Abstract

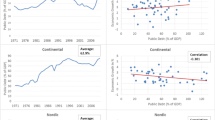

In this paper we investigate the long-run relationship between public debt and economic growth in the Spanish economy for the period 1851–2013. We develop a cliometric analysis of the debt–growth nexus using novel time series methods. We find some support for a negative relationship between both variables, but no clear evidence of a debt threshold. The estimated long-run elasticity in a one-break model shows a tendency to decrease over time from a nonsignificant 0.011 to a −0.070, indicating that a 10 percentage increase in the public debt-to-GDP ratio is associated with 0.70 percentage points lower real economic growth. Indeed, we find for the first subsample (1851–1939) either “decoupling” or “saturation,” while in the second subsample (1940–2000) the long-run elasticity coefficient becomes negative and significant. When we extend our analysis up to 2013, we find a break in 1971 coinciding with the twilight of Franco’s dictatorship and the Spanish transition to democracy.

Similar content being viewed by others

Notes

See, for example, Panizza and Presbitero (2013) for a recent review of the literature.

Beyond some threshold some countries may be able to arrive to a reschedule of its debt or even some way of debt redemption program that allows new growth impetus.

See Kourtellos et al. (2013).

Estimation methods have also varied from OLS estimation, panel data estimations with fixed or random effects, Tobit estimations, or semi-parametric estimation. In addition, explanatory variables have also been augmented including lagged values, population density, locational variables, micro- or macro-variables, distributional variables, trade variables, as well as noneconomic variables such as literacy rates or political rights.

Comín (2016) has stressed this issue when explaining the debt crisis in Spain; see pp. 280–286.

Gómez-Puig and Sosvilla-Rivero (2015) being a remarkable exception.

See Sect. 3 for further details.

However, this simple analysis does not find any support of an inverted U-shaped figure (Debt Laffer curve).

There is also the waste of talent from educated unemployed young people.

See, for instance, the Stability and Growth Pact in the case of the euro area.

The above analysis implies that a full assessment of fiscal sustainability requires a comprehensive approach where debt dynamics should capture the feedback effects between fiscal policies, the macroeconomy, and the financial sector.

The channels through which public debt is likely to have an impact on economic growth rate are seen to be private saving, public investment, total factor productivity, and sovereign long-term nominal and real interest rates. The estimated debt threshold of 90–100% of GDP, after which additional debt starts to have a negative impact on growth, is an average for the sample of 12 countries and it may go as low as 70% of GDP which suggests that for many countries public debt levels may already have detrimental impact on growth as the average public debt ratios are above the lower threshold.

Preceding empirical literature has generated substantial criticism. Indeed, many studies risked spurious findings by ignoring that variables like debt and GDP per capita are likely non-stationary; moreover, studies considering the non-stationary nature of the variables still risked spurious findings by performing nonlinear (quadratic) transformations of a prospective non-stationary variable (GDP per capita growth); other more recent studies to date that have employed panel unit root and panel cointegration techniques have relied on methods that incorrectly assume that the cross sections are independent.

Eichengreen et al. (2005) described the inability of emerging market countries to borrow in their own currencies as an original sin. Unfortunately, the recent experience has shown that more advanced economies are not immune to potential sovereign debt problems similar to those widely observed in less developed economies.

See Comín (2016) pp. 129–132, 143–148 and 178–184 where this relevant issue is explained for different historical periods.

The subscript b stands for “break” and the subscript f stands for “fixed” (across regimes).

See Carrion-i Silvestre et al. (2009) for more details.

These tests are the \(MZ_{\alpha }^{GLS}\), \({\textit{MSB}}^{GLS}\), \({\textit{MZ}}_{t}^{GLS}\) and \({\textit{MP}}_{T}^{GLS}\). For the \({\textit{MZ}}_{\alpha }^{GLS}\) and \({\textit{MZ}}_{t}^{GLS}\) tests the null hypothesis is a unit root, while for the \({\textit{MSB}}^{GLS}\) and \(MP_{T}^{GLS}\) tests the null hypothesis is non-stationarity. See Ng and Perron (2001) and Perron and Rodríguez (2003) for more details.

