}} < 0\), the external part is stronger than the inner system entropy increase, which will make the total entropy of the system decrease. The system may evolve into a higher shape (Fig. 2).

It is also worth noting that as an indicator describing the orderliness of a system, entropy does not reflect the stability or functionality of the system. That is, two systems with the same total entropy value must not be judged as the same level of stability or functionality. We can only tell the differences of orderliness between two systems if they have different entropy value. Dissipative theory explains the process of a far from equilibrium system evolving into an equilibrium state by monitoring the variation in the system’s entropy, which is also called the self-organization mechanism (Prigogine 1977).

At the microlevel, elements usually have limited functions and do not have long-term goals or macro-expectations and their fluctuations (decisions or movement) only pursue microscopic optima (Pulselli et al. 2009). But when expanding the analysis scale and taking the feedbacks between the elements into consideration, the element’s goal may conflict with that of its related elements, which in turn feedback to it and affect its movements. After rounds of adjustments and compromise among these microelements, both sides make concessions to reach their conditional related optimum (resonance). And when this simple behavior associated with these few elements grows to the whole system, the giant fluctuation will result in a new form of orderliness.

Most economies are dissipative systems. By exchanging matter and information with their surroundings, they are highly organized, ordered, and capable of securing and guaranteeing the life and interests of their residents. What is attracting us is that usually the most powerful countries (having the highest system “energy”) have the highest stability, which is contrary to “the lower energy, the more stable a system is” again. Similar to the process of “resonance” referred to above, the system is guided by the profit-seeking behavior of elements. Local optima contribute to the global stability, which can be a systematic interpretation of the “invisible hand,” a widely known economic term. For decades, the “hand” motivated the market until another “hand,” the “visible hand,” appeared. The visible hand, aiming to control the whole system’s behavior from the macro-level, works in conditions where multiple steady solutions exist, that is, for the system’s state equation:

The equation has multiple steady solutions \(x_{{{\text{e}}1}} , x_{{{\text{e}}2}} ,x_{{{\text{e}}3}} \ldots\)

The invisible hand cannot decide which \(x_{\text{e}}\) is better, or more fit its purpose. It treats these \(x_{\text{e}}\) at the same level and only tends to approve the strongest attractor. But the “visible hand” can judge which \(x_{\text{e}}\) is better or fit its goal and help to adjust the movement of the system. Linked with the background of the emergence of “visible hand,” the Great Depression in 1929–1933 was the result of a free competitive market leading to over-supply. Without disruptions from government, the market can evolve into many shapes. The perfectly competitive market and the complete monopoly market are two of them, and they are both attractive solutions because having once reached these states, the market will not go out if no disruption is involved.

While with the government functions to maintain and guide the development of the country, the whole system’s behavior will show its tendency toward some particular \(x_{\text{e}}\).

The process might be indirect or even never reached, but indeed it is approaching and can be defined as steady according to Lyapunov (1892).

But the visible hand is more than just the guide: It is also the implementation capability. As the complex system approaches some particular \(x_{\text{e}}\), it may face disruption from some other \(x_{\text{e}}\) and need to break its gravity. That is, the intrinsic complexity and nonlinear mechanisms of the system make long-term prediction unavailable (Chaos), which requires a high level of institutions to maintain the process under control. This control includes but is not limited to scientific and legal systems, conscious planning, and strict monitoring mechanisms.

Ren’s conclusions (Ren 1998) have suggested that the efficiency and functionality of a management system can be reflected using the management entropy. Taking it as a precondition, the management interpretation of the second law of thermodynamics can be described that the stability requirements of the system elements like structure, regulatory systems, or other factors will result in the delay of the system to the outer surroundings, which determines a management’s gradual failure of functionality because the system’s reactions cannot response immediately to changes of its environment. As a consequence, the management entropy increases.

3 Venezuela’s management entropy

The history of Venezuela exploiting and exporting oil can be traced back to early 1910s. With very rapid development, Venezuela soon became the second largest oil producer in the world and the largest oil exporter. The boom of the oil industry promoted the country’s economy but also the government’s revenue. To maintain more of this income, decrees were published to protect the oil industry. After two rounds of nationalization of PDVSA, Venezuela successfully controlled the whole oil industry, with a full monopoly oil regulatory system along with a series of other related laws.

