Abstract

Internationally earthquake insurance, like all other insurance (fire, auto), adopted actuarial approach in the past, which is, based on historical loss experience to determine insurance rate. Due to the fact that earthquake is a rare event with severe consequence, irrational determination of premium rate and lack of understanding scale of potential loss led to many insurance companies insolvent after Northridge earthquake in 1994.

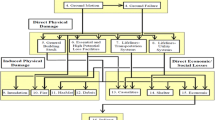

Along with recent advances in earth science, computer science and engineering, computerized loss estimation methodologies based on first principles have been developed to the point that losses from destructive earthquakes can be quantified with reasonable accuracy using scientific modeling techniques.

This paper intends to introduce how engineering models can assist to quantify earthquake risk and how insurance industry can use this information to manage their risk in the United States and abroad.

Similar content being viewed by others

References

Kreps, R. (1990), “Reinsurer Risk Loads From Marginal Surplus Requirements,” Proc. of the Casualty Actuarial Society (PCAS), LXXVII, 196–203.

Kunreuther, H., and Roth, R. J., Sr. (1998), “Paying the Price- The status and role of insurance against natural disasters in the United States”, National Academy of Sciences, Joseph Henry Press, Washington D.C..

Panjer, H. H. (1980), “The Aggregate Claims Distribution and Stop-Loss Reinsurance,” Trans. Soc. of Actuaries, XXXII, 523–45.

Roth, R. J., Jr., and Van, T. Q. (1993–1994), “California Earthquake Zoning and Probable Maximum Loss Estimation Program,” California Department of Insurance, Los Angeles, California.

RMS, Inc. USA (1995a), “What if the 1906 Earthquake strikes again?” Topical Issues Series, RMS Publications.

RMS, Inc. USA (1995b), “What if a Major Earthquake Strikes the Los Angeles Area?” Topical Issues Series, RMS Publications.

Steinbrugge, K. V. (1982), “Earthquakes, Volcanoes, and Tsunamis, An Anatomy of Hazards”, Skandia America Group, New York.

Tower Group (1999), “Technology of Modeling Natural Catastrophe Risks”, www.towergroup.com

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported partially by: Institute of Engineering Mechanics, CSB

Rights and permissions

About this article

Cite this article

Dong, W. Engineering models for catastrophe risk and their application to insurance. Earthq. Engin. Engin. Vib. 1, 145–151 (2002). https://doi.org/10.1007/s11803-002-0018-9

Issue Date:

DOI: https://doi.org/10.1007/s11803-002-0018-9