Abstract

Following executive turnovers big bath accounting is often observed. We investigate a new manager’s earnings management incentives in his first year in office in a two-period model with career concerns and earnings’ lack of timeliness. We determine the optimal incentive contract and decompose the manager’s equilibrium earnings management into two components: an explicit incentive resulting from the compensation contract and an implicit incentive from career concerns. While career concerns always motivate the manager to shift earnings backwards, the optimal contract induces the manager to either shift earnings forwards or backwards. In particular, we show that with optimal contracts a "negative" big bath may result in equilibrium, i.e., the manager may inflate earnings after a CEO turnover. We demonstrate how the optimal contract and the equilibrium earnings management strategy depend on the earnings’ timeliness, the precision of the initial information about the manager’s ability and the intensity of competition for CEOs. Our results may help to explain why big bath accounting after a CEO turnover is observed in many but not in all cases.

Similar content being viewed by others

1 Introduction

Executive compensation often relies on periodical accounting numbers such as earnings that are based on financial reporting. Therefore, managers may have incentives to undertake earnings management to increase their remuneration. Surrounding CEO turnover, a special kind of earnings management is observed. A number of empirical studies document big bath accounting, i.e., incoming CEOs increase discretionary expenses during their first year in charge.Footnote 1 The existing literature argues that an incoming CEO takes earnings baths to reduce the performance targets and to save earnings for future periods. The poor performance in the first year, which is commonly a partial year, is often blamed on the previous CEO and, therefore, has only little impact on the new CEO’s reputation.Footnote 2 In contrast, the good results of the following years are attributed to the new manager’s performance and enhance his reputation. Thus, one motivation behind big bath accounting is career concerns.Footnote 3 Career concerns create implicit incentives through expected future wages related to the employment opportunities of a CEO. Labor market participants update their beliefs concerning the CEO’s ability with the arrival of new information about his performance. Thus, the current accounting earnings have an impact on the manager’s reputation and thus on his future compensation. However, big bath accounting is not observed in all firms after a management turnover (e.g., Murphy and Zimmerman 1993) such that additional factors that affect the manager’s earnings management incentives in his first year in office need to be considered.

One further determinant of earnings management considered in the literature is the manager’s incentive contract (e.g., Liang 2004; Ewert and Wagenhofer 2005). In a dynamic view incentives for shifting earnings forwards or backwards arise if the sensitivity of the manager’s compensation to his performance (earnings) is not constant over time. More specifically, in a two-period setting, the incentive for forward- or backward-shifting of earnings results from a difference in incentive rates in the two periods (Liang 2004; Dutta and Fan 2014; Nieken and Sliwka 2015). We consider earnings management as an activity that affects the reported earnings but has no effect on the underlying economic earnings.Footnote 4 Nevertheless, earnings management is costly for the firm because it has to compensate the manager for his disutility (personal cost) from manipulating earnings. Thus, the optimal incentive contract needs to control effort incentives, risk sharing, and earnings management simultaneously.

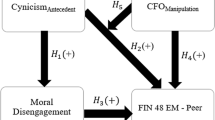

In this paper, we examine the interplay between career concerns and the optimal incentive contract in such a setting. We analyze under which circumstances the manager in equilibrium is induced to shift earnings forwards and when he will take an earnings bath. For this purpose, we decompose the total earnings management activity into two components, an implicit incentive from career concerns and an explicit incentive from the compensation contract. We show when explicit incentives from an optimal contract strengthen career-related big bath accounting maneuvers after executive turnover and when they induce forward-shifting of earnings. Furthermore, we conduct an in-depth analysis of how earnings’ lack of timeliness and the precision of initial information about the manager’s ability affect the optimal contract and equilibrium earnings management. Finally, we investigate how the intensity of competition for CEOs influences the manager’s incentives to shift earnings forwards or backwards.

To address these questions, we consider a two-period agency relationship in which the manager shall be induced to perform a productive effort in each period. In addition, he can engage in earnings management in the first period. At the end of each period accounting earnings will be disclosed by the manager. Accounting earnings are publicly observable and contractible and depend on effort, the manager’s earnings management, the manager’s unknown ability and accounting noise. Earnings management leads to a shift of earnings between two periods: the amount by which the first-period earnings are increased or reduced reverses in the second-period earnings. The manager receives a long-term (renegotiation-proof) compensation contract based on disclosed accounting earnings. Besides the contract, effort and earnings management incentives are affected by career concerns. These arise because after the termination of the contract with the firm, the manager receives a new contract from the labor market that depends on his reputation. More specifically, the payment from the new contract depends on the agent’s expected ability conditional on the observed earnings in the previous periods. Thus, both the CEO’s current reward (explicitly) and the future compensation from the labor market (implicitly) depend on the reported accounting earnings.

We derive the manager’s equilibrium earnings management strategy, which determines whether the manager inflates or deflates earnings in his first period in office. The effect of career concerns on the earnings management strategy depends on the accounting earnings’ informativeness about the manager’s ability. Due to lack of earnings’ timeliness, second-period earnings are more informative about the manager’s ability than first-period ones, with the result that the manager will shift earnings from the first to the second period to improve his labor market assessment. Thus, incentives to take a big bath arise. These incentives are the higher the lower the timeliness of earnings and the less precise the initial information about the manager’s ability. With regard to the explicit compensation contract, the manager shifts earnings to the period with the higher incentive rate (pay-performance sensitivity). If there is no lack of earnings’ timeliness and no uncertainty about the manager’s ability, both periods are independent and identical and thus no earnings management incentives from the optimal contract occur. With lack of timeliness the optimal incentive rates always induce a big bath if the initial information about the managerial ability is perfect. The same result applies if there is no lack of earnings’ timeliness but imprecise initial information about the manager’s ability. However, if the initial information about the manager’s ability is imperfect but sufficiently precise and at the same time there is lack of earnings’ timeliness, the incentive contract may induce forward shifting of earnings. In this case, if the explicit incentive is stronger than the implicit incentive a "negative" big bath results, i.e., the manager inflates earnings after a management change.

We show furthermore that high managerial risk aversion and high intensity of competition for CEOs always result in a contract that induces forward-shifting of earnings. As opposed to that, higher intertemporal covariance of earnings moves contractual incentives from the first to the second-period such that less forward-shifting or more backward-shifting results. In particular, if backward-shifting of earnings is optimal altogether, the absolute amount of earnings management increases with higher covariance. The intensity of competition for CEOs affects both components of earnings management. First, it directly increases the value of the manager’s future compensation and thus the implicit incentive. Second, it indirectly influences the explicit incentive via its effect on the difference in incentive rates. Incentive rates depend on the degree of competition solely via its effect on the riskiness of the manager’s future compensation. If the manager’s degree of risk aversion is low, the implicit incentive always dominates the explicit incentive, thus higher competition reinforces big bath accounting. However, with high risk aversion, as mentioned above, the reverse might be true.

Our paper is closely related to Nieken and Sliwka (2015). They consider an overlapping generations model in which a risk-neutral agent works for two periods and is then replaced by a new manager.Footnote 5 The agent’s earnings management incentives in his first year in office depend on the difference between incentive rates of both periods (similar effect as in our model) and on short-term and long-term reputation effects. Short-term reputation works in favor of shifting earnings forwards, long-term reputation has a similar effect as career concerns in our model and motivates to take a big bath. While Nieken and Sliwka (2015) analyze earnings management incentives for exogenous parameters of the incentive contract, we derive the optimal incentive rates when contracting with a risk-averse agent and we focus on earnings’ lack of timeliness. But even for the case of a risk-neutral agent, our analysis provides some additional results. While Nieken and Sliwka (2015) show that either forward- or backward-shifting of earnings may occur after a management change, we prove that with an optimal contract and lack of earnings’ timeliness the manager always shifts earnings backwards in his first year.

Our paper is also related to Goldman and Slezak (2006) who analyze earnings management incentives arising from stock-price based compensation. Their setting is comparable to our first-period problem where the incentive rate needs to control first-period effort and earnings management simultaneously. However, as we consider career concerns and second-period effort in our model, the manager may deflate first-period earnings in equilibrium.

Kirschenheiter and Melumad (2002) examine big bath accounting in a capital market model. They show that for sufficiently bad news managers will take an earnings bath. As opposed to our paper, Kirschenheiter and Melumad (2002) consider no agency conflicts. In their model, there is no need (and no possibility) to control the manager’s reporting behavior. The manager’s reporting strategy is solely chosen to affect the capital market’s inferences about the firm’s future cash flows.

Similar to our model, Christensen et al. (2013) and Dutta and Fan (2014) analyze a LEN-model with earnings management. Christensen et al. (2013) identify settings in which the possibility of earnings management improves the agency’s surplus. Dutta and Fan (2014) study how earnings management opportunities affect the optimal contract for the manager. Like us, they find that the incentives to manage earnings are driven by the difference between the incentive rates in the two periods, whereas their absolute levels have no effect. However, as opposed to our model, neither study investigates the influence of career concerns on earnings management. In addition, our paper is related to Christensen et al. (2021) who consider a dynamic LEN-model to analyze the influence of the timeliness of reports on the agent’s risk premium.