The government believed oil had made the promise that prosperity is in sight with oil in hand. And oil did, but only when its price was high. After the first monopoly of PDVSA in 1976, the oil price reached over $100/bbl but then plunged to < $20/bbl until 2000. The government’s over-optimistic attitude brought Venezuela into troubles. The sluggish economy because of the fall in the oil price led to commodity price shocks, local currency devaluation, and necessities in short supply, which created serious unrest and unease among society.

Base on the research of Wilpert (2003), Ding (2005) and Cerny and Filer (2007), the main sources of Venezuela’s management entropy increase could be categorized as below.

3.1 Structure

In a system, structure describes the relations between elements and the way they cooperate against the external environment. And it determines the system’s functionality, properties, and stability. As one of the most important factors, structure must be function dominant, low coupling, and high cohesion.

Before 1973, the first oil crisis, Venezuela’s structure problem was not that significant. During the first crisis, the oil price almost quadrupled. Stunned by the sudden rush of oil money, the president Carlos Andrés Perez believed Venezuela’s prosperity was in sight. The best known sayings were “La Gran Venezuela,” Venezuelans “sow the oil” to fight poverty. And to guarantee this, nationalization of Venezuela’s oil industry seemed natural. Since 1976, the oil industry has been fully nationalized, with the creation of Petroleos de Venezuela (PDVSA). Ever since then, the whole country has taken “control” over their oil industry.

After President Hugo Chávez took office in 1998, the “Bolivarian Revolution” was promoted. Laws were amended to support the projects of the revolution. With more social expenditure from oil revenues, PDVSA was nationalized again to assure revenues.

Obviously, oil has made the illusion to every government that via massive infrastructure projects, the prosperity of Venezuela is within reach, and all they need to do is to protect the oil revenue and nationalize PDVSA.

The Venezuela government is actually doing this. After rounds of nationalization, the country has become an oil-centric assembly in which oil has taken the dominant role to affect every prospect of the country. The oil-oriented structure has shaped this. To a country’s economy, rich resources may be an advantage especially when the resource price is high. Yet to put the whole economy fully on it seems not that wise. As including the fluctuation of resource price into the system will result in the instability of it. With other factors (industries) weakening, oil seems to be the last chip Venezuela has.

Till now, Venezuela has kept a very high percentage of GDP leaning to oil (Fig. 2), which makes the system very vulnerable to changes both from internal and external systems. The oil price has been varying violently since the crises. To make matters worse, in over 40 years Venezuela has stumbled in this illusion that oil has made, yet no tendency to change this dilemma is ever revealed in any regulatory system in the country.

Devastated by Dutch disease, the Venezuela industries are in very bad shape. With most other industries withering, strengthening the oil industry to support the others seems the last choice. But will this contribute to decrease the system’s entropy? In theory, the most profitable strategy is always “all in” yet ironically, the one with most losses seems to be the same one. Total dependence on oil makes no difference with “all in,” but Venezuela fails to close its hands immediately and make transitions. Optimistic expectations result in the current conditions.

This paper means no prejudice on this oil-oriented economy structure or else. That is because when talking about one structure is superior to others, specific situations must be taken into account. What is worth questioning in this paper is that whether it is still appropriate for Venezuela to use this structure under the current scenario. As entropy, or more directly, the disorderliness increases, it is really worth reconsideration.

3.2 Regulatory systems

Considering the importance of a system’s structure, the contents to define it need to be more specific and inviolable and the power to enforce and defend it must be more strong and equitable. Regulatory structures, or principles according to which such structures are built, create legal restrictions and allocate contractual responsibilities in a nation. It secures the nation’s structural efficiency and stability which require orderliness, while that mostly can only regulations give. Moreover, as the level of institutions determines that of the regulatory system, a high level of democratic accountability is essential to the authority of legislation and enforcement.

