Abstract

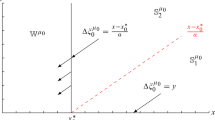

We study the problem of selling an asset near its ultimate maximum in the minimax setting. The regret-based notion of a perfect stopping time is introduced. A perfect stopping time is uniquely characterized by its optimality properties and has the following form: one should sell the asset if its price deviates from the running maximum by a certain time-dependent quantity. The related selling rule improves any earlier one and cannot be improved by further delay. The results, which are applicable to a quite general price model, are illustrated by several examples.

Similar content being viewed by others

References

Abramowicz, M., Stegun, I.A. (eds): Handbook of mathematical functions with formulas, graphs, and mathematical tables, vol. 55 of NBS Appl. Math. Series. Washington (1972)

Bawa, V.S.: Minimax policies for selling a nondivisible asset. Manage. Sci. 19(7), 760–762 (1973)

Dai, M., Jin, H., Zhong, Y., Zhou, X.Y.: Buy low and sell high. In: Contemporary quantitative finance, pp. 317–333. Springer, New York (2010)

Dellacherie, C., Meyer, P.-A.: Probabilities and potential. North-Holland, Amsterdam (1978)

du Toit, J., Peskir, G.: The trap of complacency in predicting the maximum. Ann. Probab. 35(1), 340–365 (2007)

du Toit, J., Peskir, G.: Selling a stock at the ultimate maximum. Ann. Appl. Probab. 19(3), 983–1014 (2009)

Graversen, S.E., Peskir, G., Shiryaev, A.N.: Stopping Brownian motion without anticipation as close as possible to its ultimate maximum. Theory Probab. Appl. 45(1), 125–136 (2001)

Evans, J., Henderson, V., Hobson, D.: Optimal timing for an indivisible asset sale. Math. Finance 18(4), 545–567 (2008)

Jeanblanc, M., Yor, M., Chesney, M.: Mathematical methods for financial markets. Springer, London (2009)

Pedersen, J.L.: Optimal prediction of the ultimate maximum of Brownian motion. Stoch. Stoch. Rep. 75(4), 205–219 (2003)

Pye, G.: Minimax policies for selling an asset and dollar averaging. Manage. Sci. 17(7), 379–393 (1971)

Shiryaev, A., Xu, Z., Zhou, X.Y.: Thou shalt buy and hold. Quant. Finance 8(8), 765–776 (2008)

Shiryaev, A.N.: Quickest detection problems in the technical analysis of the financial data. In: Proc. Math. Finance Bachelier Congress (Paris, 2000), pp. 487–521. Springer, New York (2002)

Wang, H.: Monte Carlo Simulation with Applications to Finance. CRC Press, Boca Raton (2012)

Acknowledgments

The author is grateful to anonymous referees for stimulating suggestions, especially concerning the necessity of case studies.

Author information

Authors and Affiliations

Corresponding author

Additional information

The research is supported by Southern Federal University, Project 213.01-07-2014/07.

Rights and permissions

About this article

Cite this article

Rokhlin, D.B. Minimax perfect stopping rules for selling an asset near its ultimate maximum. Optim Lett 11, 1743–1756 (2017). https://doi.org/10.1007/s11590-016-1091-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-016-1091-8