Abstract

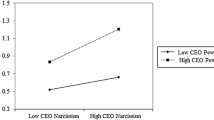

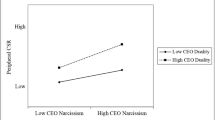

Based on the upper echelons theory, this paper uses an empirical study to examine the impact of CEO narcissism on M&A decisions and the moderating effects of media attention and CEO equity incentives. In order to further explore the relationship and mechanism between CEO narcissism and M & A behavior of listed companies in China, this paper uses the size of CEO signature to measure the degree of CEO narcissism and uses the data of Chinese A-share listed companies from 2011 to 2020 for analysis. The results show that CEO narcissism has a significant positive effect on firm M&A decisions; media attention plays a positive moderating role between CEO narcissism and M&A decisions; and the positive effect of CEO narcissism on M&A decisions is more significant when the CEO owns shares of the firm. The existing literature rarely considers media attention and equity incentives as factors influencing the relationship between CEO narcissism and M&A decisions. This paper creatively analyzes the moderating role of media attention and equity incentives, thus broadening the scope of research on CEO narcissism. The findings of this paper establish a better theoretical and practical understanding for a more comprehensive study of how CEO narcissistic personality affects a firm's M&A behavior.

Similar content being viewed by others

Data availability

Data available on request from the authors.

References

Abbas, A. F., Jusoh, A., Mas’od, A., Sahi, A. M., & Khatib, S. F. (2022). Current Status of Market Mavens Research: A Literature Review. Emerging Science Journal. https://doi.org/10.28991/ESJ-2023-07-01-019

Ahern, K. R., Daminelli, D., & Fracassi, C. (2015). Lost in translation? The effect of cultural values on mergers around the world. Journal of Financial Economics, 117(1), 165–189. https://doi.org/10.1016/j.jfineco.2012.08.006

Aktas, N., De Bodt, E., & Roll, R. (2013). MicroHoo: Deal failure, industry rivalry, and sources of overbidding. Journal of Corporate Finance, 19, 20–35. https://doi.org/10.1016/j.jcorpfin.2012.09.006

Aktas, N., De Bodt, E., Bollaert, H., & Roll, R. (2016). CEO narcissism and the takeover process: From private initiation to deal completion. Journal of Financial and Quantitative Analysis, 51(1), 113–137. https://doi.org/10.1017/S0022109016000065

Amernic, J. H., & Craig, R. J. (2010). Accounting as a facilitator of extreme narcissism. Journal of Business Ethics, 96(1), 79–93. https://doi.org/10.1007/s10551-010-0450-0

Bennedsen, M., Pérez-González, F., & Wolfenzon, D. (2020). Do CEOs matter? Evidence from hospitalization events. The Journal of Finance, 75(4), 1877–1911. https://doi.org/10.1111/jofi.12897

Bouletreau, V., Vincent, N., Sabourin, R., & Emptoz, H. (1998). Handwriting and signature: one or two personality identifiers? In Proceedings. Fourteenth International Conference on Pattern Recognition, 2, 1758–1760. https://doi.org/10.1109/ICPR.1998.712067

Brunell, A. B., Gentry, W. A., Campbell, W. K., Hoffman, B. J., Kuhnert, K. W., & DeMarree, K. G. (2008). Leader emergence: The case of the narcissistic leader. Personality and Social Psychology Bulletin, 34(12), 1663–1676. https://doi.org/10.1177/0146167208324101

Buffardi, L. E., & Campbell, W. K. (2008). Narcissism and social networking web sites. Personality and Social Psychology Bulletin, 34(10), 1303–1314. https://doi.org/10.1177/0146167208320061

Bushee, B. J., Core, J. E., Guay, W., & Hamm, S. J. (2010). The role of the business press as an information intermediary. Journal of Accounting Research, 48(1), 1–19. https://doi.org/10.1111/j.1475-679X.2009.00357.x

Campbell, W. K., Goodie, A. S., & Foster, J. D. (2004). Narcissism, confidence, and risk attitude. Journal of Behavioral Decision Making, 17(4), 297–311. https://doi.org/10.1002/bdm.475

Chatterjee, A., & Hambrick, D. C. (2007). It's all about me: Narcissistic chief executive officers and their effects on company strategy and performance. Administrative Science Quarterly, 52(3), 351–386. https://doi.org/10.2189/asqu.52.3.351