Research about investment risks in Latin American countries (Mendes et al. 2014; Rubio and Folchi 2012; Zamora 2014; Ngoasong 2014; Recalde 2011) has pointed out the political risk is usually the most uncertain factor in analyzing and evaluating the Latin investment environment, especially frequent changes and strict rules on oil companies.

To most international oil companies (IOCs), Venezuela’s subtle regulatory system is too discouraging. Starting from the 1943 Hydrocarbons Act, IOCs’ profits were strictly limited to less than they invested in Venezuela. Meanwhile, the act stipulated oil taxes should be based on income from mining while previous ones mostly on common customs. In 1998, President Chavez nationalized the entire Venezuelan oil industry and canceled all the PDVSA’s international strategies; Venezuela’s oil industry fully relied on the guidance of President Chavez.

Besides, Venezuela’s long criticized monetary policy should bear some responsibility for Venezuela’s current situations. For a long period, the country has kept its fixed exchange rate policy. Though having an advantage of reducing the uncertainties during normal economic activities, this will directly expose the country to the oil price volatility. When oil price hit bottom, too much money rushed into Venezuela’s economy system. To make matters worse, because there are no other industries that can match the impacts of oil industry in Venezuela, the government has to publish more local currency to offset the foreign inflow cash, which resulted in the over-supply of currency. The consequences are Venezuela experienced its historical highest inflation rate along with the expansion of the “Black Market” due to the lack of effective management.

Empirical results (Brunnschweiler and Bulte 2008; Shao and Yang 2010; Kolstad and Wiig 2009) have suggested that resource countries with different level of institutions usually fall into completely different situations. It seems that the negative impacts of resources only happen in low-democratic level countries while those with high levels, like Norway and Botswana, do not. This can be easily understood as the evolutionary history of human civilization is tantamount to the conversion process of “rule by man” to “rule by law” and to “rule by good law.”

During his administration, President Hugo ChavezFootnote 2 drafted and revised the constitution several times to merge the bicameral parliament into a unicameral one and grant the president the right to dissolve the parliament. At 2009, he again made amendment to cancel the limit of two consecutive terms; thus, his reelection could be achieved. While the separation of power has been running through the entire history of Western development, Venezuela is developing a path to centralized power, omnipotent government, and a man-governed society.

3.3 External influence

Supported by a variety of scientific disciplines, evolution by natural selection, originated from Darwin’s theory of evolution, clarified the survival of the fittest. But when this comes to the fields of management, it seems not that obvious.

A management system, deliberately or not, is actually an artificial system, which means all its frame, structure, and other factors are designed by man. Limited by human cognition, any system built by man is only to fit the present or even the past, not the future. That is because laws and rules must be clear and stable (static) to exercise its effectiveness yet the environment need not be stable. And a functionality delay is produced.

This means a management system can maintain its highest performance at the very beginning, consistent with the description of the second law of thermodynamics. As the environment develops, the system will gradually lose its efficiency, which directly results in a high entropy increase. Therefore, considering the truth that the long-term future is unpredictable, further amendments are always needed.

As for Venezuela, the volatility of oil price is probably the most vital threat to the country. The over-reliance on oil indicates that any price fluctuation will trigger a series of economic chain reactions. Meanwhile, the Venezuela government’s over-optimistic attitude toward oil price worsened the case that almost all the regulations are designed to defend, and of course spend the country’s excessive benefits. With no alternative programs for a low oil price case, the government spent every coin of their fiscal budget in the good years. Amounts of social projects like increasing employment or income were launched to accelerate the process toward a developed country regardless of whether these over-spending programs would become a burden if oil price went down. What’s worse, not having enough money to support the projects will not only delay the process of development, but also cause unrest among society. With oil price dropping to 47 $/bbl, Venezuela has suffered serious inflation and currency devaluations. The heavy debt Venezuela government is bearing has made agencies lower the sovereign rating of Venezuela to CCC+.

Another thing worth noting is that recent researchers have turned to clean energy areas like solar, wind, or nuclear from the traditional fossil fuels. A decreasing demand for oil in the future is foreseeable. Thus, this demand decrease is more noteworthy though the production increase from non-OPEC countries might be blamed for the low oil price. In short, under the background of a declining demand of oil and rising production from other countries, an entire change from the state level is needed.