References

Afonso A, Arghyrou MG, Kontonikas A (2014) Pricing sovereign bond risk in the European Monetary Union area: an empirical investigation. Int J Finance Econ 19(1):49–56

Andrews DWK, Ploberger W (1994) Optimal tests when a nuisance parameter is present only under the alternative. Econometrica 62(6):1383–1414

Arai Y, Kurozumi E (2007) Testing for the null hypothesis of cointegration with a structural break. Econom Rev 26(6):705–739

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Bai J, Perron P (1998) Estimating and testing linear models with multiple structural changes. Econometrica 66(1):47–78

Bai J, Perron P (2003) Computation and analysis of multiple structural change models. J Appl Econom 18(1):1–22

Balassone F, Francese M, Pace A (2011) Public debt and economic growth in Italy. Quaderni di Storia Economica, Rome

Banco de España (2014) Cuentas Financieras de la Economía Española, 1980–2013. Technical report, Banco de España, Madrid

Barro RJ (1974) Are government bonds net wealth? J Polit Econ 82(6):1095–1117

Baum A, Checherita-Westphal C, Rother P (2013) Debt and growth: new evidence for the euro area. J Int Money Finance 32(1):809–821

Blundell R, Bond B (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Bohn H (1998) The behavior of U.S. public debt and deficits. Q J Econ 113(3):949–963

Bohn H (2007) Are stationarity and cointegration restrictions really necessary for the intertemporal budget constraint? J Monet Econ 54(7):1837–1847

Campbell JY, Perron P (1991) Unit what opportunities: know macroeconomists should know about unit roots. In: NBER macroeconomics annual, vol 6, pp 141–220

Caner M, Grennes TJ, Köhler-Geib FFN (2010) Finding the tipping point—when sovereign debt turns bad. SSRN Electron J 1–15

Carreras A, Prados de la Escosura L, Rosés JR (2005) Renta y Riqueza. In Carreras, A. and Tafunell, X., editors, Estadísticas Históricas de España, chapter 17, pp 1297–1375. BBVA Foundation, Bilbao, second edition

Carrion-i Silvestre JL, Kim D, Perron P (2009) Gls-based unit root tests with multiple structural breaks under both the null and the alternative hypotheses. Econom Theory 25(06):1754

Cecchetti SG, Mohanty MS, Zampolli F (2011) The real effects of debt. Rev Financ Stud 22(September):25–27

Checherita-Westphal C, Hughes Hallett A, Rother P (2014) Fiscal sustainability using growth-maximizing debt targets. Appl Econ 46(6):638–647

Checherita-Westphal C, Rother P (2012) The impact of high government debt on economic growth and its channels: an empirical investigation for the euro area. Eur Econ Rev 56(7):1392–1405

Comín F (2007) Reaching a political consensus for tax reform in Spain. The Moncloa pacts, joining the European Union and the rest of the journey. In: Martínez Vázquez J, Sanz Sanz JF (eds) Fiscal reform in Spain. Accomplishments and challenges, Cheltenham, Chapter 1, pp 8–57

Comín F (2012) Default, rescheduling and inflation: public debt crises in Spain during the 19th and 20th centuries. Rev Hist Econ/J Iberian Latin Am Econ Hist 30(03):353–390

Comín F (2015) La deuda pública: el bálsamo financiero del régimen de Franco (1939–1975). Rev Hist Ind 57:173–211

Comín F (2016) La crisis de la deuda soberana en España (1500–2015). Catarata, Madrid

Comín F, Díaz D (2005) Sector público administrativo y estado del bienestar. Chapter 12. In: Carreras A, Tafunell X (eds) Estadísticas Históricas de España, 2nd edn. BBVA Foundation, Bilbao, pp 873–964

Comín F, Martorell M (2013) La Hacienda Pública en el franquismo. La guerra y la autarquía (1936-1959). Madrid

Cottarelli C, Forni L, Gottschalk J, Mauro P (2010) Default in today’s advanced economies: unnecessary, undesirable, and unlikely. IMF Staff Position Note, pp 1–25

De Grauwe P (2012) The governance of a fragile Eurozone. Aust Econ Rev 45(3):255–268

Delong JB, Summers LH (2012) Fiscal policy in a depressed economy. Brook Pap Econ Act 2012(1):233–297