Our paper is also tied to the literature on career incentives. This area of research is strongly influenced by the work of Holmström (1982) . He shows that, even in the absence of explicit contracts, managerial effort incentives are provided since the labor market uses firm performance to update expectations about the manager’s talent. Gibbons and Murphy (1992) analyze optimal incentive contracts in the presence of career concerns. While they capture career concerns via short-term contracts and a perfectly competitive market for managers, we consider a long-term renegotiation-proof contract and imperfect competition. Autrey et al. (2007) analyze a related career concerns model, but they do neither consider second-period effort nor the possibility of earnings management. Similar to our setting, career concerns induce both implicit effort incentives and a risk effect. In the models of Gibbons and Murphy (1992) and Autrey et al. (2007) the principal can undo all implicit incentives arising from contractible information by adjusting the explicit incentives. However, this result may no longer hold true if implicit incentives also arise from soft (non-contractible) information.Footnote 6 Christensen et al. (2020) consider implicit incentives from career concerns in a setting with both contractible and soft information. They investigate under which conditions soft information can effectively be contracted via renegotiation of a long-term contract such that any real consequences of implicit incentives vanish. As opposed to their study, in our model implicit incentives due to the labor market’s revision of the manager’s ability rely only on contractible information. Nonetheless, as we assume that the labor market cannot observe the incentive contract offered by the principal, the principal does not undo implicit incentives in equilibrium.

Moreover, further studies examine career concerns to provide insights into, e.g., performance reporting (Wolitzky 2012), investment incentives (Milbourn et al. 2001), aggregate performance measures (Arya and Mittendorf 2011), and stock-price based and profit-based compensation contract design (Khoroshilov and Narayanan 2008). Demers and Wang (2010) find that the incentives for earnings management increase in later stages of the manager’s career.

Finally, our paper contributes to the literature that investigates the relation between internal and external governance mechanisms. While we find that both mechanisms act as substitutes, for example Cheng and Indjejikian (2009) show that both controls are complements.Footnote 7 We discuss the differences in results.

The rest of the paper is organized as follows. The next section introduces the model setup. In Sect. 3 we derive the optimal incentive contract and the equilibrium earnings management strategy. In Sect. 4 we discuss our results and provide some suggestions for empirical research, and Sect. 5 concludes. All proofs are relegated to the Appendix.

2 The model setup

We consider a two-period LEN-setting with a risk-neutral owner (principal) and a risk-averse manager (agent).

2.1 Accounting timeliness and CEO turnover

The accounting system is not capable to capture all changes in firm value, that are due to the manager’s current period’s actions, in the same period’s accounting earnings. We define timeliness as the extent to which accounting earnings incorporate economic earnings over time (Ball et al. 2000). Lack of timeliness of accounting earnings is the result of two effects. First, the incorporation of economic earnings is limited by accounting principles such as reliability and prudence. Second, part of the economic consequences of the manager’s decisions in a period shows up some time in the future and, thus, is not included in the current period’s accounting earnings. Examples are the implementation of a new corporate strategy or a new R&D project. The recognition of the economic effects of the manager’s decisions in the accounting earnings is also significantly influenced by the industry and the business model of a firm. For example, accounting earnings of firms in high innovation industries likely reflect managerial effort with a significant delay.Footnote 8

Therefore, we assume that accounting earnings \(x_{t}\) of period \(t=1,2\) reflect only a fraction \(q\in [0,1]\) of the value creation in period t.Footnote 9 The remaining share is captured in the next period’s accounting earnings \(x_{t+1}\). The specific value of q essentially depends on the accounting standards used and the industry the firm operates in. The manager exerts an effort \(e_{t}\) in each period \(t=1,2\). Furthermore, let a denote the manager’s ability. Then, the true accounting earnings in period t are defined by:

All players in the game (including the manager) are uncertain about the ability such that a is modeled as a random variable. Further, \(\theta _t\) is a random variable that captures accounting noise. Both the ability a and the accounting noise terms \(\theta _{t}\) are normally distributed:

\(\gamma =\frac{Var(a)}{Var(a)+Var(\theta _{t})}\in [0,1]\) is the fraction of the variance of total noise \((a+\theta _{t})\) attributable to the manager’s ability. As such \(\gamma\) is a measure of the imprecision of the initial information about the manager’s ability. The higher \(\gamma\) the less precise the initial information about a (and the more precise the information about accounting noise).Footnote 10 We assume that all noise terms are pairwisely uncorrelated.

Following executive turnover, a new CEO is in charge. Ignoring the effect of the new manager’s predecessor, the accounting earnings in the two periods following the CEO turnover are given by:Footnote 11

2.2 Earnings management and big bath accounting

At the end of each period the manager privately observes accounting earnings \(x_{t}\). Based on this information, he has to disclose an earnings report \(y_{t}\) at the end of period t. He has some discretion over the reported numbers which he can use to manage accounting earnings, e.g., using professional judgments in a principle-based accounting system. In particular, we assume that he can add or subtract an amount b to the earnings in the first period that is fully reversed in the second period. The reported accounting earnings are defined as follows:

The earnings management activity b can be viewed as a window dressing task and its sign can be either positive or negative. In what follows, a positive sign of b is synonymous with forward-shifting of earnings (or inflating earnings) and a negative sign corresponds to shifting earnings backwards (or deflating earnings). Reported earnings are publicly observable and can be used as performance measures for the manager’s compensation contract.

In the literature, the term big bath is used to describe a setting where current reported earnings are biased downwards at the benefit of higher future earnings (Nikolai et al. 2010). In our model, similar to Nieken and Sliwka (2015), a big bath corresponds to a reduction in current earnings and goes along with \(b <0\). As we focus on earnings management incentives directly after a management turnover, we do not explicitly consider a second-period earnings management activity in the model.

2.3 Career concerns

The manager is concerned about his reputation on the labor market. At the end of the second period, the manager leaves the firm and obtains a new contract from another firm. Labor market participants neither observe the manager’s actions nor the design of the contract, but they build rational conjectures about both. Similar to Autrey et al. (2007), we assume that the market sets the manager’s wage proportionally to his expected ability, conditional on the reported signals \(y_{1}\) and \(y_{2}\), and conditional on rational conjectures with respect to the unobservable compensation contract \({\widehat{w}}\), efforts \(\widehat{e_{1}},\widehat{e_{2}}\), and earnings management \({\widehat{b}}\). More specifically, career-related compensation is defined by \(\phi LM_{2}\), where \(LM_{2}\) is given by:

Modeling career concerns, we deviate from the literature (in particular from Gibbons and Murphy 1992 and Autrey et al. 2007) with respect to two aspects. First, we assume that the market for top-managerial ability is not perfectly competitive. In a recent study, Cziraki and Jenter (2020) show that over 80% of new CEOs are insiders, and, from the remaining outsiders only a minority was attracted from a CEO position outside the firm. These results suggest that managerial ability is highly firm-specific and hiring decisions are influenced by intra-firm relationships. Therefore, we do not assume a perfectly competitive labor market but consider that the match between CEO ability and future firm requirements may be more or less fitting. This fit will be modeled by the variable \(\phi\) which is multiplicatively connected with the expected ability and determines the manager’s future compensation. We interpret \(\phi \ge 0\) as the degree of competition for the manager in place. Higher values of \(\phi\) correspond to a fit with the requirements of a higher number of firms in the market. Second, career concerns in Gibbons and Murphy (1992) and Autrey et al. (2007) arise from the contracting parties’ inability to commit to the two-period employment horizon. They do not arise if the sequence of short-term contracts would be replaced by a renegotiation-proof two-period contract.Footnote 12 We consider renegotiation-proof contracts because short-term contracts require additional commitment assumptions.Footnote 13 Thus, while our different (competition and commitment) assumptions do not allow for career concerns resulting during the considered two-period agency-relationship, they result from employment opportunities after the duration of the relationship.

As \(\left( a,y_{1},y_{2}\right)\) are jointly normally distributed, \(LM_{2}\) is normally distributed, too. Applying the rules for updating the probability distribution of a normally distributed random variable, conditional on the observation of a set of normally distributed variables,Footnote 14 we obtain:

with

\(\beta _{0}\) is a constant term given by

Thus, the manager’s expected ability conditional on the observation of the reported accounting earnings is a linear function of the earnings. Notice that \(\beta _{2}q=\beta _{1}\) such that \(\beta _{1}<\) \(\beta _{2}\). This implies that the labor market puts more emphasis on \(y_{2}\) than on \(y_{1}\) when revising expectations about the manager’s ability after having observed \(y_{1}\) and \(y_{2}\). The reason for this is that the new manager’s ability affects first-period earnings only by the fraction \(q<1\). The second-period earnings in contrast are affected by the full ability such that the relation \(\beta _{1}=q\beta _{2}\) holds true. The fact that second-period earnings are more informative about the manager’s ability than first-period ones implies that his career-related future compensation (via \(\phi LM_{2}\)) is more sensitive towards the second-period earnings \(y_{2}\).