Chen, C. W., Pantzalis, C., & Park, J. C. (2013). Press coverage and stock price deviation from fundamental value. Journal of Financial Research, 36(2), 175–214. https://doi.org/10.1111/j.1475-6803.2013.12007.x

Croci, E., & Petmezas, D. (2015). Do risk-taking incentives induce CEOs to invest? Evidence from acquisitions. Journal of Corporate Finance, 32, 1–23. https://doi.org/10.1016/j.jcorpfin.2015.03.001

Daellenbach, U. S., McCarthy, A. M., & Schoenecker, T. S. (1999). Commitment to innovation: The impact of top management team characteristics. R&d Management, 29(3), 199–208. https://doi.org/10.1111/1467-9310.00130

Dang, T. V., & Xu, Z. (2018). Market sentiment and innovation activities. Journal of Financial and Quantitative Analysis, 53(3), 1135–1161. https://doi.org/10.1017/S0022109018000078

Deluga, R. J. (1997). Relationship among American presidential charismatic leadership, narcissism, and rated performance. The Leadership Quarterly, 8(1), 49–65. https://doi.org/10.1016/S1048-9843(97)90030-8

Doukas, J. A., & Petmezas, D. (2007). Acquisitions, overconfident managers and self-attribution bias. European Financial Management, 13(3), 531–577. https://doi.org/10.1111/j.1468-036X.2007.00371.x

Emmons, R. A. (1984). Factor analysis and construct validity of the narcissistic personality inventory. Journal of Personality Assessment, 48(3), 291–300. https://doi.org/10.1207/s15327752jpa4803_11

Fang, J. X. (2008). Government Intervention, Nature of Ownership and Enterprise Mergers and Acquisitions. Management World, 9, 118–123. https://doi.org/10.19744/j.cnki.11-1235/f.2008.09.012

Farwell, L., & Wohlwend-Lloyd, R. (1998). Narcissistic processes: Optimistic expectations, favorable self-evaluations, and self-enhancing attributions. Journal of Personality, 66(1), 65–83. https://doi.org/10.1111/1467-6494.00003

Field, L. C., & Mkrtchyan, A. (2017). The effect of director experience on acquisition performance. Journal of Financial Economics, 123(3), 488–511. https://doi.org/10.1016/j.jfineco.2016.12.001

Fukunishi, I., Nakagawa, T., Nakamura, H., Li, K., Hua, Z. Q., & Kratz, T. S. (1996). Relationships between Type A behavior, narcissism, and maternal closeness for college students in Japan, the United States of America, and the People's Republic of China. Psychological Reports, 78(3), 939–944. https://doi.org/10.2466/pr0.1996.78.3.939

Furnham, A., & Gunter, B. (1987). Graphology and personality: Another failure to validate graphological analysis. Personality and Individual Differences, 8(3), 433–435. https://doi.org/10.1016/0191-8869(87)90045-6

Geukes, K., Mesagno, C., Hanrahan, S. J., & Kellmann, M. (2012). Testing an interactionist perspective on the relationship between personality traits and performance under public pressure. Psychology of Sport and Exercise, 13(3), 243–250. https://doi.org/10.1016/j.psychsport.2011.12.004

Guay, W. R. (1999). The sensitivity of CEO wealth to equity risk: an analysis of the magnitude and determinants. Journal of Financial Economics, 53(1), 43–71. https://doi.org/10.1016/S0304-405X(99)00016-1

Ham, C., Lang, M., Seybert, N., & Wang, S. (2017). CFO narcissism and financial reporting quality. Journal of Accounting Research, 55(5), 1089–1135. https://doi.org/10.1111/1475-679X.12176

Ham, C., Seybert, N., & Wang, S. (2018). Narcissism is a bad sign: CEO signature size, investment, and performance. Review of Accounting Studies, 23(1), 234–264. https://doi.org/10.1007/s11142-017-9427-x

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193–206. https://doi.org/10.2307/258434

Hayward, M. L., & Hambrick, D. C. (1997). Explaining the premiums paid for large acquisitions: Evidence of CEO hubris. Administrative Science Quarterly, 103–127. https://doi.org/10.2307/2393810

Hsieh, T. S., Bedard, J. C., & Johnstone, K. M. (2014). CEO overconfidence and earnings management during shifting regulatory regimes. Journal of Business Finance & Accounting, 41(9-10), 1243–1268. https://doi.org/10.1111/jbfa.12089

Huang, X., Xu, C. X., & Li, W. M. (2013). Research on the influence of the background characteristics of senior executives of Chinese listed companies on corporate mergers and acquisitions. Macroeconomic Research, 10, 67–73. https://doi.org/10.16304/j.cnki.11-3952/f.2013.10.018

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360. https://doi.org/10.1016/0304-405X(76)90026-X

Jenter, D., & Lewellen, K. (2015). CEO preferences and acquisitions. The Journal of Finance, 70(6), 2813–2852.

