Abstract

Low-price guarantees (LPG) signal the market position of a seller’s offer price and promise to compensate consumers in case that information is erroneous. In this research, we demonstrate that when retailers default on the information provided by an LPG, consumer perceptions of the retailer suffer, but the extent of the damage depends on the conditions associated with the default. On the basis of attribution theory, we posit that consumers may attribute default to the retailer’s opportunism but emphasize this attribution differently in various default conditions. Furthermore, we show that the restoration of consumer perceptions after a refund depends on consumers’ focus in terms of the signal itself. If they consider the protective, compensatory function of a low price signal, their post-refund outcomes are more favorable; when they focus on the informational function, these outcomes are less favorable. We discuss the theoretical and practical implications of these findings.

Similar content being viewed by others

Notes

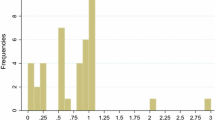

We conducted a pretest to determine default magnitude, in which we asked 41 undergraduate students, not part of the main experiment, to imagine they had purchased a digital camera for $279.99 under an LPG and report what they would consider to be “somewhat lower” and “substantially lower” prices if they found lower price for this model after their purchase. Subjects also reported the likelihood of their returning to the store for refund on seven-point scales (1 = extremely unlikely, 7 = extremely likely) for each of the two prices they reported. The means of the somewhat lower and substantially lower prices reported by the subjects are $264.11 and $223.18, and on average, the likelihood of seeking a refund is significantly higher for the former (t 39 = 5.15; p < 0.01). On the basis of these results, we selected a $15 (=$279.99−$264.99) difference for the small default and a $56 (=$279.99−$223.99) difference for the large default.

References

Arbatskaya, M., Hviid, M., & Shaffer, G. (2004). On the incidence and variety of low-price guarantees. Journal of Law and Economics, 48, 307–332 (April).

Biswas, A., Dutta, S., & Pullig, C. (2006). Low price guarantees as signals of lowest price: The moderating role of perceived price dispersion. Journal of Retailing, 82(3), 245–257.

Biswas, A., Pullig, C., Yagci, M. I., & Dean, D. H. (2002). Consumer evaluation of low price guarantees: The moderating role of reference price and store image. Journal of Consumer Psychology, 12(2), 107–118.

Bitner, M. J. (1990). Evaluating service encounters: The effects of physical surroundings and employee reponses. Journal of Marketing, 54, 69–82 (April).

Boulding, W., & Kirmani, A. (1993). A consumer-side experimental examination of signaling theory. Journal of Consumer Research, 20(1), 111–123.

Campbell, M. C. (1999). Perceptions of price unfairness: Antecedents and consequences. Journal of Marketing Research, 36, 187–199 (May).

Chatterjee, S., Heath, T. B., & Basuroy, S. (2003). Failure to suspect collusion in price-matching guarantees: Consumer limitations in game-theoretic reasoning. Journal of Consumer Psychology, 13(3), 255–267.

Dutta, S., & Biswas, A. (2005). Effects of low price guarantees on consumer postpurchase search intention: The moderating roles of value consciousness and penalty level. Journal of Retailing, 81(4), 283–291.

Estelami, H., Grewal, D., & Roggeveen, A. L. (2007). The negative effect of policy restrictions on consumers’ postpurchase reactions to price-matching guarantees. Journal of the Academy of Marketing Science (forthcoming).

Folkes, V. S. (1988). Recent attribution research in consumer behavior: A review and new directions. Journal of Consumer Research, 14, 548–565 (March).

Gourville, J. T., & Soman, D. (1998). Payment depreciation: The behavioral effects of temporally separating payments from consumption. Journal of Consumer Research, 25, 160–174 (September).

Grewal, D., Marmorstein, H., & Sharma, A. (1996). Communicating price information through semantic cues: The moderating effects of situation and discount size. Journal of Consumer Research, 23, 148–155 (September).

Herr, P. M. (1989). Priming price: Prior knowledge and context effects. Journal of Consumer Research, 16, 67–75 (June).

Jain, S., & Srivastava, J. (2000). An experimental and theoretical analysis of price-matching refund policies. Journal of Marketing Research, 37, 351–362 (August).