2.4 The manager’s utility

At the beginning of the first period, the principal offers a two-period renegotiation-proof compensation contract w to the manager. The contract is assumed to be linear in \(y_{1}\) and \(y_{2}\) and is defined by

where f denotes the fixed salary and \(s_{t}\) the incentive rate in period t. The earnings management activity and the effort are costly for the manager. The corresponding disutility functions of the manager in period \(t=1,2\) are given by:

The parameter \(\lambda >0\) scales the cost of earnings management. We denote the manager’s total disutility from working by \(C=c_{1}+c_{2}\).

The manager is risk-averse with utility \(U^{M}=-\exp (-r(w-C+\phi LM_{2}))\). \(r>0\) is the manager’s degree of risk aversion. Given linearity and normally distributed random variables, the manager’s certainty equivalent given the information at \(t=0\) is:

We assume that if the agent does not accept the offer by the principal, he is not able to signal his ability and receives directly a contract from the market with wage \(\phi LM_{2}=\phi E\left( a\right) =\phi {\overline{a}}\). Thus, the agent’s reservation wage over his entire duration of employment is \({\overline{CE}}=\phi {\overline{a}}\).

2.5 The principal’s objective

The risk-neutral principal aims at maximizing the difference between the manager’s contribution to the firm value V and the agent’s expected compensation E(w). Firm value contribution V equals the expected economic earnings generated by the agent over the agency-relationship. The (true) accounting earnings \(x_{1}\) and \(x_{2}\) deviate from the economic earnings due to the timeliness parameter q. Thus, the proportion \((1-q)(a+e_{2})\) of the agent’s second-period work is only captured by the (not explicitly modeled) accounting earnings \(x_{3}\). Thus, formally we define V as

Since V will be realized only after the manager has left the firm, it cannot be used for contracting purposes.Footnote 15 Only the reported earnings \(y_{1}\) and \(y_{2}\) are contractible.

2.6 Timeline of the model

At \(t=0\), the principal offers the manager the compensation contract w. If the manager accepts the offer, he performs a productive effort at the beginning of both periods. The earnings management activity only takes place in the first period. At the end of the first period, the manager reports \(y_{1}=x_{1}+b\), by choosing the amount b. As there is no earnings management in the second period, the signal reported at the end of the second period is \(y_{2}=x_{2}-b\). At the end of period two, the manager leaves the firm and the labor market offers the manager a contract with a payment of \(\phi LM_{2}\). For simplicity, the discount rate is normalized to be zero. Figure 1 summarizes the timeline of the model.

3 Equilibrium analysis

3.1 Benchmark solution

If the manager’s actions were observable and contractible, it would be strictly optimal to pay only a fixed payment f to the risk-averse manager to avoid the risk premium \(\frac{r}{2}Var(\cdot )\). At the optimum, f makes the manager’s participation constraint binding, \(f=C-\phi E\left( LM_{2}\right) +{\overline{CE}}\). If we would assume that the agent’s actions are also observable to the labor market (\(\widehat{e_{1}}=e_{1},\widehat{e_{2}}=e_{2}, {\widehat{b}}=b\)), \(E\left( LM_{2}\right) ={\overline{a}}\) immediately results and the principal chooses \(e_{1},e_{2},b\) so as to maximize \(V -f= 2 {\overline{a}}+e_{1}+e_{2}-\frac{ e_{1}^{2}+\lambda b^{2}}{2}-\frac{e_{2}^{2}}{2}\). The optimal solution is \(e_{1}=e_{2}=1\) and \(b=0\).

In our model, neither the manager’s actions nor the principal’s contracting decisions are observable to the market. In this caseFootnote 16, we obtain the following expression for the principal’s objective function in the benchmark setting where the agent’s actions are contractible:

This expression is maximized by the following (first-best) action values:

Since \(\beta _{1}\) and \(\beta _{2}\) are positive and \(\beta _{2}>\beta _1\) holds true, see (9) and (10), backward-shifting of earnings is induced (\(b^{FB}<0\)) and both productive efforts are higher than 1. As with the binding participation constraint (\(f=C-\phi E\left( LM_{2}\right) +{\overline{CE}}\)) the optimal fixed payment f reduces with higher \(E\left( LM_{2}\right)\), the principal is trapped into inducing higher productive effort and earnings management to suggest to the labor market a high managerial ability. The reason is that the labor market attributes the difference between realized earnings and expected earnings to the agent’s ability. This becomes obvious if we rewrite \(LM_{2}\) as \({\overline{a}}+\beta _{1}( y_{1}-E( y_{1}| \widehat{e_{1}},\widehat{e_{2}}, {\widehat{b}})) +\beta _{2}( y_{2}-E( y_{2}| \widehat{e_{1}},\widehat{e_{2}}, {\widehat{b}}))\). In equilibrium, however, the market is not fooled and correctly anticipates the induced efforts and the earnings management activity, \((\widehat{e_{1}},\widehat{e_{2}}, {\widehat{b}})\) = \((e_{1}^{FB},e_{2}^{FB},b^{FB})\). Thus, again \(E\left( LM_{2}\right) ={\overline{a}}\) results and no reduction of the fixed payment occurs.

3.2 Second-best solution

We assume that the parties can commit to the two-period relationship. Therefore, if the manager accepts the initial contract, the owner does not replace the manager after the first period and the manager does not leave. However, the parties cannot exclude renegotiation of the contract at the end of the first period. Specifically, we assume that the principal can offer a new contract \(w^{R}=f+s_{1}y_{1}+s_{2}^{R}y_{2}+f^{R}\) at the end of the first period (after \(y_{1}\) has been observed). \(w^{R}\) can change the incentive coefficient \(s_{2}^{R}\) for \(y_{2}\) and potentially pay an additional fixed payment \(f^{R}\). In a setting with complete contracts, the anticipated change of the contract at the renegotiation stage can be included in the initial contract w, such that there is no loss of generality in considering renegotiation-proof contracts, i.e., initial contracts that are robust against renegotiation at the end of the first period. Christensen et al. (2003) have shown that (only) any initial contract in which the second-period incentive coefficient is chosen sequentially optimal is renegotiation-proof. We consider this kind of renegotiation-proof contracts in our paper.

In the next subsection, we derive the sequentially optimal incentive weight for the second period that makes any initial contract w renegotiation-proof.

3.2.1 Second-period effort and sequentially optimal second-period incentive rate

At the beginning of the second period, the manager has performed \(e_{1}\) and b and he has reported \(y_{1}\). If \(w^{R}\) is the final contract, he chooses second-period effort so as to maximize his certainty equivalent given his information set at \(t=1\) which is given by:

\(e_{2}^{R}\) denotes the manager’s second-period effort if \(w^{R}\) is the final contract and \(y_{2}^{R}\) is the corresponding value of second-period accounting earnings. From the first-order condition \(\frac{\partial CE_{1}^{R}}{\partial e_{2}^{R}}=0\), we obtain \(e_{2}^{R}=q(s_{2}^{R}+\phi \beta _{2})\).

We now assume that the principal has selected contract w at the beginning of the game. Denote \(CE_1\) the respective certainty equivalent given the information set at \(t=1\) (similar to (20) with variables \(s_{2},e_{2}\), \(y_{2}\)). The sequentially optimal second-period incentive rate at the renegotiation stage solves (jointly with \(f^R\)) the following problem:

\(EU_{1}\) is the principal’s expected return from second-period effort less the compensation cost from the new contract \(w^{R}\), conditional on the observation of \(y_{1}\) and conditional on conjectures about first-period actions \(\left( \widehat{e_{1}},{\widehat{b}}\right)\). All other elements of the principal’s objective function can be regarded as constants at the renegotiation stage. The principal has to consider two constraints in her optimization problem. First, the incentive constraint for the effort of period two and second, the participation constraint \(CE_{1}^{R}\ge CE_{1}\). The latter ensures that the manager will only accept the new contract offer at the renegotiation stage if he is not worse off with it. Lemma 1 states the solution to the above problem.

Lemma 1

The sequentially optimal incentive rate for the second period and the corresponding effort are given by:

Note that \(s_{2}^{*}\) trades-off incentivizing \(e_{2}\) subject to the posterior risk premium to be paid to the risk-averse manager, represented by \(r\sigma _{2|1}^{2}\). Neither the long-term effect of \(e_{1}\) on \(y_{2}\) nor the ex ante risk premium are considered ex post. Comparative statics show that \(\frac{\partial s_{2}^{*}}{\partial \sigma _{2|1}^{2}}<0\) and \(\frac{\partial s_{2}^{*}}{\partial \beta _{2}}<0\). High \(\sigma _{2|1}^{2}\) rises costs to motivate \(e_{2}\) from a risk-charging perspective, such that low-powered incentives are optimal. Future market compensation is uncertain and the posterior risk premium increases in the product \(\beta _{2}{\cdot }s_{2}\). Therefore, if \(\beta _{2}\) increases, \(s_{2}^{*}\) decreases to keep the risk premium down.