4 NEIFs (negative entropy inflows)

The dissipative structure provides theoretical support that a system’s orderliness can be restored by introducing NEIFs into the system. In combination with Venezuela’s current conditions, though having a − 4% GDP growth rate, 60% inflation rate, local currency devaluation, and mistrust of government due to the shortage of necessities make it impossible to believe Venezuela can overcome, the theory make sure of the answer with the introduction of NEIFs (see Fig. 3).

4.1 Funds

Bearing over $5 billion of debt and series deficit, Venezuela is having serious financial problems and the government’s credit has recently been lowered to Caa3 level by Moody’s. According to the IMF, Venezuela’s external accounts could be balanced only with the oil price above $100. If the oil price keeps falling, the problem will be worsened.

To this end, President Maduro hopes to seek help from other countries and persuade them to control the oil price. Achievements have been made, for example the visit on January 2015 to China has brought $20 billion loans to Venezuela, which can ease the country’s present needs. But even with this much money, Venezuela’s problems can hardly be settled. As improving a system’s architecture is a lasting process, this one-time help can barely help. Furthermore, it needs time for this money flow to transform into the economy system. But the question is how to spend this budget without arousing other troubles and whether Venezuela can survive this transforming period.

The principle is clear. Through negotiating with other countries, exchanging information, and introducing money flow, NEIFs are introduced into the system to mitigate urgent problems so that new orderliness can be formed.

Fortunately, President Maduro’s efforts worked. Moody’s has adjusted the forecast of Venezuela from “negative” to “stable.” This, to some degree, indicates that the introduction of negative entropy flow alleviated the financial pressure of Venezuela, which can reduce the loss of investors.

To stabilize society, reduce entropy, and guarantee the material supply for Venezuela, this funds flow is direct and effective. However, given Venezuela government’s credit rating condition, it is impossible to borrow enough money. Although external funds may alleviate Venezuela’s economic plight, this article hold the opinion that this NEIF does not have much impact.

4.2 Policy

Though President Maduro continues President Chavez’s governing philosophy, it is essential to begin some necessary adjustments considering the low oil prices and the deterioration of the domestic economic situation. These include changing the fixed exchange rate system to a multitrack exchange rate system, which would to some extent curb the rampant black market.

To ensure the orderly operation of the system under a certain frame, a reasonable and scientific framework is important for the development of the Venezuelan economy. And a rigorous, thorough regulatory system is a powerful guarantee for sustained economic development in Venezuela. Therefore, although the current policy adjustment has played a certain role, yet Venezuela still needs a scientific and effective plan to deal with the changes both from outside and inside. Venezuela should learn from foreign advanced management experience, the plan to cope with risks, such as follow the example of Norway, which allocates the excess oil revenues to establish risk funds when oil prices are high to compensate the income when oil prices are low; develop a reasonable expenditure plan; improve the legal system, to avoid corruption, excessive bureaucracy, centralization, and the like.

The exchange of information with outside world includes learning advanced knowledge, like other country’s management experience and regulatory systems, which will help rebuild the country’s structure, develop its management, and improve performance. The new structure, designed to adapt the current poor economic system under a low oil price external environment, will strengthen the negative entropy in the system so that the system can maintain high efficiency and long-term stability. But this paper argues that the improvement of a policy system toward a sound and complete one is a long-term task, which can hardly bear fruit in the short term.

4.3 Technology

The low oil price in last few years is believed the main cause of the economic plight Venezuelan economy. It exposed the defects of Venezuela’s oil resources. Venezuela’s oil resources are mainly concentrated in the Orinoco heavy oil belt. Though oil reserves are huge, most of them are heavy oil. Heavy oil is highly viscous, but most importantly, it is a mixture of kinds of oil whose density or specific gravity is higher than that of light crude oil. That means the oil density and viscosity are various, and it is difficult to use a single development approach to split up all of it, which result in the high cost of heavy oil. So even having a much larger scale of oil reserves compared with Saudi Arab, Venezuela’s oil type is different from most OPEC countries. In this case, Venezuela can only afford a small range of crude oil price while Middle East countries can afford much lower (Fig. 4). Meanwhile, because of heavy oil’s special chemical characteristics, the development of heavy oil requires a large investment, yet the ultimate recovery is extremely low, which resulted in heavy oil’s usage being quite limited, but the mining tax is very high.Footnote 3 That is why the crude oil development in Venezuela becomes very restricted in recent years (Mu et al. 2009; Mu 2010; Hou et al. 2014) and the current breakeven price has achieved to over $100/bbl in Venezuela.