John, O. P., & Robins, R. W. (1994). Accuracy and bias in self-perception: individual differences in self-enhancement and the role of narcissism. Journal of Personality and Social Psychology, 66(1), 206–219. https://doi.org/10.1037/0022-3514.66.1.206

Jorgenson, D. O. (1977). Signature size and dominance: A brief note. The Journal of Psychology, 97(2), 269–270. https://doi.org/10.1080/00223980.1977.9923972

Judd, J. S., Olsen, K. J., & Stekelberg, J. (2017). How do auditors respond to CEO narcissism? Evidence from external audit fees. Accounting Horizons, 31(4), 33–52. https://doi.org/10.2308/acch-51810

King, R. N., & Koehler, D. J. (2000). Illusory correlations in graphological inference. Journal of Experimental Psychology: Applied, 6(4), 336–348. https://doi.org/10.1037/1076-898X.6.4.336

Lai, L., Gong, Y. L., & Ma, Y. Q. (2017). Military experience of managers and enterprise mergers and acquisitions. World Economy, 40(12), 141–164.

Li, J., & Tang, Y. I. (2010). CEO hubris and firm risk taking in China: The moderating role of managerial discretion. Academy of Management Journal, 53(1), 45–68. https://doi.org/10.5465/amj.2010.48036912

Maccoby, M. (2004). Narcissistic leaders: The incredible pros, the inevitable cons. Harvard Business Review, 82(1), 92–92.

Malmendier, U., & Tate, G. (2005). CEO overconfidence and corporate investment. The Journal of Finance, 60(6), 2661–2700. https://doi.org/10.1111/j.1540-6261.2005.00813.x

Malmendier, U., & Tate, G. (2008). Who makes acquisitions? CEO overconfidence and the market's reaction. Journal of Financial Economics, 89(1), 20–43. https://doi.org/10.1016/j.jfineco.2007.07.002

Morf, C. C., & Rhodewalt, F. (2001). Unraveling the paradoxes of narcissism: A dynamic self-regulatory processing model. Psychological Inquiry, 12(4), 177–196. https://doi.org/10.1207/S15327965PLI1204_1

Morrone-Strupinsky, J. V., & Depue, R. A. (2004). Differential relation of two distinct, film-induced positive emotional states to affiliative and agentic extraversion. Personality and Individual Differences, 36(5), 1109–1126. https://doi.org/10.1016/S0191-8869(03)00204-6

Nell, P. C., Puck, J., & Heidenreich, S. (2015). Strictly limited choice or agency? Institutional duality, legitimacy, and subsidiaries’ political strategies. Journal of World Business, 50(2), 302–311. https://doi.org/10.1016/j.jwb.2014.10.007

Olsen, K. J., & Stekelberg, J. (2016). CEO narcissism and corporate tax sheltering. The journal of the American Taxation Association, 38(1), 1–22. https://doi.org/10.2308/atax-51251

Olsen, K. J., Dworkis, K. K., & Young, S. M. (2014). CEO narcissism and accounting: A picture of profits. Journal of Management Accounting Research, 26(2), 243–267. https://doi.org/10.2308/jmar-50638

Peterson, S. J., Galvin, B. M., & Lange, D. (2012). CEO servant leadership: Exploring executive characteristics and firm performance. Personnel Psychology, 65(3), 565–596. https://doi.org/10.1111/j.1744-6570.2012.01253.x

Raskin, R. N., & Hall, C. S. (1979). A narcissistic personality inventory. Psychological Reports, 45(2), 590. https://doi.org/10.2466/pr0.1979.45.2.590

Raskin, R., & Terry, H. (1988). A principal-components analysis of the Narcissistic Personality Inventory and further evidence of its construct validity. Journal of Personality and Social Psychology, 54(5), 890–902. https://doi.org/10.1037//0022-3514.54.5.890

Resick, C. J., Whitman, D. S., Weingarden, S. M., & Hiller, N. J. (2009). The bright-side and the dark-side of CEO personality: examining core self-evaluations, narcissism, transformational leadership, and strategic influence. Journal of Applied Psychology, 94(6), 1365. https://doi.org/10.1037/a0016238

Rijsenbilt, A. (2011). CEO narcissism: Measurement and impact (No. EPS-2011-238-STR).

