Abstract

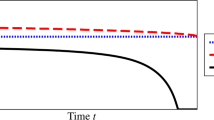

This paper concerns optimal investment problem with proportional transaction costs and finite time horizon based on exponential utility function. Using a partial differential equation approach, we reveal that the problem is equivalent to a parabolic double obstacle problem involving two free boundaries that correspond to the optimal buying and selling policies. Numerical examples are obtained by the binomial method.

Similar content being viewed by others

References

P P Boyle, T C F Vorst. Option replication in discrete time with transaction costs, Journal of Finance, 1992, 47: 271–293.

G M Constantinides, T Zariphopoulou. Bounds on prices of contingent claims in an intertemporal economy with proportional transaction costs and general preferences, Finance and Stochastics, 1999, 3: 345–369.

J Cvitanic, I Karatzas. On dynamic measures of risk, Finance and Stochastics, 1999, 3: 451–482.

J Cvitanic, H Pham, N Touzi. A closed-form solution to the problem of super-replication under transaction costs, Finance and Stochastics, 1999, 3: 35–54.

M Dai, F H Yi. Finite-Horizon Optimal Investment with Transaction Costs: A Parabolic Double Obstacle Problem, Journal of Differential Equations, 2009, 246: 1445–1469.

M H A Davis, A R Norman. Portfolio selection with transaction costs, Mathematics of Operation Research, 1990, 15: 676–713.

M H A Davis, V G Panas, T Zariphopoulou. European option pricing with Transaction costs, SIAM Journal of Control and Optimization, 1993, 31(2): 470–493.

M H A Davis, J M C Clark. A note on super-replicating strategies, Philosophical Transactions of the Royal Society of London A, 1994, 347: 485–494.

M H A Davis. Option Pricing in Incomplete Markets, In: Dempster, M.A.H., 1997.

C Edirisinghe, V Naik, R Uppal. Optimal replication of options with transactions costs and trading restrictions, Journal of Financial and Quantitative Analysis, 1993, 28: 117–128.

S D Hodges, A Neuberger. Optimal replication of contingent claims under transaction costs, Review of Futures Markets, 1989, 8: 222–239.

H J Kushner. Numerical methods for stochastic control problems in continuous time, SIAM Journal of Control and Optimization, 1990, 28: 999–1048.

H J Kushner. Numerical Methods for Stochastic Control Problems in Finance, In: Dempster, M.A.H., 1997.

H J Kushner, L F Martins. Numerical methods for stochastic singular control problems, SIAM Journal of Control and Optimization, 1991, 29: 1443–1475.

H E Leland. Option pricing and replication with transactions costs, Journal of Finance, 1985, 40: 1283–1301.

R C Merton. Optimal consumption and portfolio rules in a continuous time model, Journal of Economic Theory, 1971, 3: 373–413.

S E Shreve, H M Soner. Optimal investment and consumption with transaction costs, Annals of Applied Probility, 1994, 4: 609–692.

H M Soner, S E Shreve, J Cvitanic. There is no nontrivial hedging portfolio for option pricing with transaction costs, Annals of Applied Probability, 1995, 5: 327–355.

F H Yi, Z Yang. A variational inequality arising from European option pricing with transaction costs, Science in China Series A: Mathematics, 2008, 51(5): 935–954.

K Zhao. Continuous-Time Finite-Horizon Optimal Investment and Consumption Problems with Proportional Transaction Costs, PHD thesis of National University of Singapore, 2009.

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported by the Key Grant Project of Chinese Ministry of Education (NO.309018), National Natural Science Foundation of China (NO.70973104, NO.11171304) and Zhejiang Provincial Natural Science Foundation of China (NO.Y6110023).

Rights and permissions

About this article

Cite this article

Bao, Qf., Yang, Jy., Sun, C. et al. Optimal investment with transaction costs based on exponential utility function: a parabolic double obstacle problem. Appl. Math. J. Chin. Univ. 26, 483–492 (2011). https://doi.org/10.1007/s11766-011-2294-5

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11766-011-2294-5