As \(f^{R}\)’s only task is to ensure that the participation constraint is binding, we omit its value in Lemma 1. Obviously, if the principal sets \(s_{2}=s_{2}^{*}\) in the initial contract, she has no incentive to renegotiate the initial contract such that the initial contract is also the final contract. In what follows, we consider the set of renegotiation-proof initial contracts characterized by \(s_{2}=s_{2}^{*}\).

3.2.2 Choice of first-period actions and optimal contract

Any initial contract w with \(s_{2}=s_{2}^{*}\) as given in (22) is renegotiation-proof. We now determine the optimal first-period incentive rate of the contract and the resulting values for first-period effort and earnings management. The corresponding optimization problem is given by:

The owner maximizes the manager’s contribution to firm value net of expected managerial compensation, subject to four constraints. The first constraint ensures participation of the manager, the second and the third constraint are the incentive constraints for the manager’s first- and second-period actions, and the last constraint makes the initial contract renegotiation-proof. The solution to the problem is presented in Lemma 2.

Lemma 2

The optimal first-period incentive rate and the corresponding first-period actions are given by:

with \(\sigma _{1}^{2} \equiv Var(y_1)={\sigma }^{2}\left( 1-\gamma (1-q^2) \right) , c\equiv Cov(y_1,y_2)=\sigma ^2\gamma q\).

In contrast to \(s_{2}^{*}\), the equilibrium first-period incentive rate \(s_{1}^{*}\) depends on the cost of earnings management \(\left( \lambda \right)\). This is because the principal uses \(s_{1}\) to control both first-period effort and earnings management.

Equation (28) shows that the equilibrium level of earnings management is a function of two components, \(b^{*}=b^{S}+b^{LM}\), with

The first component \(b^{S}\) is the explicit incentive which is determined by the difference of incentive rates of the contract \(\Delta s=s_{1}^{*}-s_{2}^{*}\), while the second component \(b^{LM}\) results from career-related incentives based on the labor market’s assessment of managerial ability.

3.3 Equilibrium earnings management

We now turn our attention to the question whether the manager inflates or deflates earnings in the first period in office. This depends on the sign of \(b^{*}=b^S+b^{LM}\). If the optimal amount of earnings management \(b^*\) is negative, the manager shifts earnings from the first to the second period and, thus, an earnings bath occurs. For \(b^*>0\) the manager shifts earnings forwards.

For the following analysis it will be useful to define (or recall) the following variables:

As a starting point for analyzing the manager’s equilibrium earnings management strategy assume \(q=1\) and \(\gamma =0\). \(q=1\) means that accounting earnings report economic earnings immediately without a time lag. \(\gamma =0\) implies that uncertainty in the performance measures is completely due to accounting noise \(\theta _{t}\) and the ability a is deterministic so that \(\beta _{1}=\beta _{2}=0\) follows immediately. Thus, both periods’ accounting earnings are stochastically and technologically independent and they are identical except for the effect of how earnings management b affects \(y_{1}\) and \(y_{2}\). As both periods have the same characteristics with regard to productive effort and noise, \(s_{1}^{*}=s_{2}^{*}=\frac{1}{1+r\sigma ^{2}}\) results. Thus, at the optimum there are no explicit earnings management incentives from the contract, \(\Delta s=0\Leftrightarrow b^{S}=0\). In addition, \(\beta _{1}=\beta _{2}=0\) implies \(b^{LM}=0\) such that there are also no implicit earnings management incentives from the labor market and the total earnings management is \(b^{*}=0\).

For \(q<1\) (still assuming \(\gamma =0\)) the effort incentives for both periods become different: \(e_{1}=qs_{1}+\left( 1-q\right) s_{2}\) and \(e_{2}=qs_{2}\). As part of the first-period effort’s consequences is now measured via the second period’s performance measure, at the optimum the first-period incentive rate is always lower than the second-period one:

This proves the first result:

Result 1 With perfect initial information about the manager’s ability \(\left( \gamma =0\right)\), earnings’ lack of timeliness \(\left( q<1\right)\) induces big bath accounting via the optimal incentive contract: \(b^{*}=b^{S}<0\).

Notice that the lower the cost of earnings management \(\lambda\) the higher \(\Delta s\) (i.e., the smaller \(|\Delta s|\)). While the sequentially optimal second-period incentive rate \(s_{2}^{*}\) is independent of \(\lambda ,\) \(s_{1}^{*}\) increases with decreasing \(\lambda\) to hold earnings management incentives \(b^{S}\) at bay. However, it is too costly in terms of inducing too high first-period effort to completely avoid \(b^{S}\). Thus, \(b^{*}=b^{S}<0\) already results with lack of timeliness of the accounting earnings in the absence of an uncertain managerial ability.Footnote 17

In the next step we allow for \(\gamma >0\). With \(\gamma >0\) the agent’s ability becomes uncertain such that career concerns arise. Introducing \(\gamma >0\) has the following specific effects:

-

1.

Regression coefficients \(\beta _{1}\) and \(\beta _{2}\) become positive such that \(b^{LM}<0\) results in equilibrium and \(e_{1}\) and \(e_{2}\) will be influenced by implicit incentives via \(\phi \beta _{1}\) and \(\phi \beta _{2}\) . Furthermore, with positive \(\beta _{1}\) and \(\beta _{2}\) the agent’s compensation becomes riskier due to the uncertain future compensation \(\phi LM_{2}\).

-

2.

A positive covariance \(c>0\) between first- and second-period earnings results.

-

3.

The variance of first-period earnings \(\sigma _{1}^{2}\) reduces since the noise now stems from both components, a and \(\theta _{t}\), with a only being weighted with fraction \(q<1.\)

-

4.

The posterior variance \(\sigma _{2|1}^{2}\) reduces due to the covariance effect.

These effects have several consequences: First, additional earnings management incentives from career concerns \(b^{LM}<0\) ceteris paribus motivate the manager to shift earnings to the second period. Obviously, the higher the intensity of competition \(\phi\), the stronger (more negative) is the implicit incentive \(b^{LM}\). The comparative-statics of the implicit incentive with respect to its further influencing factors are given in the next result:

Result 2 Higher timeliness of earnings and more precise initial information about the manager’s ability increase \(b^{LM}\), i.e., reduce the absolute value \(|b^{LM}|\) of earnings management from career concerns: \(\frac{db^{LM}}{dq}>0\) and \(\frac{db^{LM}}{d\gamma }<0\).

While the manager’s ability completely enters second-period earnings, its influence on first-period earnings is limited to the factor q. Thus, the higher q the lower the difference between the weights on first-period earnings (\(\beta _1\)) and second-period earnings (\(\beta _2\)), thus, the less negative the amount of earnings management related to career concerns. Higher precision of initial information about the manager’s ability (lower \(\gamma\)) also reduces the absolute value of \(b^{LM}\). In other words, the more precise the initial information about the ability, the smaller the weight on accounting earnings within the updating process.

Second, the covariance effect affects earnings management incentives from the contract. The positive covariance implies that the posterior variance of second-period earnings is lower than their prior variance, \(\sigma _{2|1}^{2}<\sigma _{2}^{2}\). With lower \(\sigma _{2|1}^{2}\), the second-period sequentially optimal incentive rate \(s_{2}^{*}\) increases. At the same time, a higher covariance increases the prior variance of the agent’s total compensation such that \(s_{1}^{*}\) becomes smaller. Thus, we can state the following result:

Result 3 Higher covariance c between first- and second-period earnings decrease \(b^{S}\).

Result 3 implies that, given the manager engages in big bath accounting, with increasing covariance he takes an even bigger bath because a higher covariance shifts contractual incentives from the first into the second period. Notice that while in the special case \(q=1\) with a deterministic ability \(\left( \gamma =0\right)\) no earnings management occurs, with \(q=1\) and \(\gamma >0\) the manager always uses big bath accounting. In this case, there is no earnings management from career concerns, \(b^{LM}=0\), as with \(q=1\) \(\beta _{1}=\beta _{2}\) results: earnings of both periods are equally informative about the agent’s ability. However, the amount of earnings management resulting from the contract \(b^{S}\) becomes negative. As compared to the case \(\gamma =0\), with \(\gamma >0\) the covariance effect increases \(s_{2}^{*}.\) While the first-period earnings’ variance \(\sigma _{1}^{2}\) remains the same as with \(\gamma =0\), the first-period incentive rate decreases due to the positive covariance such that \(\Delta s<0\) results.

Having focused so far on the circumstances under which big bath incentives from the contract arise, we now investigate if there are conditions where the incentive contract counteracts big bath incentives \(b^{LM}\) from the labor market’s updating, i.e., \(b^{S}>0\). To do so, we first recall that the variables \(\beta _{1},\beta _{2},\sigma _{1}^{2},\sigma _{2|1}^{2}\) and c all depend on the timeliness parameter q and the imprecision of the initial information about the manager’s ability \(\gamma\). Thus, an in-depth analysis of the impact of these two parameters on the equilibrium solution is needed.