Data source: http://knoema.com

Breakeven oil price (2015).

This means it is unwise for Venezuela to count on selling raw oil to support the country’s economy. Besides, empirical researches suggest “Dutch disease” mostly happens in countries relying on exports of primary raw resources (Rossi 2011). Based on these, this paper recommends the introduction of advanced non-traditional oil development technology especially on tight oil and heavy oil into Venezuela’s oil industry and increasing the investment in research into exploration and development technology to improve well production and reduce costs. Venezuela needs to deepen the development and improvement on existing research and technology to improve the quality of refined oil, increase the added value of oil products and develop new uses of heavy oil, and transfer the traditional pattern of selling crude oil to a fine, high-quality, high-tech, and multifunctional way. Such transforming model can cope with low oil impact and increase income in the short term, and Venezuela’s advantages in resources and a stable oil position in the country’s economy in the long run.

5 Discussion

As mentioned in this paper, entropy cannot directly reflect the stability of Venezuela’s economic system. But based on the analysis above, Venezuela’s entropy itself is obviously not in a stable state, which to some extent describes the stability of Venezuela’s economic system. Venezuela’s oil-oriented economics represents a series of systems that merely rely on resources, yet ignores that the prices of these resources are unstable. A global stability can only be achieved within a diverse, averaging, and internal motivated multifactored system. In such systems, healthy structure and various elements stick to their duties, obey their rules, seek self-adaption, and pursue the global optimization and stability together.

To achieve a self-organizing system, Venezuela should implement a multipronged approach and avoid dependence on a single negative entropy flow considering the shortcomings of each negative entropy flow. Venezuela should get rid of the traditional development model that is over-reliant on oil revenues and apply a development model of pluralistic competition. Besides, adjustment of the industrial structure, diversification of the industries, economic stability improvement, introduction of advanced management experience, technological innovation, product value improvement, and promotion of creativity should all be encouraged. On the oil issue, the Venezuelan government should hold an open attitude as for its own oil companies, the intervention on the national oil company should be reduced so that these companies can have sufficient autonomy. While the sovereignty on petroleum resources is needed, the Venezuela’s oil companies should be entitled to compete with international oil companies given the advantages of the country’s rich oil and gas resources. The “oil service people” purpose can only be achieved when Venezuela enhanced its international competitiveness not only in oil.

6 Conclusion

This paper analyzed Venezuela’s oil-oriented economy from the level of system view, but from a more general perspective, this paper also contributes to the knowledge of dissipative structure in national system research. With the globalization of national development, the internal effort for any country to seek the prosperity is never sufficient, which provides the theoretical basis of multilateral cooperation and participation among China and other emerging developed economies

According to previous researches, this paper accounts for three sources resulting in the increase in Venezuela’s management entropy:

-

(1)

The oil-centered economic structure weakens the country’s capability to resist risks.

-

(2)

An inefficient regulatory system causes the country’s maladjustment and hinders the NEIFs coming in.

-

(3)

The inadequate environmental response makes the country lag to environmental changes.

The dissipative structure provides the theory supports that by exchanging “energy” including human, money, information, and other flows, the system can evolve into a higher orderliness through self-organization mechanisms. To reach this condition, strong NEIFs from outer system need be introduced:

-

(1)

The fund flow can directly and effectively decrease the management entropy, relieve the main contradiction in Venezuela, but it is a quite limited role because of Venezuela government’s low credit rating.