Roll, R. (1986) The Hubris Hypothesis of Corporate Takeovers. Journal of Business, 59, 197–216. https://doi.org/10.1086/296325

Rosenthal, S. A., & Pittinsky, T. L. (2006). Narcissistic Leadership. The Leadership Quarterly, 17(6), 617–633. https://doi.org/10.1016/j.leaqua.2006.10.005

Tripopsakul, S., Mokkhamakkul, T., & Puriwat, W. (2022). The Development of the Entrepreneurial Spirit Index: An Application of the Entrepreneurial Cognition Approach. Emerging Science Journal. https://doi.org/10.28991/ESJ-2022-06-03-05

Skaife, H. A., & Wangerin, D. D. (2013). Target financial reporting quality and M&A deals that go bust. Contemporary Accounting Research, 30(2), 719–749. https://doi.org/10.1111/j.1911-3846.2012.01172.x

Snyder, C. R., & Fromkin, H. L. (1977). Abnormality as a positive characteristic: The development and validation of a scale measuring need for uniqueness. Journal of Abnormal Psychology, 86(5), 518–527. https://doi.org/10.1037/0021-843X.86.5.518

Wagener, S., Gorgievski, M., & Rijsdijk, S. (2010). Businessman or host? Individual differences between entrepreneurs and small business owners in the hospitality industry. Service Industries Journal, 30(9), 1513–1527. https://doi.org/10.1080/02642060802624324

Wallace, H. M., & Baumeister, R. F. (2002). The performance of narcissists rises and falls with perceived opportunity for glory. Journal of Personality and Social Psychology, 82(5), 819. https://doi.org/10.1037/0022-3514.82.5.819

Wen, D. H., Tong, W. H., & Peng, X. (2015). CEO Narcissism, Nature of Ownership and Organizational Consequences-Evidence from Chinese Listed Companies. Economic Management, 37(8), 65–75. https://doi.org/10.19616/j.cnki.bmj.2015.08.009

Wilt, J., & Revelle, W. (2015). Affect, behaviour, cognition and desire in the Big Five: An analysis of item content and structure. European Journal of Personality, 29(4), 478–497. https://doi.org/10.1002/per.2002

Wright, G. N., & Phillips, L. D. (1980). Cultural variation in probabilistic thinking: Alternative ways of dealing with uncertainty. International Journal of Psychology, 15(1-4), 239–257. https://doi.org/10.1080/00207598008246995

Zhang, S. Y. (2010). We-one self-one other. Henan. Social Sciences, 18, 44–48. https://doi.org/10.3969/j.issn.1007-905X.2010.01.012

Zhu, D. H., & Chen, G. (2015). Narcissism, director selection, and risk-taking spending. Strategic Management Journal, 36(13), 2075–2098. https://doi.org/10.1002/smj.2322

Zweigenhaft, R. L. (1970). Signature size: A key to status awareness. The Journal of Social Psychology, 81(1), 49–54. https://doi.org/10.1080/00224545.1970.9919908

Zweigenhaft, R. L. (1977). The empirical study of signature size. Social Behavior and Personality: An International Journal, 5(1), 177–185. https://doi.org/10.2224/sbp.1977.5.1.177

Zweigenhaft, R. L., & Marlowe, D. (1973). Signature size: studies in expressive movement. Journal of Consulting and Clinical Psychology, 40(3), 469–473. https://doi.org/10.1037/h0034503

Author information

Authors and Affiliations

Contributions

HL and YM: writing. LW: providing revised advice. All authors contributed to the article and approved the submitted version.

Corresponding author

Ethics declarations

Ethics statements

Studies involving animal subjects

Generated Statement: No animal studies are presented in this manuscript.

Studies involving human subjects

Generated Statement: No human studies are presented in this manuscript.

Inclusion of identifiable human data

Generated Statement: No potentially identifiable human images or data is presented in this study.

Conflicts of interest

The authors declare no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, L., Li, H. & Mu, Y. Research on CEO narcissism and mergers and acquisitions of listed companies. Curr Psychol 43, 3328–3340 (2024). https://doi.org/10.1007/s12144-023-04605-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12144-023-04605-1