Abstract

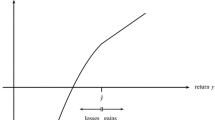

Considering the effect of economic agents’ preferences on their actions, the relationships between conventional summary statistics and forecast profits are investigated. An analytical examination of loss function families demonstrates that investors’ utility maximisation is determined by their risk attitudes. In computational settings, stock traders’ fitness is assessed in response to a slow step increase in the value of the risk aversion coefficient. The experiment rejects the claims that the accuracy of the forecast does not depend upon which error-criteria are used and that none of them is related to the profitability of the forecast. The profitability of networks trained with L 6 loss function appeared to be statistically significant and stable, although links between the loss functions and the accuracy of forecasts were less conclusive.

Similar content being viewed by others

References

Blume L, Easley D. Evolution and market behavior. Journal of Economic Theory, 1992, 58: 9–40

Chen S H, Huang Y C. Simulating the evolution of portfolio behavior in a multiple-asset agent-based artificial stock market. In: Processdings of the 9th International Conference on Computing in Economics and Finance, University of Washington, Seattle, USA, 2003

Leitch G, Tanner E. Economic forecast evaluation: profits versus the conventional error measure. American Economic Review, 2001, 81: 580–590

Gordon M J, Paradis G E, Rorke C H. Experimental evidence on alternative portfolio decision rules. American Economic Review, 1972, 62(1): 107–118

Friend I, Blume M E. The demand for risky assets. American Economic Review, 1975, 65(5): 900–922

Hayward S. Heterogeneous agents’ past and forward time horizons in setting up a computational model. In: Proceedings of the 10th International Conference on Computing in Economics and Finance, University of Amsterdam, Netherlands, 2004

Sweeney R J. Some filter rule tests: methods and results. Journal of Financial and Quantitative Analysis, 1988, 23: 285–301

Hayward S. Setting up performance surface of an artificial neural network with genetic algorithm optimization: in search of an accurate and profitable prediction for stock trading. In: Proceedings of IEEE Congress on Evolutionary Computation (CEC), Portland, Oregon, US, 2004, 1: 948–954

Rustem B. Algorithms for nonlinear programming and multiple objective decisions. New York, NY: John Wiley & Sons, Inc., 1998

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hayward, S. Risk aversion and agents’ survivability in a financial market. Front. Comput. Sci. China 3, 158–166 (2009). https://doi.org/10.1007/s11704-009-0021-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11704-009-0021-7