-

(2)

Formulate policy and fiscal spending plan system scientifically and improve the ability to cope with risks; design a well-developed legal framework and regulatory system to avoid corruption. The improvement of a scientifically sound policy regime and regulatory system is the key to improve the management efficiency of the system, though it is a long-term task.

-

(3)

On the technical side, introducing advanced exploration and development technologies to increase production and reduce costs; exploring heavy oil functions, improving quality and value, and realizing oil function transformation based on the characteristics of Venezuela’s resources are effective ways to reduce the system management entropy.

Notes

International Monetary Fund World Economic Outlook 2015 Uneven Growth: Short- and Long-Term Factors [OL] http://www.imf.org/external/pubs/ft/weo/2015/01/.

Venezuelan President Calls for New Round of “Revision, Rectification, and Re-Advance”[OL] https://venezuelanalysis.com/news/5688.

EY Global Oil and Gas Tax Guide 2014[OL] http://www.ey.com/GL/en/Services/Tax/Global-oil-and-gas-tax-guide---Country-list.

References

Ahn HH. Speculation in the financial system as a ‘dissipative structure’. Seoul J Econ. 1998;11(3):295.

Arezki R, Bruckner M. International commodity price shocks, democracy, and external debt. IMF Working Papers. 2010; WP/10/53.

Arezki R, Ismail K. Boom–bust cycle, asymmetrical fiscal response and the Dutch disease. J Dev Econ. 2013;101(10/94):256–67. https://doi.org/10.1016/j.jdeveco.2012.11.007.

Bacon R, Tordo S. Experiences with oil funds: institutional and financial aspects. World Bank. 2006.

Betz MR, Partridge MD, Farren M, et al. Coal mining, economic development, and the natural resources curse. Energy Econ. 2015;50:105–16. https://doi.org/10.1016/j.eneco.2015.04.005.

Brunnschweiler CN, Bulte EH. The resource curse revisited and revised: a tale of paradoxes and red herrings. Environ Econ Manag. 2008;55:248–64.

Cerny A, Filer RK. Natural resources: Are they really a curse? SSRN Electron J. 2007;11(wp321):291–320. https://doi.org/10.2139/ssrn.1114352.

Deng X, Zheng S, Xu PP, et al. Study on dissipative structure of China’s building energy service industry system based on brusselator model. J Clean Prod. 2017;150:112–22. https://doi.org/10.1016/j.jclepro.2017.02.198.

Ding JN. Natural resource abundance and economic growth: a reexamination. Land Econ. 2005;81(4):496–502. https://doi.org/10.3368/le.81.4.496.

Hou J, Dai GH, Wei J, et al. Reservoir characterization and exploitation potential in Orinoco heavy oil belt in Venezuela. Pet Geol Exp. 2014;11:725–30.

Kolstad I, Wiig A. It’s the rents, stupid! The political economy of the resource curse. Energy Policy. 2009;37(12):5317–25. https://doi.org/10.1016/j.enpol.2009.07.055.

Kott A. Assessing whether oil dependency in Venezuela contributes to national instability. J Strateg Secur. 2012;5(3):69–86. https://doi.org/10.5038/1944-0472.5.3.5.

Lyapunov AM. The general problem of the stability of motion (in Russian), Doctoral dissertation, University of Kharkov. 1892.

Mendes PAS, Hall J, Matos S, et al. Reforming Brazil’s offshore oil and gas safety regulatory framework: lessons from Norway, the United Kingdom and the United States. Energy Policy. 2014;74:443–53. https://doi.org/10.1016/j.enpol.2014.08.014.

Moradbeigi M, Law SH. Growth volatility and resource curse: Does financial development dampen the oil shocks? Resour Policy. 2016;48:97–103. https://doi.org/10.1016/j.resourpol.2016.02.009.

Mu LX, Han GQ, Xu BJ. Geology and reserves of the Orinoco heavy oil belt, Venezuela. Pet Explor Dev. 2009;12:784–9 (in Chinese).

Mu LX. Development actualities and characteristics of the Orinoco heavy oil belt, Venezuela. Pet Explor Dev. 2010;6:338–43 (in Chinese).

