Abstract

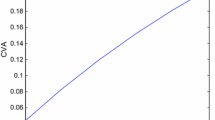

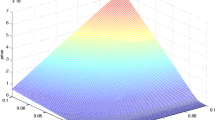

In this paper, the pricing of a Credit Default Swap (CDS) contract with multiple counterparties is considered. The pricing model takes into account the credit rating migration risk of the reference. It is a new model established under the reduced form framework, where the intensity rates are assumed to have structural styles. We derive from it a non-linear partial differential equation system where both positive and negative correlations of counterparties and the references are considered via a single factor model. Then, an ADI (Alternating Direction Implicit) difference method is used to solve the partial differential equations by iteration. From the numerical results, the comparison of multi-counterparty CDS contract and the standard one are analyzed respectively. Moreover, the impact of default parameters on value of the contracts are discussed.

Similar content being viewed by others

References

Agostino Capponi. Pricing and Mitigation of Counterparty Credit Exposures, Handbook of Systemic Risk, Cambridge University Press, 2013.

Bei Hu, Lishang Jiang, Jin Liang, Wei Wei. A fully non-linear PDE problem from pricing CDS with counterparty risk, Discrete and Continuous Dynamical Systems, 2012, 17(6): 2001–2016.

Bei Hu, Jin Liang, Yuan Wu. A free boundary problem for corporate bond with credit rating migration, Journal of Mathematical Analysis & Applications, 2015, 428(2): 896–909.

Damiano Brigo, Andrea Pallavicini. Counterparty Risk Pricing under Correlation between Default and Interest Rates, Numerical Methods for Finance,Chapman & Hall/CRC, 2007, DOI: https://doi.org/10.1201/9781584889267.ch4.

Damiano Brigo, Andrea Pallavicini. Counterparty risk and CCDSs under correlation, Risk, 2008.

Dilip B. Madan, Haluk Unal. Pricing the risks of default, Review of Derivatives Research, 1998, 2(2–3): 121–160.

David Lando. Credit risk modeling: theory and applications, Princeton University Press, 2009.

Giovanni Cesari, John Aquilina, Niels Charpillon, Zlatko Filipovic, Gordon Lee, Ion Manda. Modelling, pricing, and hedging counterparty credit exposure: A technical guide, Springer-Verlag Berlin Heidelberg, 2009.

Jin Liang, Yuan Wu, Bei Hu. Asymptotic Traveling Wave Solution for a Credit Rating Migration Problem, Journal of Differential Equations, 2016, 261(2): 1017–1045.

Jin Liang, Yuejuan Zhao, Xudan Zhang. Utility indifference valuation of corporate bond with credit rating migration by structure approach, Economic Modelling, 2016, 54: 339–346.

Jin Liang, Wenyi Li. Counterparty Valuation Adjustment Calculation Model of Multi-counterparties Credit Default Swap, Journal of Tongji University, 2014, 42(1): 144–150.

Jin Liang, Tao Wang. Valuation of Loan-only Credit Default Swap with Negatively Correlated Default and Prepayment Intensities, International Journal of Computer Mathematics, 2012, 89(9): 1255–1268.

Lijun Bo, Agostino Capponi. Bilateral credit valuation adjustment for large credit derivatives portfolios, Finance and Stochastics, 2013, 18(2): 431–482.

Robert Jarrow, Yildiray Yildirim. Pricing Treasury Inflation Protected Securities and Related Derivatives using an HJM Model, Journal of Financial and Quantitative Analysis, 2003, 38(2): 337–358.

Robert Alan Jarrow, Fan Yu. Counterparty Risk and the Pricing of Defaultable Securities, The Journal of Finance, 2001, 56(5): 1765–1799.

Shahram Alavianz, Jie Dingx, Peter Whitehead, Leonardo Laudicinak. Counterparty Valuation Adjustment(CVA), Available at SSRN, 2008.

S Crpey, M Jeanblanc, B Zargari. Counterparty Risk on a CDS in a Markov Chain Copula Model with Joint Defaults, Working paper, 2009.

Seng Yuen Leung, Yue Kuen Kwok. Credit default swap valuation with counterparty risk, The Kyoto Economic Review, 2005, 74(1): 25–45.

Tomasz R Bielecki, Stphane Crpey, Monique Jeanblanc, B Zargari. Valuation and hedging of CDS counterparty exposure in a Markov copula model, International Journal of Theoretical and Applied Finance, 2012, 15(15).

Wei Wei. Counterparty Credit Risk on a Standard Swap in “Risky Closeout”, International Journal of Financial Research, 2011, 2(2): 40–51.

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported by the National Natural Science Foundation of China (11671301, 12071349).

Rights and permissions

About this article

Cite this article

Li, Wy., Guo, Hy., Liang, J. et al. The valuation of multi-counterparties CDS with credit rating migration. Appl. Math. J. Chin. Univ. 35, 379–391 (2020). https://doi.org/10.1007/s11766-020-3503-4

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11766-020-3503-4