The following representation of \(\Delta s\) will be useful for the subsequent analysis:

with

\(\Delta s\) is linear in the degree of competition for managers \(\phi\). Assume \(\phi =0\) for the moment. Then no career effects prevail \(\left( \Delta s=-A_{2}\right)\) and whether \(\Delta s\) is positive or negative depends on the induced variance and covariance effects. \(\Delta s\) becomes positive if \(A_{2}\) gets negative which requires \(\sigma _{1}^{2}+c<\sigma _{2|1}^{2}\) , i.e., the posterior variance of the second-period earnings must be higher than the variance of the first-period earnings plus the covariance. Intuitively, higher \(\sigma _{2|1}^{2}\) reduces \(s_{2}^{*}\) and this effect is always stronger than the indirect effect of \(\sigma _{2|1}^{2}\) on \(s_{1}^{*}\) (whose sign is ambiguous, see (25) and (26)) such that ceteris paribus \(\Delta s\) increases. However, as c itself is part of \(\sigma _{2|1}^{2}\)—as mentioned above—we need to decompose the condition into terms of timeliness q and ability-imprecision measure \(\gamma\). If all the noise in the earnings stems from the manager’s uncertain ability, \(\gamma =1\), \(\sigma _{1}^{2}+c>\sigma _{2|1}^{2}\) holds certainly true: after observing first-period earnings \(y_{1}\), the manager’s ability is perfectly known and \(\sigma _{2|1}^{2}=0\) results. Thus, \(\gamma\) must be sufficiently small \(\left( \gamma <{\overline{\gamma }}\right)\) to induce forward-shifting earnings management \(\left( b^{S}>0\right)\) from the contract. The higher q the higher the covariance c and thus the lower \(\sigma _{2|1}^{2}\) (and at the same time the higher \(\sigma _{1}^{2})\) , such that lower \(\gamma\) is required with increasing q \(\left( \frac{d {\overline{\gamma }}}{dq}<0\right)\) for \(\sigma _{1}^{2}+c<\sigma _{2|1}^{2}\) to hold true. Furthermore, from our previous analysis we know that for \(q=1\) and \(\gamma >0\) the optimal contract always induces big bath accounting, such that q must be also below some threshold value \(\left( q<{\overline{q}} \right)\).

Given these insights, the effect of the intensity of competition for CEOs, \(\phi >0\), depends on whether \(\Delta s\) is increasing (or decreasing) in \(\phi\). Result 4 shows the conditions under which this is true and specifies our findings for the case that there is no competition, \(\phi =0\).

Result 4 (a) For \(\phi =0\), a necessary condition for \(b^{*}=b^{S}>\) 0 is that \(q<{\overline{q}}=\frac{1}{2}\left( \sqrt{5}-1\right)\) and \(0<\gamma <{\overline{\gamma }}\left( q\right) =\frac{1-q-q^{2}}{ 1-q-q^{2}+q^{3}\left( 1+q\right) }\) with \(\frac{d{\overline{\gamma }}\left( q\right) }{dq}<0\).

(b) If the conditions for q and \(\gamma\) from (a) are jointly fulfilled there exists a critical value \(\overline{\phi }=\max \{0,\frac{A_{2}}{A_{1}} \}\) such that \(b^{S}>\) 0 if \(\phi >{\overline{\phi }}\).

(c) For \(q,\gamma \in (0,1)\) there always exists a critical value \({\overline{r}}=\max \{0,\frac{q\left( \beta _{1}q\sigma _{1}^{2}+\beta _{2}cq-\beta _{2}\sigma _{2|1}^{2}\right) }{ \sigma _{1}^{2}\sigma _{2|1}^{2}\left( \beta _{2}-\beta _{1}\right) }\}\) such that \(b^{S}>0\) if \(r>{\overline{r}}\) and \(\phi>\) \({\overline{\phi }}=\max \{0,\frac{A_{2}}{A_{1}}\}\).

(d) If r is sufficiently low, \(b^{*}=b^{S}+b^{LM}<0\) and \(\frac{ \partial b^{*}}{\partial \phi }<0\), i.e., higher competition reinforces big bath accounting.

While part (a) of Result 4 states a necessary condition for the contract to induce forward-shifting of earnings, \(b^S>0\), without career concerns (\(\phi =0\)), part (b) of Result 4 shows that if this condition is fulfilled, the amount of earnings management resulting from the contract increases in the degree of competition \(\phi\). If this condition is not fulfilled, as part (c) shows, \(b^S>0\) increases in \(\phi\) if the agent is sufficiently risk-averse.Footnote 18 The more risk-averse the agent, the lower are the optimal efforts in both periods to be induced in equilibrium. Efforts depend on explicit and implicit incentives and are given by \(e_{1}=q\left( \phi \beta _{1}+s_{1}\right) +\left( 1-q\right) \left( s_{2}+\phi \beta _{2}\right)\) and \(e_{2}=q\left( s_{2}+\phi \beta _{2}\right)\). Implicit second-period effort incentives are given by \(q\phi \beta _{2}\). If second-period effort becomes small, \(s_{2}+\phi \beta _{2}\) is small such that relevant first-period implicit incentives are given by \(q\phi \beta _{1}\). As \(\beta _{1}<\beta _{2}\), the decline in first-period incentive rate to induce low first-period effort is then lower than the decline in second-period incentive rate and thus \(\Delta s>0\) results. If this is true, the higher \(\phi\) the stronger is this effect as the implicit incentives are getting more powerful. While results (a)–(c) consider the amount of earnings management resulting from the contract, part (d) refers to the total amount \(b^{*}=b^{S}+b^{LM}\). \(b^{LM}\) is negative and linearly decreasing in \(\phi\). Even if \(b^{S}\) is increasing in \(\phi\), if r gets sufficiently small this effect will be overcompensated by the reduction in \(b^{LM}\) (gets more negative) such that the overall amount of earnings management is getting negative. Higher \(\phi\) then reinforces big bath accounting. As can be seen from (22) and (26), the optimal incentive rates only depend on \(\phi\) via the risk aversion parameter r, i.e., the effect of \(\phi\) on the optimal incentive rates stems solely from the manager’s career-related compensation risk \(\phi LM_{2}\). The lower the manager’s degree of risk aversion r, the smaller is this risk effect and the larger the impact of \(\phi\) on the total amount of earnings management \(b^{*}\) via \(b^{LM}\) such that higher competition \(\phi\) increases big bath earnings management activities.

Our analysis also shows that with regard to the sign of the explicit incentive \(b^{S}\), in the absence of career concerns (\(\phi =0\)), timeliness q and imprecision of ability \(\gamma\) act as substitutes. A higher timeliness q requires more precise initial information about the manager’s ability (lower level of \(\gamma\)) to sustain \(b^{S}>0\); similarly, for a given value of \(\gamma\), q must be sufficiently low to induce a positive amount of earnings management.

As an example consider the parameters \(q=0.2,r=0.05,\sigma =10,\phi =0\), and \(\lambda =0.4\). This leads to \({\overline{\gamma }}=0.988\) (with \({\overline{q}}= \frac{1}{2}\left( \sqrt{5}-1\right) \thickapprox 0.618)\). With \(\gamma =0.8\) we obtain \(b^{S}=0.07\), \(b^{LM}=0\) and \(b^{*}=0.07\). If q would increase to 0.5 (all other variables unchanged) the critical value \({\overline{\gamma }}\) would change to 0.57 such that \(\gamma >{\overline{\gamma }}\) and backward-shifting from the contract results, \(b^{S}=b^{*}=-0.1\). Increasing \(\phi\) from 0 to 0.5 (again assuming the initial parameter set) increases the explicit incentive—as q and \(\gamma\) are below their critical values \(\Delta s\) is increasing in \(\phi\)—to \(b^{S}=0.36\). However, with \(\phi >0\) also the implicit incentive emerges, \(b^{LM}=-0.775,\) such that a total amount of \(b^{*}=-0.41\) results. Reducing the manager’s risk aversion from 0.05 to 0.005 decreases \(b^S\) to 0.13 such that with an unchanged value of \(b^{LM}\) the manager shifts more earnings backwards, \(b^{*}=-0.65\).

4 Discussion

In this section we discuss the results of our study and we suggest empirical implications of our findings.

Nieken and Sliwka (2015) consider a similar setting as ours with risk-neutral agents and exogenously given incentive rates. As in our study, the level of earnings management of a manager in his first year in office depends on the difference of the incentives rates and long-term reputation effects.Footnote 19 They show that the manager engages in big bath accounting if the difference in incentive rates in period 1 and 2 is low and long-term reputation effects are strong. Otherwise, forward shifting of earnings occurs. To compare our analysis with theirs, we consider our results for a risk-neutral manager (by inserting \(r=0\) into the expressions from our analysis).Footnote 20 We obtain \(\Delta {s}=\frac{\lambda \left( q-1\right) }{ 1+\lambda q^{2}}<0\) such that \(b^{S}<0\) and \(b^{*}<0\). Thus, we show that the manager always uses big bath accounting (if there is lack of earnings’ timeliness): with optimal incentive rates forward shifting of earnings is never part of the equilibrium earnings management strategy of a risk-neutral agent. Nieken and Sliwka (2015) also conclude from their analysis that managers conduct higher levels of earnings management if the market has less precise information about the manager’s ability. While we can confirm this result for a risk-neutral manager, it not necessarily holds true with a risk-averse manager.