Ngoasong MZ. How international oil and gas companies respond to local content policies in petroleum-producing developing countries: a narrative enquiry. Energy Policy. 2014;73(13):471–9. https://doi.org/10.1016/j.enpol.2014.05.048.

Prigogine I. The new alliance. Scientia. 1977;71(12):643.

Pulselli RM, Simoncini E, Tiezzi E. Self-organization in dissipative structures: a thermodynamic theory for the emergence of prebiotic cells and their epigenetic evolution. Biosystems. 2009;96(3):237–41. https://doi.org/10.1016/j.biosystems.2009.02.004.

Recalde M. Energy policy and energy market performance: the Argentinean case. Energy Policy. 2011;39(6):3860–8.

Ren PY, Zhang L, Lu Y. The theory of management entropy, management dissipative structure based on the science of complexity and its application on enterprise organization and decision-making. Manag World. 2001;6:142–7 (in Chinese).

Ren PY. The strategic decision-making in reconstruction organizations from the perspective of management efficiency. Reform Econ Syst. 1998;3:98–101 (in Chinese).

Reynolds DB, Pippenger MK. OPEC and Venezuelan oil production: evidence against a cartel hypothesis. Energy Policy. 2010;38(10):6045–55. https://doi.org/10.1016/j.enpol.2010.05.060.

Rossi CA. Oil wealth and the resource curse in Venezuela. Int Assoc Energy Econ. 2011;3:11–5.

Rubio MDM, Folchi M. Will small energy consumers be faster in transition? Evidence from the early shift from coal to oil in Latin America. Energy Policy. 2012;50(6):50–61. https://doi.org/10.1016/j.enpol.2012.03.054.

Satti SL, Farooq A, Loganathan N, et al. Empirical evidence on the resource curse hypothesis in oil abundant economy. Econ Model. 2014;42:421–9. https://doi.org/10.1016/j.econmod.2014.07.020.

Shao S, Yang LL. Natural resource abundance, resource-based industry dependence, and China’s regional economic growth. Manag World. 2010;9:26–44 (in Chinese).

Shao S, Yang LL. Natural resource dependence, human capital accumulation, and economic growth: a combined explanation for the resource curse and the resource blessing. Energy Policy. 2014;74(33):632–42. https://doi.org/10.1016/j.enpol.2014.07.007.

Stevens P, Dietsche E. Resource curse: an analysis of causes, experiences and possible ways forward. Energy Policy. 2008;36(1):56–65. https://doi.org/10.1016/j.enpol.2007.10.003.

Wang P. Venezuela’s social organizations during the Chavez Presidency. J Lat Am Stud. 2011;33(2):15–8 (in Chinese).

Wang XB, Yan GL. Relations between stability, brittle and entropy of monetary policy transmission system based on theory and empirical analysis of dissipative structure and mutation. Syst Eng. 2012;30(4):10–7 (in Chinese).

Wiens D, Poast P, Clark WR. The political resource curse: an empirical re-evaluation. Polit Res Q. 2014;67(4):783–94. https://doi.org/10.1177/1065912914543836.

Wiens D. Natural resources and institutional development. J Theor Polit. 2014;26(2):197–221. https://doi.org/10.1177/0951629813493835.

Wilpert G. The economics, culture, and politics of oil in Venezuela. Venezuela analysis. 2003; 8(30). https://venezuelanalysis.com/analysis/74.

Zamora A. Strategic implications of emerging market-oriented Latin American petroleum policies. Energy Strategy Rev. 2014;3:55–62. https://doi.org/10.1016/j.esr.2014.07.001.

Zhao CY. PDVSA under the Chavez Government. J Lat Am Stud. 2010;5:38–42 (in Chinese).

Acknowledgements

This work is funded by the National Natural Science Foundation of China (Grant Nos. 71273021 and 7167030506).

Author information

Authors and Affiliations

Corresponding author

Additional information

Edited by Xiu-Qin Zhu

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Mu, XZ., Hu, GW. Analysis of Venezuela’s oil-oriented economy: from the perspective of entropy. Pet. Sci. 15, 200–209 (2018). https://doi.org/10.1007/s12182-018-0215-4

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12182-018-0215-4