Di Sanzo S, Bella M (2015) Public debt and growth in the euro area: evidence from parametric and nonparametric Granger causality. BE J Macroecon 15(2):631–648

Dias Da, Richmond C, Wright ML (2014) The stock of external sovereign debt: can we take the data at face value’? J Int Econ 94(1):1–17

Eberhardt M, Presbitero AF (2015) Public debt and growth: heterogeneity and non-linearity. J Int Econ

Égert B (2015a) Public debt, economic growth and nonlinear effects: myth or reality? J Macroecon 43:226–238

Égert B (2015b) The 90% public debt threshold: the rise and fall of a stylized fact. Appl Econ 47(34–35):3756–3770

Eichengreen B, Hausmann R, Panizza U (2005) The mystery of original sin. In: Eichengreen B, Hausmann R (eds) Other people’s money: debt denomination and financial instability in emerging-market economies. University of Chicago Press, Chicago, pp 233–265

Elliott BYG, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836

Elmendorf DW, Mankiw NG (1999) Chapter 25 Government debt. In: Handbook of macroeconomics, pp 1615–1669

Elmeskov J, Sutherland D (2012) Post-crisis debt overhang: growth implications across countries

European Central Bank (2011) Articles ensuring fiscal sustainability. Mon Bull 04(109):61–77

Ghosh AR, Kim JI, Mendoza EG, Ostry JD, Qureshi MS (2013) Fiscal fatigue, fiscal space and debt sustainability in advanced economies. Econ J 123(566):F4–F30

Gómez-Puig M, Sosvilla-Rivero S (2015) On the bi-directional causal relationship between public debt and economic growth in EMU countries . IREA working paper 2015/12, (12)

Harvey DI, Leybourne SJ, Taylor aR (2013) Testing for unit roots in the possible presence of multiple trend breaks using minimum DickeyFuller statistics. J Econom 177(2):265–284

International Monetary Fund (2012) World economic outlook: coping with high debt and sluggish growth. Number October

Jordà Ò, Schularick M, Taylor AM (2016) Sovereign versus banks: credit, crises, and consequences. J Eur Econ Assoc 14(1):45–79

Kejriwal M (2008) Cointegration with structural breaks: an application to the Feldstein-Horioka puzzle. Stud Nonlinear Dyn Econom 12(1):1–37

Kejriwal M, Perron P (2008) The limit distribution of the estimates in cointegrated regression models with multiple structural changes. J Econom 146(1):59–73

Kejriwal M, Perron P (2010) Testing for multiple structural changes in cointegrated regression models. J Bus Econ Stat 28(4):503–522

Kourtellos A, Stengos T, Tan CM (2013) The effect of public debt on growth in multiple regimes. J Macroecon 38(PA):35–43

Laubach T (2009) New evidence on the interest rate effects of budget deficits and debt. J Eur Econ Assoc 7(June):858–885

Lee C-C, Chang C-P (2009) FDI, financial development, and economic growth: international evidence. J Appl Econ 12(2):249–271

Newey WK, West KD (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica 55(3):703

Ng S, Perron P (2001) LAG length selection and the construction of unit root tests with good size and power. Econometrica 69(6):1519–1554

Ogaki M, Park JY (1997) A cointegration approach to estimating parameters. J Econom 82:107–134

Paniagua J, Sapena J, Tamarit C (2016) Sovereign debt spreads in EMU: time-varying role of fundamentals and market distrust. J Financ Stab (in press)

Panizza U, Presbitero A (2013) Public debt and economic growth in advanced economies: a survey. Swiss J Econ Stat 149(II):175–204

Panizza U, Presbitero AF (2014) Public debt and economic growth: is there a causal effect? J Macroecon 41:21–41

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57(6):1361–1401

Perron P (1997) Further evidence on breaking trend functions in macroeconomic variables. J Econom 80(2):355–385

Perron P (2006) Dealing with structural breaks. In: Patterson K, Mills T (eds) Handbook of econometrics, econometric theory, vol 1. Palgrave, New York, pp 278–352

Perron P (2008) Structural change. In: Durlauf S, Blume L (eds) The new palgrave dictionary of economics, 2nd edn. Palgrave Macmillan, New York