With a risk-neutral agent, in the absence of a risk premium, \(\Delta s<0\) can be interpreted as an indicator of how intensively the compensation contract is used as an instrument for reducing earnings management activities.Footnote 21 The lower (more negative) \(\Delta s\) the more the optimal contract is used to incentivize productive effort, the higher (more close to zero) \(\Delta s\) the more it is designed to avoid earnings management. Thus, we regard \(\Delta s\) as a measure of the strength of the internal governance of the firm. On the other hand, the level of earnings management is affected by the exogenous cost parameter \(\lambda\). If b is regarded as accrual earnings management, \(\lambda\) can be interpreted as the strength of the external governance mechanism. From \(\frac{d\left( \Delta s\right) }{d\lambda }=\frac{1}{\left( \lambda q^{2}+1\right) ^{2}} \left( q-1\right) <0\) we infer that the internal and external governance act as substitutes, i.e., higher \(\lambda\) decreases \(\Delta s\): with strong external governance the optimal contract focuses more on the provision of effort incentives than on mitigating earnings management. For low \(\lambda\), the opposite is true. As there is lack of earnings’ timeliness in our model, however, from a practical perspective, conducting accrual earnings management might also create benefits for the firm. In our model these benefits do not show up as the principal’s value V is independent of the recognition of value in earnings and earnings management is a costly window dressing task that distorts incentives for productive effort. However, if we would introduce a need for consumption-smoothing or assume that earnings management affects not only the mean of the earnings but also their variance (or other characteristics of their distribution) earnings management might improve the principal’s welfare in equilibrium. In this case, maximizing firm value goes not necessarily hand in hand with low levels of earnings management.

As \(\lambda\) is exogenously given in the model, we interpreted it as the strength of the external control mechanism so far. However, the manager’s cost of conducting earnings management can also be affected within the firm. For example, by spending more resources on internal control the firm can increase the time the manager needs to find earnings management opportunities. Thus, \(\lambda\) could also be interpreted as a combination of the strength of internal \(\left( \lambda _{I}\right)\) and external \(\left( \lambda _{E}\right)\) direct controls of earnings management, \(\lambda =\lambda _{I}+\lambda _{E}\). The incentive contract can then be interpreted as an indirect internal control for earnings management. As higher \(\lambda\) reduces both \(b^{LM}\) and \(b^{S}\) the principal always benefits from an increased value of \(\lambda\), i.e., her equilibrium surplus is increasing in \(\lambda\).Footnote 22 Hence, it is in the best interest of the principal to take actions that increase the manager’s cost of biasing the report. As long as the principal can affect \(\lambda _{I}\) without cost, it is optimal to set it as high as possible. In this case, the overall level of \(\lambda\) and the optimal contract are still substitutes in controlling earnings management. If increasing \(\lambda _{I}\) is costly for the firm higher marginal cost should increase \(\Delta {s}\). In addition, in this case also the internal and the external direct controls, \(\lambda _{I}\) and \(\lambda _{E}\), should be substitutes.

We now consider how the non-observability of the contract parameters affects our results. The manager’s optimal actions depending on the incentive rates \(s_{1}\) and \(s_{2}\) are given by

As the market cannot observe the contract parameters, its conjectures about the manager’s actions are given by (37) with \(s_{1}={\widehat{s}} _{1}\) and \(s_{2}={\widehat{s}}_{2}\). In the principal’s optimization problem the relevant term with regard to the non-observability of the incentive rates is \(\phi E\left( LM_{2}\right)\), with

\(\phi E\left( LM_{2}\right)\) increases the manager’s certainty equivalent and with the binding participation constraint it also increases the surplus of the principal. If the market conjectures (37) with \(s_{1}= {\widehat{s}}_{1}\) and \(s_{2}={\widehat{s}}_{2}\), \(E\left( LM_{2}\right)\) from the principal’s view becomes

Thus, with unobservable contract parameters the principal has an incentive to influence the market’s beliefs (\(LM_2\)) by rising \(y_1\) and \(y_2\) via \(s_{1},s_{2}\). In equilibrium the market correctly anticipates the optimal incentive rates such that \(E\left( LM_{2}\right) ={\overline{a}}\) results. Thus, the principal’s maneuver to fool the market falls flat in equilibrium. If the market observes \(s_{1}\) and \(s_{2}\), in contrast, \(E\left( LM_{2}\right) ={\overline{a}}\) directly enters the principal optimization and no incentives to influence the market’s updating exist.Footnote 23 As the principal’s temptation to fool the market’s assessment is useless and distorts optimal incentives rates, the principal would be better off if she could credibly reveal the agent’s contract parameters to the market. In this case, welfare increases if the regulator requires revelation of contract details. However, if renegotiation is possible the effect of trying to fool the market on the sequentially optimal incentive rate, and thus the cost of renegotiation, has also to be considered.

The results of our study have several empirical implications. From our analysis we predict a substitutional relation between internal and external governance in controlling earnings management. Inconsistent with this prediction, Cheng and Indjejikian (2009) empirically found that internal and external governance are complementary. This discrepancy can be explained as follows: first, Cheng and Indjejikian (2009) show their result by decomposing the performance measures into luck and skill components. Without this decomposition, internal and external governance can be regarded as being substitutes. Second, in our model the internal governance is not measured as the pay-performance sensitivity of a single period but as the difference in pay-performance sensitivities in two consecutive years. With regard to the difference in pay-performance sensitivities we predict (i) higher powered incentives in the period of CEO turnover than afterwards (i.e., decreasing pay-performance sensitivities over time) if the competition for CEOs is high and (ii) (marginally) increasing pay-performance sensitivities over time if intertemporal covariance of earnings increases. Our analysis also has empirical suggestions with regard to the influence of initial information about the manager’s ability and earnings’ timeliness on earnings management and pay-performance sensitivities. We show that the difference in pay-performance sensitivities is a good predictor for the level of earnings management, if the ability of the manager is well known, and we expect such firms to take a big bath after a CEO turnover. If the initial information about the ability is imprecise, besides pay-performance sensitivities, equilibrium earnings management is affected by career concerns, which ceteris paribus induce a backward-shifting of earnings. However, if the information about the ability is imperfect but sufficiently precise and earnings’ timeliness is low, the contract may induce inflating first-period earnings such that a negative earnings bath may occur. Higher earnings’ timeliness requires more precise information about the manager’s ability for this effect to be true independently of risk sharing considerations. As accounting earnings of firms in high innovation industries do not fully reflect managerial effort in a timely fashion, we expect a lower degree of earnings’ timeliness for such firms. Thus, our results indicate that forward shifting of earnings after a CEO turnover should be observed more often in innovative firms because a negative big bath is compatible with higher imprecision about the manager’s ability. Finally, if the pay-performance sensitivity is constant over time, we expect to observe less big bath maneuvers after a management change in firms with higher earnings’ timeliness.

5 Concluding remarks

We examine earnings management behavior following a CEO turnover in a two-period agency problem in the presence of career concerns. Due to lack of earnings’ timeliness, the second-period earnings are more informative about the new manager’s ability than the first-period earnings. This induces the manager to shift earnings to the second period to maximize future career-related compensation (implicit incentive). On the other hand, the manager’s earnings management activities will be influenced by his compensation contract (explicit incentive). We show that the optimal incentive contract may motivate both forward- as well as backward-shifting of earnings. Thus, overall, in equilibrium a manager may inflate earnings in his first period in office such that a "negative" earnings bath results.

The manager’s total amount of earnings management depends on several determinants. We demonstrate how earnings’ timeliness and the precision of initial information about the manager’s ability affect the optimal contract and the manager’s earnings management. In particular, with perfect initial information about the ability the optimal contract always induces incentives to take a big bath if there is lack of earnings’ timeliness. The same holds true, if there is no lack of earnings’ timeliness but the initial information about the manager’s ability is imprecise. However, with sufficient lack of timeliness and sufficiently precise but imperfect initial information about the ability forward-shifting of earnings may result in equilibrium.

Besides earnings’ timeliness and precision of initial information about the ability we also analyze the effect of managerial risk-aversion and the intensity of competition for CEOs on equilibrium earnings management. If managerial risk aversion plays no role, the manager always takes a big bath in equilibrium. Higher intensity of competition then reinforces big bath accounting.

Notes

A survey of over 400 CFOs by Graham et al. (2005) documents that more than 75% of the respondents agree that meeting performance targets serves to improve their external reputation.

Yu (2017) examines how earnings management is affected by the strategic interaction between an incoming and an outgoing CEO. He shows that an earnings bath can be induced by the reporting strategy of the outgoing CEO and the capital market reaction.

In addition to a contractible performance measure, Autrey et al. (2007) consider a mandated performance measure that is publicly observable but non-contractible. They show that the explicit incentive contract cannot completely undo implicit incentives related to the mandated measure.

