Abstract

We consider an economic lot sizing problem where the demand in a period is a piecewise linear and concave function of the amount of the available inventory after production in that period. We show that the problem is \({{\mathcal {N}}}{{\mathcal {P}}}\)-hard even when the production capacities are time invariant, and propose a polynomial time algorithm to the case where there are no capacity restrictions on production.

Similar content being viewed by others

References

Alfares, H.K.: Maximum-profit inventory model with stock-dependent demand, time-dependent holding cost, and all-units quantity discounts. Math. Model. Anal. 20(6), 715–736 (2015)

Baker, R.C., Urban, T.L.: A deterministic inventory system with an inventory-level-dependent demand rate. J. Oper. Res. Soc. 39(9), 823 (1988)

Bitran, G., Yanasse, H.: Computational complexity of the capacitated lot size problem. Manag. Sci. 18, 12–20 (1982)

Chuang, C., Zhao, Y.: Demand stimulation in finished-goods inventory management: empirical evidence from general motors dealerships. Int. J. Prod. Econ. 208, 208–220 (2019)

Florian, M., Klein, M.: Deterministic production planning with concave costs and capacity constraints. Manag. Sci. 18, 12–20 (1971)

Florian, M., Lenstra, J., Rinnooy Kan, A.: Deterministic production planning: algorithms and complexity. Manag. Sci. 26(7), 669–679 (1980)

Friedman, Y., Hoch, Y.: A dynamic lot-size model with inventory deterioration. INFOR 16(2), 183–188 (1978)

Gupta, R., Vrat, P.: Inventory model for stock-dependent consumption rate. OPSEARCH 23(1), 19–24 (1986)

Hoesel, Cv, Wagelmans, A.: An \(O(T^{3})\) algorithm for the economic lot-sizing problem with constant capacities. Manag. Sci. 42(1), 142–150 (1996)

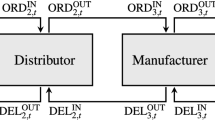

Hoesel, Sv, Romeijn, H., Morales, D.R., Wagelmans, A.: Integrated lot-sizing in serial supply chains with production capacities. Manag. Sci. 51(11), 1706–1719 (2005)

IBM: IBM ILOG CPLEX 12.9 Users Manual. IBM Corp, Armonk (2019)

Koschat, M.A.: Store inventory can affect demand: empirical evidence from magazine retailing. J. Retail. 84(2), 165–179 (2008)

Kunreuther, H., Schrage, L.: Joint pricing and inventory decisions for constant priced items. Manag. Sci. 19(7), 732–738 (1973)

Love, S.: Bounded production and inventory model with piecewise concave costs. Manag. Sci. 20(3), 313–318 (1973)

Lu, L., Zhang, J., Tang, W.: Optimal dynamic pricing and replenishment policy for perishable items with inventory-leveldependent demand. Int. J. Syst. Sci. 47, 1480–1494 (2016)

Önal, M., Romeijn, H.E.: Two-echelon requirements planning with pricing decisions. J. Ind. Manag. Optim. 5, 767–781 (2009)

Önal, M., Romeijn, H.E.: Multi-item capacitated lot-sizing problems with setup times and pricing decisions. Naval Res. Log. 57(2), 172–187 (2010)

Önal, M., Romeijn, H.E., Sapra, A., van den Heuvel, W.: The economic lot-sizing problem with perishable items and consumption order preference. Eur. J. Oper. Res. 244, 881–891 (2015)

Önal, M., van den Heuvel, W., Liu, T.: A note on “the economic lot sizing problem with inventory bounds”. Eur. J. Oper. Res. 223, 290–294 (2012)

Pando, V., García-Laguna, J., San-José, L.: Optimal policy for profit maximising in an EOQ model under non-linear holding cost and stock-dependent demand rate. Int. J. Syst. Sci. 43(11), 2160–2171 (2012)

Sargut, F.Z., Işık, G.: Dynamic economic lot size model with perishable inventory and capacity constraints. Appl. Math. Model. 48, 806–820 (2017)

Urban, T.L.: Inventory models with the demand rate dependent on stock and shortage levels. Int. J. Prod. Econ. 40(1), 21–28 (1995)

van den Heuvel, W., Wagelmans, A.: An efficient dynamic programming algorithm for a special case of the capacitated lot-sizing problem. COR 33(12), 3583–3599 (2006)

Wagner, H., Whitin, T.: Dynamic version of the economic lot size model. Manag. Sci. 5, 89–96 (1958)

Winston, W.: Operations Research: Applications and Algorithms. DP Belmont, California (1994)

Zangwill, W.: A backlogging model and a multi-echelon model of a dynamic economic lot size production system—a network approach. Manag Sci 15(9), 506–527 (1969)

Acknowledgements

The work of this author was supported by the Scientific and National Research Council of Turkey (TÜBİTAK) under Grant No. 119M278.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A. Data generation

Appendix A. Data generation

For each data instance, slope of the first segment is drawn randomly from UNIF(0.6,0.9). Once a segment slope is realized, the slope of the next segment is obtained by subtracting a random number drawn from UNIF(0.03,0.04). Low \(u_t^b\) values are drawn from UNIF(1,10) while high \(u_t^b\) values are generated by drawing from UNIF(10,20). Then, all the segment lengths are generated by drawing from UNIF(1,20).

For each data instance, prices are generated by drawing from UNIF(0,3); unit holding costs from UNIF(0,1); and unit production costs from UNIF(0,1). Low, medium, and high set up costs are generated by drawing from UNIF(250,300), UNIF(350,400), and UNIF(450,500), respectively.

Rights and permissions

About this article

Cite this article

Önal, M., Albey, E. Economic lot sizing problem with inventory dependent demand. Optim Lett 14, 2087–2106 (2020). https://doi.org/10.1007/s11590-020-01532-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-020-01532-z