Perron P, Qu Z (2007) A simple modification to improve the finite sample properties of Ng and Perron’s unit root tests. Econ Lett 94(1):12–19

Perron P, Rodríguez G (2003) GLS detrending, efficient unit root tests and structural change. J Econom 115(1):1–27

Perron P, Vogelsang TJ (1992a) Nonstationarity and level shifts with an application to purchasing power parity. J Bus Econ Stat 10(3):301–320

Perron P, Vogelsang TJ (1992b) Testing for a unit root in a time series with a changing mean. J Bus Econ Stat 10(4):467–470

Perron P, Yabu T (2009) Estimating deterministic trends with an integrated or stationary noise component. J Econom 151(1):56–69

Perron P, Zhu X (2005) Structural breaks with deterministic and stochastic trends. J Econom 129(1–2):65–119

Prados de la Escosura L (2003) El progreso económico de España. BBVA Foundation, Bilbao

Prados de la Escosura L, Rosés JR, Sanz-Villarroya I (2012) Economic reforms and growth in Franco’s Spain. Rev Hist Econ/J Iberian Latin 30(1):45–89

Pragidis I, Gogas P, Plakandaras V, Papadimitriou T (2015) Fiscal shocks and asymmetric effects: a comparative analysis. J Econ Asymmetries 12(1):22–33

Reinhart CM, Reinhart VR, Rogoff KS (2012) Public debt overhangs: advanced-economy episodes since 1800. J Econ Perspect 26(3):69–86

Reinhart CM, Rogoff KS (2009a) The aftermath of financial crises. Am Econ Rev 99(2):466–472

Reinhart CM, Rogoff KS (2009b) This time is different. Princeton University Press, Princeton

Reinhart CM, Rogoff KS (2010) Growth in a time of debt. Am Econ Rev 100(2):573–578

Saikkonen P (1993) Estimation of cointegration vectors with linear restrictions. Econom Theory 9(01):19

Shin Y (1994) A residual-based test of the null of cointegration against the alternative of no cointegration. Econom Theory 10(1):91–115

Stock J, Watson M (1999) A comparison of linear and nonlinear models for forecasting macroeconomic time series. In: Engle RF, White H (eds) Cointegration, causality and forecasting: a Festchrift in Honour of Clive W.J. Granger. Oxford University Press, Oxford, pp 1–44

Stock JH, Watson MW (1993) A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica 61(4):783–820

Stock JH, Watson MW (1996) Evidence on structural instability in macroeconomic time series. J Bus Econ Stat 14(1):11–30

Stock JH, Watson MW (2005) Implications of dynamic factor models for VAR analysis. NBER working paper series, vol 11467, pp 1–67

Tanzi V, Chalk N (2000) Impact of large debt on growth in the EU: a discussion of potential channels. Eur Econ 2:23–43

Teles VK, Mussolini CC (2014) Public debt and the limits of fiscal policy to increase economic growth. Eur Econ Rev 66:1–15

Tomova M, Rezessy A, Lenkowski A, Maincent E (2013) Eu governance and EU funds-testing the effectiveness of EU funds in a sound macroeconomic framework. European Economy-Economic Papers 510(December)

Trehan B, Walsh CE (1991) Testing intertemporal budget constraints: theory and applications to U.S. federal budget and current account deficits. J Money Credit Bank 23(2):206

Vogelsang T, Perron P (1998) Additional tests for a unit root allowing for a break in the trend function at an unknown time. Int Econ Rev 39(4):1073–1100

Woo J, Kumar MS (2015) Public debt and growth. Economica 82(328):705–739

Zivot E, Andrews DWK (1992) The great crash, the and unit-root. J Bus Econ Stat 10(3):251–270

Acknowledgements

The authors acknowledge support from FUNCAS, MINECO (Project ECO2014-58991-C3-2-R), and GV (Project PROMETEOII/2014/053). The paper has been partially elaborated during a stay of C. Tamarit at Harvard University with the support from the European Commission (Project 542434-LLP-1-2013-1-ES-AJM-CL ). The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Esteve, V., Tamarit, C. Public debt and economic growth in Spain, 1851–2013. Cliometrica 12, 219–249 (2018). https://doi.org/10.1007/s11698-017-0159-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11698-017-0159-8