Kelley, H. H. (1973). The process of causal attribution. American Psychologist, 28, 107–128 (February).

Kelley, H. H., & Michela, J. L. (1980). Attribution theory and research. Annual Review of Psychology, 31, 457–501.

Kirmani, A., & Rao, A. R. (2000). No pain, no gain: A critical review of the literature on signaling unobservable product quality. Journal of Marketing, 64, 66–79 (April).

Kukar-Kinney, M., & Walters, R. G. (2003). Consumer perceptions of refund depth and competitive scope in price-matching guarantees: Effects on store patronage. Journal of Retailing, 79(3), 53–60.

Lassar, W. M., Grewal, D., & Marmorstein, H. (1999). Consumer responses to the timing of product breakdowns in the presence of manufacturers’ warranties. Journal of Business and Psychology, 14(2), 355–371.

Lichtenstein, D. R., & Bearden, W. O. (1989). Contextual influences on perceptions of merchant-supplied reference prices. Journal of Consumer Research, 16, 55–66 (June).

Rust, R. T., Zeithaml, V. A., & Lemon, K. N. (2000). Driving customer equity. New York: The Free Press.

Sheth, J. N., & Sisodia, R. S. (2005). A dangerous divergence: Marketing and society. Journal of Public Policy & Marketing, 24(1), 160–162.

Shrum, L. J., Wyer, R. S. Jr., & O’Guinn, T. C. (1998). The effects of television consumption on social perceptions: The use of priming procedures to investigate psychological processes. Journal of Consumer Research, 24, 447–458 (March).

Smith, A. K., Bolton, R. N., & Wagner, J. (1999). A model of customer satisfaction with service encounters involving failure and recovery. Journal of Marketing Research, 36(3), 356–372.

Spence, M. (1974). Market signaling. Cambridge, MA: Harvard University Press.

Spreng, R. A., Harrell, G. D., & Mackoy, R. D. (1995). Service recovery: Impact on satisfaction and intention. Journal of Services Marketing, 9(1), 15–23.

Srivastava, J., & Lurie, N. (2004). Price-matching guarantees as signals of low store prices: Survey and experimental evidence. Journal of Retailing, 80, 117–128.

Tsiros, M., Mittal, V., & Ross, W. T. Jr. (2004). The role of attributions in consumer satisfaction: A reexamination. Journal of Consumer Research, 31, 476–483 (September).

Weiner, B. (1985). An attributional theory of achievement motivation and emotion. Psychological Review, 92, 548–573 (October).

Weiner, B. (1986). An attributional theory of motivation and emotion. Berlin Heidelberg New York: Springer.

Weiner, B. (2000). Attributional thoughts about consumer behavior. Journal of Consumer Research, 27(3), 382–387.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

The following items were used in Study three to assess the degree to which respondents’ information focus guided their responses to the dependent variables (1 = strongly disagree, 7 = strongly agree):

-

I felt hurt that even though the retailer paid the refund; the fact remains that the price charged by the retailer was not the lowest in the market after all.

-

I felt as though my trust in the retailer was violated the moment I found a lower price in the market, regardless of whether the retailer gave me a refund or not.

-

Refund or no refund, the retailer should not have given a Low Price Guarantee if it were not absolutely confident of charging the lowest market price.

-

So far as I am concerned, the Low Price Guarantee was violated by the very fact that a lower price in the market existed, regardless of whether the retailer compensated me with a refund afterward.

The following items from Study three assess the degree to which respondents’ protection focus guided their responses to the dependent variables (1 = strongly disagree, 7 = strongly agree):

-

I felt that by paying the refund, the retailer fulfilled its promise of protecting my financial interest.

-

I felt like I should not hold anything against the retailer now that it has paid to me the promised refund.

-

The fact that I found a lower price at another store did not bother me. What was important to me was that [the retailer] paid me the promised refund.

Rights and permissions

About this article

Cite this article

Dutta, S., Biswas, A. & Grewal, D. Low price signal default: an empirical investigation of its consequences. J. of the Acad. Mark. Sci. 35, 76–88 (2007). https://doi.org/10.1007/s11747-007-0017-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11747-007-0017-5