Abstract

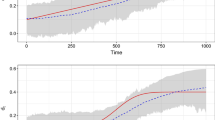

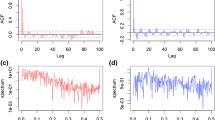

In this paper we consider the problem of testing long memory for a continuous time process based on high frequency data. We provide two test statistics to distinguish between a semimartingale and a fractional integral process with jumps, where the integral is driven by a fractional Brownian motion with long memory. The small–sample performances of the statistics are evidenced by means of simulation studies. The real data analysis shows that the fractional integral process with jumps can capture the long memory of some financial data.

Similar content being viewed by others

References

Y Aït-Sahalia, J Jacod. Testing for jumps in a discretely observed process, Ann Statist, 2009, 37: 184–222.

Y Aït-Sahalia, J Jacod. Is brownian motion necessary to model high-frequency data? Ann Statist, 2010, 38: 3093–3128.

Y Aït-Sahalia, J Jacod. Testing whether jumps have finite or infinite activity, Ann Statist, 2011, 39: 1689–1719.

T G Andersen, T Bollerslev, F X Diebold, P Labys. Modeling and forecasting realized volatility, Econometrica, 2003, 71: 579–625.

F Bandi, J Russell. Microstructure noise, realized variance, and optimal sampling, Rev Econom Stud, 2008, 75: 339–369.

O Barndorff-Nielsen, J Corcuera, M Podolskij, J Woerner. Bipower variation for Gaussian processes with stationary increments, J Appl Probab, 2009, 46: 132–150.

O Barndorff-Nielsen, S Graversen, J Jacod, M Podolskij, N Shephard. A central limit theorem for realised power and bipower variations of continuous semimartingales, In: From Stochastic Calculus to Mathematical Finance, The Shiryaev Festschrift, Y Kabanov, R Liptser, J Stoyanov, eds, Springer, 2006: 33–69.

O Barndorff-Nielsen, N Shephard. Econometrics of testing for jumps in financial economics using bipower variation, J Financial Econom, 2006, 4: 1–30.

O Barndorff-Nielsen, N Shephard, M Winkel. Limit theorems for multipower variation in the presence of jumps, Stochastic Process Appl, 2006, 116: 796–806.

J Beran, Y Feng, S Ghosh, R Kulik. Long-Memory Processes: Probabilistic Properties and Statistical Methods, Springer-Verlag, 2013.

T Björk, H Hult. A note on Wick products and the fractional Black-Scholes model, Finance Stoch, 2005, 9: 197–209.

F Black, M Scholes. The pricing of options and corporate liabilities, J Polit Econ, 1973, 81: 637–654.

P Cheridito. Arbitrage in fractional brownian motion models, Finance Stoch, 2003, 7: 533–553.

R Cont, C Mancini. Nonparametric tests for pathwise properties of semimartingales, Bernoulli, 2011, 17: 781–813.

J Corcuera, D Nualart, J Woerner. Power variation of some integral long-memory processes, Bernoulli, 2006, 12: 713–735.

F Corsi, D Pirino, R Renò. Threshold bipower variation and the impact of jumps on volatility forecasting, J Econometrics, 2010, 159: 276–288.

S Dajcman. Time-varying long-range dependence in stock market returns and financial market disruptions-a case of eight European countries, Appl Econ Lett, 2012, 19: 953–957.

F Delbaen, W Schachermayer. A general version of the fundamental theorem of asset pricing, Math Ann, 1994, 300: 463–520.

F Diebold, A Inoue. Long memory and regime switching, J Econometrics, 2001, 105: 131–159.

P Doukhan, G Oppenheim, M Taqqu. Theory and Applications of Long-Range Dependence, Birkhauser, 2003.

R J Elliott, J Van der Hoek. A general fractional white noise theory and applications to finance, Math Finance, 2003, 13: 301–330.

P Guasoni. No arbitrage under transaction costs, with fractional brownian motion and beyond, Math Finance, 2006, 16: 569–582.

J Harrison, S Pliska. Martingales and stochastic integrals in the theory of continuous trading, Stochastic Process Appl, 1981, 11: 215–260.

Y Z Hu, B Øksendal. Fractional white noise calculus and applications to finance, Infin Dimens Anal Quantum Probab Relat Top, 2003, 6: 1–32.

J Jacod, A Shiryaev. Limit Theorems for Stochastic Processes, Springer, 2003.

R Jarrow, P Protter, H Sayit. No arbitrage without semimartingales, Ann Appl Probab, 2009, 19: 596–616.

B Y Jing, X B Kong, Z Liu. Modeling high-frequency financial data by pure jump processes, Ann Statist, 2012, 40: 759–784.

X B Kong, B Y Jing, C X Li. Is the Driving Force of a Continuous Process a Brownian Motion or Fractional Brownian Motion? J Math Finance, 2013, 3: 454–464.

S Lee, P Mykland. Jumps in financial markets: A new nonparametric test and jump dynamics, Rev Financ Stud, 2008, 21: 2535–2563.

G Y Liu, X S Zhang. Power variation of fractional integral processes with jumps, Statist Probab Lett, 2011, 81: 962–972.

G Y Liu, X S Zhang, Z Y Wei. Asymptotic properties for multipower variation of semimartingales and Gaussian stationary processes with jumps, J Statist Plann Inference, 2013, 143: 1307–1319.

T Mikosch, C Starica. Nonstationarities in financial time series, the long-range dependence, and the IGARCH effects, Rev Econ Statist, 2004, 86: 378–390.

W Palma. Long-Memory Time Series: Theory and Methods, Wiley-Blackwell, 2007.

S H Poon. A Practical Guide to Forecasting Financial Market Volatility, John Wiley & Sons, 2005.

S H Poon, C W J Granger. Forecasting volatility in financial markets: A review, J Econ Lit, 2003, 41: 478–539.

S Rostek. Option Pricing in Fractional Brownian Markets, Springer, 2009.

W Willinger, M S Taqqu, V Teverovsky. Stock market prices and long-range dependence, Finance Stoch, 1999, 3: 1–13.

L Young. An inequality of the hölder type, connected with stieltjes integration, Acta Math, 1936, 67: 251–282.

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported by National NSFC(11501503), Natural Science Foundation of Jiangsu Province of China (BK20131340), China Postdoctoral Science Foundation (2014M560471, 2016T90534), QingLan Project of Jiangsu Province of China, Priority Academic Program Development of Jiangsu Higher Education Institutions (Applied Economics), Key Laboratory of Jiangsu Province (Financial Engineering Laboratory).

Rights and permissions

About this article

Cite this article

Liu, Gy., Zhang, Xs. & Zhang, Sb. Testing long memory based on a discretely observed process. Appl. Math. J. Chin. Univ. 31, 253–268 (2016). https://doi.org/10.1007/s11766-016-3342-y

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11766-016-3342-y