Said et al. (2003) show that the use of non-financial performance measures in compensation contracts is associated with firms adopting an innovation-strategy which indicates that managerial effort does translate into earnings with delay.

In a static setting, Kuhner and Pelger (2015) interpret the parameter q as the degree of the value relevance of an accounting system.

The modeling of the noise terms is similar to Autrey et al. (2007).

Note that, due to the lag in the accounting earnings, first-period earnings \(x_1\) are also influenced by the outgoing manager \(p^{\prime }\)s ability and effort, \((1-q)(a^{p}+e_{0}^{p})\). Since a consideration of a predecessor does not qualitatively change our primary results, we focus solely on the effect of the incoming manager.

Although there are no career concerns with renegotiation-proof contracts, the same equilibrium solution as with short-term contracts results (see Gibbons and Murphy 1992, Appendix A).

Christensen et al. (2003), Proposition 1, show that there is no equilibrium with short-term contracts unless some form of commitment of both contracting parties is added. More specifically, if the agent cannot commit to stay for both periods, his take-the-money-and-run strategy destroys the equilibrium. However, assuming that the agent can commit to stay is only appropriate, if the principal does not take advantage of that commitment. This can be achieved by assuming that the principal himself can commit to offer a fair second-period contract, i.e., a contract that satisfies the second-period participation constraint, given the agent has taken the first-period equilibrium action.

See DeGroot (1970), p. 55, formula (19).

If \(\left( e_{1},e_{2},b\right)\) (and the contract) are unobservable to the market, the difference between conjectured effort (\(\widehat{e_{1}},\widehat{e_{2}}, {\widehat{b}}\)) and performed effort \(\left( e_{1},e_{2},b\right)\) has to be considered. The conjectured effort is included in \(\beta _{0}\), see (11).

Only in the extreme case that earnings report all economic consequences of the agent’s effort with one period delay, \(q=0\), no big bath incentives exist. In this case \(s_{1}^{*}=s_{2}^{*}=0\) as no effort can be induced.

If the condition from (a) is fulfilled the critical value for r in (c) is zero, \({\overline{r}}=0\).

As opposed to our study Nieken and Sliwka (2015) also consider short-term reputation effects.

Even with a risk-neutral agent there are frictions in the model as the possibility of earnings management leads to an incongruent performance measurement.

See also Dutta and Fan (2014).

Given the market anticipates the values of the unobservable variables correctly, the principal’s surplus is

$$\begin{aligned} EU_{0}= 2{\overline{a}}+e_{1}+e_{2}-\frac{e_{1}^{2}}{2}-\frac{e_{2}^{2}}{2}-\frac{\lambda b^{2}}{2}-\frac{r}{2}Var\left( w+\phi LM_{2}\right) . \end{aligned}$$\(e_{1},e_{2}\) and \(Var\left( w+\phi LM_{2}\right)\) do not depend on \(\lambda\). Only \(b=\frac{s_{1}-s_{2}}{\lambda }+\phi \frac{\beta _{1}-\beta _{2}}{\lambda }\) and the cost \(\frac{\lambda b^{2}}{2}\) depend on \(\lambda\) . The cost of earnings management \(\lambda b^{2}/2\) at \(b=\frac{s_{1}-s_{2}}{\lambda }+\phi \frac{\beta _{1}-\beta _{2}}{\lambda }\) is given by \(c\left( b\right) \equiv \frac{ \left( \phi \left( \beta _{1}-\beta _{2}\right) +s_{1}-s_{2}\right) ^{2}}{ 2\lambda ^{2}}\) with \(c_{\lambda }\left( b\right) <0\). Thus, the higher \(\lambda\) the higher \(EU_{0}\) for all values of \(e_{1},e_{2}\) and \(Var\left( w+\phi LM_{2}\right)\). Therefore, also the optimal surplus \(EU_{0}^{*}\) must increase in \(\lambda\).

With observable incentive rates, similar to, e.g., Autrey et al. (2007), the incentive rates \(s_{1}^{*}\) and \(s_{2}^{*}\) would also undo implicit incentives (from contractible information) by including the terms \(-\phi \beta _{1}\) and \(-\phi \beta _{2}\). This can be verified by solving problems (45) and (55) with \(E\left( LM_{2}\right) ={\overline{a}}\) as demonstrated above.

See DeGroot (1970), p. 55.

References

Ali A, Zhang W (2015) CEO tenure and earnings management. J Acc Res 59(1):60–79. https://doi.org/10.1016/j.jacceco.2014.11.004

Arya A, Mittendorf B (2011) The benefits of aggregate performance metrics in the presence of career concerns. Manag Sci 57(8):1424–1437. https://doi.org/10.1287/mnsc.1110.1363

Autrey RL, Dikolli SS, Newman DP (2007) Career concerns and mandated disclosure. J Acc Public Policy 26(5):527–554. https://doi.org/10.1016/j.jaccpubpol.2007.08.002

Ball R, Kothar SP, Robin A (2000) The effect of international institutional factors on properties of accounting earnings. J Acc Econ 29(1):1–51. https://doi.org/10.1016/S0165-4101(00)00012-4

Becher DA, Frye MB (2011) Does regulation substitute or complement governance? J Bank Finance 35(3):736–751. https://doi.org/10.1016/j.jbankfin.2010.09.003

Bornemann S, Kick T, Pfingsten A, Schertler A (2015) Earnings baths by CEOs during turnovers: empirical evidence from German savings banks. J Bank Finance 53:188–201. https://doi.org/10.1016/j.jbankfin.2014.12.005

Budde J (2007) Performance measure congruity and the balanced scorecard. J Acc Res 45(3):515–539. https://doi.org/10.1111/j.1475-679X.2007.00246.x

Cheng S, Indjejikian RJ (2009) The market for corporate control and CEO compensation: complements or substitutes? Contemp Acc Res 26(3):701–728. https://doi.org/10.1506/car.26.3.3

Christensen PO, Feltham GA, Şabac F (2003) Dynamic incentives and responsibility accounting: a comment. J Acc Econ 35(3):423–436. https://doi.org/10.1016/S0165-4101(03)00041-7

Christensen PO, Frimor H, Şabac F (2013) The stewardship role of analyst forecasts, and discretionary versus non-discretionary accruals. Eur Acc Rev 22(2):257–296. https://doi.org/10.1080/09638180.2012.686590

Christensen PO, Frimor H, Şabac F (2020) Real incentive effects of soft information. Contemp Acc Res 37(1):514–541. https://doi.org/10.1111/1911-3846.12516

Christensen PO, Feltham GA, Hofmann C, Şabac F (2021) Timeliness, accuracy, and relevance in dynamic incentive contracts, Working paper, LMU Munich and University of Alberta

Cziraki P, Jenter D (2020) The market for CEOs. Working paper. https://doi.org/10.2139/ssrn.3644496

DeGroot MH (1970) Optimal statistical decisions. Wiley, New Jersey

Demers EA, Wang C (2010) The impact of CEO career concerns on accruals based and real earnings management. INSEAD Working Paper No. 2010/13/AC. https://doi.org/10.2139/ssrn.1716535

Dutta S, Fan Q (2014) Equilibrium earnings management and managerial compensation in a multiperiod agency setting. Rev Acc Stud 19(3):1047–1077. https://doi.org/10.1007/s11142-014-9279-6

Elliott JA, Shaw WH (1988) Write-offs as accounting procedures to manage perceptions. J Acc Res 26(Suppl):91–119. https://doi.org/10.2307/2491182

Ewert R, Wagenhofer A (2005) Economic effects of tightening accounting standards to restrict earnings management. Acc Rev 80(4):1101–1124. https://doi.org/10.2308/accr.2005.80.4.1101

Feltham GA, Xie J (1994) Performance measure congruity and diversity in multi-task principal/agent relations. Acc Rev 69(3): 429–453. https://www.jstor.org/stable/248233

Geiger MA, North DS (2006) Does hiring a new CFO change things? An investigation of changes in discretionary accruals. Acc Rev 81(4):781–809. https://doi.org/10.2308/accr.2006.81.4.781

Gibbons R, Murphy KJ (1992) Optimal incentive contracts in the presence of career concerns: theory and evidence. J Polit Econ 100(3):468–505. https://doi.org/10.1086/261826

Goldman E, Slezak SS (2006) An equilibrium model of incentive contracts in the presence of information manipulation. J Financial Econ 80(3):603–626. https://doi.org/10.1016/j.jfineco.2005.05.007

Graham JR, Harvey CR, Rajgopal S (2005) The economic implications of corporate financial reporting. J Acc Econ 40(1–3):3–73. https://doi.org/10.1016/j.jacceco.2005.01.002

Guo L, Lach P, Mobbs S (2015) Tradeoffs between internal and external governance: evidence from exogenous regulatory shocks. Financ Manage 44(1):81–114. https://doi.org/10.1111/fima.12066

Hay D, Knechel WR, Ling H (2008) Evidence on the impact of internal control and corporate governance on audit fees. Int J Audit 12(1):9–24. https://doi.org/10.1111/j.1099-1123.2008.00367.x

Holmström B (1982) Managerial incentive schemes—a dynamic perspective. In: Walross B (ed) Essays in Economics and Management in Honor of Lars Wahlbeck. Swenska Handelshogkolan, Helsinki, pp 209–230

Khoroshilov Y, Narayanan MP (2008) The role of profit-based and stock-based components in incentive compensation. J Financ Intermediat 17(3):357–378. https://doi.org/10.1016/j.jfi.2008.02.005

Kirschenheiter M, Melumad ND (2002) Can “big bath" and earnings smoothing coexist as equilibrium financial reporting strategies? J Acc Res 40(3):761–796. https://doi.org/10.1111/1475-679X.00070

Kuhner C, Pelger C (2015) On the relationship of stewardship and valuation: an analytical viewpoint. Abacus 51(3):379–411. https://doi.org/10.1111/abac.12053

Li ZF (2014) Mutual monitoring and corporate governance. J Bank Finance 45:255–269. https://doi.org/10.1016/j.jbankfin.2013.12.008

Liang PJ (2004) Equilibrium earnings management, incentive contracts, and accounting standards. Contemp Acc Res 21(3):685–718. https://doi.org/10.1506/586L-8DKT-3UYL-L9Q4

Mauch C, Schöndube JR (2019) Controlling scarce working time in a multi-task incentive problem. Eur Acc Rev 28(1):151–175. https://doi.org/10.1080/09638180.2017.1408478

Milbourn TT, Shockley RL, Thakor AV (2001) Managerial career concerns and investments in information. Rand J Econ 32(2):334–351

Moore ML (1973) Management changes and discretionary accounting decisions. J Acc Res 11(1):100–107. https://doi.org/10.2307/2490283

Murphy KJ, Zimmerman JL (1993) Financial performance surrounding CEO turnover. J Acc Econ 16(1–3):273–315. https://doi.org/10.1016/0165-4101(93)90014-7

Nieken P, Sliwka D (2015) Management changes, reputation, and “big bath"-earnings management. J Econ Manag Strategy 24(3):501–522. https://doi.org/10.1111/jems.12101

Nikolai LA, Bazley JD, Jones JP (2010) Intermediate accounting, 11th edn. South-Western Cengage Learning, New Jersey

Pourciau S (1993) Earnings management and nonroutine executive changes. J Acc Econ 16(1–3):317–336. https://doi.org/10.1016/0165-4101(93)90015-8

Reitenga AL, Tearney MG (2003) Mandatory CEO retirements, discretionary accruals, and corporate governance mechanisms. J Acc Audit Finance 18(2):255–280. https://doi.org/10.1177/0148558X0301800205

Said AA, HassabElnaby HR, Wier B (2003) An empirical investigation of the performance consequences of nonfinancial measures. J Manag Acc Res 15(1):193–223. https://doi.org/10.2308/jmar.2003.15.1.193

Strong JS, Meyer JR (1987) Asset writedowns: managerial incentives and security returns. J Finance 42(3):643–661. https://doi.org/10.1111/j.1540-6261.1987.tb04574.x

Ward AJ, Brown JA, Rodriguez D (2009) Governance bundles, firm performance, and the substitutability and complementarity of governance mechanisms. Corp Gov 17(5):646–660. https://doi.org/10.1111/j.1467-8683.2009.00766.x

Wolitzky A (2012) Career concerns and performance reporting in optimal incentive contracts. BE J Theor Econ 12(1):Article 6. https://doi.org/10.1515/1935-1704.1869

Yu CF (2017) Interactive reporting bias surrounding CEO turnover. Eur Acc Rev 26(2):239–282. https://doi.org/10.1080/09638180.2016.1145068

Acknowledgements

The authors gratefully acknowledge financial support from Dr. Werner Jackstädt Fellowship. We would like to thank Christian Hofmann (the editor), two anonymous reviewers, Nicola Bethmann, Barbara Schöndube-Pirchegger, Georg Schneider and participants in the VHB-conference at Magdeburg for valuable comments.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have not disclosed any competing interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A.1 Labor market expectations

To derive the regression parameters \((\beta _{1},\beta _{2})\), we consider the market’s updated beliefs of the managerial ability having observed the accounting signals:

Let

Given that \(\left( a,y_{1},y_{2}\right)\) have a joint normal distribution, \(LM_{2}\) is given by:Footnote 24

with \(\pmb {\Sigma _{21}}=\left( \begin{array}{cc} Cov(a,y_{1})&Cov(a,y_{2}) \end{array} \right) =\left( \begin{array}{cc} q\gamma \,{\sigma }^{2}&\gamma \,{\sigma }^{2} \end{array} \right)\), \(\pmb {y}=\left( \begin{array}{cc} y_{1}&y_{2} \end{array} \right) ^{T}\) and covariance matrix of \({\mathbf {y}}\)

Doing the matrix multiplication, we obtain \((\beta _{1},\beta _{2})=\) \(\pmb {\Sigma _{21}}\pmb {\Sigma _{11}}^{-1}=\left( \begin{array}{cc} {\frac{q\gamma }{{q}^{2}\gamma +1}}&{\frac{\gamma }{{q}^{2}\gamma +1}} \end{array} \right)\). Now \(LM_{2}\) can be written as \(LM_{2}=\beta _{0}+\beta _{1}y_{1}+\beta _{2}y_{2}\) with \(\beta _{0}=E(a)-(\beta _{1},\beta _{2})E( \pmb {y}|{\widehat{w}},\widehat{e_{1}},\widehat{e_{2}},{\widehat{b}}) ={\overline{a}}-\beta _{1}(q({\overline{a}}+\widehat{e_{1}})+{\widehat{b}} )-\beta _{2}({\overline{a}}+q\widehat{e_{2}}+(1-q)\widehat{e_{1}}-{\widehat{b}} )\).

1.2 A.2 Variances

Let \(\Gamma =w+\phi LM_{2}\). Prior and posterior variances of \(\Gamma\) are defined by:

1.3 A.3 Proof of Lemma 1

In program (21) the participation constraint is binding at the optimum: \(CE_{1}^{R}=CE_{1}\). By substituting from that constraint into the objective function, the principal’s problem can be written as

Notice that if the agent’s certainty equivalents are considered by the principal, we have to replace \(\left( e_{1},b\right)\) by \(\left( {\widehat{e}} _{1},{\widehat{b}}\right)\) as the principal does not observe first-period actions. As the variances are not influenced by the agent’s actions, we can remove \(\left( e_{1},b\right)\) or \(\left( {\widehat{e}}_{1},{\widehat{b}} \right)\), respectively, from them. Note that \(E\left( y_{2}|y_{1},\widehat{e }_{1},{\widehat{b}}\right) =E\left( y_{2}\right) +\beta _{21}\left( y_{1}-E\left( y_{1}|{\widehat{e}}_{1}, {\widehat{b}}\right) \right)\) with \(\beta _{21}=\frac{q\gamma }{q^{2}\gamma +1-\gamma }\) and \(E\left( y_{1}|{\widehat{e}}_{1},{\widehat{b}} \right) =q({\overline{a}}+{\widehat{e}}_{1})+{\widehat{b}}\) and \(Var\left( s_{2}^{R}y_{2}^{R}+\phi LM_{2}\left( y_{2}^{R}\right) |y_{1}\right) =Var\left( \left( s_{2}^{R}+\phi \beta _{2}\right) y_{2}^{R}|y_{1}\right) =\left( s_{2}^{R}+\phi \beta _{2}\right) ^{2}\sigma _{2|1}^{2}\). The term \(E( LM_{2}\left( y_{2}^{R}\right) |y_1, {\widehat{e}}_{1}, {\widehat{b}} )\) needs to be explained more carefully. Recall that

Here variables \({\widehat{e}}_{1}, {\widehat{e}}_{2}^{R},{\widehat{w}},{\widehat{b}}\) denote the market’s conjectures about the agent’s actions and the contract parameters. In the considered optimization problem the principal builds expectations about \(LM_{2}\left( y_{2}^{R}\right)\) with regard to \(y_{2}^{R}\) (and with regard to \(y_{2}\) if we consider \(LM_{2}\left( y_{2}\right)\)) for given conjectures \({\widehat{e}} _{1}\) and \({\widehat{b}}\) and knowing \(y_{1}\). Thus, we write \(E\left( LM_{2}\left( y_{2}^{R}\right) |\widehat{e_{1}},{\widehat{b}},y_{1}\right) =\) \({\overline{a}}+\beta _{1}\left( y_{1}-E\left( y_{1}|{\widehat{e}}_{1},{\widehat{e}} _{2}^{R},{\widehat{w}},{\widehat{b}}\right) \right) +\beta _{2}E\left( y_{2}^{R}-E\left( y_{2}^{R}|{\widehat{e}}_{1},{\widehat{e}}_{2}^{R},{\widehat{w}}, {\widehat{b}}\right) |{\widehat{e}}_{1},{\widehat{b}},y_{1}\right)\), with

The relevant term for the principal’s second-period optimization problem is